Veax Listing Guide: Launch Date! How $VEAX Powers Advanced DeFi Tools on NEAR?

Veax (VEAX) Listing is Around the Corner! Exciting news for cryptocurrency enthusiasts! Veax (VEAX), a capital-efficient decentralized exchange token built on the NEAR Protocol, is officially launching on Ref Finance, with integration expected on Bitget Wallet shortly after.

Users will be able to trade $VEAX under the trading pair VEAX/USDT. This marks a significant milestone for the Veax community and opens up new opportunities for traders worldwide.

This article explores everything you need to know about the $VEAX listing — including how to trade it, key project details, and why this launch matters for investors looking to get early exposure to a next-generation DeFi trading platform.

Veax (VEAX) Listing: Key Details and Trading Schedule

1. Key Listing Information

Here are the important details about the Veax (VEAX) listing:

- Exchange: TBA

- Trading Pair: VEAX/USDT

- Deposit Available: July 2025

- Trading Start: July 2025

- Withdrawal Available: July 2025

Get ready to trade Veax (VEAX) on a centralized exchange and gain early access to one of NEAR Protocol’s most advanced DeFi infrastructure tokens.

Note: Please refer to the official Veax announcement for the final schedule and exchange details.

From On-Chain Data: Veax (VEAX) Price Prediction 2025

As Veax (VEAX) prepares for its anticipated listing on centralized exchanges, on-chain metrics and market behavior from similar launches offer valuable clues into its potential price trajectory.

While direct VEAX data may not yet be available on public analytics platforms, early signals like wallet activity, token allocation structure, and market sentiment are already shaping investor expectations.

On-Chain Indicators

-

Holder Growth Trends:

Platforms like Nansen and Santiment typically monitor wallet distribution after a token generation event. Based on patterns from recent DeFi launches, an initial wave of wallet growth in the first 30 days often signals sticky adoption and long-term positioning. VEAX is expected to follow a similar curve post-TGE.

-

Whale Accumulation Potential:

In comparable launches, wallets holding >1% of total supply (often team, VCs, and early backers) tend to either accumulate more tokens post-launch or strategically rotate into liquidity events. For VEAX, early-stage positioning and limited initial float may encourage accumulation rather than sell-off.

-

Exchange Reserve Patterns:

Although direct reserve data for VEAX on CEXs isn’t yet available, similar token listings often show low initial CEX reserve levels, suggesting most tokens remain in private wallets or staked — limiting sell pressure and supporting price resilience.

Predicted Price Range Based on On-Chain Trends

| Time Frame | Predicted Price Range | Supporting Signals |

| Short-term (1–3 months) | $0.07 – $0.14 | Scarcity post-launch, low float, potential whale entries |

| Medium-term (3–6 months) | $0.13 – $0.25 | Ecosystem buildout, early protocol adoption |

| Long-term (12+ months) | $0.20 – $0.40+ | Increased wallet growth, DEX + CEX liquidity expansion |

Source: Historical market trends from Santiment, Nansen, and CryptoQuant across comparable DeFi token listings.

Disclaimer: These forecasts are based on industry precedent and publicly observable on-chain trends. This does not constitute financial advice and does not represent the official stance of Veax or any centralized exchange. Always conduct your own research before making investment decisions.

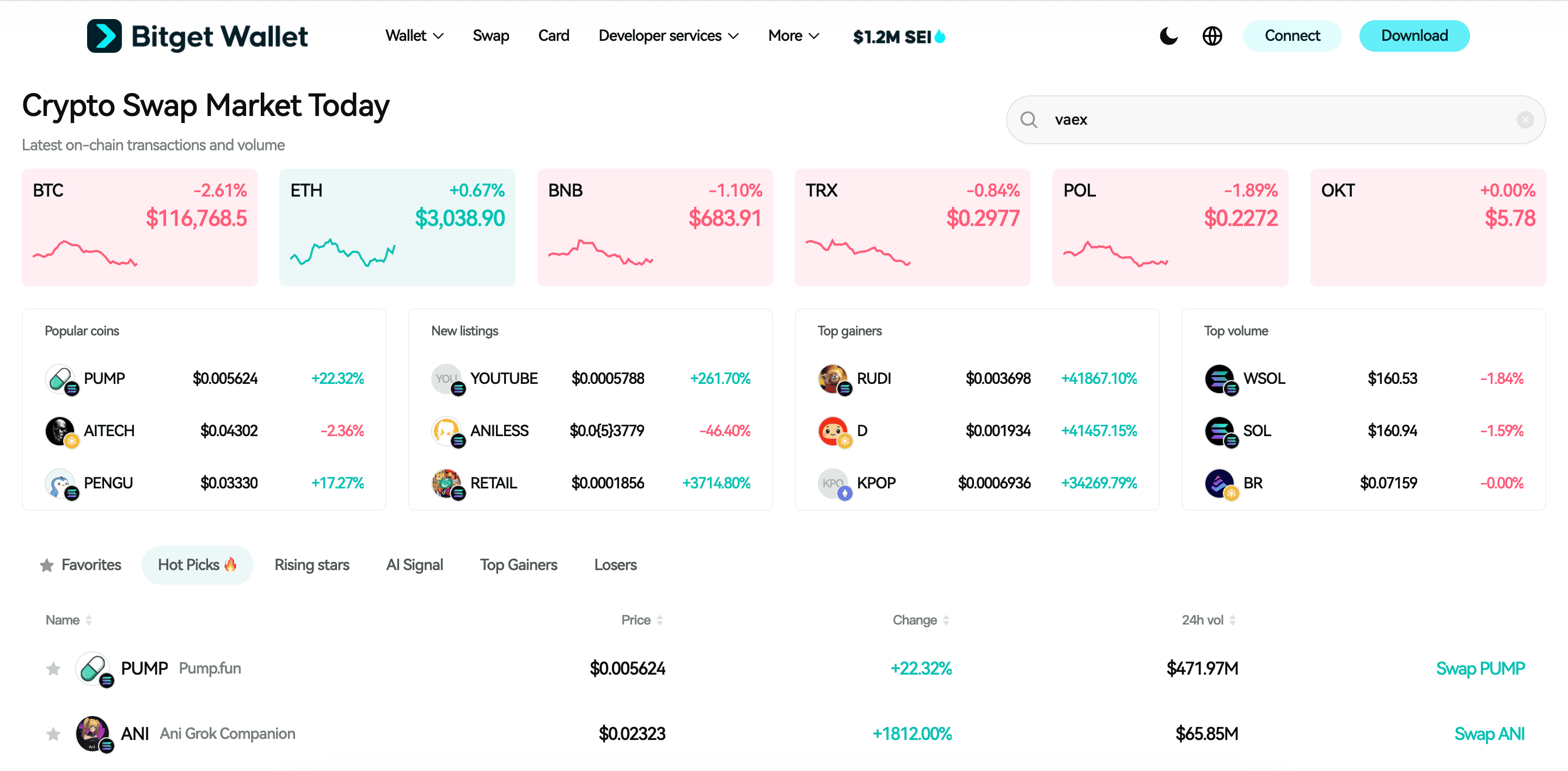

Source: Bitget Wallet

What Is Veax (VEAX): Everything You Need to Know

Veax (VEAX) is a decentralized trading platform optimized for capital efficiency and developed on the NEAR Protocol. It delivers sophisticated decentralized finance (DeFi) functionality within an accessible, trader-friendly interface. The platform’s core objective is to close the gap between conventional financial systems and DeFi by enabling direct, on-chain access to advanced features — including precision limit execution, concentrated liquidity strategies, and live portfolio tracking tools.

Key Features

- Capital-Efficient Liquidity Pools: Inspired by Uniswap v3 and Curve mechanics, Veax enables precise liquidity provisioning for higher yields and lower slippage.

- Advanced Trading Infrastructure: Offers on-chain limit orders, order routing, and risk-managed LP strategies—all from a single interface.

- Built on NEAR Protocol: Fast, scalable, low-cost, and eco-friendly blockchain that supports real-time trading and seamless wallet integration.

Source: X

Veax is positioning itself as the go-to DEX for serious DeFi traders on NEAR. With the upcoming listing of $VEAX, the platform is set to attract both institutional-grade liquidity providers and retail users seeking better execution, deeper liquidity, and more control over their trades.

How Veax (VEAX) Works and Delivers Value

The architecture of Veax is built to deliver capital efficiency, transparency, and scalability for serious DeFi traders and liquidity providers. Designed on a foundation of high-performance infrastructure and real-world trading tools, the platform aims to reshape how decentralized trading functions.

-

Blockchain Infrastructure

Veax is built natively on NEAR Protocol, a fast, low-cost Layer-1 blockchain designed for scalable and user-friendly Web3 applications. Leveraging NEAR's sharding and 1–2 second finality, Veax can support real-time execution with minimal fees. Future integration with NEAR’s cross-chain bridges, such as Rainbow Bridge, is expected to expand liquidity access beyond the NEAR ecosystem.

-

Token Utility

The $VEAX token is designed as a core utility and governance asset within the Veax ecosystem. It is expected to be used for liquidity mining, staking, and potentially unlocking premium features. As the platform evolves, $VEAX may also be used to incentivize trading activity and align long-term user participation with protocol growth.

Governance & Community Engagement

Holders of $VEAX are expected to participate in platform governance once the Veax DAO framework is launched. This may include voting on protocol upgrades, incentive distributions, and platform parameters. Community involvement will be central to maintaining a decentralized, transparent, and responsive trading infrastructure over time.

The Team Behind Veax (VEAX): Experts Driving Innovation

The Team

-

Founders & Core Leadership:

The protocol is spearheaded by Mathias Lundoe Nielsen (CEO) and James Davies (CPO), both alumni of Tacans Labs — a Swiss-based Web3 venture builder. Veax has raised pre-seed funding of $1.2 million from prominent backers such as Circle Ventures, Proximity Labs, Outlier Ventures, Qredo, Skynet Trading, and others

-

Development Partners:

Built by Tacans Labs, Veax brings together developers from around the globe—including Switzerland, Ukraine, Portugal, and the UK — leveraging cross-border expertise in DeFi architecture.

-

Advisor Line-Up:

Notably, Roger Wattenhofer, a computer science professor at ETH Zurich, contributed to its core architecture — particularly in designing its adaptable liquidity pools.

-

Marketing Leadership:

Marie Tatibouet, former CMO of Gate.io, oversees go-to-market and ecosystem growth strategies

Expert Insights

Below are key technical and strategic highlights from Veax’s architecture, driven by its expert team:

-

Concentrated Liquidity with TradFi Precision:

The platform enables single-sided, capital-efficient liquidity provisioning — a system rooted in academic models and TradFi logic, adapted for DeFi efficiency.

-

Margin & Derivatives-Ready Infrastructure:

Veax is designed to support advanced trading features like on-chain margin and derivative products — features rare on NEAR-based DEXs.

-

Global and Diverse Team:

With ~30 team members located in multiple countries and veteran leadership spanning TradFi firms and exchange ecosystems, Veax is positioned as truly international and cross-functional.

Key Use Cases of Veax (VEAX): How It’s Transforming DeFi

Veax (VEAX) is not just a utility token — it's a foundational asset within a next-generation DEX ecosystem. Below are the core use cases that highlight how $VEAX delivers value across trading, governance, and ecosystem growth.

Utility Across the Platform

- Liquidity Incentives: $VEAX is used to reward liquidity providers who add depth to trading pairs, especially during early market formation and bootstrapping phases.

- Staking & Fee Sharing: Token holders may stake $VEAX in designated pools to earn a share of protocol revenue, align with platform success, and unlock governance privileges.

- Governance Participation: $VEAX will play a central role in Veax’s DAO, allowing holders to vote on proposals, adjust protocol parameters, and shape incentive structures.

- Access to Premium Features: Future product rollouts may require $VEAX to unlock advanced tools like pro-level analytics, margin products, or launchpad access.

- Trader & Community Rewards: $VEAX can be distributed via trading competitions, referral incentives, and engagement-based quests — building grassroots adoption while reinforcing liquidity.

How Veax (VEAX) Is Transforming DeFi

Veax is transforming decentralized finance by merging the precision and power of traditional financial infrastructure with the permissionless, transparent nature of on-chain trading. Unlike copycat DEXs, Veax is designed from the ground up for professional-grade trading—delivering capital efficiency, real-time order execution, and customizable liquidity pools.

Its token, $VEAX, is more than a reward mechanism: it’s a programmable asset that aligns user incentives, decentralizes control, and powers long-term sustainability of the protocol. By embedding real utility into $VEAX and anchoring it within a high-performance Layer-1 ecosystem like NEAR, Veax offers a blueprint for how DEXs should function in the next era of DeFi.

Veax (VEAX) Roadmap: Key Milestones and Future Developments

The roadmap for Veax (VEAX) outlines a clear path for growth and innovation across decentralized trading, governance, and multichain liquidity.

| Quarter | Milestone |

| Q1 2025 | Veax launched on NEAR mainnet with its core features: capital-efficient DEX architecture, on-chain limit orders, and concentrated liquidity pools. The $VEAX token was also released, enabling staking and incentive programs. |

| Q2 2025 | The team began rolling out advanced features including a real-time portfolio dashboard. DAO governance structures entered preview mode for community testing. Partnerships were announced in preparation for listings. |

| Q3 2025 (Planned) | Development efforts are focused on multichain functionality (starting with Ethereum integration), LP vault deployment, and the introduction of trading tools like TWAP and stop-limit orders. Institutional liquidity onboarding is also in scope. |

These applications highlight the practical value of $VEAX in decentralized finance, particularly in building efficient, trader-focused infrastructure within and beyond the NEAR ecosystem.

How to Buy Veax (VEAX) on Bitget Wallet?

Trading Veax (VEAX) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading Veax (VEAX).

Step 3: Find Veax (VEAX)

On the Bitget Wallet platform, go to the market area. Search for Veax (VEAX) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

Step 4: Select Your Trading Pair

Choose your trade pair you want to work with, e.g., VEAX/USDT. With this, you will be able to trade Veax (VEAX) with USDT or another cryptocurrency.

Step 5: Place Your Order

Choose if you want to enter a market order (purchase/sell at the market rate) or a limit order (specify your own price). Input the amount of Veax (VEAX) you want to purchase or sell, then place your order.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased Veax (VEAX).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your Veax (VEAX) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

With its upcoming listing on exchanges, Veax (VEAX) is entering a broader market—opening new opportunities for investors, liquidity providers, and early DeFi adopters. As the protocol continues to scale, its mission to deliver capital-efficient, on-chain trading aligns perfectly with the evolution of decentralized finance infrastructure.

For those looking to engage with a growing ecosystem that bridges pro-level trading tools and DeFi accessibility, now is the ideal time to get involved—whether by trading, staking, or participating in future governance.

To manage your digital assets securely and efficiently, Bitget Wallet offers a trusted, high-performance solution for storing, swapping, and tracking crypto holdings. In an industry that moves fast, having a secure and user-friendly platform makes all the difference.

Download Bitget Wallet to stay ahead in the evolving digital economy and unlock the full potential of Veax and beyond.

FAQs

1. What is Veax (VEAX)?

Veax (VEAX) is a next-generation decentralized exchange (DEX) built on the NEAR Protocol. It offers capital-efficient trading through features like concentrated liquidity pools, on-chain limit orders, and an intuitive interface for both retail and pro users. $VEAX is the platform’s native token used for staking, governance, and ecosystem incentives.

2. When is the VEAX listing taking place?

The official VEAX listing date will be announced through Veax’s verified channels. Users are encouraged to follow Veax on social media and monitor the project's official announcements to stay updated on listing timelines and supported exchanges.

3. What can I do with VEAX tokens after the listing?

After the VEAX listing, holders will be able to stake $VEAX, provide liquidity, participate in future governance through the upcoming DAO, and potentially earn rewards through platform incentive programs. VEAX is designed to play a central role in platform utility and long-term protocol governance.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- FIFA World Cup Odds 2026: How to Bet on the World Cup 2026 Winner2026-03-03 | 5mins

- Fabric Airdrop Guide: How to Participate and Claim $ROBO Rewards2026-03-03 | 5mins

- Can I Buy World Cup Ticket with Cryptocurrencies?2026-03-02 | 5mins