What Is Token Unlocks in Crypto and How It Affects Prices in 2026

"What is Token Unlocks in Crypto" is a critical mechanism shaping how supply, price, and investor strategy unfold in blockchain ecosystems. Token unlocks determine when previously locked tokens enter circulation, influencing liquidity, project transparency, and market behavior. This guide explores why token unlocks matter, how they affect price, how to track them, and how to profit.

Bitget Wallet offers traders a streamlined way to monitor token unlock schedules and respond with real-time execution strategies.

What is Token Unlocks in Crypto and Why It Matters?

The token unlocking mechanism is a planned process that releases previously restricted crypto tokens into circulation. These tokens are often subject to vesting schedules. They are typically allocated to early investors, project teams, or community initiatives.

Unlocking tokens helps manage how supply enters the market. It allows projects to raise capital in stages. It also ensures contributors are rewarded over time. This structure builds trust and encourages long-term commitment.

However, token unlocks can carry risks. If the process is not well managed, it may cause price volatility. Sudden increases in supply can trigger sell-offs and weaken investor confidence.

Source: Dreamstime

How Does Token Unlock Work?

Smart Contracts and Unlock Schedules

Token unlocks are often managed by smart contracts. These contracts follow rules defined in the project’s whitepaper. The unlock schedule may be based on time, milestones, or both.

Smart contracts handle the process automatically. This reduces the risk of mistakes or manual interference. It also ensures that tokens are released in a fair and transparent manner.

Unlock Timing and Conditions

Unlocks can be linked to Token Generation Events (TGEs). They may also follow fundraising milestones or fixed time intervals. These intervals might be monthly, quarterly, or yearly.

Each project chooses a structure based on its goals. Milestone-based unlocks release tokens as development progresses. Time-based unlocks follow a set calendar schedule.

What are the Benefits of Token Unlocks?

Token unlocks offer several advantages:

- Provide liquidity to the market

- Support continued project development

- Increase trust through transparent tokenomics

- Attract new users by ensuring access to circulating tokens

Using a fair token unlocking mechanism reinforces long-term alignment and ecosystem health.

What are the Disadvantages of Token Unlocks?

Despite their utility, token unlocks can create challenges:

- Short-term price drops due to increased supply

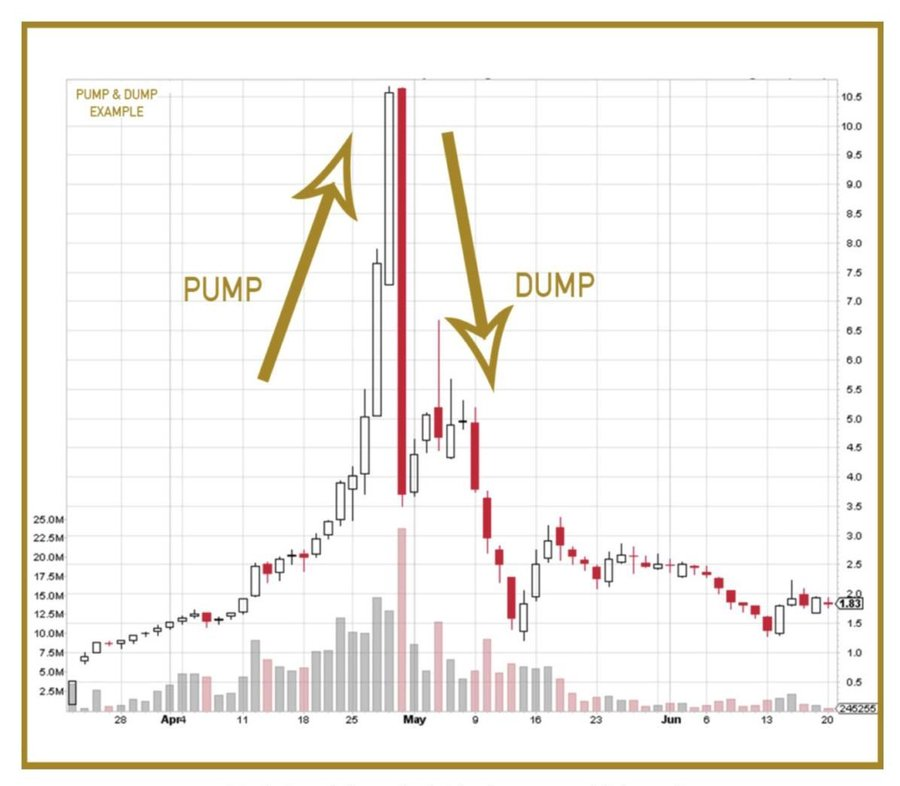

- Risk of insider dumping if not transparently handled

- Complex regulation and enforcement

- Centralization concerns if large portions go to a few entities

What’s the Difference: Cliff Unlock vs. Linear Unlock?

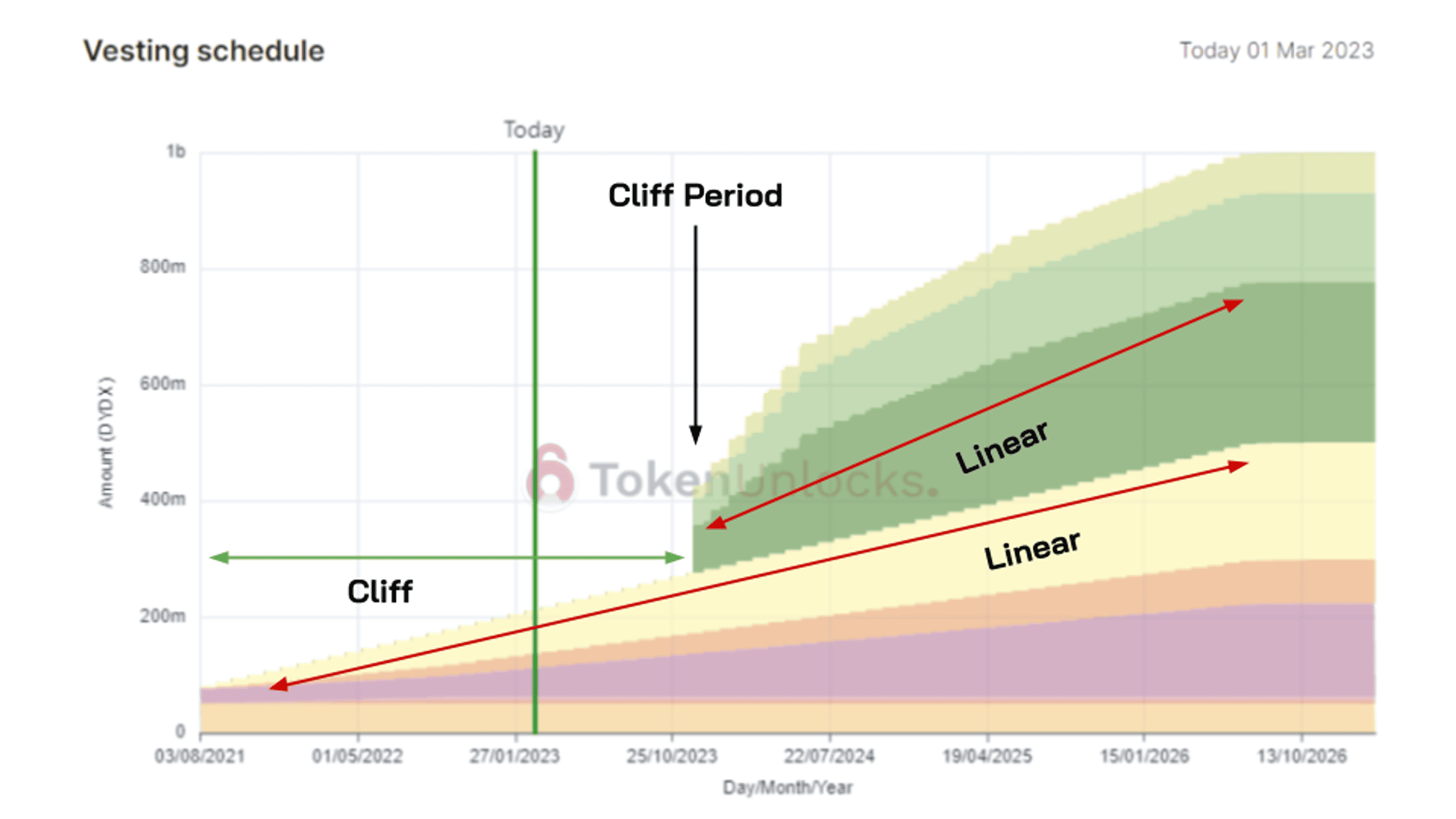

How Does Cliff Unlock Work?

A cliff unlock delays all token release until a set period passes (e.g., 6-12 months), then a bulk amount is released instantly. This can lead to high volatility as large token volumes hit the market.

Source: Cryptorank

How Does Linear Unlock Work?

Linear unlocks distribute tokens gradually over time—such as monthly or daily—allowing for more predictable supply and better market absorption. This often leads to greater stability in price and confidence among traders.

Source: Coin98

Cliff vs Linear Unlock Comparison Table

| Feature | Cliff Unlock | Linear Unlock |

| Release Style | Bulk after delay | Gradual over time |

| Market Impact | Sudden supply spike | Smooth integration |

| Price Volatility | High risk | Low to moderate |

| Investor Perception | Uncertain, risky | More predictable |

Which One is Better for Investors or Price?

Linear unlocks tend to be safer for price stability, especially in retail-heavy markets. However, cliff unlocks can be beneficial when timed with positive events or restricted to strategic contributors.

Source: Tradingview

What is the Difference Between Token Unlock and Token Vesting?

What is Token Vesting?

Vesting refers to the gradual entitlement of tokens over time, typically for team members, advisors, or developers. These tokens may still be locked until fully vested, and unlocking mechanisms are applied afterward.

Token Unlock vs Token Vesting Comparison Table

| Aspect | Token Unlock | Token Vesting |

| Definition | Token enters circulation | Token becomes accessible |

| Purpose | Expand supply/liquidity | Align long-term contributions |

| Recipients | Investors, users, ecosystem | Team, advisors, contributors |

| Impact | Affects market price | Affects team control over time |

Understanding both is essential for evaluating tokenomics and long-term project stability.

Will Token Unlocks Impact Crypto Price?

What Happens to Price When Tokens Unlock?

Token unlocks often lead to short-term price volatility. Prices may drop before the unlock and fall further just after it.

However, the market can absorb the new supply if the unlock serves a clear purpose. This includes use cases like staking, funding, or network growth. Over time, prices may stabilize or even recover.

Many traders act based on these patterns. Some sell before or during the unlock. Others wait for the dip and buy when the price settles.

How Does Token Unlock Affect Price?

- Prices often dip when unlocked tokens are sold right away. This is common when early investors or insiders receive large allocations. Many are motivated to sell quickly and take profits

- The crypto token unlock impact is usually negative in the short term. A sudden increase in supply can lower the token’s value, especially if demand stays the same.

- Long-term unlock schedules can help build market confidence. They show a fair and transparent plan that supports steady project growth.

- Timing also plays a key role. If an unlock happens alongside a product launch or major listing, the extra demand can balance out the new supply.

- Markets tend to react poorly when unlocks appear unfair. Bearish sentiment grows when insiders receive most of the tokens. But if the process is gradual and benefits the community, it can build trust. In that case, bullish sentiment may follow.

Crypto token unlock impact ultimately depends on:

- The magnitude of the supply surge

- The clarity and structure of the tokenomics

- The market’s perception of the unlock purpose

Overall demand and trading volume at the time of release

How to Track Upcoming Token Unlocks?

Tracking token unlock schedules gives traders and investors an informational edge. Knowing when large unlock events are approaching allows you to prepare for market movements, hedge exposure, or capitalize on volatility.

Here are the top resources for tracking upcoming unlocks:

- token.unlocks – A dedicated platform that lists upcoming token unlocks, vesting schedules, and detailed allocation data.

- cryptorank.io – Offers filters by token, category, and date, making it easy to track events relevant to your portfolio.

- messari.io – Best for deeper analysis and project fundamentals related to unlock schedules.

To simplify this process, Bitget Wallet integrates token unlock alerts directly into your mobile dashboard. You can track unlocks, receive notifications, and even place trades before or after key events—all from one place.

Where to track token unlocks has become a strategic decision. Choosing tools like Bitget Wallet that consolidate real-time unlock data and execution features ensures you’re always prepared to act quickly and profitably.

How to Take Advantage of Token Unlock Events?

Token unlocks present both risk and opportunity. By studying token allocation, sentiment, and timing, traders can formulate strategies to profit from unlock-related volatility.

1. Anticipate Selling Pressure

Start by analyzing who is receiving the unlocked tokens—are they early investors, the core team, or ecosystem grants? Large unlocks going to private investors or the founding team often trigger sell-offs. Review historical price reactions and monitor community sentiment leading up to the unlock date. Early exits by insiders can signal upcoming volatility.

2. Use Short-Selling Strategies

Traders anticipating price drops can open short positions ahead of large unlock events. This approach works best when:

- A significant portion of the supply is being released

- The unlock is not accompanied by bullish project updates

- Previous unlocks led to price dips

However, shorting is inherently risky. Market conditions can change quickly, and positive news may override unlock pressure. Always use stop losses and risk management strategies.

3. Trade Volatility Post-Unlock

Even if you miss the pre-unlock trade, you can still profit from the price swings that follow. Watch for signs of recovery after an initial dip. Use technical indicators to identify entry points or oversold conditions. Projects with strong fundamentals may bounce back quickly, especially if tokens are redistributed into staking or ecosystem growth.

4. Pair With News or Roadmap Announcements

Some projects time their token unlocks with major updates. These may include protocol upgrades, exchange listings, or ecosystem expansions.

Such events can create buying pressure. This can reduce the negative impact of increased token supply. The result is often a more stable or even rising price.

Traders should watch project news and announcements. Sources include communication channels, governance forums, and analytics platforms. Staying informed helps traders act at the right moment.

Unlocks that follow real progress or strong community support often perform better. Even with higher supply, the price may stay steady or move upward.

How to Earn with Unlock Tokens?

Token unlocks don’t just create trading opportunities—they also open up paths for passive income and strategic positioning. Here's how to make the most of unlocked assets.

Trading Before and After Unlocks

Market participants often trade around unlock events by evaluating sentiment, historical reactions, and tokenomics.

- Buy before the unlock if the project has positive momentum, strong fundamentals, or upcoming bullish announcements.

- Short before unlock if large supply inflows are expected to suppress price.

- Reenter after unlock dips, when the market stabilizes and oversold conditions present favorable risk-to-reward setups.

Unlock cycles can act as recurring alpha points—especially for seasoned traders who combine market data with news catalysts.

Using Unlocked Tokens for Yield

Unlocked tokens can be deployed across DeFi and staking ecosystems for compounding gains. Depending on the project, you can:

- Stake them to support validators and earn native rewards

- Provide liquidity to decentralized exchanges for trading fees and incentives

- Lend or farm via protocols that offer interest, governance power, or farming tokens in return

These options not only offer income but also help reduce sell pressure by incentivizing holders to lock their tokens again.

Tools and Risk Management

- Always Do Your Own Research (DYOR) to understand project unlock mechanics and real utility.

- Use Bitget Wallet to stay updated on unlock schedules, access integrated swaps, and participate in staking directly.

- Avoid excessive leverage, especially during high-volatility phases following unlocks.

By combining informed timing with practical token usage, traders and long-term holders can convert unlock events into recurring income strategies.

Can a Crypto Wallet Trade Unlocked Tokens?

Not only can crypto wallets hold tokens—they can now play an active role in helping users track, manage, and trade unlocked tokens with precision.

Tracking Unlocks Through Crypto Wallets

Modern crypto wallets like Bitget Wallet provide real-time tracking of token unlock schedules. These features include:

- Integrated unlock calendars

- Notifications for upcoming unlock events

- Allocation insights (team, investor, ecosystem)

This gives users the ability to prepare in advance—whether to trade, hold, or stake.

Trading Unlocked Tokens Post-Release

Once tokens become available, Bitget Wallet enables immediate action. Users can:

- Execute DEX swaps within the app

- Route trades across chains with built-in bridge support

- Transfer assets to CEX platforms for additional liquidity options

This seamless access is crucial during unlock periods when timing matters most.

Why Use Bitget Wallet?

Bitget Wallet combines trading, monitoring, and portfolio management into a single, intuitive tool:

- Integrated unlock tracking dashboard with project timelines

- Real-time alerts for upcoming unlocks

- Low-slippage swaps and staking options directly in-app

- Performance analytics and wallet insights for better decisions

Whether you're anticipating volatility or planning to stake your rewards, Bitget Wallet empowers you to stay ahead of unlock trends.

Final Thoughts

Token unlocks in crypto play a vital role in shaping price, investor strategy, and project growth. While they can lead to short-term volatility, they also signal progress, distribute supply, and reward contributors. By understanding how unlocks work—and tracking them using tools like Bitget Wallet—you can stay ahead of the market.

Stay ahead of token unlock trends — download Bitget Wallet today and trade with confidence.

Frequently Asked Questions (FAQs)

What is the purpose of token unlocks in crypto projects?

Token unlocks regulate how and when previously locked tokens are released into circulation. They ensure gradual distribution to investors, team members, or the ecosystem, helping manage inflation, build trust, and align long-term incentives.

How does token unlock affect price and investor sentiment?

Crypto token unlock impact can be significant. Prices often drop if large amounts are released suddenly, especially if distributed to early investors. However, transparent, gradual unlocks tied to utility or growth can strengthen investor confidence.

Where can I track upcoming token unlocks efficiently?

You can track unlock schedules using platforms like token.unlocks.app, CryptoRank.io, or Messari.io. For real-time alerts and trade execution in one place, Bitget Wallet offers an integrated unlock calendar and market tools.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is Crypto Fear and Greed Index: How Traders Read Fear vs Greed Signals2025-11-19 | 5 mins

- How to Pay with Crypto: Fast, Safe, and Beginner-Friendly Method2025-11-18 | 5 mins

- How to Convert Your Crypto to Cash: 5 Easy Ways for Beginners2025-11-18 | 5 mins