Ethena Labs (ENA): What is the Crypto-Native Synthetic Dollar (USDe)?

What is Ethena Labs (ENA)? Ethena Labs is not just another DeFi project; it represents a paradigm shift in decentralized finance by creating the world's first crypto-native synthetic dollar (USDe) that operates independently of traditional banking systems. In the realm of stablecoins and yield-bearing assets, Ethena combines cutting-edge financial engineering with blockchain transparency, ushering in a new era of decentralized money markets.

With strong support from industry giants like Dragonfly, Binance, Bybit, and Arthur Hayes (BitMEX founder), Ethena Labs (ENA) is not just a trendsetter in crypto—it’s a revolutionary force offering high-yield opportunities for investors. This guide will explore every facet of Ethena Labs (ENA) to help you capitalize on its growth potential and join the movement reshaping global finance.

Key Takeaways

- Ethena Labs (ENA) introduces USDe – the first crypto-native stablecoin independent of traditional banks.

- USDe by Ethena Labs maintains price stability through delta-hedging using ETH collateral and short positions.

- Ethena Labs aims to make USDe the native currency of the internet, driving a decentralized financial future.

What is Ethena Labs (ENA)?

Ethena Labs (ENA) is a governance token based on the Ethereum blockchain that represents a modern version of decentralized stablecoin protocols. The project embodies the following values:

- Decentralization: Creating stablecoins independent of traditional banking systems

- Innovation: Pioneering delta-hedging strategies for crypto-native stability

- Yield Generation: Combining staking rewards and derivatives for sustainable returns

Ethena Labs (ENA) not only inherits the spirit of cryptocurrency's financial freedom but also applies it to decentralized finance (DeFi) to build a sustainable, trustworthy, and collaborative stablecoin ecosystem.

Source: Ethena on X

Ethena Labs Shakes Up Crypto Market With Game-Changing Moves - USDe Goes Mainstream!

In just two months, Ethena Labs (ENA) has sent shockwaves through the crypto space with a series of strategic power moves: from integrating BlackRock's BUIDL tokenized treasury to launch USDtb - a revolutionary hybrid stablecoin bridging TradFi and DeFi, to deploying a USDe trading bot directly on Telegram - unlocking access to 900 million global users. Most impressively, Ethena's TVL has skyrocketed to $6.3 billion, catapulting USDe to become the 4th largest decentralized stablecoin worldwide, now hot on the heels of USDT and USDC.

This is no ordinary DeFi project - Ethena is rewriting the rulebook by simultaneously invading traditional finance and crypto's largest social platform. At this explosive growth rate, analysts predict USDe could dethrone DAI as the #1 decentralized stablecoin before 2025 ends!

Ethena Labs (ENA) Price Prediction 2025

The price prediction of any crypto coin depends on three main factors: market trends, project foundation, and community acceptance. With the advantage of giants like Dragonfly, Binance, and a breakthrough synthetic stablecoin model, Ethena Labs (ENA) is expected to fluctuate between 0.33 - 0.81 USD in 2025, with an average price of around 0.77 USD.

If it maintains a steady growth momentum and expands its application in the field of decentralized finance (DeFi) and traditional markets, the value of ENA can absolutely grow stronger in 2026, even reaching 0.94 USD when the ecosystem matures and is widely recognized.

Source: digitalcoinprice.com

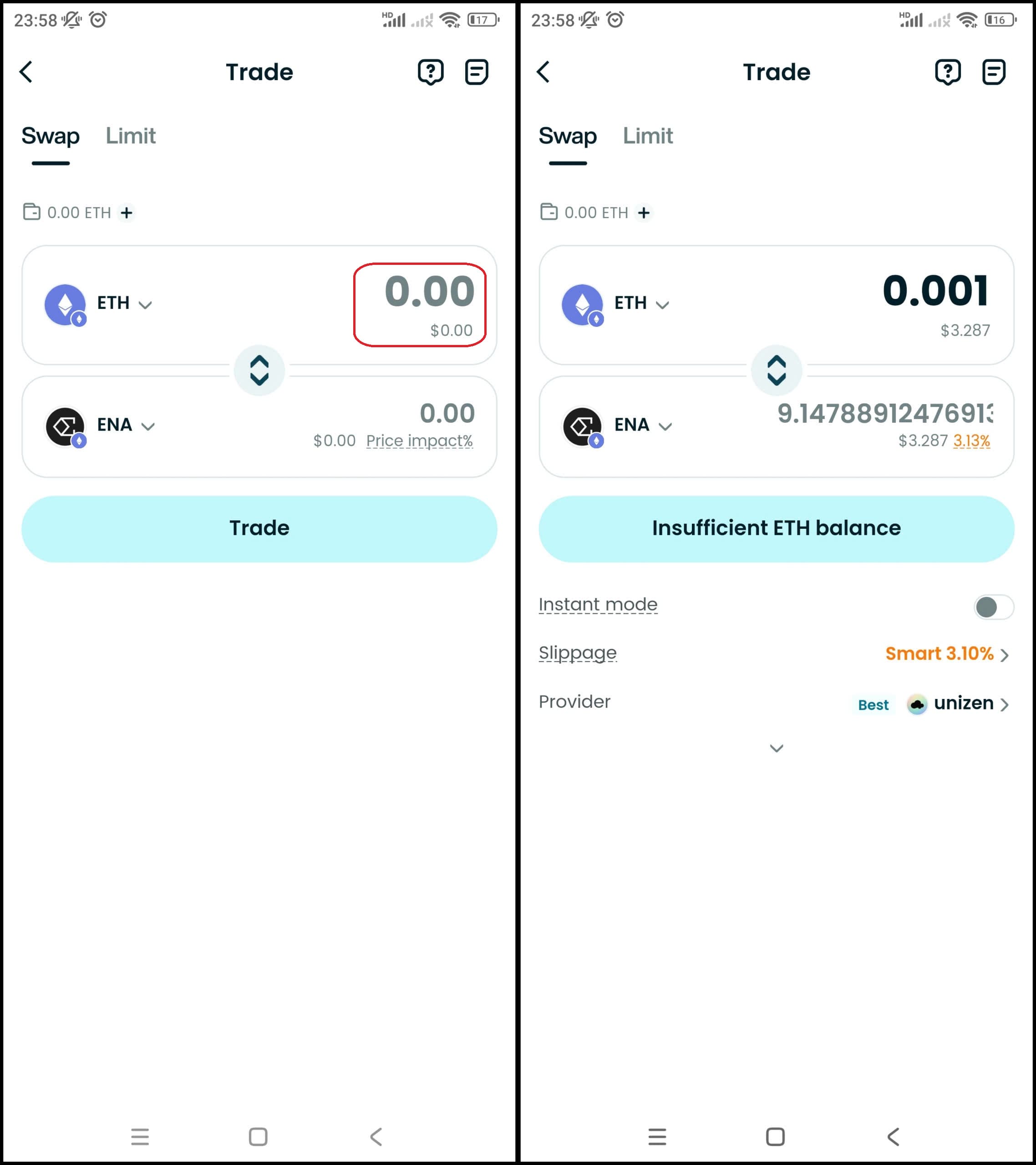

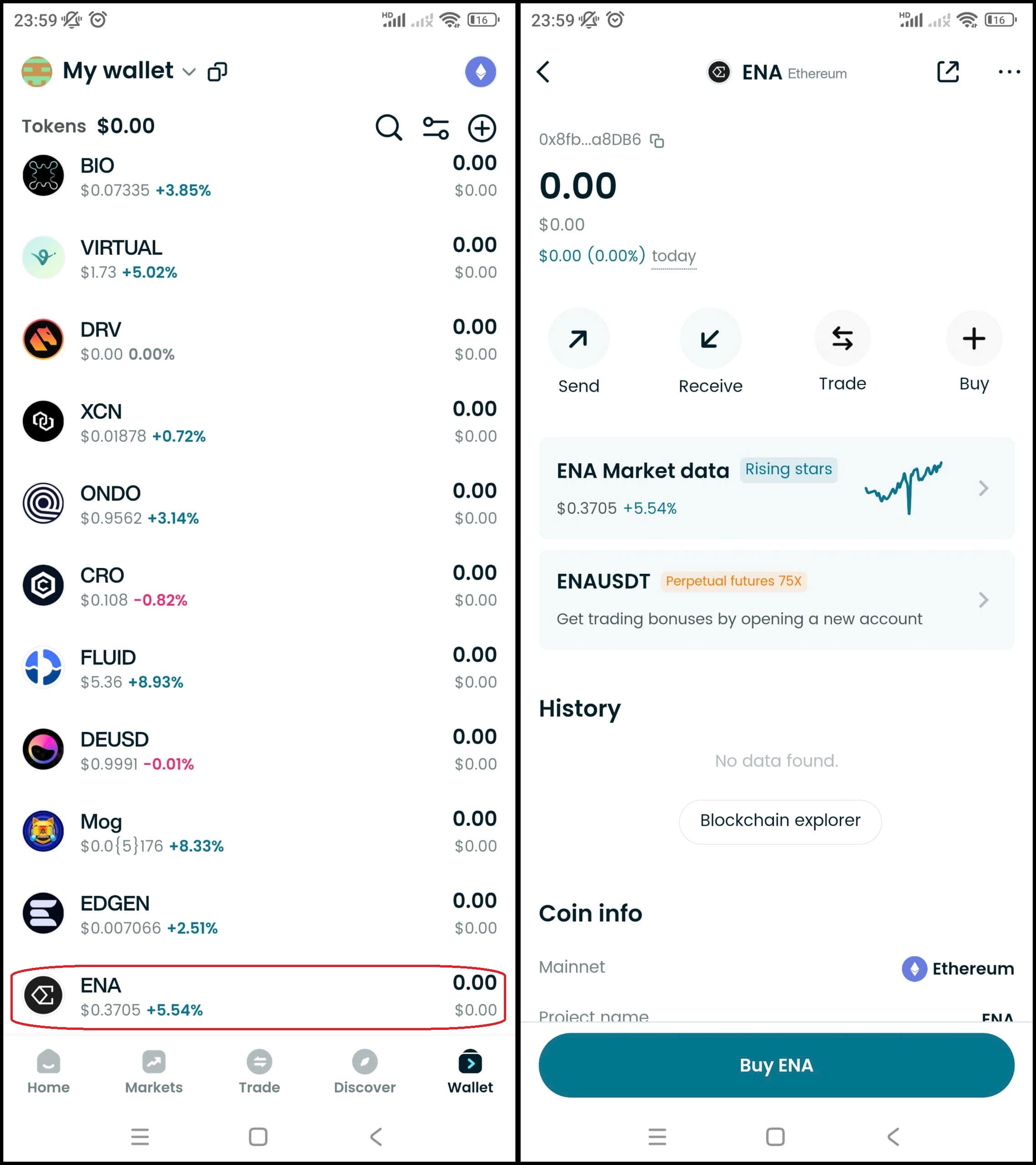

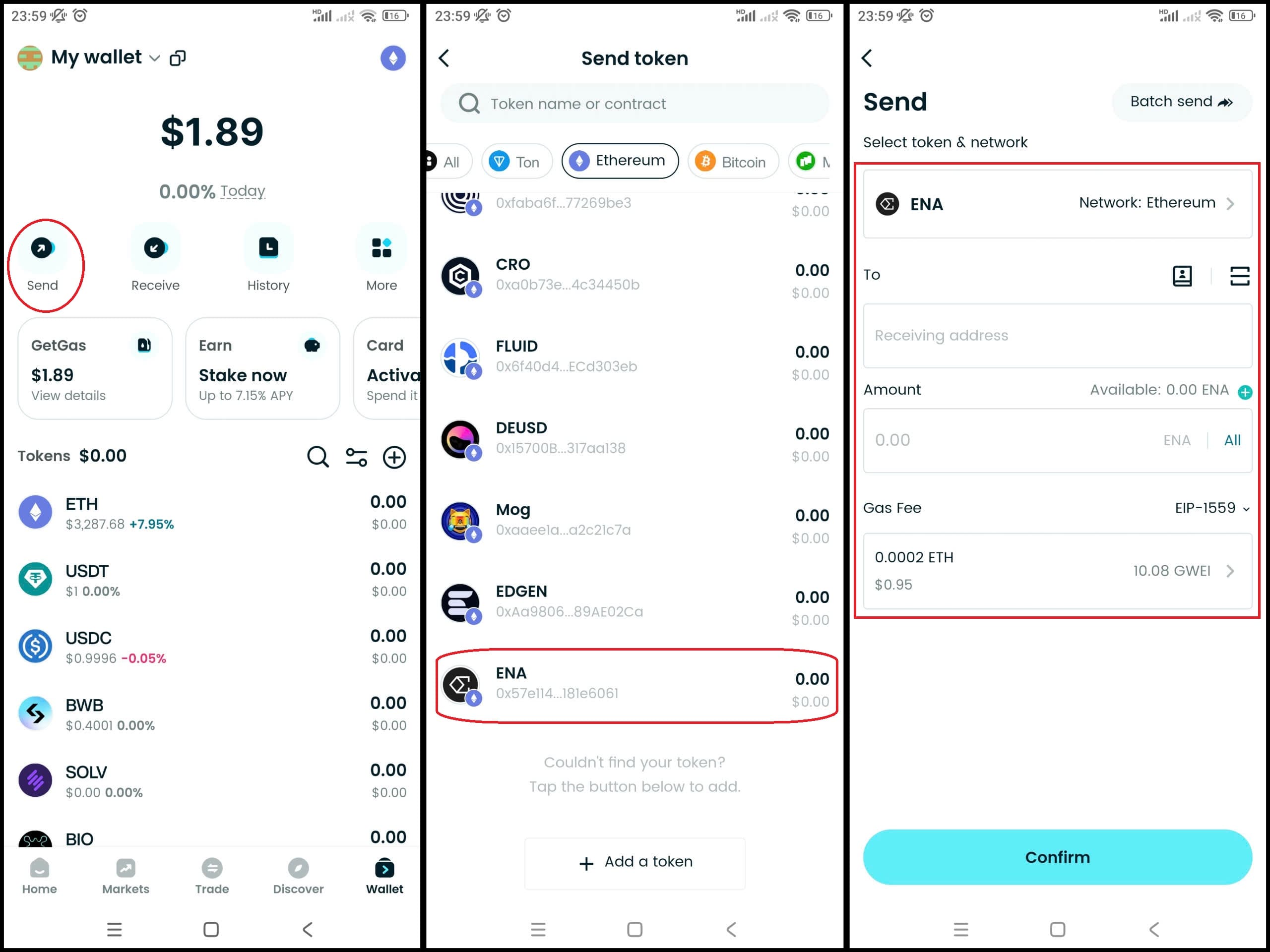

Source: Bitget Wallet

Key Features of Ethena Labs (ENA)

The standout features of Ethena Labs (ENA) include:

-

USDe Synthetic Dollar

The world's first crypto-native stablecoin that maintains its peg through delta-neutral hedging rather than bank reserves, combining staked ETH collateral with short perpetual positions.

-

Internet Bond

A revolutionary yield-generating product that delivers consistent returns (historically 15-35% APY) through staking rewards, perpetual funding rates, and stablecoin yields.

-

Institutional-Grade Infrastructure

Off-exchange custody solutions through partners like Fireblocks and Copper, with compliance-ready products like iUSDe for traditional finance adoption.

How Does Ethena Labs Work?

The operation of Ethena Labs is based on its innovative financial engineering and growing ecosystem:

-

Delta-Hedging Mechanism

When users mint USDe with crypto collateral, the protocol automatically opens corresponding short positions on derivatives exchanges to neutralize price volatility.

-

Multi-Chain Expansion

While built on Ethereum, Ethena supports cross-chain operations and is developing its own Converge blockchain for institutional DeFi integration.

-

Revenue Generation & Distribution

The protocol earns from three streams (staking yields, funding rates, stablecoin rewards) and distributes profits to sUSDe stakers and ENA governance participants.

By integrating cutting-edge financial engineering with strong partnerships (BlackRock, Binance, Bybit) and community governance, Ethena Labs aims to become the foundational layer for decentralized money in the global crypto ecosystem.

Ethena Labs (ENA)'s Team, Vision, and Partnerships

The Team

Led by Guy Young and a team of leading experts in decentralized finance and derivatives trading, Ethena Labs is not just creating a synthetic stablecoin - they are creating a new financial icon: a decentralized currency system that is not dependent on banks. With experience from Wintermute, Deribit and TradFi organizations, the team aims to make ENA a breakthrough in DeFi.

Vision

Ethena Labs is relentless in pursuing a dream: USDe - a free internet currency, combining price stability and high yields using only blockchain technology. This is not an ordinary stablecoin, but an "internet bond" - where global users can keep their assets safe and earn interest without the need for a bank intermediary.

Partnerships

From Binance, Bybit to the "big guy" BlackRock, Ethena Labs has built a multi-layered network of cooperation:

- Exchange: Providing liquidity and derivatives

- Custodian (Fireblocks, Copper): Securing off-chain assets

- TradFi (BlackRock): Connecting the crypto world with tokenized US bonds

With these strategic moves, Ethena is blurring the lines between DeFi and traditional finance, opening a new era for next-generation stablecoins.

Use Cases of Ethena Labs (ENA)

ENA Token serves a variety of purposes, including:

- Governance Voting: ENA holders can participate in bi-annual elections for the Risk Committee and vote on key protocol decisions, shaping the future of Ethena Labs.

- Staking Rewards: Users can stake ENA to earn yield from protocol revenue (e.g., staked ETH yields, perpetual funding rates) and receive allocations from ecosystem partners.

- Access to Ecosystem Incentives: Holding sENA (staked ENA) grants eligibility for token airdrops and rewards from integrated DeFi projects like Ethereal and Derive.

- Collateral for DeFi: ENA can be used as collateral in lending protocols or liquidity pools, enhancing utility across decentralized finance.

- TradFi Bridge: The upcoming iUSDe product will leverage ENA for institutional adoption, connecting crypto-native yields with traditional finance.

These applications highlight the practical value of $ENA in decentralized finance (DeFi), stablecoin ecosystems, and cross-border financial infrastructure, positioning it as a multi-functional asset for both retail and institutional users.

Roadmap of Ethena Labs (ENA)

The development timeline for Ethena Labs (ENA) demonstrates a clear strategic direction:

| Timeframe | Key Milestones |

| Q3-Q4 2025 | • Launch Derive Protocol - decentralized options platform • Develop cross-chain bridge for USDe |

| 2026+ | • Global payment integration for USDe in e-commerce/remittances • Develop "Internet Bond" with stable >15% APY • Institutional iUSDe solutions for TradFi adoption |

These developments highlight the practical value of $ENA in decentralized finance (DeFi), stablecoin ecosystems, and institutional crypto adoption.

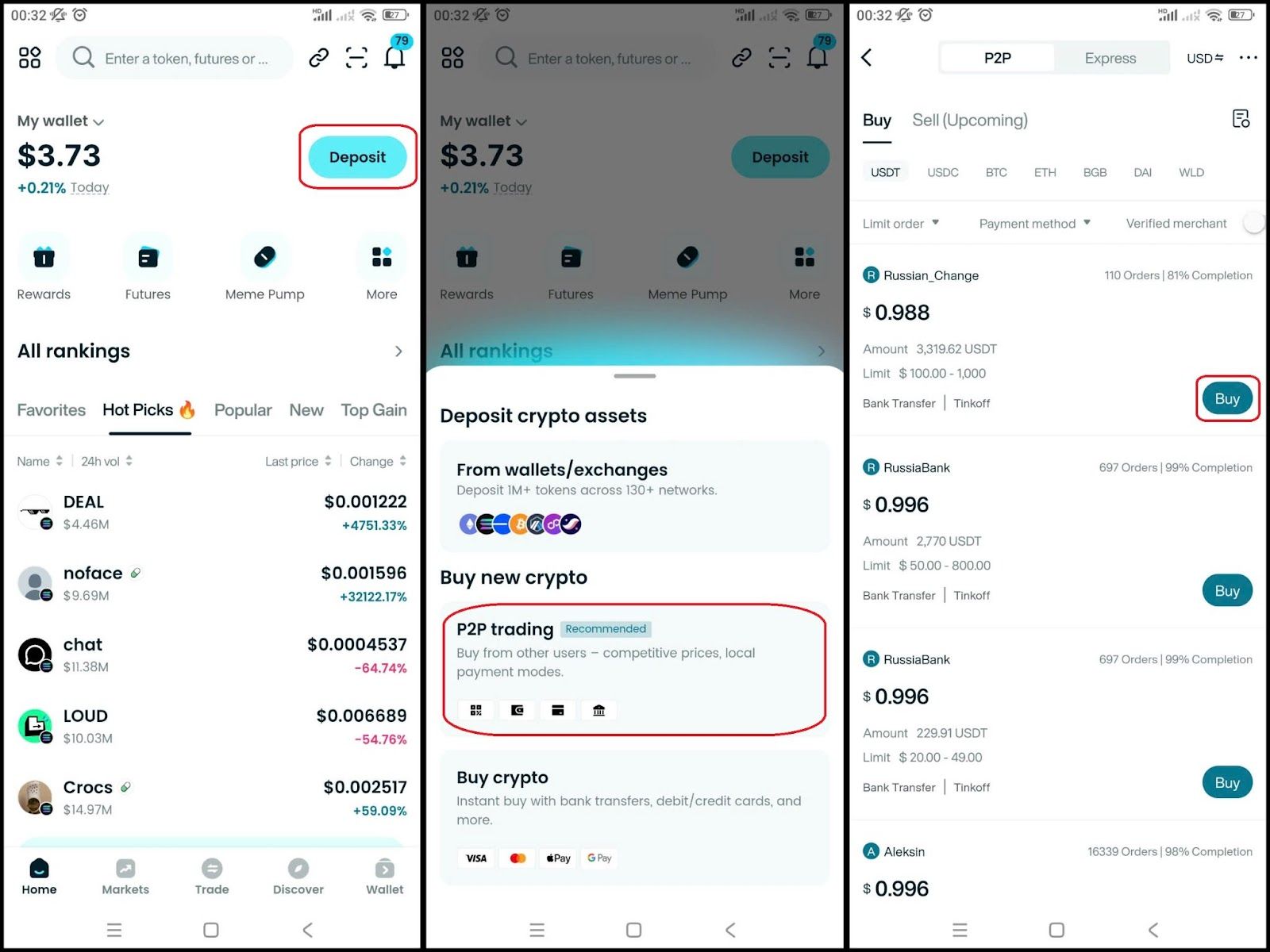

How to Buy Ethena Labs (ENA) on Bitget Wallet?

Trading Ethena Labs (ENA) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading Ethena Labs (ENA).

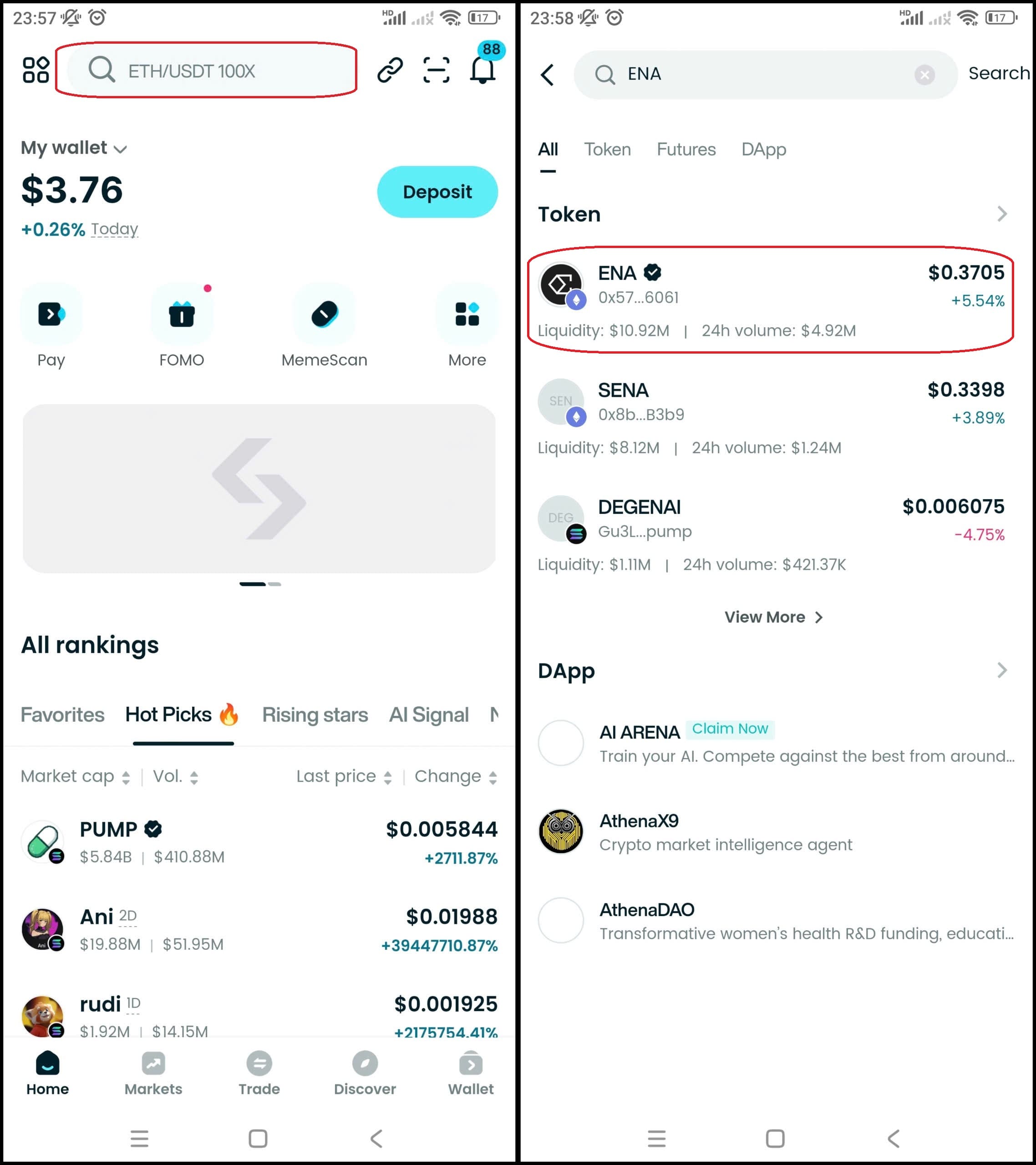

Step 3: Find Ethena Labs (ENA)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find Ethena Labs (ENA). Click on the token to view its trading page.

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as ENA/USDT. This will allow you to trade Ethena Labs (ENA) against USDT or another cryptocurrency.

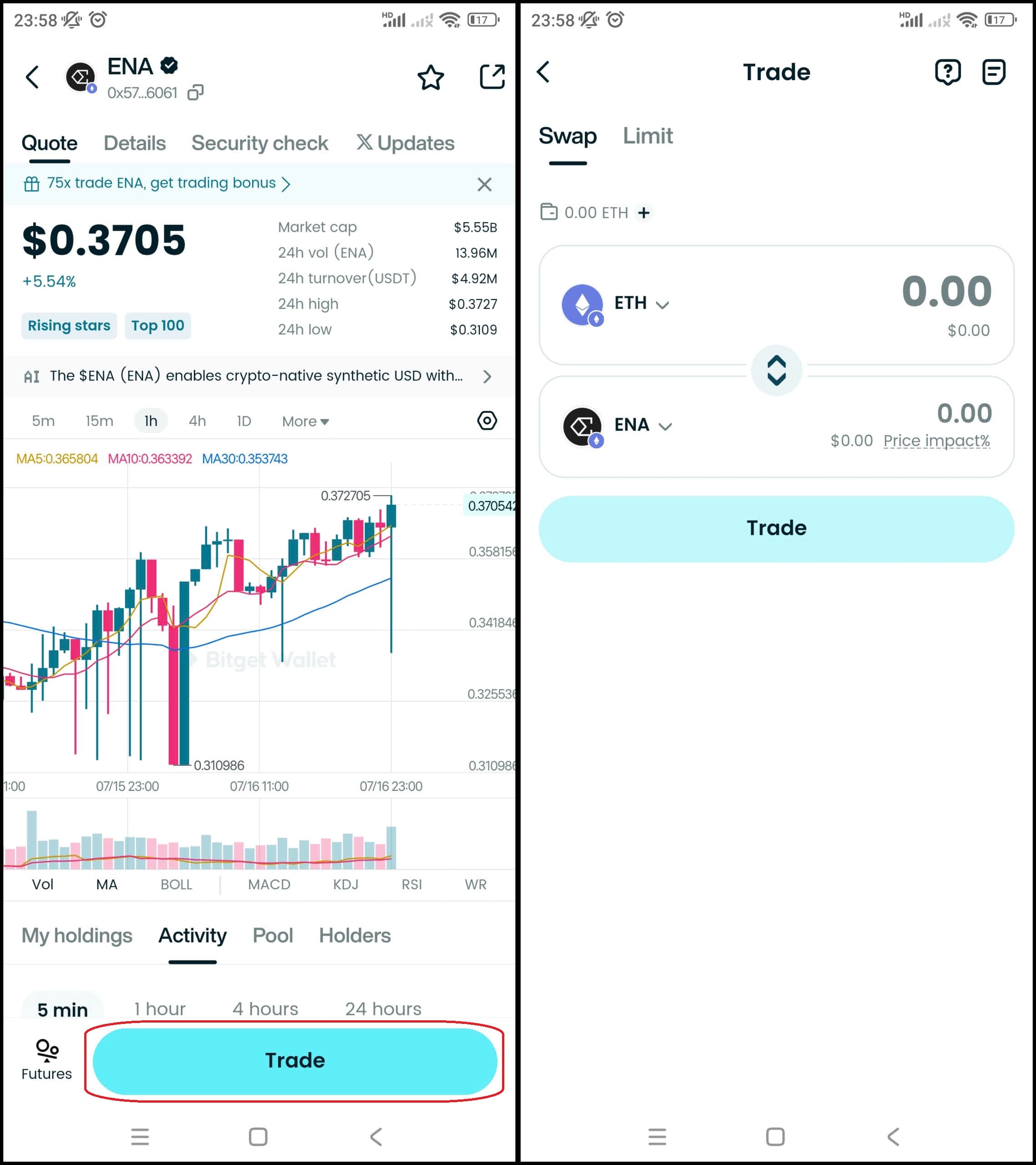

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of Ethena Labs (ENA) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired Ethena Labs (ENA).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your Ethena Labs (ENA) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶Learn more about Ethena Labs (ENA):

- What is Ethena Labs (ENA)?

- Ethena Labs (ENA) Airdrop Guide

- Ethena Labs (ENA) Listing Date and How to Buy It

Conclusion

Ethena Labs (ENA) has made a breakthrough in the decentralized stablecoin world with USDe, solving the limitations of traditional stablecoins that depend on banks. With a unique delta hedging mechanism and multi-layered yield generation, Ethena not only ensures stability but also offers attractive yields of up to 15% APY. With continuous development since its launch, multi-chain integration and strategic partners such as BlackRock, Ethena Labs (ENA) promises to become the leading decentralized stablecoin project in the cryptocurrency market by 2025.

If you are looking for a secure crypto wallet to store ENA, Bitget Wallet is the top choice with many outstanding advantages: smooth multi-chain transactions, intuitive staking yield tracking and optimal asset security. In particular, Bitget Wallet provides an "all-in-one" solution that gives you access to the entire Ethena ecosystem - from buying and selling ENA, generating USDe to staking sUSDe - opening up optimal investment opportunities in this potential DeFi space.

Download Bitget Wallet

FAQs

1. What is Ethena Labs (ENA)?

Ethena Labs (ENA) is a groundbreaking decentralized finance (DeFi) project that has created the world's first crypto-native synthetic dollar (USDe). This innovative stablecoin operates independently of traditional banking systems, aiming to revolutionize decentralized money markets by combining cutting-edge financial engineering with blockchain transparency.

2. What is USDe and how does it maintain its peg?

USDe is Ethena's synthetic dollar, designed to maintain its stability through a unique delta-hedging mechanism. When users mint USDe with crypto collateral, the protocol automatically opens corresponding short positions on derivatives exchanges, effectively neutralizing price volatility and ensuring its peg.

3. What is the best ENA wallet?

Bitget Wallet is an excellent choice for managing your ENA tokens and interacting with the Ethena ecosystem. It provides an "all-in-one" solution for seamless multi-chain transactions, intuitive staking yield tracking, and optimal asset security, making it ideal for buying ENA, minting USDe, and staking sUSDe to optimize your investment opportunities.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.