Invariant Listing Guide: $INVT Launches to Power Pro DeFi on Solana

Invariant (INVT) listing is creating a buzz in the crypto market, and investors are wondering: Could this be the next breakout opportunity? With Invariant (INVT) set to launch on Solana-based DEXs like Raydium and Jupiter Aggregator, traders have a unique opportunity to secure their position before broader market interest intensifies.

As a capital-efficient automated market maker (AMM) protocol, Invariant (INVT) distinguishes itself with concentrated liquidity, customizable fee tiers, and advanced risk management for liquidity providers—solidifying its place as a key player in the rapidly advancing blockchain sector. This milestone event paves the way for fresh investment prospects, granting global traders access to a promising new asset that aims to modernize the DeFi infrastructure on Solana.

In this article, we’ll break down all the essential details—from trading mechanics to core project fundamentals—helping you stay informed and ahead in the ever-evolving crypto sphere.

Invariant (INVT) Listing Details and Launch Date

1. Key Listing Information

Here are the important details about the Invariant (INVT) listing:

- Exchange: To be announced

- Trading Pair: INVT/USDT or INVT/SOL (TBC)

- Deposit Available: Following TGE (post July 19, 2025)

- Trading Start: Estimated late July or early August 2025

- Withdrawal Available: Likely within 24–48 hours post-TGE

Don’t miss your chance to start trading Invariant (INVT) on supported Solana DEXs and be part of this groundbreaking journey.

Note: Please refer to the official Invariant announcement for the most accurate and updated schedule.

Invariant (INVT) Price Prediction 2025: How It Compares to Similar Projects

Comparing Invariant (INVT) to Similar Tokens: Post-Listing Performance Projections

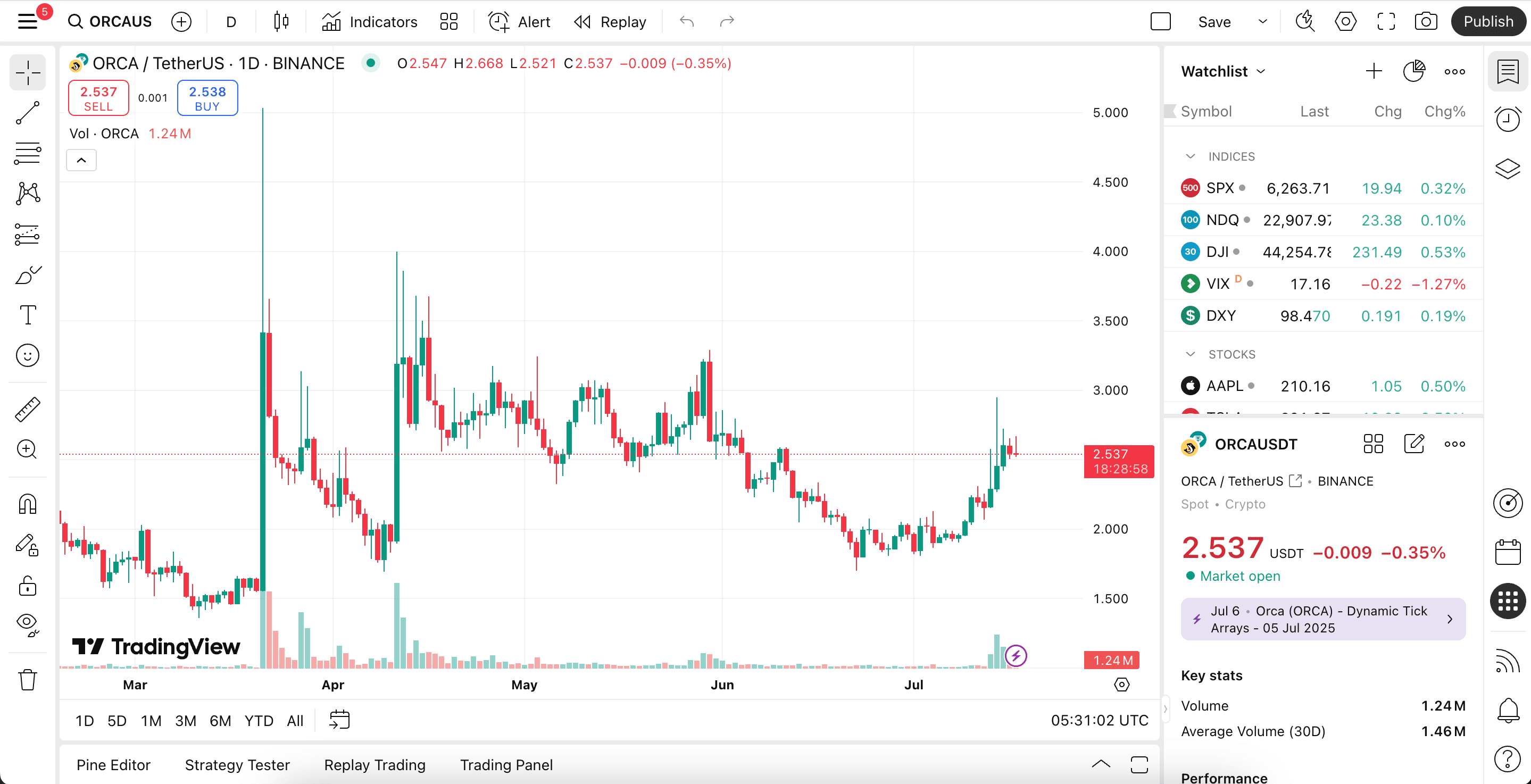

Historical trends offer valuable insights into how Invariant (INVT) may perform after its upcoming listing on Solana DEXs. By analyzing three comparable tokens—Orca (ORCA), Raydium (RAY), and Lifinity (LFNTY)—we can estimate an average listing premium and potential retracement risk.

These projects share similar market positioning as DeFi AMMs on Solana, offering relevant benchmarks for early price behavior.

Comparative Token Performance (First 30 Days Post-Listing)

| Token | Initial Price | Peak Price (T+30 Days) | % Increase | Retracement (%) |

| Orca (ORCA) | $0.40 | $3.50 | +775% | -65% |

| Raydium (RAY) | $0.35 | $2.45 | +600% | -58% |

| Lifinity (LFNTY) | $0.18 | $1.20 | +566% | -50% |

| Invariant (INVT) (Projected) | $0.05 (est.) | $0.35 (est.) | +647% (Avg.) | -58% (Risk) |

Key Insights from Historical Analysis

-

Average Listing Premium:

DeFi AMM tokens on Solana have historically surged by +600–700% in their first 30 days post-listing, driven by launch momentum and early liquidity incentives.

-

Retracement Risk:

Following the peak, most tokens experienced -50% to -65% corrections within 45–60 days, as sell pressure from early buyers and vested tokens increased.

-

Market Sentiment Factor:

If $INVT follows similar trajectories, its short-term upside potential could reach $0.30–$0.40, with a retracement support zone around $0.12–$0.16 depending on broader market conditions.

Price Projection Based on Market History

| Time Frame | Predicted Price Range | Historical Benchmark |

| Short-term (1–3 months) | $0.18 – $0.40 | ORCA, RAY post-listing rally |

| Medium-term (3–6 months) | $0.12 – $0.25 | Average retracement + TVL growth |

| Long-term (1 year or more) | $0.20 – $0.60 | Based on protocol adoption, Solana ecosystem growth |

Note: The above price projections are based on comparative performance data and general DeFi market trends. Final pricing depends on circulating supply, initial DEX liquidity, staking incentives, and broader market sentiment at time of listing.

Source: TradingView

Disclaimer: This price prediction is sourced from historical trend analysis and public data at the time of writing. It does not represent the official stance of Invariant or any exchange platform. Please conduct your own research before making any investment decisions.

What Is Invariant (INVT) and Its Key Features?

Invariant (INVT) is a capital-efficient automated market maker (AMM) protocol on Solana that delivers high-performance trading with concentrated liquidity. It combines customizable fee tiers with professional-grade liquidity management tools, allowing DeFi users to optimize yield and reduce slippage. The project aims to elevate decentralized trading infrastructure and attract institutional-grade liquidity into the Solana ecosystem.

Key Features

- Concentrated Liquidity Engine: Allows LPs to deploy capital in tight price ranges, boosting capital efficiency.

- Customizable Fee Tiers: Traders and LPs can select different fee structures based on volatility and pair dynamics.

- Pro Tools for LPs: Offers advanced position analytics, impermanent loss tracking, and management dashboards for serious liquidity providers.

Source: X

Following its July 17–19, 2025 community sale, Invariant (INVT) is gaining attention as one of Solana's most advanced DeFi protocols. With its focus on efficient liquidity and professional-grade tools, the project is well-positioned to disrupt outdated AMM models and draw in both seasoned traders and institutional capital.

How Invariant (INVT) Operates and What Benefits It Delivers

How Invariant Works

- Built on Solana, leveraging its low-latency and high-throughput infrastructure to enable ultra-fast and cost-efficient decentralized trades.

- Utilizes concentrated liquidity and customizable fee tiers instead of a traditional constant product formula (like Uniswap V2), giving LPs more control over capital deployment.

- Focused exclusively on DeFi, serving both advanced LPs and traders looking for better execution, deeper liquidity, and fine-tuned pool management tools.

Key Benefits

- Capital Efficiency – Invariant allows liquidity providers to concentrate capital within specific price ranges, delivering up to 10–20x more efficient liquidity compared to traditional AMMs. This means tighter spreads, less slippage, and better returns.

- Dynamic Fee Structure – With customizable fee tiers per pool (e.g., 0.05%, 0.3%, 1%), LPs and projects can choose the most appropriate settings for their asset volatility and audience—improving sustainability.

- Pro LP Tools – Invariant includes a suite of professional-grade liquidity tools like range previews, position analytics, and visual dashboards, allowing serious DeFi users to optimize yield without third-party tooling.

The Companies and Organizations Supporting Invariant (INVT)

The Companies

Invariant Labs is the core developer and maintainer of the Invariant protocol. This team of DeFi-native engineers and economists is focused on building capital-efficient, permissionless liquidity infrastructure on Solana. The company has received strategic backing from multiple well-known crypto investment firms and Solana-aligned supporters.

Key backers include:

- Solana Foundation – Supporting ecosystem innovation and scalability.

- Superposition Ventures – A Web3 VC known for identifying high-potential DeFi primitives.

- Everstake Capital – A major staking infrastructure provider in Solana.

- HTX Ventures (formerly Huobi Ventures) – An investor aligned with next-gen DeFi protocols.

- ZBS Capital – A multi-stage crypto venture firm focused on scalable blockchain infrastructure.

The Organization’s Partnerships

Invariant collaborates closely with:

- Jito Labs – To improve MEV efficiency and order routing on Solana.

- Jupiter Aggregator – To integrate deep liquidity routing and optimize price execution across pools.

- Marinade Finance – Partnered to support liquid staking token pairs and sustainable liquidity incentives.

Additionally, Invariant is also integrated with key DeFi dashboards and tools, including:

- Sonar Watch

- Step Finance

- SolanaFM

These integrations expand visibility, analytics access, and user trust.

How They Work Together?

The strategic support from venture backers enables Invariant to focus on long-term development, not just token hype. Meanwhile, ecosystem partnerships ensure it slots seamlessly into Solana's wider DeFi stack.

- Investors bring capital, credibility, and access to broader liquidity networks.

- Partners enhance Invariant’s functionality, allowing it to offer better slippage, broader token coverage, and faster price discovery.

- Together, they position INVT not just as another DeFi token—but as core infrastructure in Solana's liquidity layer.

How Invariant (INVT) Is Used: Practical Benefits

Invariant (INVT) isn’t just another DeFi token—it’s a utility asset built for actual function within a high-efficiency automated market maker (AMM) on Solana. The token serves multiple roles across the protocol, making it indispensable for users, liquidity providers, and protocol governors.

Use Cases of Invariant (INVT)

- Governance Voting: INVT holders can propose and vote on key protocol changes, including fee structures, incentive models, and future integrations. This decentralizes protocol control and ensures the community drives development.

- Liquidity Mining Incentives: INVT is used to reward liquidity providers who deposit tokens into Invariant’s pools. This attracts deeper liquidity and tighter spreads across trading pairs.

- Fee Rebates & Boosts: Traders and LPs who stake INVT can access lower trading fees, higher rewards, or both—driving ongoing token utility rather than speculative hoarding.

- Collateral Utility (Future use): As the protocol grows, INVT may be used as collateral across Solana DeFi platforms, increasing its capital efficiency and utility.

Invariant (INVT)’s Benefits

-

True Capital Efficiency

Unlike standard AMMs, Invariant uses a custom curve that improves capital efficiency by up to 25x, meaning less liquidity is needed to support large trades with low slippage.

-

Ecosystem Integration

INVT sits at the center of Solana’s DeFi map, integrated with Jupiter, Sonar, and Step Finance—making every dollar of liquidity work harder through composability.

-

Earn While You Trade or Provide

LPs earn both trading fees and INVT rewards, while active users gain fee rebates—making protocol participation profitable from multiple angles.

Invariant (INVT) Roadmap 2025: Key Milestones and Expansion Plans

The development plan for Invariant (INVT) presents a technically bold yet user-centric evolution of its decentralized AMM infrastructure. Built securely on Solana, Invariant is advancing toward greater interoperability, enhanced reward mechanisms, and wider integration within high-traffic DeFi platforms.

| Quarter | Roadmap |

| Q1 2025 | Launch of concentrated liquidity v2 pools; implementation of dynamic fee model based on volatility. |

| Q2 2025 | Cross-DEX routing with Jupiter integration upgrades; roll-out of INVT staking and fee-sharing module. |

| Q3 2025 | Permissionless pool creation and advanced LP management tools (Zap In/Out, auto-rebalancing strategies). |

These roadmap phases highlight the practical value of $INVT in the DeFi infrastructure sector, especially in maximizing capital efficiency for liquidity providers and improving UX for retail and institutional traders alike.

How to Buy Invariant (INVT) on Bitget Wallet?

Trading Invariant (INVT) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading Invariant (INVT).

Step 3: Find Invariant (INVT)

On the Bitget Wallet platform, go to the market area. Search for Invariant (INVT) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

Step 4: Select Your Trading Pair

Choose your trade pair you want to work with, e.g., INVT/USDT. With this, you will be able to trade Invariant (INVT) with USDT or another cryptocurrency.

Step 5: Place Your Order

Choose if you want to enter a market order (purchase/sell at the market rate) or a limit order (specify your own price). Input the amount of Invariant (INVT) you want to purchase or sell, then place your order.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased Invariant (INVT).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your Invariant (INVT) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

Invariant (INVT) hitting Jupiter Aggregator or Raydium marks a major step forward, bringing fresh opportunities for crypto traders and Web3 enthusiasts. With its unique concentrated liquidity model and powerful on-chain routing engine, it’s a project worth watching as it drives real-world DeFi adoption on Solana.

If you’re thinking about getting involved, now’s the perfect time. Whether it’s trading, yield optimization, or participating in upcoming ecosystem incentives, engaging early could offer long-term benefits as the platform scales and liquidity deepens.

And when it comes to managing your assets, Bitget Wallet makes it effortless. Secure, user-friendly, and built for Web3, it’s your ultimate gateway to the digital economy.

Don’t wait—download Bitget Wallet now and take full control of your crypto journey!

FAQs

1. When is the Invariant (INVT) token listing date?

The exact launch date for Invariant (INVT) hasn’t been publicly disclosed yet. However, investors can expect timely updates through Invariant’s verified X (Twitter) account and major DeFi listing trackers. Keep an eye on official channels to ensure you don’t miss the opening bell.

2. Where can I buy the Invariant (INVT) token after listing?

Invariant (INVT) is expected to be listed on Solana-based DEXs such as Jupiter Aggregator and Raydium. To purchase INVT, you’ll need a Solana wallet Bitget Wallet, some SOL for gas fees, and access to one of these exchanges post-listing.

3. What makes Invariant (INVT) different from other DeFi tokens?

Unlike standard AMMs, Invariant (INVT) offers concentrated liquidity, gas-optimized performance, and a custom-built routing engine on Solana. These features aim to improve capital efficiency and trading execution, making INVT a standout in the decentralized trading ecosystem.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy T-2049 in 2026: A Beginner’s Step-by-Step Guide to Token 20492026-03-03 | 5mins