What Is Arbitrum (ARB) and Why It’s the Top Ethereum Scaling Solution in 2025

What is Arbitrum (ARB)? This project is a part of Ethereum's scaling revolution and shows the core principles of DeFi and blockchain infrastructure. By combining optimistic rollup technology with the most advanced Layer-2 solutions, it lays the ground for a major change in the world of cryptocurrencies.

With the support of Offchain Labs and large DeFi platforms like Uniswap and Aave, Arbitrum (ARB) opens up new opportunities for investors who want to see how much the initiative can expand by lowering transaction costs and increasing throughput.

This article provides you with all you need to know about Arbitrum (ARB), including useful tips on how to make the most of your investments in this fast-changing market.

Key Takeaways

- As a top Layer-2 scaling protocol, Arbitrum (ARB) effectively solves Ethereum's problems using optimistic rollup methods, handling thousands of transactions each second while keeping strong safety measures and claiming more than 30% of Layer-2 market control.

- Price experts forecast ARB values between $0.282 and $0.438 by late 2025, with careful predictions showing steady rises while hopeful views expect major gains fueled by growing Layer-2 use and platform growth.

- This initiative shows outstanding flexibility across digital finance, NFT trading sites, crypto gaming, and supply tracking systems.

What Is Arbitrum (ARB) and Why Does It Matters?

Arbitrum (ARB) is a governance token based on the Ethereum blockchain that represents a modern version of Layer-2 scaling solutions. The project embodies the following values:

-

Scalability Enhancement:

Arbitrum (ARB) handles thousands of deals each second while Ethereum manages only 15-30, greatly boosting network speed for crypto apps.

-

Cost Efficiency:

Transaction fees on Arbitrum typically cost less than $0.05, making blockchain interactions accessible to a broader user base.

-

Security Inheritance:

Through final deals on Ethereum plus fraud checks, Arbitrum keeps the same strong safety rules as Ethereum's main network.

Using optimistic rollup methods, Arbitrum (ARB) groups many deals off the main chain, assuming validity by default unless someone proves otherwise through fraud checks. This way cuts computational burden and costs while keeping Ethereum's safety promises intact.

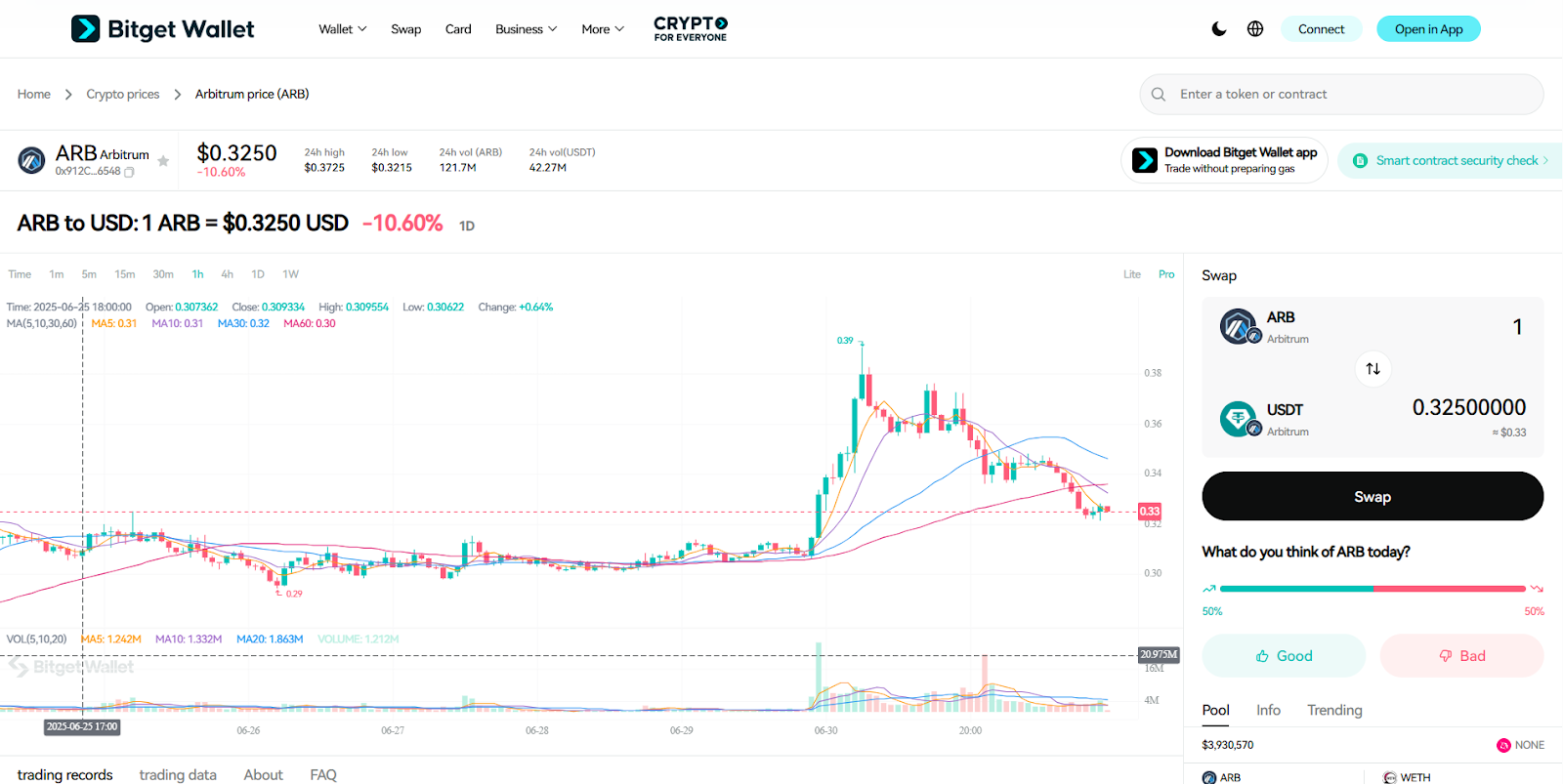

ARB Price Surges Amid Robinhood Partnership Speculation

Arbitrum (ARB) saw a strong 16% price jump to $0.36, fueled by rumors about a possible Robinhood partnership after news of a planned fireside chat with top leaders. This upward move got stronger when reports hinted that Arbitrum might work with Robinhood on their blockchain building projects.

Yet blockchain data shows warning signs even as prices climb higher. The Chaikin Money Flow metric displays a negative trend at -0.12, pointing to weaker buying power. Also, trading maps show large groups of sell orders sitting below today's price points, hinting at possible downward force that might cause a quick price drop.

Will Arbitrum (ARB) See Growth in 2025? Price Outlook & Predictions

The value of Arbitrum (ARB) is shaped by market trends, project strength, and community participation. With strong industry backing and Layer-2 scaling significance, it is expected to trade within $0.282 and $0.438 by the end of 2025. Should development progress steadily and adoption in DeFi expand, the token's price may rise toward $4.15 to $5.03 by 2030.

Key Factors Impacting Arbitrum (ARB) Price

Several aspects influence the potential price movement of Arbitrum (ARB):

-

Market Conditions:

Encompass overall cryptocurrency sentiment and macroeconomic events that heavily influence ARB's price performance alongside regulatory changes and global adoption trends.

-

Adoption and Utility:

Centers on network usage growth, with increasing active addresses and transaction volumes signaling higher demand for ARB governance tokens and ecosystem participation.

-

Project Expansion:

Includes protocol upgrades like sequencer decentralization, partnerships with financial institutions such as Franklin Templeton, and regulatory milestones including potential IPO filings.

Future Price Outlook

While Arbitrum (ARB) grows within blockchain systems, rising use might boost demand levels. Experts think continued progress and stronger market ties could lift values toward $4.15 to $5.03 by 2030. Smart investors should closely review market dangers, rule changes, and broad money conditions before making wise decisions.

Source: Changelly

Note: The price prediction is sourced from third-party media at the time of writing and is for reference only. It does not represent the official stance of Arbitrum and Bitget Wallet. Please conduct your own research and refer to official market data before making any investment decisions.

Source: Bitget Wallet

Arbitrum (ARB) Features: What Sets It Apart?

The standout features of Arbitrum (ARB) include:

-

EVM Compatibility:

Enables seamless migration for developers, allowing existing Ethereum smart contracts to deploy without modification while supporting identical programming languages and development tools.

-

BoLD Protocol:

The BoLD (Bounded Liquidity Delay) system improves conflict solving by allowing more validators to join and boosting network safety through open validation methods that anyone can use.

-

Decentralized Governance:

ARB token owners can take part in system updates, money management, and Security Council votes, while delegation choices make ruling processes easier and more effective for every user.

How Arbitrum (ARB) Works: A Step-by-Step Breakdown

The architecture of Arbitrum is designed with multiple elements that work together to support adoption and provide lasting value.

-

Blockchain Infrastructure:

Utilizes optimistic rollups as a Layer-2 solution built on Ethereum, featuring sequencers that batch transactions, bridges connecting networks, and the Arbitrum Virtual Machine processing smart contracts off-chain to optimize efficiency.

-

Token Utility:

ARB acts as the main ruling token inside the Arbitrum network. The token helps system changes through vote systems, fund management, Security Council picks, and allows sharing power to boost user involvement rates.

-

Governance and Community Engagement:

ARB owners can join shared choices through the Arbitrum DAO group. Security Council members watch over key system fixes while users work together via creative centers and clear involvement tracking methods.

The Team Behind Arbitrum (ARB): Experts Driving Innovation

Arbitrum (ARB)'s development stems from a skilled group of crypto experts at Offchain Labs, mixing top school knowledge with real-world building skills.

The Team

-

Leadership Foundation:

Arbitrum (ARB) is led by three Princeton University experts who founded Offchain Labs in 2018, bringing deep expertise in cryptography, computer security, and blockchain research to address Ethereum's scalability challenges.

-

Mission Statement:

The team's core mission focuses on scaling Ethereum and bringing its benefits to the public by solving critical scalability and cost challenges without compromising the network's fundamental security principles.

-

Strategic Partnerships:

Arbitrum (ARB) has gained big partnerships like Reddit's Community Points system work and collected more than $120 million from top investment companies including Lightspeed Venture Partners and Polychain Capital.

Expert Insights

Former White House Deputy Chief Technology Officer Ed Felten, who also taught at Princeton, points out how Arbitrum works as a smart middle system. He explains that Arbitrum (ARB) connects people to Ethereum, giving full crypto safety promises while using much less of Ethereum's main power.

Steven Goldfeder, the company's top leader who holds a PhD in code science, talks about why growth tools matter for wide use. He shows excitement about working with money backers who get the key need for taking Ethereum's system to people everywhere, mainly by linking old money tech with new crypto finance tools.

Key Use Cases of Arbitrum (ARB): How It’s Transforming Multiple Industries

Arbitrum (ARB)'s Layer-2 solution pushes new ideas across many fields by boosting growth ability and cutting deal costs.

-

Decentralized Finance (DeFi):

Helps sites like Uniswap and Sushiswap give quicker deals and lower gas costs, growing access for everyday money users.

-

NFT Marketplaces:

Supports cost-effective NFT minting and trading through integration with platforms like OpenSea, making digital art creation more affordable for creators.

-

Blockchain Gaming:

Powers real-time in-game transactions and digital asset ownership, enabling seamless play-to-earn experiences and NFT-powered gaming ecosystems.

-

Supply Chain Management:

Gives instant tracking and clear views for product truth checking, very important in food and medicine businesses.

-

Microtransactions:

Helps low-cost payment ways for content earning, tip systems, and pay-per-use digital services through tiny deal fees.

How Arbitrum (ARB) Is Transforming Industries?

Arbitrum (ARB) revolutionizes traditional business models by removing cost blocks that once stopped crypto use. Industries ranging from finance to gaming now leverage real-time transactions and transparent operations.

The platform's cross-chain compatibility bridges Ethereum with other blockchains, fostering broader collaboration and innovation across the decentralized ecosystem while maintaining security standards.

Arbitrum (ARB) Roadmap: Key Milestones and Future Developments

The roadmap for Arbitrum (ARB) outlines a clear path for growth and innovation:

| Quarter | Roadmap |

| Q2 2025 | Transition begins from centralized to distributed sequencer operations, reducing single points of failure while maintaining transaction processing efficiency. |

| Q3 2025 | Zero-knowledge proof technology merges with optimistic rollups, delivering faster settlement times and enhanced economic incentives for network participants. |

| Q4 2025 | Major collaborations with financial institutions like Franklin Templeton accelerate real-world asset tokenization, while user experience improvements include one-click swap functionality and gas sponsorship programs. |

These applications highlight the practical value of ARB in bridging traditional finance with decentralized infrastructure, positioning Arbitrum as the leading Layer-2 solution for institutional adoption.

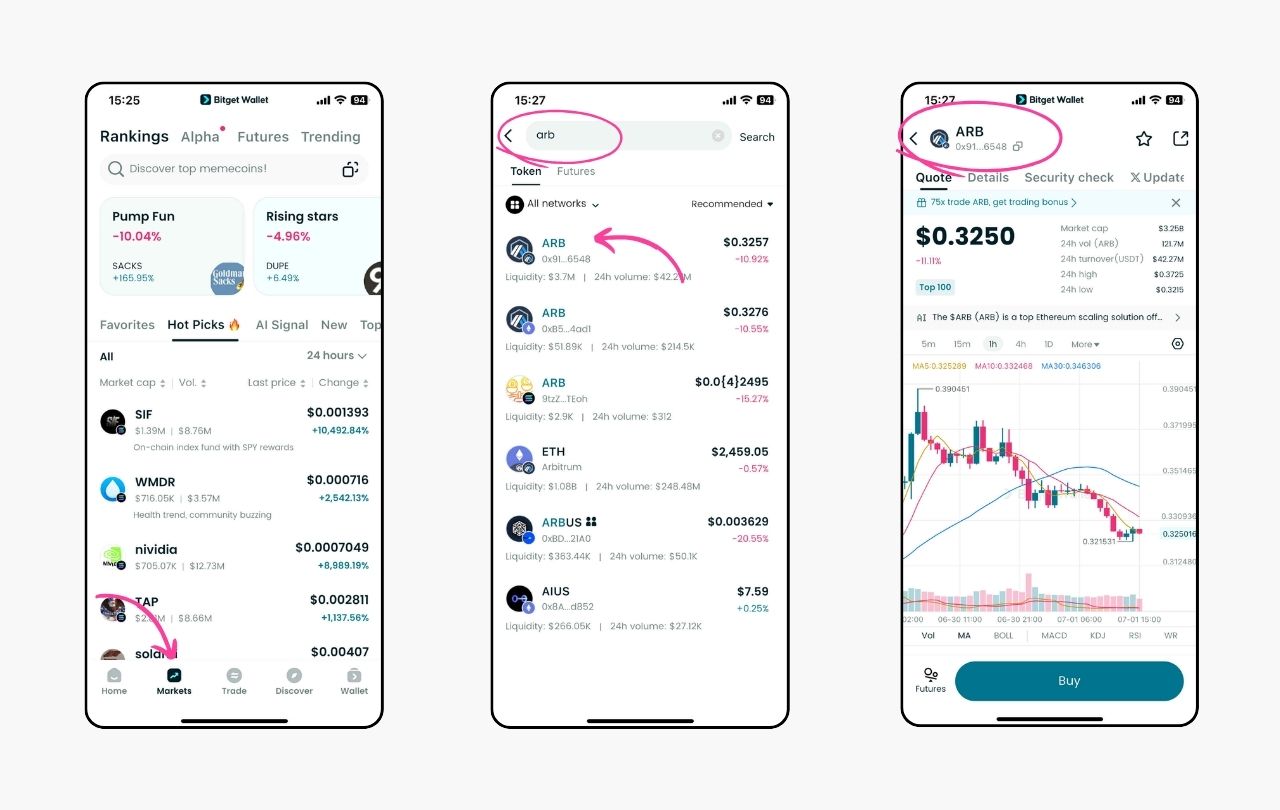

How to Buy Arbitrum (ARB) on Bitget Wallet?

Trading Arbitrum (ARB) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Move crypto from your existing wallet.

- Buying Crypto: Buy crypto using credit or debit cards directly through Bitget Wallet, making sure you have sufficient balance for Arbitrum (ARB) transactions.

Step 3: Find Arbitrum (ARB)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find Arbitrum (ARB). Click on the token to view its trading page.

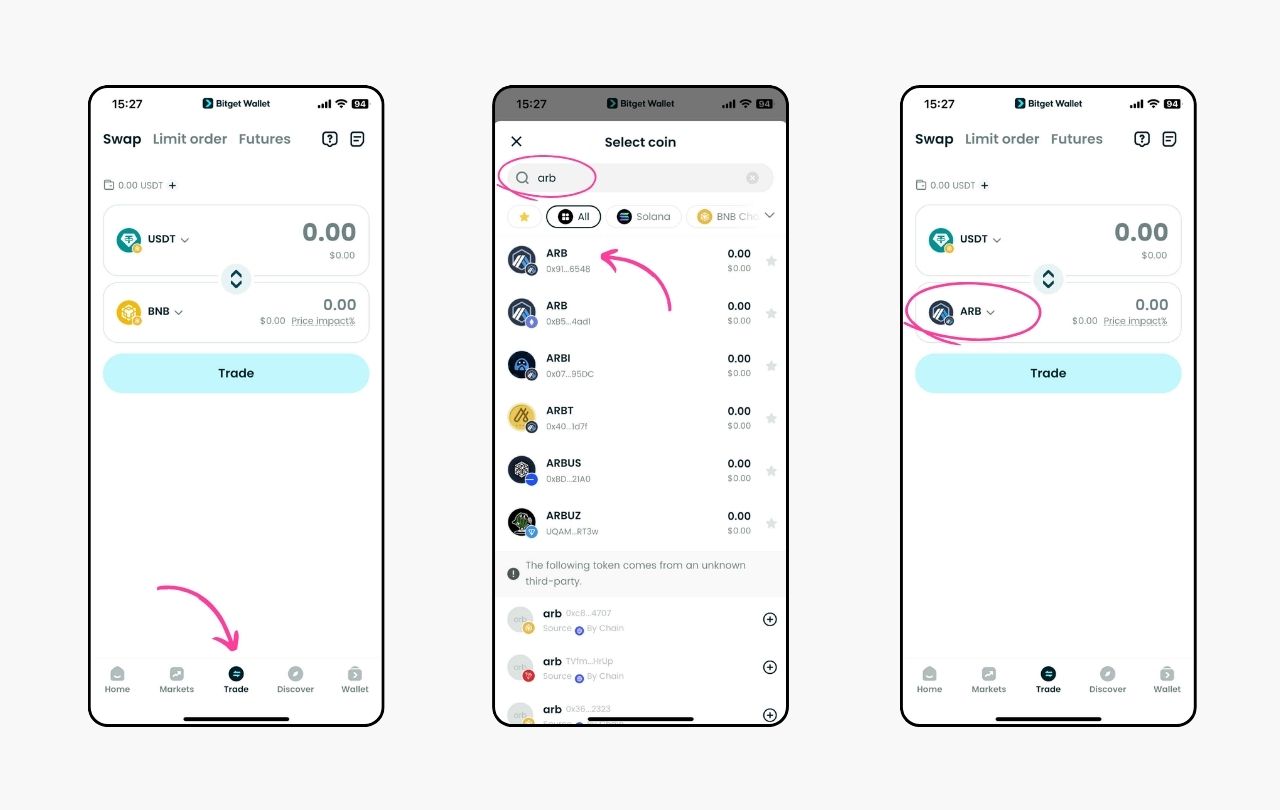

Step 4: Choose Your Trading Pair

Pick the trading combination you prefer, like ARB/USDT. This will allow you to trade Arbitrum (ARB) against USDT or another cryptocurrency.

Step 5: Place Your Order

Choose between placing a market order (buy/sell at the current market price) or a limit order (set your own price). Input the Arbitrum (ARB) quantity you want to purchase or sell, then approve your transaction.

Step 6: Monitor Your Trade

After placing your order, track what's happening in the "Open Orders" part. When the order goes through, check your balance to see your new Arbitrum (ARB).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your Arbitrum (ARB) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶ Learn more about Arbitrum (ARB):

- What is Arbitrum (ARB)?

- Arbitrum (ARB) Airdrop Guide

- Arbitrum (ARB) Listing Date and How to Buy It

Conclusion

What is Arbitrum (ARB)? This project represents a changing Layer-2 system that effectively fixes Ethereum's growth problems using hopeful rollup methods.

The platform shows great promise through its strong tech base, skilled building team, and quickly growing network that backs different apps across digital finance, gaming, and business areas.

For seamless ARB management and trading, Bitget Wallet offers complete Web3 tools with enhanced safety features and robust trading benefits. Download Bitget Wallet today to optimize your Arbitrum investment experience.

FAQs

1. What is Arbitrum (ARB)?

Arbitrum (ARB) is a Layer-2 scaling solution for Ethereum that uses optimistic rollup technology to process transactions off-chain, dramatically reducing fees and increasing speed while maintaining Ethereum's security.

2. How does Arbitrum (ARB) improve Ethereum's scalability and user experience?

Arbitrum (ARB) groups thousands of deals off the main chain before sending proof data to Ethereum, cutting gas costs below $0.05 and allowing smooth dApp moves through complete EVM support.

3. What are the main use cases and industries adopting Arbitrum (ARB)?

Arbitrum (ARB) powers DeFi platforms like Uniswap and Aave, NFT marketplaces, blockchain gaming, and supply tracking systems, giving growth solutions across many fields with cheap deal processing.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.