What is USDE? A Complete Guide to Ethena's Synthetic Dollar Stablecoin in 2025

What is USDE? USDE is a synthetic dollar stablecoin developed by Ethena Labs that maintains its dollar peg through crypto assets and delta-neutral hedging rather than traditional fiat reserves.

The protocol leverages advanced financial engineering to balance crypto collateral with derivatives positions, which keeps things stable even when the market is volatile. Users can access USDE through various platforms, including Bitget Wallet and other major crypto exchanges.

This comprehensive guide explores how USDE transforms the stablecoin landscape. Specifically, it examines USDE’s technical operations, yield opportunities, benefits, and associated risks to provide complete insight into this synthetic dollar innovation.

Key Takeaways

- USDE is Ethena Labs' unique approach to creating a dollar-pegged token that breaks free from traditional banking dependencies.

- This synthetic stablecoin operates by accepting crypto deposits as collateral while simultaneously opening short positions in derivatives markets. This delta-neutral strategy ensures that gains or losses from collateral are perfectly offset by opposite movements in the hedging positions.

- USDE delivers several advantages, including complete independence from traditional financial systems, native yield generation through staking mechanisms, and capital-efficient 1:1 collateralization.

What is USDE: Definition and Core Features

USDE is a synthetic dollar stablecoin developed by Ethena Labs that maintains its $1 peg through crypto assets rather than conventional fiat reserves. This approach distinguishes USDE from traditional stablecoins through several key characteristics:

-

Crypto-backed collateral:

Uses ETH, stETH, BTC, and USDT as backing instead of bank-held dollars.

-

Delta-neutral hedging:

Maintains stability through derivatives trading that offsets collateral volatility.

-

Native yield generation:

Offers staking rewards through sUSDe tokens, unlike traditional stablecoins.

USDE runs on the Ethereum blockchain, taking advantage of its security and decentralized financial environment. As of July 2025, USDE has a market valuation of about $5.31 billion, placing it in the top 31 cryptocurrencies by market capitalization.

USDE vs Traditional Stablecoins: Key Differences

The Ethena stablecoin introduces fundamental innovations that distinguish it from established stablecoins like USDT, USDC, and DAI.

| Feature | USDE (Ethena) | Traditional Stablecoins |

| Collateral Type | Crypto assets + derivatives hedging | Fiat reserves (USDT/USDC) or over-collateralized crypto (DAI) |

| Stability Mechanism | Delta-neutral hedging strategy | Fiat reserves or liquidation mechanisms |

| Yield Generation | Native staking rewards through sUSDe | Requires external DeFi protocols |

| Censorship Resistance | High (fully crypto-native) | Low to medium (bank-dependent for fiat-backed) |

| Regulatory Dependency | Minimal oversight required | High compliance requirements |

| Capital Efficiency | 1:1 collateral ratio | Over-collateralization needed (DAI) or reserve requirements |

| Transparency | Real-time on-chain metrics | Varies from audited reports to full on-chain visibility |

| Decentralization | Smart contract governance | Centralized issuers (USDT/USDC) or DAO governance (DAI) |

How Does USDE Work? The Delta-Hedging Mechanism

USDE operates through a three-stage process that combines collateralization, hedging, and automated market mechanisms to maintain dollar stability.

Minting Process

Users begin by depositing supported crypto assets, primarily ETH or stETH, into the Ethena protocol as collateral. The protocol simultaneously opens equivalent short positions in perpetual futures markets to offset the price exposure of the deposited assets.

For every dollar worth of collateral deposited, the protocol issues one USDE token to the user. This 1:1 issuance ratio ensures that circulating USDE tokens are always backed by equivalent value in hedged collateral.

Stability Maintenance

The core stability mechanism relies on delta-neutral positioning, where long exposure from collateral is perfectly balanced by short derivatives positions. When collateral gains value, the short position loses an equivalent amount, keeping the total value stable.

The protocol continuously monitors market conditions and automatically rebalances these hedged positions in real time. If USDE token prices deviate from the dollar peg on secondary markets, arbitrageurs can profit by minting new tokens at $1 or redeeming existing ones. This mechanism naturally restores the peg through market forces.

Redemption Process

Users redeem USDE tokens by submitting them to the protocol, which then burns the tokens to reduce circulating supply. The protocol simultaneously closes the corresponding short futures positions that were hedging the original collateral.

After completing the token burn and position closure, the protocol returns the underlying collateral assets to users minus applicable fees. This entire process maintains the delta-neutral balance while allowing users to exit their positions and recover their original crypto assets.

USDE Yield Generation and Staking (sUSDe)

USDE introduces the revolutionary "Internet Bond" concept, creating a crypto-native, yield-bearing savings instrument that combines multiple revenue streams into a single scalable product. The yield generation mechanism operates through two distinct but complementary sources:

-

Staked Ethereum Rewards:

A portion of the collateral backing Ethena USDe consists of staked ETH assets like stETH, which earn consensus and execution layer rewards from the Ethereum network. These rewards typically range from 3% to 6% APY.

-

Derivatives Funding Rates:

The protocol's short positions in perpetual futures markets generate additional yield when funding rates are positive. Historical funding rates have shown significant variability, with ETH perpetuals returning 16% in 2021, 0.6% in 2022, 9% in 2023, and 13% in 2024.

-

sUSDe Non-Rebasing Structure:

When users stake USDE tokens, they get sUSDe, a yield-bearing asset that gains value instead of increasing in quantity. This structure allows each sUSDe token to become worth more as time passes, so unstaking returns more USDE than the original deposit amount.

Historical performance demonstrates the potential of this dual-yield approach, with sUSDe APY averaging around 18% in 2024 and reaching peaks of up to 29% during periods of high derivatives funding rates and strong DeFi demand.

Benefits and Use Cases of USDE

USDE's design creates multiple advantages for users across the crypto ecosystem.

Benefits

USDE offers five core benefits as follows:

-

Censorship Resistance:

USDE maintains complete independence from traditional banking systems through its crypto-native backing structure. This design ensures no centralized entity can freeze or block transactions.

-

Capital Efficiency:

Unlike decentralized alternatives that require over-collateralization, USDE achieves its dollar peg with a 1:1 collateral ratio. This approach maximizes capital efficiency and reduces the opportunity cost of locking up assets.

-

Native Yield:

USDE holders can stake their tokens to receive sUSDe, which accrues yield directly from the protocol. This eliminates dependence on third-party DeFi platforms while generating returns from both staked ETH rewards and derivatives funding rates.

-

Scalability:

The delta-neutral hedging mechanism enables efficient supply scaling through derivatives markets. This approach removes limitations imposed by fiat reserve availability, allowing for rapid growth and broad adoption.

-

DeFi Integration:

USDE seamlessly integrates with both decentralized and centralized finance platforms. This compatibility enables usage across lending, borrowing, trading, and liquidity provision activities.

Use Cases

USDE serves four below primary practical applications:

-

Trading Collateral:

USDE functions as margin collateral on major exchanges, supporting perpetual futures and spot trading pairs while enabling participation in yield-generating earn platforms.

-

Yield Farming:

Users can supply USDE to DeFi lending platforms, such as Aave and Morpho, or pair it in liquidity pools, earning both protocol rewards and additional incentives.

-

Savings Instrument:

By staking USDE for sUSDe, users access a crypto-native "Internet Bond" that historically provides competitive yields in a permissionless manner.

-

Cross-Platform Liquidity:

USDE's multi-chain support across Ethereum, Arbitrum, Solana, and Mantle enables liquidity provision across various protocols, enhancing market efficiency and trading depth.

Risks and Considerations When Using USDE

Despite the aforementioned benefits and use cases, USDE's innovative synthetic structure also poses several risk categories that users should carefully evaluate.

-

Funding Rate Risk:

When derivatives markets experience persistently negative funding rates, the protocol must pay to maintain its short positions. This situation can erode or completely eliminate yield generation. In severe cases where the insurance fund becomes depleted, it may threaten the protocol's solvency and the USDE peg.

-

Counterparty Risk:

If major exchanges experience technical failures, insolvency, or regulatory targeting, Ethena may lose the ability to close or rebalance critical hedge positions, potentially causing significant losses or depegging events.

-

Regulatory Risk:

USDE's complex structure may attract heightened scrutiny, especially in jurisdictions with strict rules governing derivatives or unregistered securities, potentially restricting access or forcing protocol modifications.

-

Market Risk:

Sudden market crashes or derivative market illiquidity can overwhelm automated rebalancing systems, potentially leading to forced liquidations or temporary depegging scenarios.

-

Complexity Risk:

This increased complexity raises the probability of smart contract vulnerabilities, technical failures, or operational mismanagement compared to simpler fiat-backed alternatives.

How to Buy USDE on Bitget Wallet?

Trading USDE is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Move crypto from your existing wallet.

- Buying Crypto: Buy crypto using credit or debit cards directly through Bitget Wallet, making sure you have sufficient balance for USDE transactions.

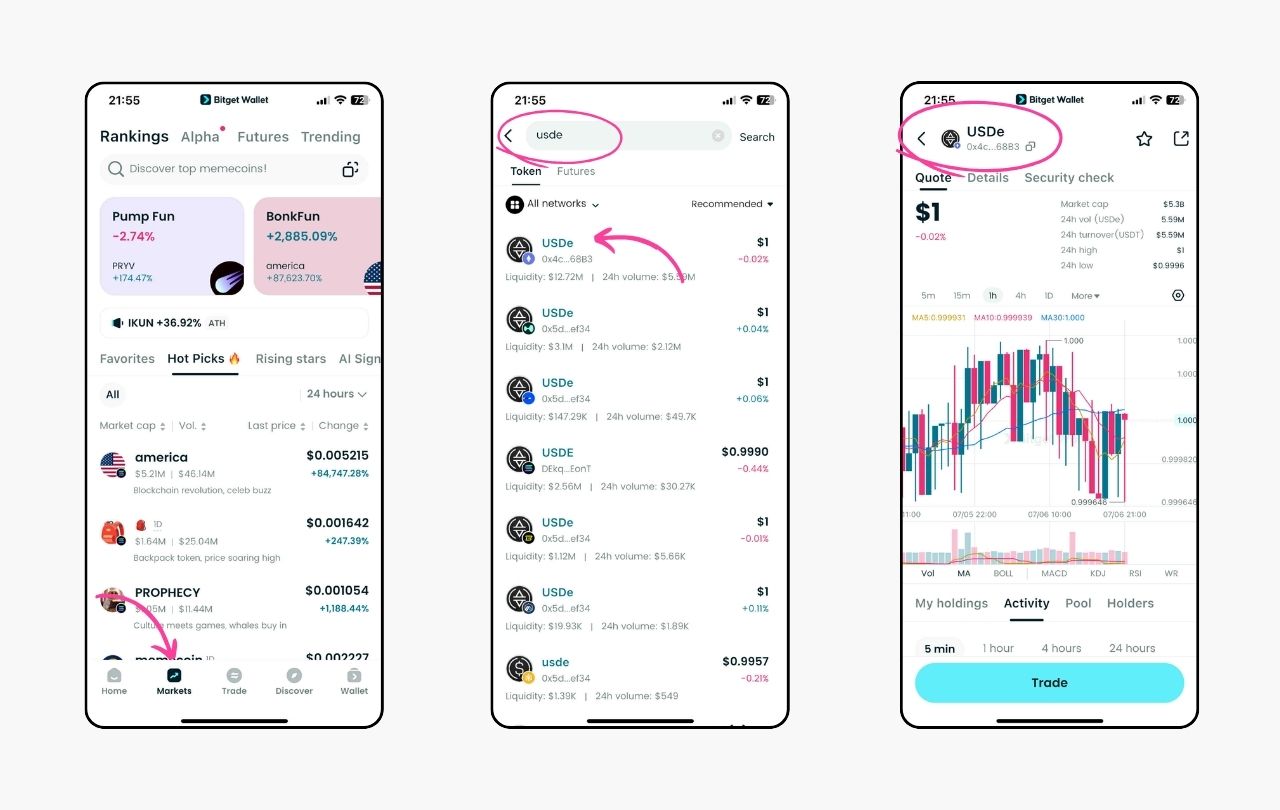

Step 3: Find USDE

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find USDE. Click on the token to view its trading page.

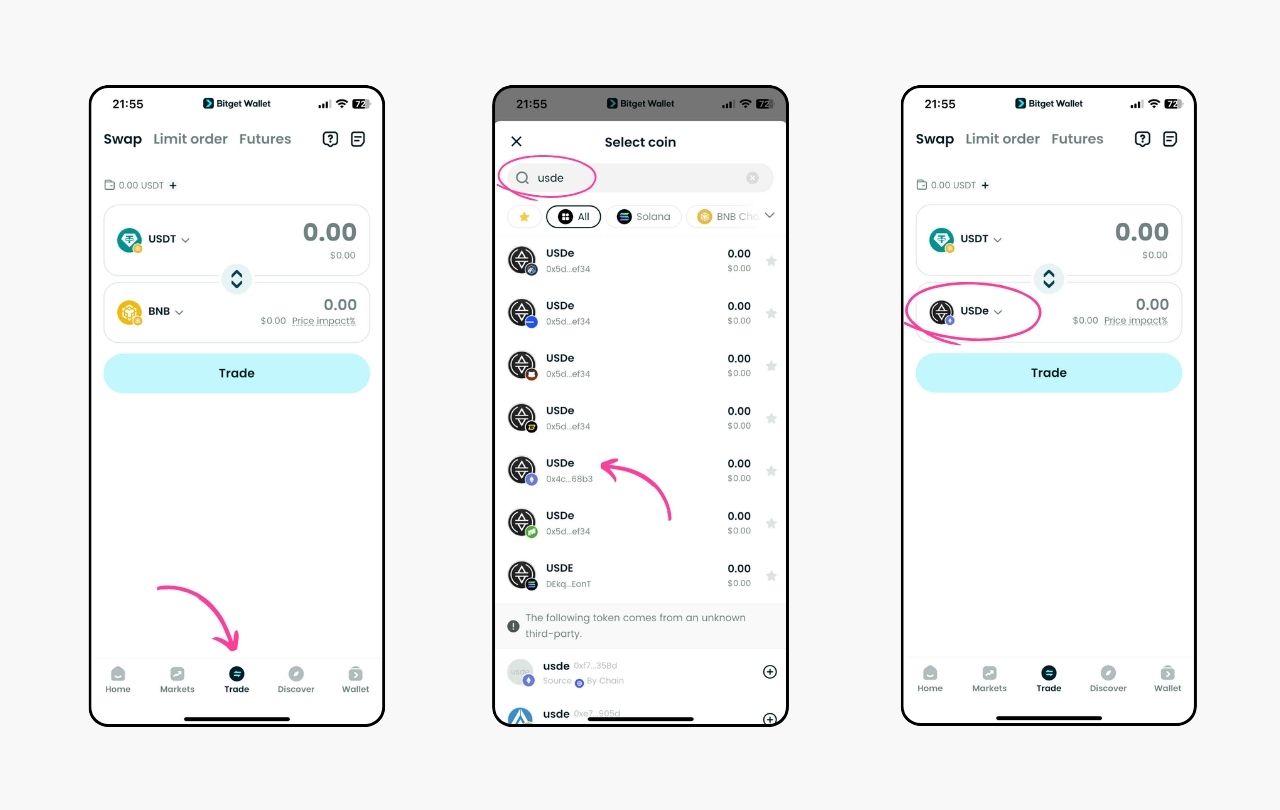

Step 4: Choose Your Trading Pair

Pick the trading combination you prefer, like USDE/USDT. This will allow you to trade USDE against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of USDE you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, track what's happening in the "Open Orders" part. When the order goes through, check your balance to see your new USDE.

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your USDE or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

Conclusion

USDE is a novel evolution in stablecoin design, successfully addressing the traditional trilemma of stability, decentralization, and capital efficiency through its innovative delta-neutral hedging mechanism.

Bitget Wallet stands out as the premier choice for USDE management through several key advantages:

-

Comprehensive DeFi Integration:

Native support for sUSDe staking, liquidity provision, and cross-platform yield opportunities across Ethereum, Arbitrum, and Solana networks

-

Advanced Security Architecture:

Multi-layer protection with hardware wallet compatibility, ensuring safe storage of USDE holdings and staked positions

Download Bitget Wallet today to unlock the full potential of USDE's yield-generating capabilities and experience the future of synthetic dollar stablecoins with complete security and convenience.

FAQs about USDE

1. What is USDE in crypto?

USDE is a synthetic dollar stablecoin created by Ethena Labs that maintains its USD peg through delta-hedging mechanisms rather than traditional fiat reserves. This approach uses crypto assets as collateral while opening equivalent short positions in derivatives markets to neutralize price volatility.

2. How does USDE generate yield?

USDE generates yield through two primary sources: staked Ethereum rewards from collateral assets like stETH and funding rates earned from perpetual futures markets. Users can stake USDE to receive sUSDe tokens, which appreciate over time as these dual yield sources accumulate within the protocol.

3. Is USDE safe to use?

USDE uses delta-neutral hedging for stability but carries unique risks including funding rate volatility and counterparty exposure to derivative exchanges. While the protocol maintains an insurance fund to protect against negative yields, users should understand these risks before participating in the ecosystem.

4. What makes USDE different from USDT?

Unlike USDT's fiat backing, USDE uses crypto collateral with derivatives hedging for enhanced censorship resistance and native yield generation. This fundamental difference allows USDE to operate independently of traditional banking systems while offering staking rewards that USDT cannot provide.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Cash Out USDC: How to Withdraw USDC to Bank Account?2026-03-03 | 5mins

- Best USDC Yield Strategies: How to Earn Stablecoin Interest?2026-02-23 | 5mins

- What Are Crypto On-Ramp and How They Shape Fiat-to-Crypto Capital Flows2026-02-23 | 5mins