DeFituna (TUNA) Listing Date: DeFi Fitness Token with Yield & Airdrop Utility

DeFituna (TUNA) is gaining momentum across the crypto landscape. As interest grows, many are evaluating its potential as a new entrant in the evolving decentralized finance (DeFi) and wellness tech sectors.

At its core, DeFituna is a next-generation DeFi fitness protocol. It integrates move-to-earn incentives, AI-driven health tracking, and real-world utility to deliver a unique blend of wellness and blockchain technology. The protocol aims to provide users with tools that reward physical activity while offering advanced financial features such as capital-efficient liquidity, leveraged yield strategies, and decentralized lending.

This project represents more than just another token. It marks a growing intersection between health innovation and DeFi infrastructure—particularly on Solana. With an expanding user base, emerging use cases, and clear product direction, DeFituna is positioning itself as a contributor to both user engagement and market experimentation in the crypto wellness space.

This article offers an in-depth overview of DeFituna’s fundamentals. It examines the token’s mechanics, ecosystem use cases, and potential value. The goal is to provide readers with an informed perspective on where DeFituna fits within the broader Web3 landscape.

DeFituna (TUNA) Listing Details and Launch Date

1. Key Listing Information

Here are the important details about the DeFituna (TUNA) listing:

- Exchange: To be announced

- Trading Pair: TUNA/USDT

- Deposit Available: TBA

- Trading Start: TBA

- Withdrawal Available: TBA

Don’t miss your chance to start trading DeFituna (TUNA) on upcoming exchanges and be part of this next-gen DeFi protocol focused on concentrated liquidity and leveraged yield strategies.

- Please refer to the official announcements for the most accurate schedule.

Differences Between CEX and DEX Trading

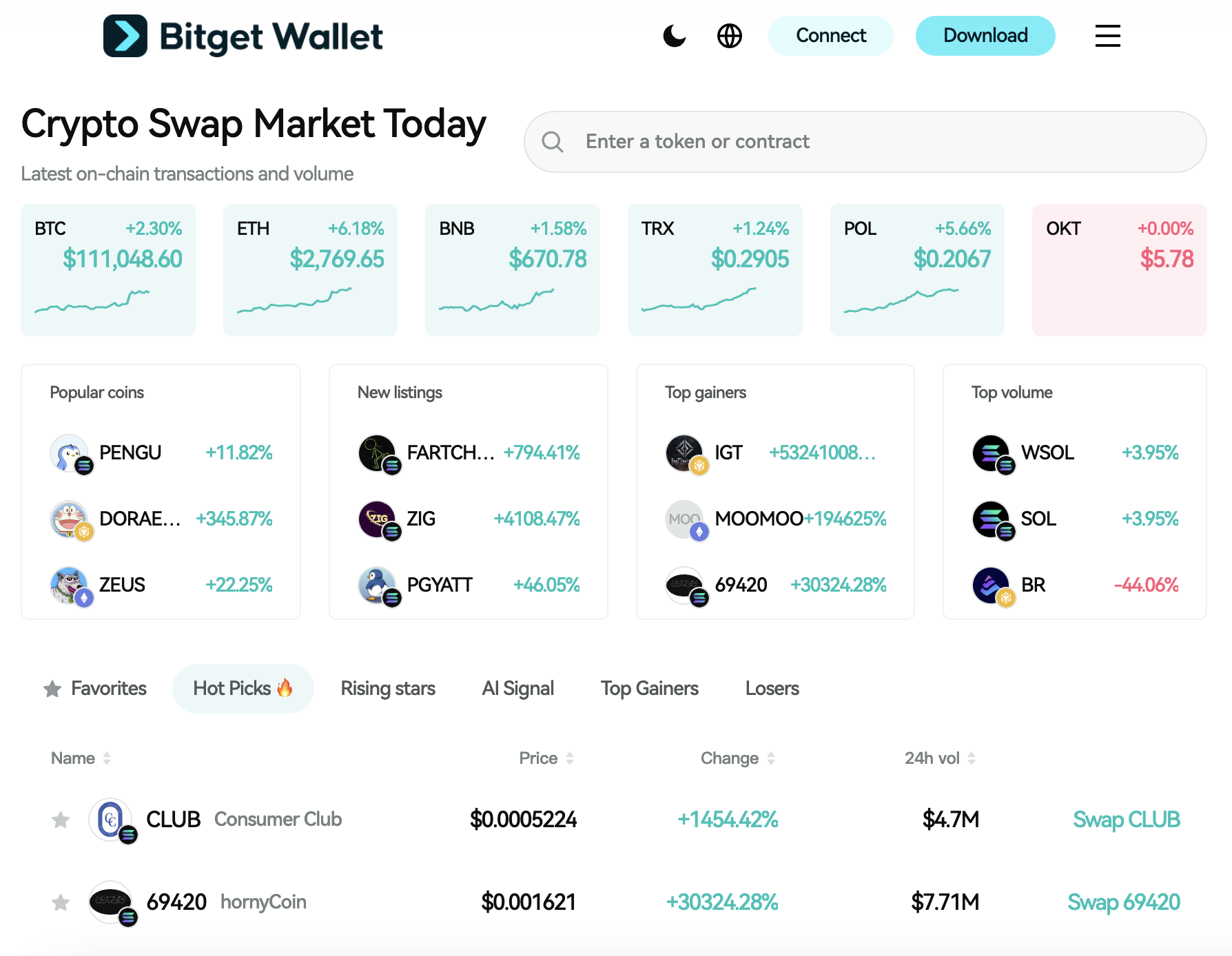

Centralized exchanges (CEX) like and decentralized exchanges (DEX) like Bitget Wallet offer distinct trading experiences. Binance, as a CEX, provides a user-friendly interface, high liquidity, and advanced trading tools, requiring users to deposit funds into the exchange to keep the fund safe.

On the other hand, Bitget Wallet operates as a self-custodial solution, allowing users to manage their assets independently without reliance on third parties. Its design supports permissionless trading and prioritizes privacy, aligning with the principles of decentralized finance.

By facilitating direct access to decentralized markets, Bitget Wallet eliminates intermediaries, offering a trading environment where users retain full control over their funds. This structure appeals to those who seek a more autonomous and transparent approach to digital asset management.

From On-Chain Data: DeFituna (TUNA) Price Prediction 2025

As of now, no public on-chain data for DeFituna (TUNA) is available from major analytics platforms like Santiment, Nansen, or CryptoQuant. This is because the token has not yet been listed on a major exchange, and real-time on-chain metrics (such as holder count, whale behavior, and exchange reserves) require post-listing liquidity and adoption to be tracked reliably.

On-Chain Indicators

-

Holder Growth Rate:

Not available. As of July 2025, TUNA is not yet tracked by Santiment or Nansen due to lack of post-listing wallet activity.

-

Whale Activity:

No whale activity data is available from CryptoQuant, Nansen, or other aggregator sources. Institutional or large-wallet accumulation cannot yet be confirmed.

-

Exchange Reserves:

No centralized exchange reserves data exists for TUNA. Exchange outflows/inflows will be observable only after listing.

Predicted Price Range Based on On-Chain Trends

At this stage, no price prediction can be responsibly made based on on-chain data. The project has yet to generate sufficient trading volume and wallet activity for meaningful analytics. Any projection would be speculative and not grounded in actual blockchain metrics.

| Time Frame | Predicted Price Range | On-Chain Signals |

| Short-term (1–3 months) | Not available | No tracked liquidity or trading data |

| Medium-term (3–6 months) | Not available | Awaiting listing and ecosystem engagement |

| Long-term (1 year+) | Not available | No measurable adoption trends yet |

Source: Nansen, CryptoQuant, Santiment

Note: This summary is based on currently available third-party data and does not reflect an official stance from DeFituna or Bitget Wallet. Please conduct independent research and refer to live market sources before making investment decisions.

Source: Bitget Wallet

What is DeFituna (TUNA)?

DeFituna (TUNA) is a Solana-based DeFi protocol that combines concentrated liquidity market making (CLMM) with leveraged yield strategies and capital-efficient lending. The project aims to empower liquidity providers and DeFi traders with tools to optimize yield, manage directional exposure, and access real-time risk control—all within a user-friendly interface.

Key features

- Concentrated Liquidity Pools: Users can provide liquidity within specific price ranges to maximize capital efficiency and fee generation.

- Leveraged Positions: Traders can open positions with up to 5× leverage, with built-in controls like stop-loss and limit orders.

- Lending & Borrowing: Users can lend assets to earn passive yield or borrow tokens to support leveraged strategies and liquidity provisioning.

Source: X

DeFituna launched its airdrop eligibility checker in mid-2025 and has quickly gained traction on Solana, with growing TVL and user interest ahead of its upcoming token listing.

How DeFituna (TUNA) Works and Delivers Value

The operation of DeFituna (TUNA) is based on its upcoming Solana-based CLMM and lending infrastructure rollout.

-

Concentrated Liquidity Market Making (CLMM)

Users provide liquidity within custom price ranges rather than across the full curve, increasing capital efficiency and fee generation potential.

-

Leverage Trading and Yield Amplification

DeFituna enables users to open leveraged positions (up to 5×) on token pairs, allowing directional strategies while managing risk through features like stop-loss, take-profit, and auto-compounding.

-

Integrated Lending and Borrowing Mechanism

Lenders can earn passive income by supplying tokens used by leveraged traders. Borrowers access flexible terms to amplify trades or liquidity provisioning.

By integrating DeFi-native tools, advanced position control, and a focused Solana-native experience, DeFituna (TUNA) aims to become a sustainable and influential player within the crypto ecosystem.

The Team Behind DeFituna (TUNA): Experts Driving Innovation

The Team

DeFituna (TUNA) is led by the Torii Finance team, a group with strong expertise in DeFi infrastructure, trading strategies, and Solana development. The team aims not only to create a high-performance DeFi token but also to establish DeFituna as a cultural and financial symbol representing innovation, efficiency, and user empowerment in the Solana ecosystem.

The Vision

The core of DeFituna (TUNA) lies in building a capital-efficient, decentralized yield infrastructure. The project aspires to develop a sustainable ecosystem that represents composable financial tooling for traders, LPs, and DeFi-native users across Solana and beyond.

Partnerships

DeFituna (TUNA) has collaborated with Solana ecosystem players, early-stage DeFi protocols, and key infrastructure providers to strengthen its ecosystem and expand its reach into liquidity provisioning, on-chain lending, and leveraged trading sectors.

DeFituna (TUNA): Practical Applications & Use Cases

DeFituna (TUNA) serves a variety of purposes, including:

-

Liquidity Incentives

TUNA is used to incentivize liquidity providers on concentrated liquidity pools, encouraging deeper and more efficient markets.

-

Leverage & Collateral Utility

TUNA can be used as collateral within the platform’s leveraged trading system, allowing users to amplify yield strategies while maintaining exposure to the token.

-

Governance & Protocol Upgrades

Token holders will participate in governance decisions, influencing future parameters such as fee structures, emissions, and feature rollouts.

These applications highlight the practical value of $TUNA in the decentralized finance (DeFi) sector, particularly within the capital-efficient Solana ecosystem.

Roadmap of DeFituna (TUNA)

The roadmap for DeFituna (TUNA) outlines a clear path for growth and innovation:

| Quarter | Roadmap |

| Q1 2025 | Launch of DeFituna protocol on Solana mainnet; activation of CLMM (Concentrated Liquidity Market Making) pools; internal testing of leverage modules |

| Q2 2025 | Expansion of leveraged yield strategies (up to 5×); launch of permissionless lending markets; airdrop eligibility snapshot and community onboarding |

| Q3 2025 | TUNA token generation and listing; rollout of governance module; integration with external Solana-based aggregators and DeFi dashboards |

These milestones reinforce the practical value of $TUNA in the decentralized finance (DeFi) sector, supporting advanced trading, lending, and liquidity provisioning across Solana.

How to Buy DeFituna (TUNA) on Bitget Wallet?

Trading DeFituna (TUNA) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading DeFituna (TUNA).

Step 3: Find DeFituna (TUNA)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find DeFituna (TUNA). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as TUNA/USDT. This will allow you to trade DeFituna (TUNA) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of DeFituna (TUNA) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired DeFituna (TUNA).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your DeFituna (TUNA) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

Conclusion

The listing of DeFituna (TUNA) on Bitget is more than a trading event. It marks a move toward a more decentralized and user-driven future. The project’s mission is simple and direct. It aims to give users secure access, strong incentives, and real control within the DeFi space.

As DeFituna continues to grow, active participation will matter. Whether you trade, stake, or join the community, your involvement can help shape the ecosystem—and keep you ahead of the curve.

For secure and simple asset management, Bitget Wallet offers a reliable solution. It lets users trade and store digital assets with confidence.

Ready to explore the future of finance? Download Bitget Wallet and unlock your place in Web3 today.

Download Bitget Wallet

FAQs

1. When will DeFituna (TUNA) be listed?

The official listing date for DeFituna (TUNA) has not been announced yet. Users should monitor DeFituna's official channels and Bitget announcements for the confirmed timeline.

2. Is there a DeFituna (TUNA) airdrop?

Yes. DeFituna ran an eligibility snapshot from December 14, 2024, to May 10, 2025. Airdrop details, including claim instructions and final token allocation, are expected to be announced closer to the token generation event.

3. What can I do with TUNA tokens?

TUNA tokens will be used for liquidity incentives, leveraged trading collateral, lending, and governance within the DeFituna protocol. They form the backbone of DeFituna’s Solana-based DeFi infrastructure.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.