USDC vs USDT: What’s the Difference? Investor’s Guide for 2026

USDC vs USDT has emerged as one of the most important comparisons for crypto investors. As stablecoins become essential tools of trading, remittances, and decentralized finance (DeFi), it is important that one knows USD Coin (USDC) and Tether (USDT) differ. They are both intended to be pegged at 1:1 to the U.S. dollar, but they also substantially differ in terms of transparency, regulatory compliance, and market acceptance.

What Are USDC and USDT?

What is USDC?

USD Coin (USDC) is a fiat-backed stablecoin introduced in 2018 by Coinbase and Circle via the Centre Consortium. Every USDC token is collateralized 1:1 by U.S. dollars deposited in regulated financial institutions. USDC provides monthly attestations (not full audits) by top accounting firms like Deloitte, verifying its 1:1 reserve backing. Such transparency has enabled USDC to become a favorite for institutional investors and DeFi platforms.

Source: cryptologos

Learn more about USDC wallets here: USDC Wallet Guide

What is USDT?

USDT, the most widely used stablecoin, is backed by a mix of assets, primarily U.S. Treasury bills and cash equivalents. Despite recent improvements in reserve reporting, concerns about the depth of third-party audits persist.

Source: seeklogo

Learn more about USDT wallets here: USDT Wallet Guide

Key Differences Between USDC and USDT

1. Market Cap & Liquidity

-

USDT: As of 2026, USDT continues to dominate the global stablecoin market, with its market capitalization now surpassing $200 billion. Its deep liquidity across virtually all major CEXs and DEXs makes it the most widely used trading and settlement stablecoin worldwide.

-

USDC: In 2026, USDC maintains its position as the second-largest stablecoin, holding a market capitalization of roughly $90–100 billion. Its regulated structure and strong institutional adoption help sustain high liquidity, especially in DeFi, fintech platforms, and U.S.-compliant exchanges.

2. Transparency & Reserves

-

USDC: Provides monthly attestations from independent auditors, confirming that each token is fully backed by U.S. dollar reserves held in regulated financial institutions. This transparency builds trust among users and regulators.

-

USDT: While Tether has made efforts to publish reserve attestations, the frequency and detail of these reports have been questioned. Past controversies regarding reserve composition have led to concerns about USDT's transparency.

3. Regulatory Compliance

-

USDC: Complies with U.S. regulations, following money transmission laws and closely working with regulators to abide by them. This regulatory compliance adds value to its standing as a safe and trusted stablecoin.

-

USDT: Has come under legal scrutiny, such as investigations by the New York Attorney General, and has been questioned about its operational procedures and reserve management. Its regulatory status remains less clear compared to USDC.

4. Blockchain Support

| Feature |

USDC |

USDT |

| Ethereum |

✅ |

✅ |

| Solana |

✅ |

✅ |

| Algorand |

✅ |

❌ |

| Tron |

✅ |

✅ |

| Omni |

❌ |

✅ |

| Binance Smart Chain |

✅ |

✅ |

USDC and USDT both exist on popular blockchains but have varying support. USDC is strong on Ethereum, Solana, and Algorand, whereas USDT enjoys wider support, including Tron and Omni.

Table of Difference between USDC and USDT

| Category |

USDC |

USDT |

| Market Cap (2025) |

~$58 billion |

~$143 billion |

| Liquidity |

High, especially in North America and DeFi platforms |

Very high, globally adopted by most exchanges |

| Transparency |

Monthly audits by independent firms; fully backed by USD |

Irregular attestations; past controversies on reserve composition |

| Regulatory Compliance |

Strong U.S. regulatory compliance; follows money transmission laws |

Subject to investigations; less transparent regulatory status |

| Blockchain Support |

Ethereum, Solana, Algorand, Tron, BSC |

Ethereum, Solana, Tron, Omni, BSC |

| Notable Absence |

No support for Omni |

No support for Algorand |

USDC vs USDT: Which Is Safer and Better for Investors?

When comparing "USDT vs USDC which is safer," keep the following in mind:

-

Safety: USDC's transparency and regulatory compliance commitment make it a safer bet for conservative investors. Compliance with U.S. regulations and periodic audits gives confidence in its support and operations.

-

Practicality: USDT's larger market cap and general acceptance on all exchanges provide higher liquidity, making it more convenient for regular trading and global transactions.

Investor Recommendations:

-

For Institutional Investors and DeFi Users: USDC is preferable due to its transparency and regulatory compliance.

-

For Active Traders and Global Transactions: USDT's liquidity and broad exchange support make it a practical choice.

How to Buy and Use USDC or USDT?

Bitget Exchange is a trusted global platform for trading USDC and USDT. It offers low fees, fast transactions, and supports multiple blockchain networks, making it accessible to users worldwide.

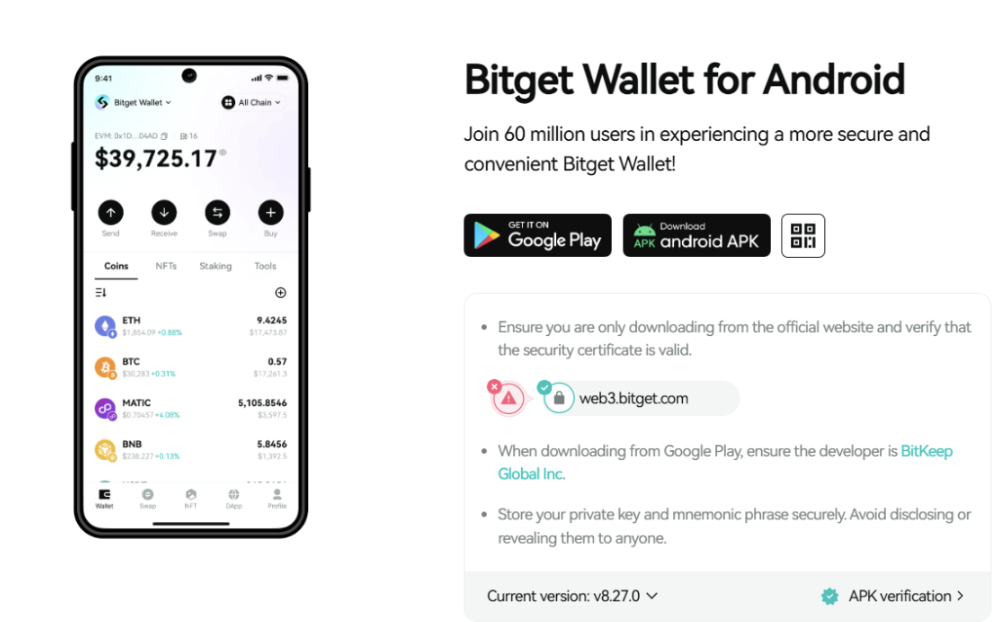

Why Use Bitget Wallet for Stablecoins?

-

Secure Storage: Non-custodial wallet features ensure users have full control over their assets.

-

Multi-Chain Support: Compatible with Ethereum, Tron, Solana, and more, allowing flexibility in asset management.

-

Easy Swaps: In-app features enable seamless swaps between stablecoins and other cryptocurrencies.

-

Risk Mitigation: Protects assets from centralized exchange risks by allowing users to manage their private keys.

How to Buy USDT or USDC on Bitget Wallet?

Step 1: Download and Install Bitget Wallet

Available on iOS, Android, and as a browser extension.

Step 2: Create a New Wallet or Import Existing

Set a strong password and securely back up your recovery phrase.

Step 3: Deposit Crypto or Fiat

Deposit crypto from an external wallet or use the integrated fiat onramp to buy with a credit card.

Step 4: Swap or Buy USDT/USDC Directly

Use the in-app swap feature or connect to Bitget Exchange. Review rates and confirm the transaction.

Step 5: Store or Use in DeFi/Trading

Keep stablecoins in the wallet or connect to DeFi protocols, dApps, or exchanges for further use.

Conclusion

In the USDC vs USDT debate, the choice depends on your priorities:

-

Safety and Transparency: USDC stands out with its regulatory compliance and regular audits.

-

Liquidity and Accessibility: USDT offers higher liquidity and broader acceptance across exchanges.

No matter which stablecoin you choose, a secure wallet is essential. Download Bitget Wallet today to trade and store your USDC or USDT with confidence.

FAQs

Q1: USDT vs USDC – Which stablecoin is safer in 2025?

A: In the USDT vs USDC safety comparison, USDC is considered safer due to its transparent monthly reserve attestations and strict U.S. regulatory compliance. USDT, while widely used, has faced past controversies regarding its reserves and remains less transparent.

Q2: What’s the difference between USDT vs USDC in terms of liquidity and adoption?

A: USDT leads in global liquidity, with a market cap above $200B in 2026 and broad adoption across most exchanges. USDC (~$90–100B) is preferred in North America and DeFi, where its transparency and regulatory alignment attract institutional users.

Q3: USDT vs USDC – Which is better for DeFi and long-term holding?

A: For DeFi and long-term holding, USDC is preferred due to its regulated structure and predictable reserve management. While USDT offers convenience for active trading, USDC’s compliance makes it more appealing to conservative and institutional users.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Cash Out USDC: How to Withdraw USDC to Bank Account?2026-03-03 | 5mins

- Best USDC Yield Strategies: How to Earn Stablecoin Interest?2026-02-23 | 5mins

- What Are Crypto On-Ramp and How They Shape Fiat-to-Crypto Capital Flows2026-02-23 | 5mins