What Is Maple Finance ($SYRUP)? Institutional Credit and Price Growth in DeFi 2026

What is Maple Finance (SYRUP)? Rooted in institutional-grade finance and DeFi transparency, Maple Finance (SYRUP) bridges traditional financial systems and decentralized innovation within the on-chain capital markets industry. It leverages blockchain to bring trust, efficiency, and access to credit in the digital economy, ensuring that lending and liquidity provisioning evolve to meet modern financial demands.

Thanks to the support of leading DeFi protocols, institutional lenders, and venture capital backers, Maple Finance (SYRUP) is redefining digital assets, allowing investors and participants to engage in its rapidly growing network. It functions as more than just a token—SYRUP powers decentralized credit delegation, underpins on-chain loan issuance, and supports sustainable yield generation for both lenders and borrowers.

Through this article, we explore Maple Finance (SYRUP), outlining its vision, unique characteristics, and market prospects. Whether you’re assessing its real-world functionality, investment potential, or broader impact, this guide helps you navigate its significance in the evolving crypto lending space.

Key Takeaways

-

Maple Finance is revolutionizing DeFi lending by offering institutional-grade, undercollateralized loans on-chain with full transparency.

-

$SYRUP is the new utility and governance token, replacing MPL at a 1:100 ratio and powering staking, rewards, and protocol governance.

-

You can buy $SYRUP on major exchanges like Binance, Bitget, and MEXC using fiat or crypto—making it accessible to both new and seasoned investors.

What Is Maple Finance ($SYRUP): What You Should Know?

Maple Finance is changing the way decentralized credit works. It connects institutional borrowers with capital on-chain. The platform recently launched its new governance token, $SYRUP. This token adds more utility to the system. It also enables staking rewards and allows users to take part in governance.

Maple’s mission is clear: build a trusted, scalable credit platform for the DeFi space. Its technology is designed for efficiency and transparency. The tokenomics behind $SYRUP support long-term growth and user incentives.

If you're interested in DeFi or looking for new investment opportunities, it’s important to understand how Maple works. Knowing its goals, tools, and token structure helps you assess its future value.

Source: Forbes

$SYRUP Soars 65% After Binance Listing as Maple Finance TVL Tops $1.3B

$SYRUP surged up to 65% following its Binance listing, reaching a high of approximately $0.31 before stabilizing near $0.20, as Maple Finance's total value locked (TVL) exceeded $1.3 billion in early 2025. To celebrate its $1B TVL milestone, Maple launched a $500K USDC reward campaign for SyrupUSDC participants during May 2025. $SYRUP is now trading on major exchanges, including Binance.

Maple Finance ($SYRUP) Market Trends & Price Predictions 2026

Factors such as market conditions, project fundamentals, and community trust shape cryptocurrency valuations. With substantial backing and a strong presence in decentralized finance, Maple Finance ($SYRUP) is anticipated to remain in the $0.25–$0.40 price range. If adoption in on-chain institutional lending accelerates, its value may rise to $0.80–$1.00 in the long term.

Key Drivers of Maple Finance ($SYRUP) Price Movement

-

Market Dynamics:

$SYRUP’s performance is heavily influenced by broader DeFi trends, crypto liquidity cycles, and Ethereum ecosystem activity. A strong resurgence in decentralized lending could boost token demand. -

Adoption & Practical Use Cases:

With Maple facilitating real-world lending for institutions, $SYRUP gains relevance as it supports governance, staking, and pool incentive models. Expansion into new borrower markets also drives token utility. -

Technological Development & Expansion:

Ongoing protocol upgrades, the introduction of new credit pools (like SyrupUSDC), and multi-chain deployment strategies will be key to sustaining momentum and enhancing investor confidence.

Future Growth Prospects

If Maple Finance ($SYRUP) maintains its growth within the decentralized credit and institutional DeFi sector, rising demand could push its valuation higher. Experts suggest that continuous development and increasing adoption may elevate its price to $0.80–$1.00, though investors should remain cautious of market volatility and regulatory changes.

Note: The price prediction is sourced from third-party media at the time of writing and is for reference only. It does not represent the official stance of Maple Finance and Bitget Wallet. Please conduct your own research and refer to official market data before making any investment decisions.

Maple Finance ($SYRUP) Key Innovations: Top Reasons to Watch

-

On-chain institutional lending:

Maple enables undercollateralized loans for institutional borrowers, a rare feature in DeFi. -

Revamped token utility:

$SYRUP replaces MPL with enhanced staking, rewards, and governance functionality. -

Rapid TVL growth:

With over $1B in total value locked and the launch of SyrupUSDC, Maple is scaling fast in the DeFi lending space.

The Maple Finance ($SYRUP) Ecosystem: How It Functions

The architecture of Maple Finance is designed with multiple elements that work together to support adoption and provide lasting value.

- Blockchain Infrastructure:

Utilizes Ethereum Layer-1 with future Layer-2 compatibility to optimize transaction efficiency and reduce costs. -

Token Utility:

Serves as a governance and reward token within the ecosystem. Facilitates DeFi staking, loan pool incentives, and protocol governance participation. -

Governance & Community Engagement:

Holders of $SYRUP can vote on protocol upgrades, pool parameters, and reward mechanisms, promoting decentralized decision-making and long-term engagement.

Maple Finance ($SYRUP) is powered by Ethereum blockchain technology, ensuring security, scalability, and efficiency in its transactions and operations.

Key Technological Components

-

Blockchain Network: Runs on Ethereum, integrating with institutional DeFi infrastructure.

-

Consensus Mechanism: Secured via Ethereum’s Proof-of-Stake (PoS).

-

Smart Contracts: Automate loan issuance, repayments, interest distribution, and governance functions.

-

Scalability Solutions: Exploring Layer-2 deployment and off-chain computation to enhance speed and reduce fees.

Who Leads Maple Finance ($SYRUP) – Team & Key Partnerships

Key Use Cases of Maple Finance ($SYRUP): How It’s Transforming DeFi Lending

Maple Finance is reshaping decentralized finance by bringing institutional-grade credit infrastructure to the blockchain. Through its native token $SYRUP, the platform enables secure, efficient, and scalable lending processes.

How It’s Transforming DeFi Lending?

-

On-Chain Institutional Lending:

$SYRUP supports lending pools that allow institutions to access undercollateralized loans—bridging the gap between traditional finance and DeFi. -

Governance and Protocol Control:

Token holders use $SYRUP to vote on key parameters such as interest rates, fees, and pool structures—ensuring decentralized governance. -

Staking and Yield Incentives:

Users can stake $SYRUP to earn a share of protocol revenue, promoting long-term participation and sustainable liquidity within Maple’s ecosystem.

The Development Roadmap of Maple Finance ($SYRUP): What to Expect

The roadmap for Maple Finance ($SYRUP) outlines a clear path for growth and innovation, focusing on expanding institutional lending, deepening real-world asset (RWA) integrations, and enhancing token utility across new chains and credit products.

| Q3 2025 | Launch of permissionless lending pools, enabling any credit professional to deploy lending strategies on Maple; continued scaling of SyrupUSDC pools across Ethereum & Base. |

| Q4 2025 | Introduction of institutional-grade risk automation tools, updated credit dashboards, and onboarding of new real-world asset partners for private credit markets. |

| Q1 2026 | Deployment of cross-chain lending infrastructure, expanding $SYRUP utility across additional L2 ecosystems (e.g., Arbitrum, Optimism); improved collateralization frameworks. |

| Q2 2026 | Release of multi-asset lending support (beyond USDC), integration with major DeFi aggregators, and expansion into regulated global credit partners to grow institutional borrower demand. |

These applications highlight the practical value of $SYRUP in advancing scalable, transparent, institution-friendly credit markets within the decentralized finance (DeFi) industry.

How to Buy Maple Finance (SYRUP) on Bitget Wallet?

Trading Maple Finance (SYRUP) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

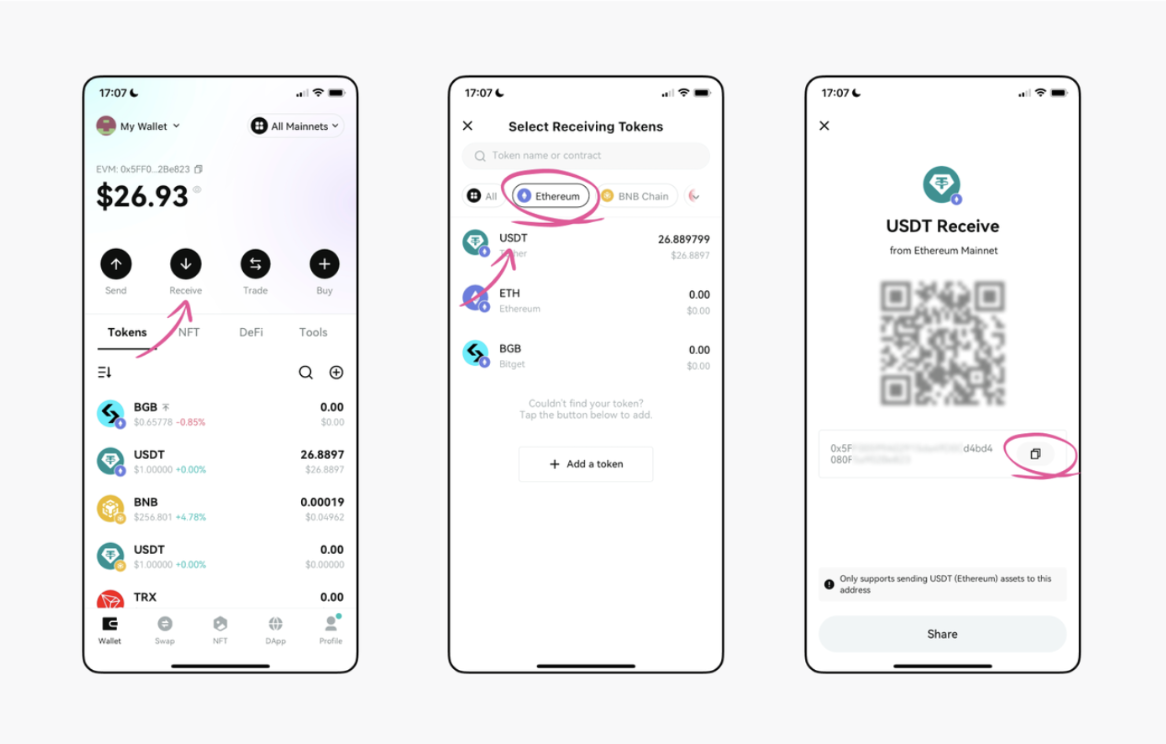

Once your account is set up, you need to deposit funds. You can do this by:

-

Transferring Cryptocurrency: Send crypto from another wallet.

-

Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading [Projector Name](Token Name).

Step 3: Find Maple Finance (SYRUP)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find Maple Finance (SYRUP). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

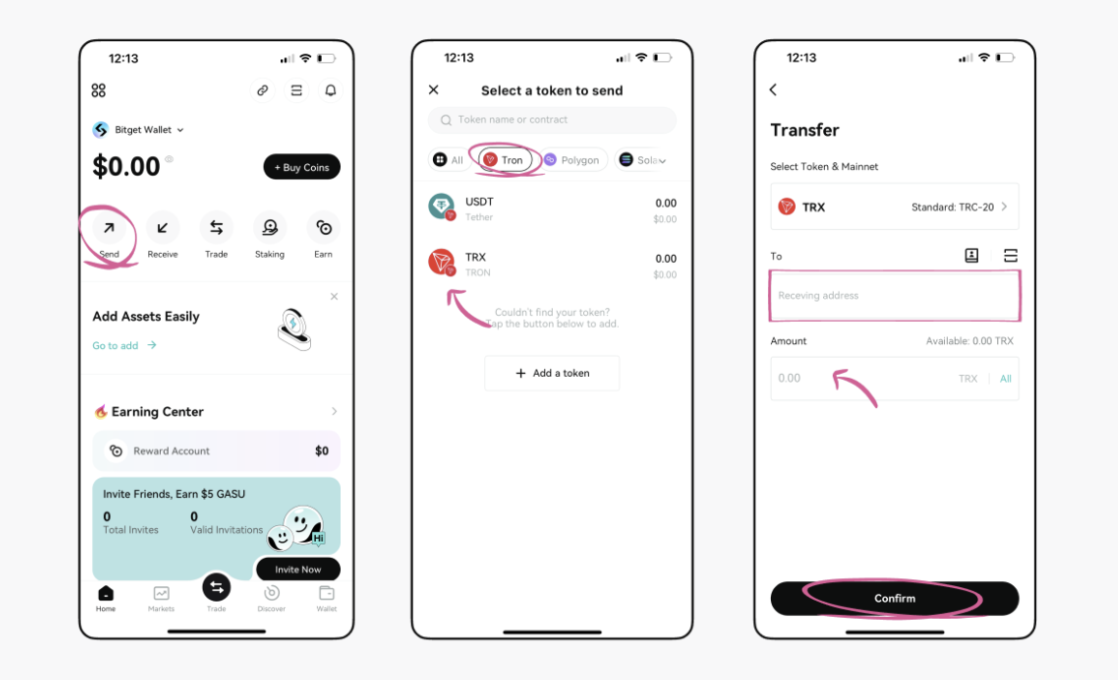

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as SYRUP/USDT. This will allow you to trade Maple Finance (SYRUP) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of Maple Finance (SYRUP) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired Maple Finance (SYRUP).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your Maple Finance (SYRUP) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

Conclusion

Maple Finance ($SYRUP) is transforming DeFi by bringing institutional-grade lending to the blockchain. Backed by a clear roadmap, strong partnerships, and real-world utility, $SYRUP plays a central role in scaling transparent, on-chain credit markets.

Buying and managing $SYRUP through Bitget Wallet adds even more value. With fast, low-cost transactions, support for multiple networks (including Ethereum and Layer-2s), and secure, non-custodial asset management, Bitget Wallet ensures a seamless DeFi experience.

Whether you're staking, trading, or participating in governance, Bitget Wallet gives you the tools to explore Maple Finance with confidence, security, and convenience—all in one powerful app.

Download Bitget Wallet today and take control of your DeFi journey.

FAQs

1. What is Maple Finance and what does $SYRUP do?

Maple Finance is a decentralized lending platform designed for institutional borrowers. Its native token, $SYRUP, powers protocol governance, staking rewards, and ecosystem incentives.

2. How can I buy $SYRUP?

You can purchase $SYRUP on major exchanges like Binance, Bitget, and MEXC. Simply create an account, deposit funds, and search for the $SYRUP trading pair to complete your transaction.

3. Why use Bitget Wallet to hold or buy $SYRUP?

Bitget Wallet offers secure, non-custodial storage, fast transaction speeds, multi-chain support, and easy access to DeFi tokens like $SYRUP—all in one intuitive mobile app.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.