JPYC ($JPY) Listing: Airdrop & Launch Date for Yen-Pegged Stablecoin

JPYC ($JPY) listing is creating a stir in the crypto sphere, with many wondering if it could replicate recent success stories—like early PEPE investors turning $500 into $50,000 overnight. Now, a stablecoin with real‑world backing is on the brink of hitting a global platform.

Set to launch on Binance on July 10, 2025 at 08:00 UTC under the JPYC/JPY pair, this Japanese yen‑pegged stablecoin offers cross‑chain utility, fiat interoperability, and trusted regulation from JPYC Co. Ltd.

With Binance’s reach, JPYC gains global accessibility, liquidity depth, and credibility—potentially unlocking yield‑earning options and drawing institutional interest. In this article, we'll explore what sets JPYC apart, how to trade it, its projected price outlook, and why so many are watching this upcoming listing.

JPYC ($JPY) Listing: Key Dates, Airdrops & Participation Guide

1. Key Listing Information

Here are the important details about the JPYC ($JPY) listing:

- Exchange: Binance

- Trading Pair: JPYC/JPY

- Deposit Available: To Be Announced

- Trading Start: July 10, 2025 – 08:00 UTC

- Withdrawal Available: To Be Announced

Don’t miss your chance to start trading JPYC ($JPY) on Binance and be part of this groundbreaking stablecoin journey.

Note: Please refer to the official announcement for the most accurate schedule.

Differences Between CEX and DEX Trading

Centralized exchanges (CEX) like Binance and decentralized exchanges (DEX) like Bitget Wallet offer distinct trading experiences. Binance, as a CEX, provides a user-friendly interface, high liquidity, and advanced trading tools, requiring users to deposit funds into the exchange to keep the fund safe.

On the other hand, Bitget Wallet operates as a self-custodial solution, allowing users to manage their assets independently without reliance on third parties. Its design supports permissionless trading and prioritizes privacy, aligning with the principles of decentralized finance.

By facilitating direct access to decentralized markets, Bitget Wallet eliminates intermediaries, offering a trading environment where users retain full control over their funds. This structure appeals to those who seek a more autonomous and transparent approach to digital asset management.

JPYC Airdrop: How to Claim $JPY Rewards?

JPYC is a yen-pegged, legally compliant stablecoin built to support secure Web3 payments, real-world integrations, and cross-chain utility. To celebrate its adoption, an independent airdrop campaign is distributing free $JPY tokens to eligible participants via staking.

Airdrop Timeline

- Airdrop Period: July 1 – July 14, 2025

- Winner Announcement: July 18, 2025

How to Join the $JPY Airdrop

Step 1: Visit the Official Airdrop Guide

Start by reviewing the official security and participation walkthrough on Medium. This guide outlines safe participation methods, wallet setup, and official DappRadar links to avoid phishing scams.

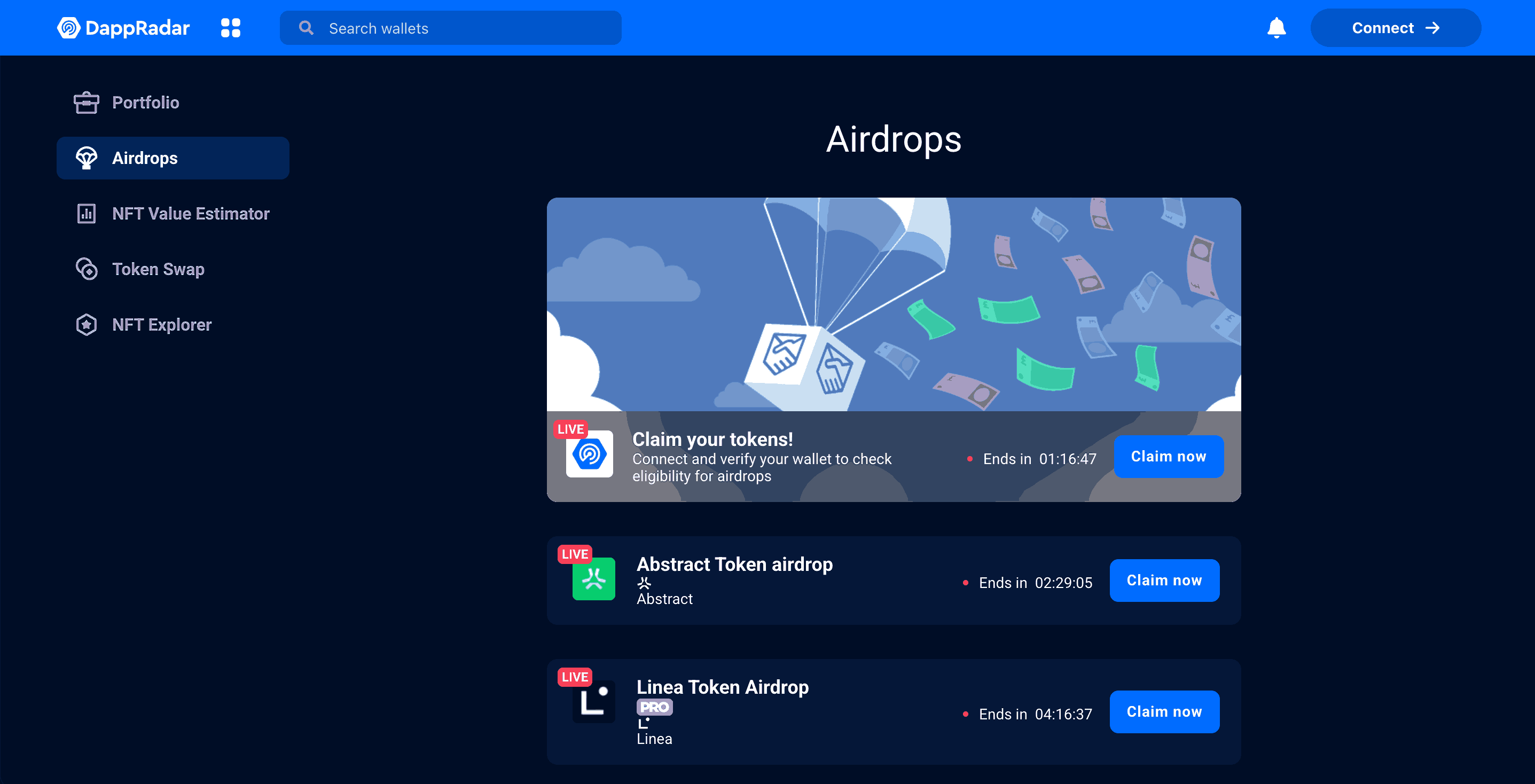

Source: DAppRadar

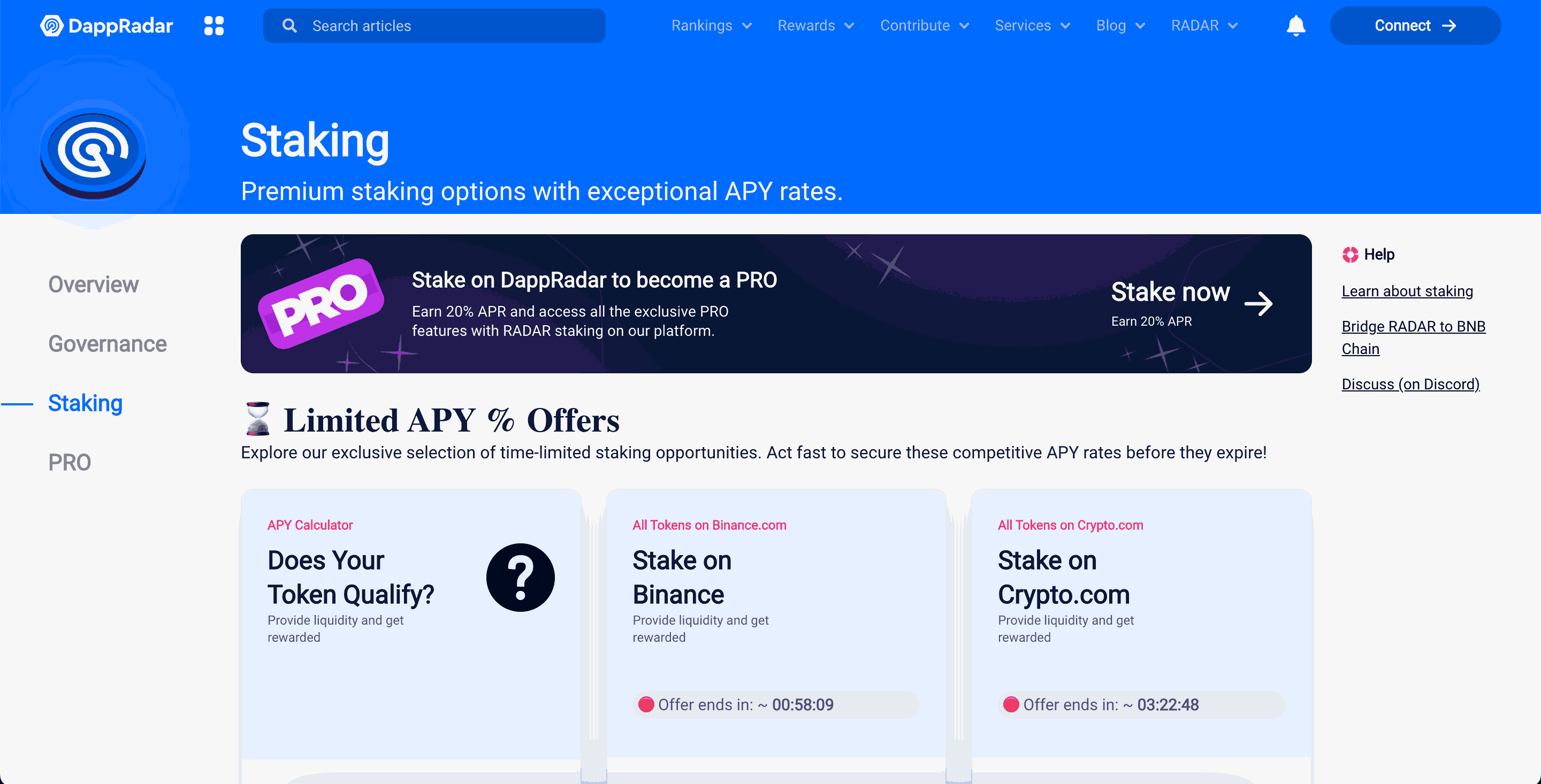

Step 2: Stake JPYC via DappRadar

Once on the correct DappRadar campaign page:

- Connect your ERC-20 compatible wallet

- Stake the required amount of JPYC as outlined

- No social tasks, no retweeting—staking is the only requirement

Source: DAppRadar

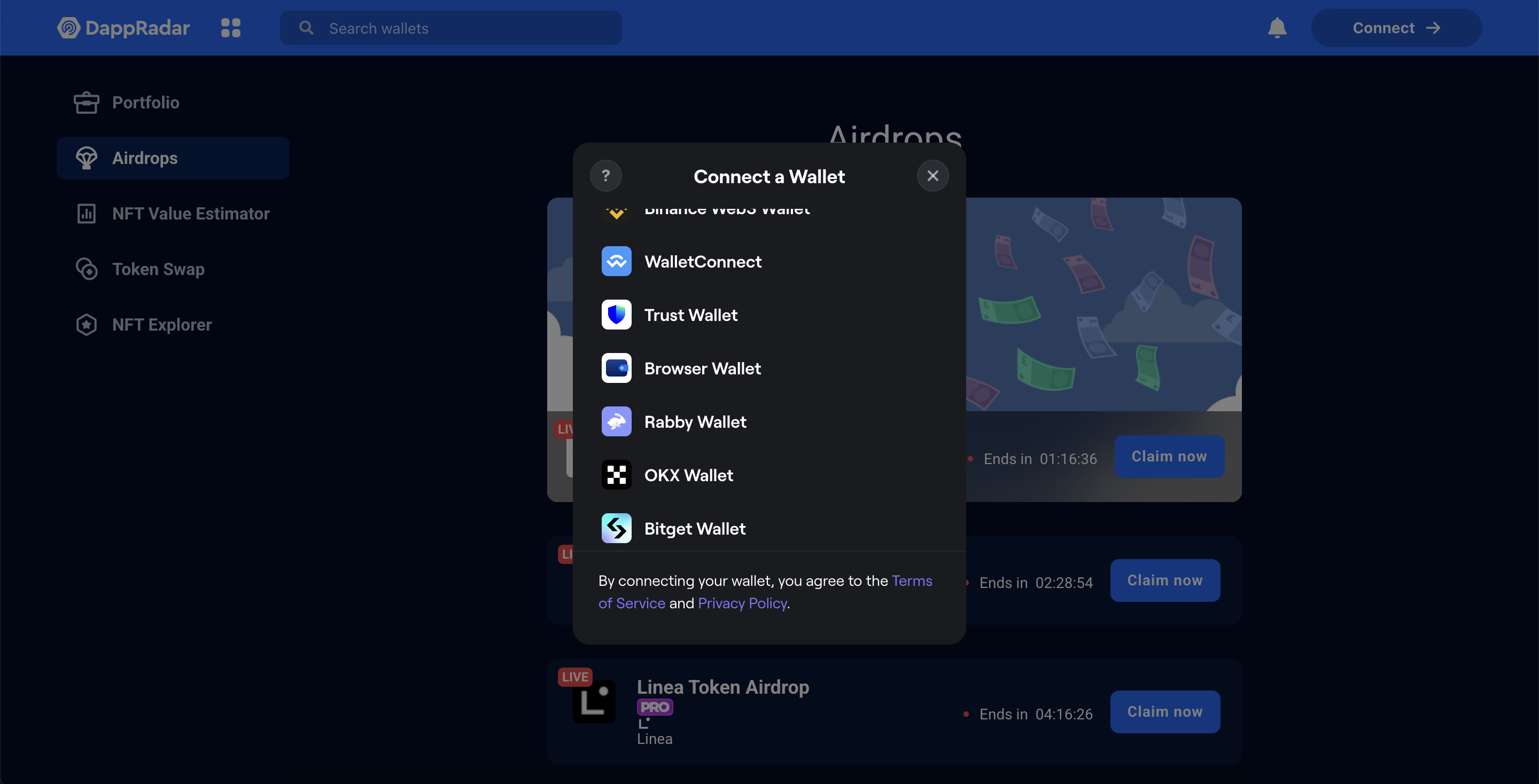

Step 3: Use a Secure, Non-Custodial Wallet

Use a trusted wallet and double-check contract approvals. Do not share your seed phrase or interact with suspicious DMs or sites.

Source: DAppRadar

Step 4: Receive Your $JPY Tokens

If selected, tokens will be automatically distributed after July 15. No manual claiming is required. Stay cautious and refer only to links provided in the official guide.

▶ Learn more: How to Claim Airdrop to Wallet

JPYC ($JPY) Price Prediction: Market Maker & Market Dynamics Impact

The listing of JPYC ($JPY) on a major centralized exchange will not only draw retail interest but also mark a critical entry point for market makers. These liquidity providers play a key role in shaping early price action through algorithmic trading and spread management.

Key Market Maker Indicators

-

Market Maker Presence & Strategy

Providers like Wintermute and GSR—active in stablecoin markets—could influence price fluctuations by adjusting liquidity and tightening spreads during early trading. Though JPYC-specific names aren't disclosed, these firms typically deploy aggressive, high-frequency strategies.

-

Initial Liquidity Pool Size

A large initial liquidity pool suggests less vulnerability to price spikes from single trades, helping dampen volatility in the critical first days.

-

Options & Open Interest Trends

JPYC doesn’t currently have options trading, but historical patterns from similar tokens show that rising options open interest—especially near expiries—can correlate with higher volatility.

Price Projection Based on Market Maker Activity

| Time Frame | Predicted Price Range | Market Maker Influence |

| Short-term (1–3 mo) | $0.0065 – $0.0085 | Volatility expected as market makers adjust liquidity depth and spreads. |

| Medium-term (3–6 mo) | $0.0070 – $0.0090 | Potential stabilization as algorithmic strategies mature. |

| Long-term (12+ mo) | $0.0075 – $0.0100+ | Price guided more by macroeconomic factors and stablecoin labor fundamentals. |

Fear & Greed Narrative

🚨 Short-term traders should be cautious—early market maker activity may trigger sharp fluctuations and spread shifts. Monitor open interest announcements and liquidity patterns as key signals.

Sources: MEXC, Coindataflow

Note: The price prediction is sourced from third-party media at the time of writing and is for reference only. It does not represent the official stance of JPYC and Bitget Wallet. Please conduct your own research and refer to official market data before making any investment decisions.

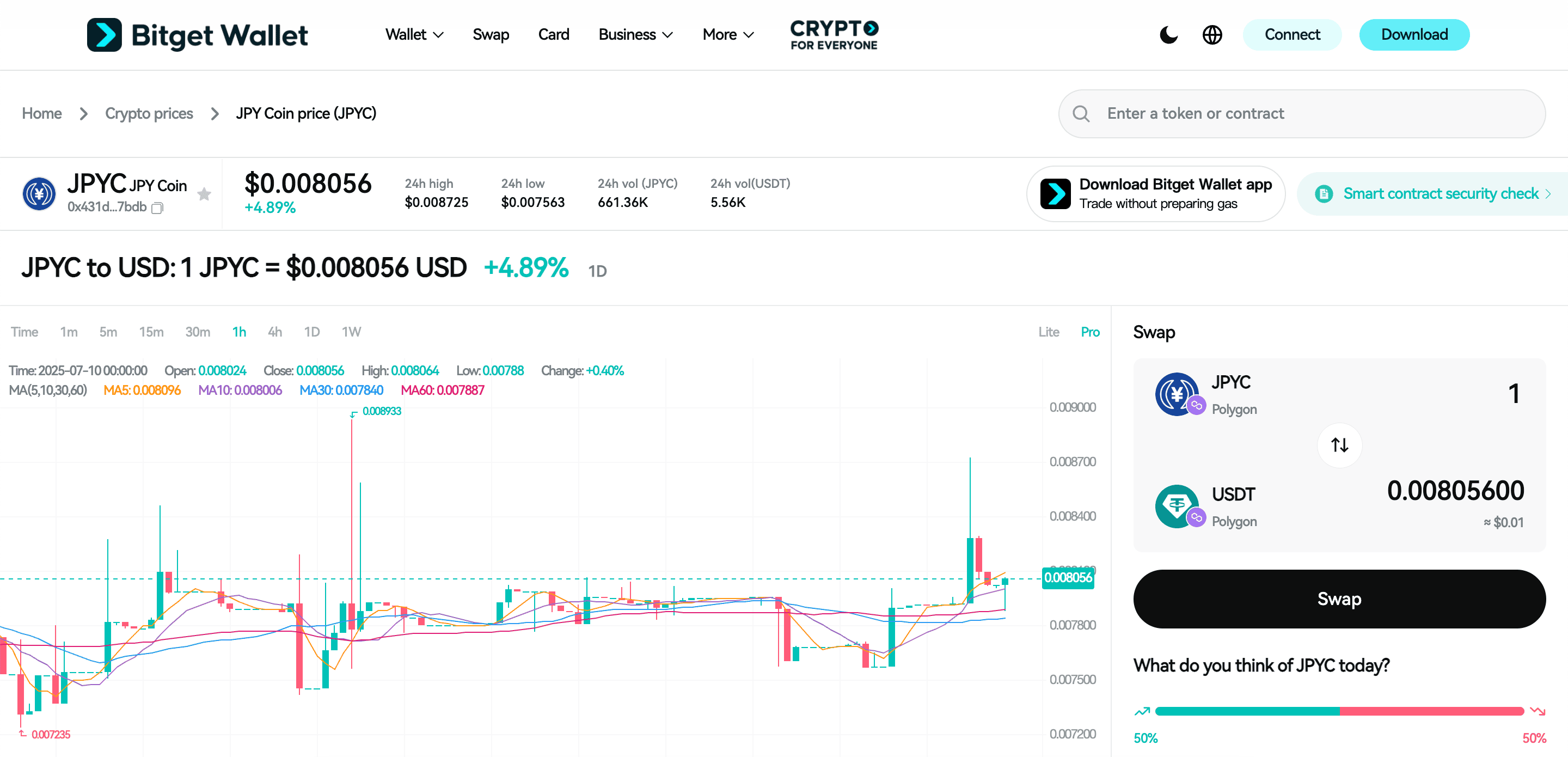

Source: Bitget Wallet

What is JPYC ($JPY)?

JPYC ($JPY) is a prepaid Japanese yen–pegged stablecoin developed by JPYC Inc., a Japan-based fintech company. The project combines regulatory-compliant financial infrastructure with multi-chain blockchain accessibility, allowing users to use the yen digitally in Web3 environments. JPYC functions as a stable, 1:1 fiat-backed token designed to enable secure, instant, and tax-compliant transactions both online and offline.

The project aims to connect Japan’s fiat economy with the global Web3 ecosystem, offering individuals and institutions a practical tool for spending, saving, and building with digital yen. Through its use in NFT purchases, DeFi apps, gift card platforms, and local government initiatives, JPYC is working to make stablecoins a daily utility—not just a financial asset.

Why JPYC ($JPY) Stands Out?

- Fully Yen-Pegged & Prepaid: JPYC is backed 1:1 with Japanese yen, avoiding algorithmic volatility common in some stablecoins.

- Real-World Utility: JPYC is used to purchase NFTs, pay for goods and services, and even contribute to local tax or gift card programs.

- Cross-Chain Compatibility: Operates on Ethereum and multiple layer-2 chains (Polygon, Avalanche, etc.), enabling users to transact seamlessly across different ecosystems.

Source: X

JPYC ($JPY), a prepaid yen-pegged stablecoin issued by JPYC Inc., is gaining traction as Japan’s leading compliant digital currency. Designed for fast, stable, and legally recognized Web3 transactions, JPYC is already being used for NFT purchases, gift cards, and local government programs—making it a real-world use case in the growing stablecoin sector.

The JPYC ($JPY) Ecosystem: How It Functions?

How JPYC Works?

- Built on multiple blockchains including Ethereum, Polygon, Avalanche, and Gnosis Chain, enabling fast and secure transactions across networks.

- Uses standard token contracts (ERC-20 and equivalents), allowing seamless integration with wallets, dApps, and DeFi platforms.

- Supports payments, NFT purchases, real-world commerce, and DeFi applications through partnerships and integrations across Japan and global Web3 projects.

Key Benefits

- Regulatory Compliance – JPYC Inc. is registered with Japan’s Financial Services Agency as a Prepaid Payment Instruments Issuer, giving the token legal standing and credibility in one of the world’s most regulated markets.

- Multi-Chain Utility – JPYC is accessible on several major blockchains, offering users low-fee, cross-chain functionality for daily transactions and crypto-native operations.

- Real-World Adoption – JPYC is actively used in government pilot programs, NFT marketplaces, and digital gift card platforms—showing real integration between Web3 and the traditional economy.

Meet the Team Behind JPYC ($JPY): Leadership and Strategy

Leadership

JPYC ($JPY) is developed and issued by JPYC Inc., founded in 2019 and led by CEO Noritaka Okabe, a serial entrepreneur who introduced JPYC in early 2021. The core team includes seasoned professionals in fintech, blockchain development, and regulatory compliance, backed by partnerships with firms like Circle Ventures. Their combined expertise ensures both innovation and adherence to financial regulations.

Strategy

JPYC’s strategy centers on regulatory compliance, real-world adoption, and blockchain interoperability. Registered under Japan’s Prepaid Payment Instruments framework, it has forged partnerships with financial institutions like MUFG’s Progmat platform to prepare for trust-based stablecoin issuance. Technically, JPYC is issued across Ethereum, Polygon, Avalanche, and Gnosis Chain, enabling seamless cross-chain payments, DeFi integration, NFT use cases, and integration into Japanese municipalities’ services.

JPYC ($JPY): Practical Applications & Use Cases

Why Utility Matters for JPYC ($JPY)

JPYC is a yen-pegged stablecoin fully backed on a prepaid model, designed to bring the stability of fiat currency into Web3 environments. With practical applications ranging from NFT transactions and digital voucher systems to municipal tax programs and interoperable DeFi platforms, JPYC proves itself as a utility-focused stablecoin. It functions as a usable form of digital yen, firmly rooted in daily transactions and aligned with regulatory frameworks.

Key Use Cases of JPYC ($JPY)

- Gift Cards & Retail Integration: JPYC can be used to purchase digital gift cards for platforms like Amazon Japan and services like Amaten, enabling users to spend in everyday ecommerce environments.

- Institutional & Government Services: Through partnerships with MUFG’s Progmat platform and municipal pilots, JPYC is being explored for stablecoin issuance under Japan’s revised regulations, and for use in government tax programs and fund flows.

- Cross‑Chain & DeFi Applications: Issued on Ethereum and planned for multiple networks, JPYC offers seamless transactions in DeFi ecosystems, enabling liquidity, lending, and bridging operations tied to real-world asset backings.

What’s Next for JPYC ($JPY)?

JPYC is advancing toward regulated trust-type issuance via collaboration with MUFG Trust Bank and Progmat Coin, enabling cash-redemption and cross-border stablecoin exchange using a trust-backed model. It’s also involved in carbon-credit settlement pilots with KlimaDAO Japan, driving new finance use cases on tokenized proof-of-carbon platforms. Future expansions may include international remittances, institutional stablecoin services, and integrations across municipal systems—all leveraging Japan’s evolving regulatory landscape.

JPYC ($JPY) Roadmap: What to Expect in 2025 and Beyond?

The roadmap for JPYC ($JPY) outlines a clear path for growth, regulation-aligned innovation, and broader real-world adoption across Japan and global Web3 ecosystems:

| Quarter | Roadmap |

| Q1 2025 | Launch of trust-type JPYC under Japan’s revised stablecoin law, via partnership with MUFG’s Progmat Coin platform for legally backed issuance. |

| Q2 2025 | Expansion of use cases in municipal services—including tax payments, subsidies, and digital vouchers—using JPYC as a stable, prepaid settlement method. |

| Q3 2025 | Integration with carbon credit platforms like KlimaDAO Japan for settlement of environmental assets using JPYC as a compliant, yen-denominated token. |

These initiatives highlight the practical value of $JPY in regulated financial services, real-world payments, and ESG-driven blockchain use cases—all while positioning JPYC as a global benchmark for stablecoin innovation.

How to Buy JPYC ($JPY) on Bitget Wallet?

Trading JPYC ($JPY) is easy on Bitget Wallet. Follow these simple steps to get started:

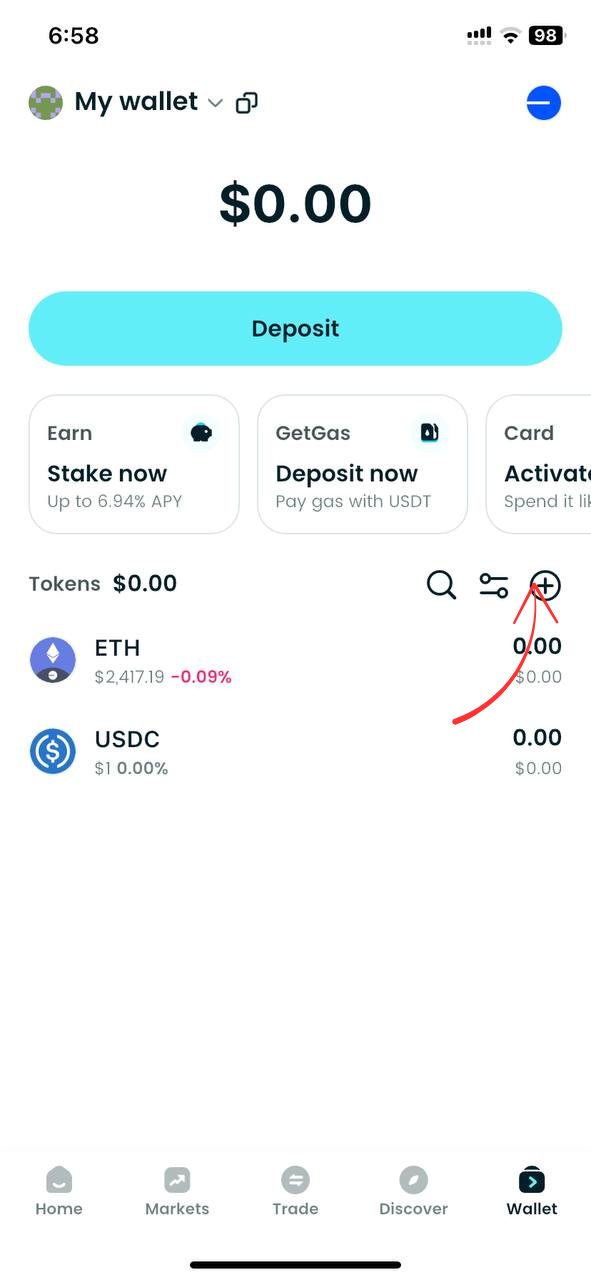

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading JPYC ($JPY).

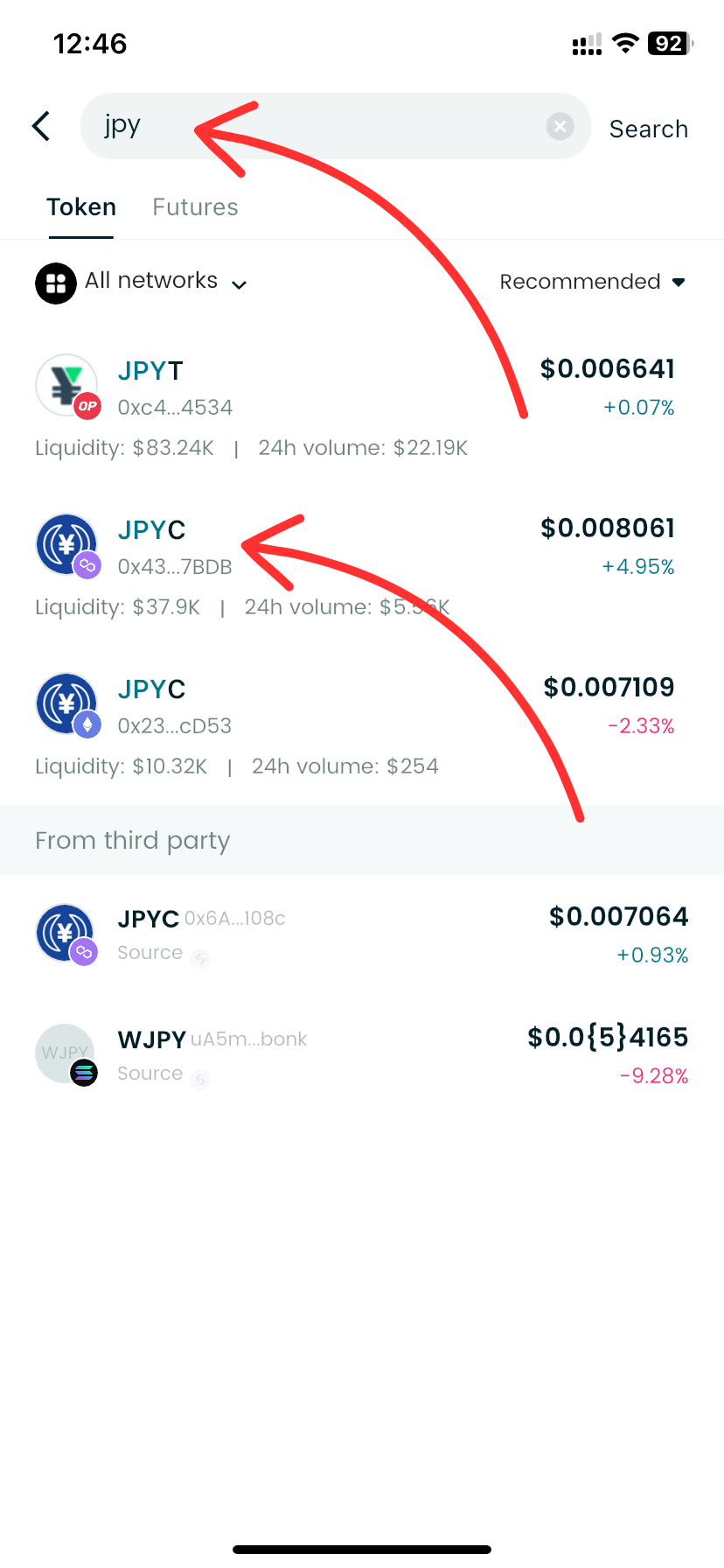

Step 3: Find JPYC ($JPY)

On the Bitget Wallet platform, go to the market area. Search for JPYC ($JPY) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

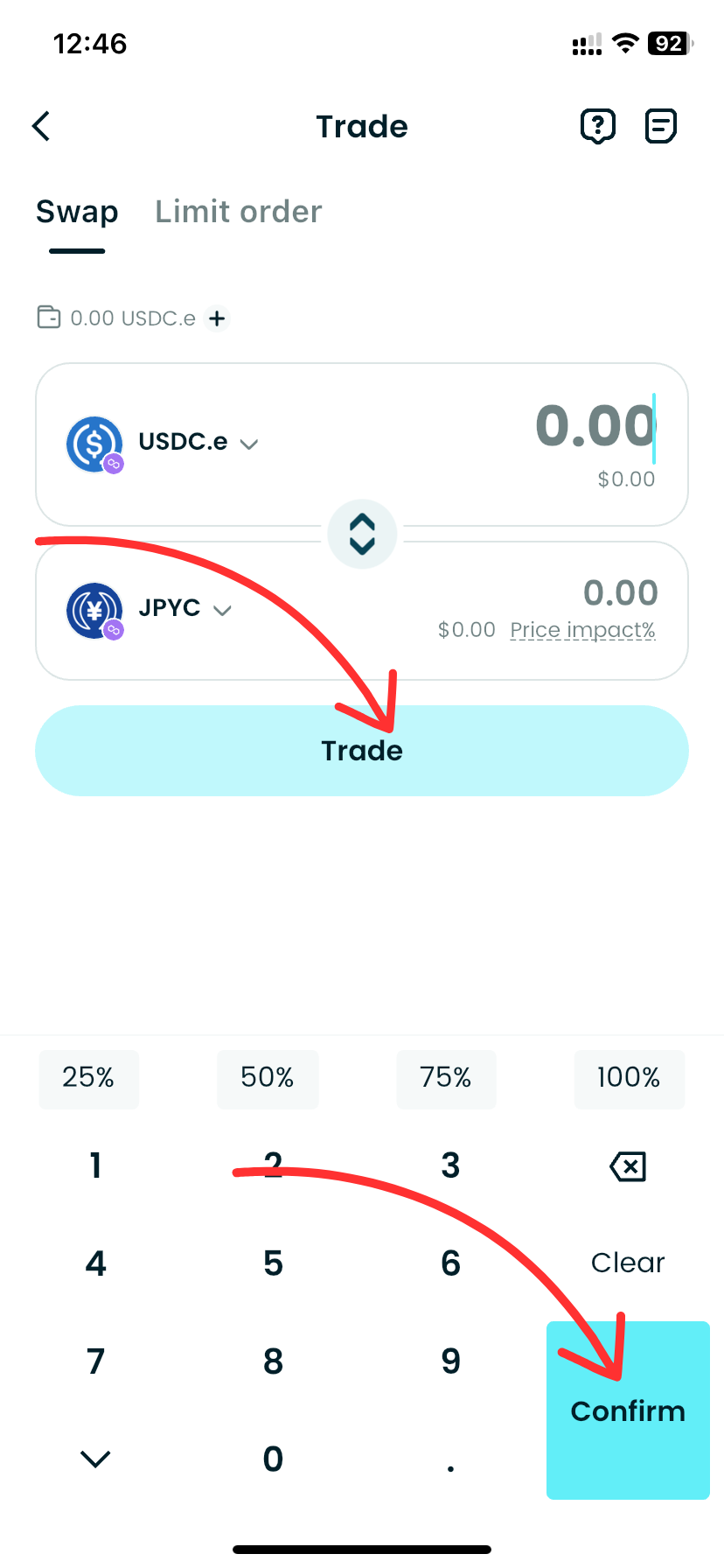

Step 4: Select Your Trading Pair

Choose your trade pair you want to work with, e.g., JPY/USDT. With this, you will be able to trade JPYC ($JPY) with USDT or another cryptocurrency.

Step 5: Place Your Order

Choose if you want to enter a market order (purchase/sell at the market rate) or a limit order (specify your own price). Input the amount of JPYC ($JPY) you want to purchase or sell, then place your order.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased JPYC ($JPY).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your JPYC ($JPY) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

The listing of JPYC ($JPY) on major exchanges isn’t just about immediate gains—it’s a step toward building a compliant and accessible future for stablecoins in the Web3 space. The project’s mission is clear: empower users with seamless access, legal transparency, and practical utility for digital yen transactions across both decentralized and real-world environments.

As JPYC ($JPY) gains momentum, being an active participant—whether through trading, integrating with dApps, or engaging in community-driven initiatives—will be key to staying ahead in this rapidly evolving ecosystem.

For secure asset management, Bitget Wallet provides a reliable and efficient platform, ensuring users can trade, store, and use JPYC and other digital assets with confidence in a compliant and connected Web3 economy.

Step into the future of finance—download Bitget Wallet today and unlock limitless possibilities in the world of digital yen and beyond!

1. What is JPYC and how is it different from other stablecoins?

JPYC is a Japanese yen–pegged stablecoin issued on a prepaid model by JPYC Inc. Unlike algorithmic or crypto-collateralized stablecoins, JPYC is backed 1:1 by fiat yen, offering price stability and compliance with Japan’s financial regulations. It’s also one of the first stablecoins actively used in both digital and real-world scenarios—like gift cards, NFTs, and local tax programs.

2. Where is JPYC listed and how can I trade it?

As of the latest JPYC listing, the token is available on select centralized and decentralized exchanges that support multi-chain assets (Ethereum, Polygon, Avalanche). You can trade JPYC through Bitget Wallet, which supports secure swaps, token bridging, and cross-chain transfers.

3. Is JPYC regulated in Japan?

Yes. JPYC Inc. is registered as a Prepaid Payment Instruments Issuer under Japan’s Payment Services Act. The company is also working toward launching a trust-type stablecoin version of JPYC in partnership with MUFG’s Progmat platform to meet new 2024–2025 regulatory standards. This makes JPYC one of the most legally compliant stablecoins in the market today.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Enso Finance Listing: $ENSO DeFi Strategy Layer Launches on PancakeSwap2025-07-17 | 5 mins

- Arena-Z Listing Guide: Launch Date & Web3 Multigame Features2025-07-16 | 5 mins