What Is a Bitcoin Card 2026: Types, Fees and Limits

What is a Bitcoin card? A Bitcoin card is a type of crypto debit card that lets users spend their Bitcoin like cash anywhere traditional cards are accepted. These cards convert crypto into local currency in real time, offering seamless integration with global payment networks like Visa and Mastercard. In this guide, we’ll cover how Bitcoin cards work, associated fees, and how to get started with the Bitget Wallet Card.

What Is a Bitcoin Card and How Does It Work?

A Bitcoin card works like a traditional debit or credit card, but it’s linked to your cryptocurrency holdings instead of a bank account. It allows you to spend your Bitcoin and other digital assets at any store that accepts Visa or Mastercard by automatically converting crypto into local currency at the time of purchase. This seamless integration bridges the gap between digital assets and real-world payments—making crypto easier to use than ever before.

What Does Bitcoin Cards Actually Do?

A Bitcoin card is a crypto debit card that allows users to spend Bitcoin directly. At checkout, the card converts Bitcoin to fiat currency instantly. It’s compatible with global systems like Visa and Mastercard, making it ideal for everyday use.

How Bitcoin Cards Work When You Pay?

When paying with a Bitcoin card, the crypto balance in your linked wallet is converted in real time into the local currency of the merchant. This is facilitated via instant conversion, ensuring smooth transactions. Unlike traditional bank cards, Bitcoin cards link to a crypto wallet (like Bitget Wallet), bypassing banks entirely.

What Are the Types of Bitcoin Cards?

There are several types of Bitcoin cards, each designed to suit different user needs and spending styles. From prepaid debit cards that convert crypto on the spot to credit cards that offer Bitcoin rewards, these tools provide flexibility in how you use and earn with your digital assets. Understanding the different types can help you choose the right card for your lifestyle and financial goals.

1. Virtual Bitcoin Card

- Designed for online payments and digital subscriptions.

- Instantly issued with no shipping delay.

- Great for platforms that don’t require a physical swipe.

Pros and Cons:

| Pros | Cons |

| Instant issuance | Can’t be used at physical stores |

| No delivery wait | Not ATM compatible |

| Easy to lock and replace | Limited merchant acceptance offline |

2. Physical Bitcoin Card

- Ideal for use in stores, restaurants, and ATMs.

- Supports swipe, chip, and contactless payments.

- Bitget Wallet Card supports both Visa and Mastercard globally.

Pros and Cons:

| Pros | Cons |

| ATM access | 1–2 weeks delivery time |

| Tap-to-pay and chip support | Higher loss risk |

| Global acceptance | Requires more KYC |

What Are the Differences Between Virtual and Physical Bitcoin Cards?

When choosing a Bitcoin card, you'll often be asked to pick between a virtual or physical version. While both serve the same core purpose—spending crypto like cash—they differ in how and where they can be used. Understanding these differences can help you decide which option best fits your daily spending habits and security preferences.

| Feature | Virtual Bitcoin Card | Physical Bitcoin Card |

| Best For | Online use | In-store & ATM transactions |

| Delivery Time | Instant digital issuance | 1–2 weeks for shipping |

| Security | Easier to lock/replace digitally | Physical PIN + 2FA |

| Accepted Locations | Online stores | Global retail + ATM (Visa/Mastercard) |

| Bitget Wallet Card | ✅ Yes | ❌ No |

Tip: Bitget Wallet card lets you manage both types of cards under one dashboard for full spending flexibility.

What Are the Fees and Limits for Using a Bitcoin Card?

Before using a Bitcoin card, it’s important to understand the fees and limits involved. From transaction and conversion fees to daily spending and ATM withdrawal limits, each card has its own cost structure. Knowing these details upfront can help you avoid surprises and manage your crypto spending more efficiently.

1. Bitcoin Card Fees

Common Bitcoin Card Fees

| Fee Type | Typical Range | Bitget Wallet Card |

| Issuance Fee | $0 – $15 (some cards free) | Free for virtual / Small fee for physical |

| Monthly Maintenance | $0 – $10/month | None |

| ATM Withdrawal Fee | $1 – $5 per withdrawal | Standard network fee (variable) |

| Foreign Exchange Fee | 0% – 3% | 0% for major fiat pairs |

| Conversion Spread | 0.5% – 2% | Competitive (real-time market rates) |

2. Bitcoin Card Limits

Common Bitcoin Card Limits

| Limit Type | Typical Range | Bitget Wallet Card |

| Daily Spend Limit | $1,000 – $10,000/day | Adjustable via app; up to $10,000/day |

| ATM Withdrawal Limit | $200 – $3,000/day | Up to $3,000/day |

| Top-Up Limit | $5,000/month average | Flexible; depends on KYC level |

| Transaction Frequency | 10–50/day typical | High frequency enabled (no major cap) |

How to Load and Manage Funds on Your Bitcoin Card?

There are two main ways to load a Bitcoin card: auto-conversion and manual loading. Each method suits different user preferences, whether you prioritize speed and convenience or budget control and planning. Understanding how these methods work helps you choose the right setup for your spending habits.

1. Auto-Conversion (Best for Fast, Real-Time Spending)

Auto-conversion means your crypto is automatically converted into fiat currency at the time of purchase. This method removes the need to preload your Bitcoin card, making it ideal for spontaneous or everyday use.

- Your Bitcoin card pulls funds directly from your crypto wallet at checkout.

- Conversion happens in real time, based on current exchange rates.

- Bitget Wallet supports gas-free swaps for a seamless spending experience.

Auto-conversion is perfect for users who prefer hands-off, real-time payments without managing card balances manually.

2. Manual Loading (Best for Budgeting and Control)

Manual loading lets you convert crypto into fiat in advance and store it on your Bitcoin card. This method offers more control over spending and allows you to lock in favorable exchange rates.

- You preload fiat onto your Bitcoin card using crypto from your wallet.

- Useful for budgeting, especially in volatile market conditions.

- Ensures a predictable balance and spending limit.

Manual loading is ideal for users who want to plan their finances and avoid real-time conversion risks.

Why Bitget Wallet Makes It Easy?

Regardless of which method you choose, Bitget Wallet streamlines the entire Bitcoin card experience:

- Easy switching between auto-conversion and manual top-up modes.

- 0-gas swaps and efficient transaction processing.

- Clear visibility into both crypto and fiat balances.

- Integration with your non-custodial wallet for full control and security.

With Bitget Wallet, loading and managing your Bitcoin card becomes effortless—whether you prefer speed or strategy.

Are Bitcoin Cards Safe to Use?

Security is one of the most important considerations when using a Bitcoin card. These cards are designed with strong protective measures to keep your assets secure—whether you're spending online, in-store, or managing your account from a mobile app.

Security Features You Should Expect

Every reliable Bitcoin card should include the following core security features:

- Two-factor authentication (2FA): Adds an extra layer of login protection.

- PIN protection: Prevents unauthorized use of your physical card.

- Real-time freeze/unfreeze: Instantly lock your card from the app if lost or compromised.

- Fraud monitoring systems: Detects suspicious activity and unauthorized transactions.

These features help prevent both digital and physical card misuse.

Is Bitget Wallet Card Safe to Use?

Yes. The Bitget Wallet Card is built on a secure, non-custodial foundation and includes multiple layers of protection:

- Comes with 2FA, biometric login, and in-app card control for maximum user security.

- Supports instant virtual card replacement in case of loss.

- Uses a non-custodial model—you retain control of your private keys, not the platform.

- No involvement from banks or third parties—your crypto stays securely in your Web3 wallet.

The Bitget Wallet Card gives you full control and top-tier protection, making it one of the safest ways to use crypto in everyday transactions.

Can I Use a Bitcoin Card Internationally?

You can use a Bitcoin card internationally in most countries where Visa or Mastercard is accepted. These cards convert your crypto into local currency at the point of sale, making them ideal for travel or global online shopping. Still, it’s important to check for foreign transaction fees, card network compatibility, and country restrictions before use.

Where Bitcoin Cards Are Accepted?

Yes, you can use a Bitcoin card internationally. These cards function on global payment rails like Visa and Mastercard and are accepted in over 170 countries. Bitget Wallet Card supports international use with no top-up fees.

Things to Know Before Using a Bitcoin Card Abroad

- Currency exchange fees may apply: Some Bitcoin cards charge a foreign transaction fee or include hidden exchange rate markups when converting your crypto into local currency. Always check the fee schedule before traveling.

- Not all merchants accept crypto-backed cards: While most Bitcoin cards operate on Visa or Mastercard rails, a few merchants—especially in remote areas—may not recognize or process crypto-linked cards properly. It’s smart to carry a backup payment method.

- Card network compatibility varies by country: Your Bitcoin card must be issued through a major payment network like Visa or Mastercard to ensure global usability. Confirm that the card is supported in the countries you plan to visit.

- Stablecoin pairing can reduce volatility risks: For smoother international spending, consider linking your Bitcoin card to a stablecoin like USDT or USDC. This helps avoid sudden price swings and makes your spending more predictable while abroad.

How to Get a Bitcoin Card in 2025?

Getting a Bitcoin card in 2025 is easier than ever, thanks to growing adoption and simplified onboarding processes. Most providers let you apply online through a crypto wallet or exchange, often requiring basic KYC verification. With just a few steps, you can order a virtual or physical card, load it with crypto, and start spending like a regular debit card—anywhere Visa or Mastercard is accepted.

1. Requirements

- Crypto Wallet: You’ll need a supported crypto wallet—Bitget Wallet is highly recommended for its built-in card integration, rewards system, and self-custody features.

- Age & Location: You must be at least 18 years old and reside in a country where the Bitcoin card is supported. Availability may vary depending on local regulations.

- Email & Phone: A valid email address and mobile number are required to complete sign-up and receive transaction alerts.

2. KYC

To comply with international financial regulations and ensure security, most Bitcoin card providers require a short identity verification process:

- Step 1: Upload a government-issued ID (e.g., passport, national ID card, or driver’s license).

- Step 2: Take a real-time selfie to match your ID and confirm liveness.

- Step 3: Provide proof of address (in some cases), such as a utility bill or bank statement.

- Virtual Card Issuance: Typically instant after successful KYC—ready for online purchases and mobile wallets (e.g., Apple Pay, Google Pay).

- Physical Card Delivery: Takes 1–2 weeks depending on your location. Most providers ship globally with tracking and optional express delivery.

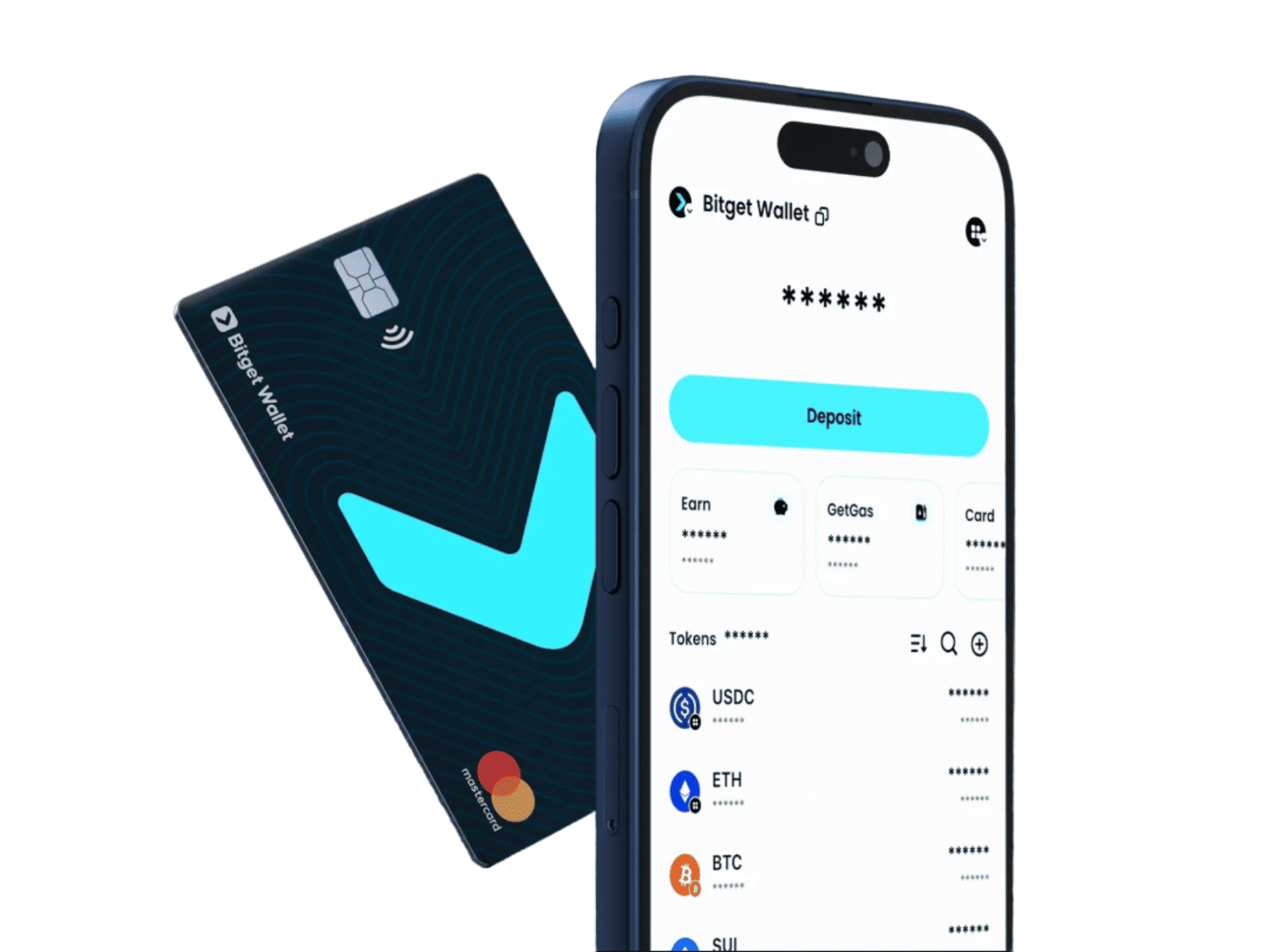

What Is the Bitget Wallet Card and Why Use It?

Bitget Wallet is the latest major wallet to partner with Immersve to bring seamless, direct crypto payments through the Mastercard network; with real-time multichain swap and deposit functionality streamlining how users fund and spend from any supported blockchain.

All transactions will be processed instantly, on-chain, and in compliance with security and regulatory framework, including KYC and AML protections.

- Product Highlights

✅ Sign-Up in minutes: No credit checks or asset stake required, just sign up with ease using ID or passport or driver license

✅ Seamless Integration: Easily add your wallet to Google Pay, Apple Pay, and more

✅ Unbeatable Low Fees: Enjoy no annual fees, no top-up fees, and competitive exchange rates

✅ Pay Anywhere Anytime: Easily make payments where Mastercards are accepted.

✅ More Perks

1. Earn 5 USDC upon identity verification(KYC)

2. Stake Stablecoins and earn up to 8% APY

3. Extra cashback for the first 30 days

What Can You Do With a Bitget Wallet Card?

- Spend crypto like cash in 170+ countries using Visa/Mastercard rails.

- Use it for travel, dining, online shopping, and ATM withdrawals.

- Works with BTC, ETH, and 250K+ tokens via Bitget Wallet's swap engine.

- No top-up fees, real-time conversion from wallet to fiat.

What Features Make Bitget Wallet Card Stand Out?

- Multi-chain support: 130+ networks (Ethereum, Solana, BNB, etc.).

- Instant token swaps with 0 gas fees via internal routing.

- Mobile-first UI with real-time card balance and price tracking.

- Compatible with both virtual and physical card formats

How to Start Bitget Wallet Card?

Step 1: Download and Set Up Bitget Wallet

Download the Bitget Wallet app from the App Store or Google Play. Create a new wallet or import an existing one, and securely back up your recovery phrase.

Step 2: Complete KYC Verification

Verify your identity by submitting a government-issued ID and a selfie directly within the app. This step is required to request a Bitcoin card.

Step 3: Request Your Bitcoin Card

Once verified, go to the “Card” section in the app to order your virtual or physical Bitcoin card. Virtual cards are issued instantly; physical cards typically arrive in 7–14 days.

FAQs About Bitcoin Cards

1. What is a Bitcoin card and how is it different from a bank card?

A Bitcoin card lets you spend crypto like cash by converting it to fiat at checkout. Unlike a bank card, it links to a crypto wallet, not a bank account.

2. Can I use a Bitcoin card at ATMs?

Yes, physical Bitcoin cards work at most ATMs worldwide via Visa or Mastercard. Crypto is converted to local currency before cash is dispensed.

3. Do Bitcoin cards support stablecoins?

Yes, most support stablecoins like USDT and USDC. This helps avoid price volatility while spending.

Conclusion

A Bitcoin card, such as the Bitget Wallet Card, offers a modern way to use crypto like traditional money. Whether you’re shopping online or spending abroad, it combines convenience, flexibility, and global access. Explore the features and download Bitget Wallet today to unlock real-world spending with your crypto.

Download Bitget Wallet

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Apply for a Crypto Mastercard2026-01-05 | 5 mins

- How to Apply for a Crypto Visa Card and Start Spending Crypto Worldwide2026-01-02 | 5 mins

- How to Top Up Your Crypto Debit Card with USDT2025-12-29 | 5mins