What Is MANTRA (OM)? Cosmos RWA Blockchain Explained with Token Migration and Staking

What is MANTRA (OM)? MANTRA (OM) is a Cosmos-based Layer-1 blockchain focused on real-world asset (RWA) tokenization with compliance at its core. Offering ≈18% staking yields and a capped supply of 2.5 billion tokens, it bridges traditional finance and Web3 by bringing regulated assets such as real estate and institutional products on-chain.

Backed by partners like Google Cloud, Inveniam, DAMAC Group, Binance, and Nansen, MANTRA positions itself as more than just a token project. The OM token powers staking, governance, transaction fees, and access to its Guard Module, making MANTRA a compliance-first hub for regulated DeFi. While its yields and capped supply attract investors, risks such as liquidity crunches and centralization—highlighted during the April 2025 flash crash—remain important considerations.

In this guide, we explore Mantra (OM), outlining its vision, features, and market outlook. Whether you’re evaluating its RWA use cases, investment potential, or ecosystem tools, platforms like Bitget Wallet make it easier to engage—offering Secure Stablecoin Storage, Hot Memecoin Trading, and Seamless Cross-chain Experience for OM and beyond.

Key Takeaways

- Institutional adoption is strong — partnerships with Google Cloud, Inveniam, DAMAC Group, Binance, and Nansen reinforce trust and visibility.

- Token migration underway — by January 2026, OM will shift fully from Ethereum ERC-20 to its native Mantra Chain, consolidating liquidity and ecosystem strength.

- What is Mantra OM? — it’s the governance and utility token of Mantra Chain, offering ≈18% APR staking yields with a capped 2.5B supply, though risks like liquidity crunches and centralization remain.

A Deep Dive into Mantra: What Is Mantra (OM)?

MANTRA (OM) is a utility and governance token based on the Cosmos blockchain that represents a modern approach to compliant real-world asset (RWA) tokenization. The project embodies the following values:

- Compliance and Transparency

- Innovation in RWA Finance

- Community-Driven Governance

MANTRA (OM) not only carries the ethos of building trust in decentralized systems but also applies it to the regulated DeFi and asset tokenization industry, creating a sustainable, transparent, and collaborative ecosystem.

Source: X

MANTRA(OM) is making headlines with its upcoming migration from Ethereum ERC-20 to a fully native Cosmos-based token by January 2026, aiming to consolidate liquidity and strengthen its compliance-first RWA ecosystem. With high staking rewards of around 18% APR and strong partnerships including Google Cloud, Inveniam, and DAMAC Group, the project continues to attract both institutional and retail attention in the evolving regulated DeFi space.

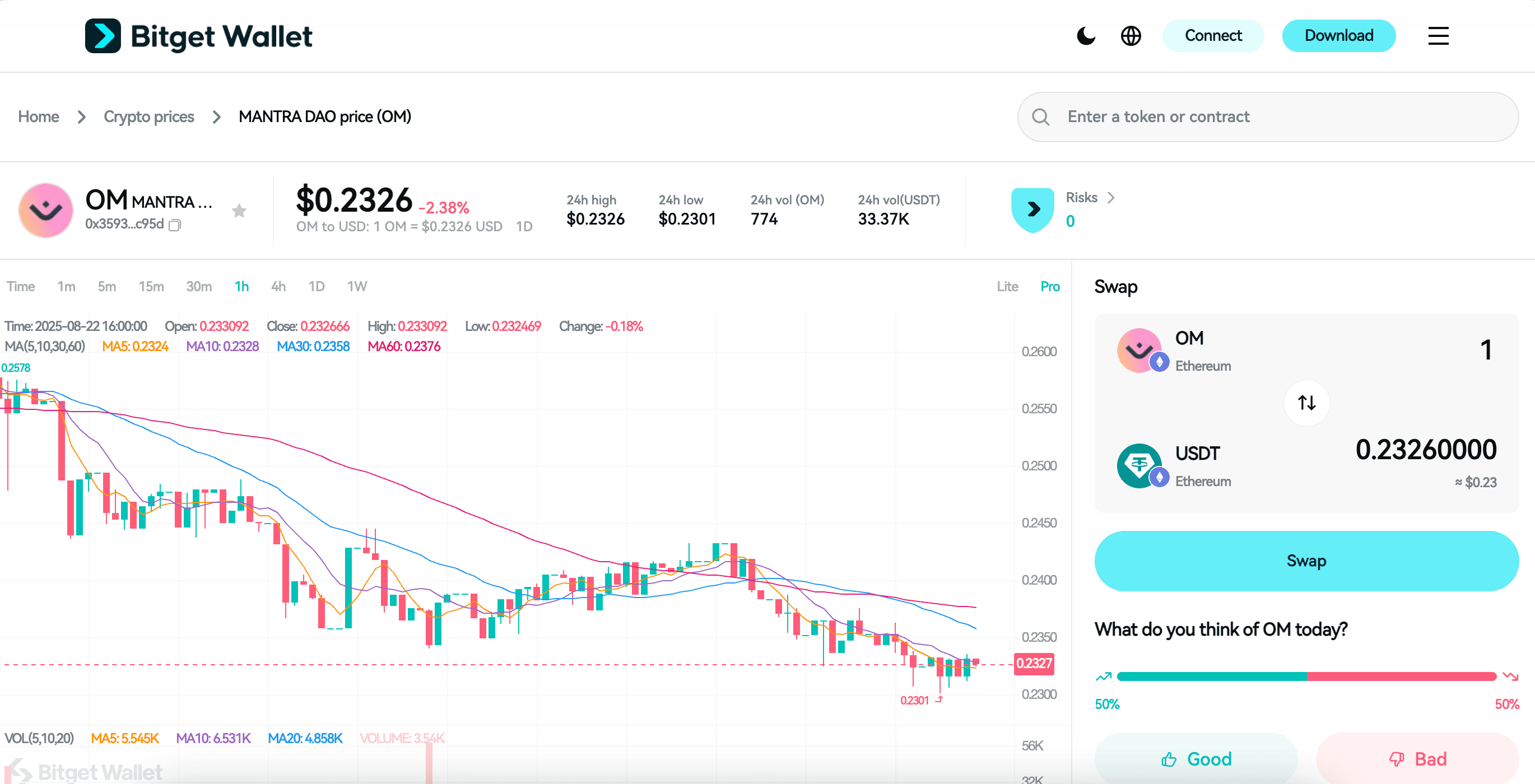

MANTRA (OM) Market Trends & Price Predictions 2025

MANTRA (OM)’s price hinges on broader crypto sentiment, its increasing RWA utility, and adoption by institutions. With strategic moves like the migration to its native chain and partnerships in the institutional asset sphere, future valuation is poised to stay stable in the $0.23–$0.25 range through late 2025. Aggressive forecasts suggest upside to $0.45 by 2029 if growth and ecosystem expansion continue—just don’t ignore volatility and regulatory risk.

Factors Influencing the Price of MANTRA (OM)

- Market Trends: Analysts expect OM to hover around $0.23–$0.24 by year-end. For instance, Bitget projects $0.2384 in 2025, rising to roughly $0.2503 in 2026 and $0.3042 by 2030 under a steady growth model.

- Adoption & Real-World Utility: As of August 2025, 28% of the total OM supply (250 million tokens) has already migrated to the native Mantra Chain—an indicator of strong early adoption and reduced liquidity fragmentation. Meanwhile, partnerships—such as a $1B deal with DAMAC Group and integration with Elliptic for compliance—are reinforcing institutional use cases.

- Project Advancements: The upcoming EVM Mainnet Launch in September 2025 will add developer appeal via Solidity and Ethereum tool compatibility. This multi‑VM capability could be a game-changer for dApp growth and token utility.

Long-Term Growth Potential

If MANTRA (OM) continues scaling its RWA ecosystem and institutional integrations, we could see upward momentum toward $0.45 by 2029, with some bold projections even tipping $0.50+. But history—like the April 2025 flash crash—reminds us of liquidity and concentration risks. Regulatory shifts or market missteps could easily drag valuations lower, so tread wisely.

Source: Bitget, AInvest, CoinMarketCap

Source: Bitget Wallet

Explore MANTRA (OM) easily with Bitget Wallet — offering Secure Stablecoin Storage, Hot Memecoin Trading, and a Seamless Multi‑chain Experience, all in one beginner‑friendly app.

Why MANTRA (OM) Stands Out: Essential Features

The standout features of MANTRA (OM) include:

-

Compliance-First RWA Infrastructure

MANTRA Chain is designed with built-in modules for KYC/AML, decentralized identity (DID), and regulated DeFi. This makes it one of the few Layer-1s capable of bridging traditional finance (TradFi) and Web3 without cutting corners on compliance.

-

Multi-VM Compatibility (CosmWasm + EVM)

Unlike many Cosmos-based chains, MANTRA offers both CosmWasm and Ethereum Virtual Machine (EVM) support. Developers can use familiar Solidity tools (like MetaMask and Hardhat) while benefiting from Cosmos interoperability—opening the door to a wider range of dApps and cross-chain integrations.

-

High Staking Rewards & Token Utility

The OM token powers staking, governance, and transaction fees across MANTRA Chain. With staking yields of around 18% APR and a capped supply of 2.5 billion OM, the token provides strong incentives for participation while securing the network and ensuring long-term utility.

How MANTRA (OM) Operates and What Benefits It Delivers

How MANTRA Works

- Built on the Cosmos SDK with IBC interoperability, enabling fast, scalable, and cross-chain transactions.

- Uses a Tendermint-based PoS (CometBFT) consensus mechanism, providing secure, final-state transactions with validator-based validation.

- Supports regulated DeFi, RWA tokenization, governance tools, and dApp deployment, with both CosmWasm and EVM support for Hermes Solidity tooling access.

Key Benefits

- Regulated RWA Tokenization – Baked-in compliance modules like KYC/AML, DID, and Soulbound NFTs shape a trusted environment for tokenizing real-world assets.

- Developer Flexibility – Dual VM support means developers can choose whether to deploy via CosmWasm or EVM, enabling the use of Ethereum development tools while tapping into Cosmos ecosystems.

- Governance & Staking with Future High Yield Potential – Currently offering ~5.7% APR in staking with 3% inflation, but a proposal to introduce an 8% inflation rate (targeting ~18% APR) and cap supply at 2.5B OM could add serious upside if approved.

MANTRA (OM) Team: Leadership and Strategic Vision

Leadership

MANTRA is led by John Patrick Mullin, its co-founder and CEO. Mullin has a background in investment banking and fintech, and he has been active in blockchain education and venture building across Asia and the Middle East. Under his leadership, MANTRA has evolved from its early roots as MANTRA DAO into MANTRA Chain, a compliance-focused Layer-1 designed for real-world asset (RWA) tokenization. The project’s leadership combines experience in finance, regulation, and Web3 development, positioning MANTRA to bridge institutional capital with decentralized finance.

Strategy

The core strategy of MANTRA is to become the leading compliance-first blockchain for tokenized RWAs. This involves three key pillars:

- Regulated RWA Tokenization – Embedding compliance modules such as KYC/AML, decentralized identity (DID), and on-chain governance to meet institutional standards.

- Developer Accessibility – Offering dual support for CosmWasm and EVM, making it easier for builders from both Cosmos and Ethereum ecosystems to deploy dApps on MANTRA.

- Institutional Adoption – Building high-value partnerships, including a $1B tokenization deal with DAMAC Group, a $20M strategic partnership with Inveniam, and collaborations with Google Cloud to accelerate enterprise-grade RWA development.

This strategy reflects MANTRA’s effort to stand apart from unregulated DeFi by creating a compliance-first, institution-ready blockchain ecosystem for tokenized real-world assets.

MANTRA (OM): Practical Applications & Use Cases

Why Utility Matters for MANTRA (OM)?

Utility is the backbone of MANTRA (OM) because it determines whether the project is more than just a speculative asset. As the native token of the MANTRA Chain, OM isn’t just for trading — it underpins staking, governance, and transaction fees. Its real strength lies in enabling compliant real-world asset (RWA) tokenization, where on-chain assets must align with legal and regulatory standards. This utility ensures that OM is tied directly to the growth of institutional adoption and RWA integration in Web3.

Key Use Cases of MANTRA (OM)

- Staking & Governance – OM holders can stake tokens to secure the network and earn rewards (targeting ~18% APR under the proposed model), while also voting on governance proposals.

- Transaction Fees & Guard Module – OM is used to pay for transactions and to access regulated modules, such as KYC/AML frameworks, decentralized identity (DID), and compliance features.

- RWA Tokenization & dApps – OM powers tokenized assets on MANTRA Chain, including real estate, commodities, and institutional investment products, alongside developer-built dApps on both CosmWasm and EVM.

What’s Next for MANTRA (OM)?

Looking ahead, MANTRA is focused on scaling its institutional partnerships and ecosystem. The Ethereum-to-native OM migration (set to complete by January 2026) will consolidate liquidity and strengthen the token’s long-term role. The launch of the EVM-compatible mainnet (September 2025) is another milestone, expected to attract developers from both Ethereum and Cosmos. With billion-dollar RWA tokenization deals, compliance certifications (like Dubai’s VARA license), and expanding integrations through Google Cloud’s accelerator, MANTRA is positioning itself as the go-to chain for regulated RWA adoption.

MANTRA (OM) Roadmap: What to Expect in 2025 and Beyond

The roadmap for MANTRA (OM) outlines a clear path for scaling regulated real-world asset (RWA) adoption, strengthening liquidity, and expanding developer access:

| Quarter | Roadmap |

| Q1 2025 | Strategic partnerships with institutions (e.g., Inveniam $20M deal, DAMAC $1B real estate tokenization pilot) and launch of Google Cloud’s RWAccelerator program for RWA projects. |

| Q2 2025 | Migration process begins for OM from Ethereum ERC-20 to native MANTRA Chain, reducing liquidity fragmentation and preparing for validator/gov changes. |

| Q3 2025 | Launch of EVM-compatible mainnet (multi-VM with CosmWasm + EVM) to attract Ethereum developers and expand dApp ecosystem. Governance proposal to adjust inflation (~8%) and staking rewards (~18% APR). |

| Q4 2025 | Expansion of tokenized RWA products across asset classes (real estate, commodities, institutional funds). Focus on institutional DeFi tools and compliance integrations under VARA license. |

| 2026 and Beyond | Full migration of OM to native chain by January 2026, ecosystem scaling with secondary markets for RWAs, yield-bearing products, and global expansion of institutional adoption. |

These milestones highlight the practical value of $OM in the regulated DeFi and RWA tokenization industry, positioning MANTRA as a frontrunner in bridging institutional finance and Web3.

How to Buy MANTRA (OM) on Bitget Wallet?

Trading MANTRA (OM) is easy on Bitget Wallet. Follow these simple steps to get started:

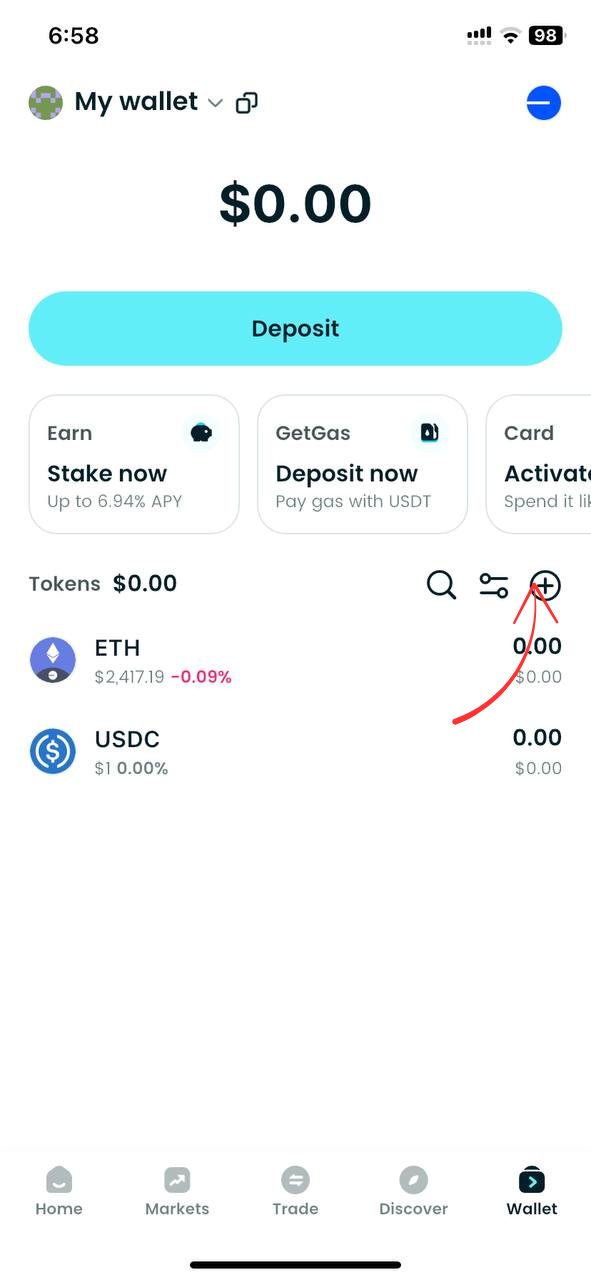

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading MANTRA (OM).

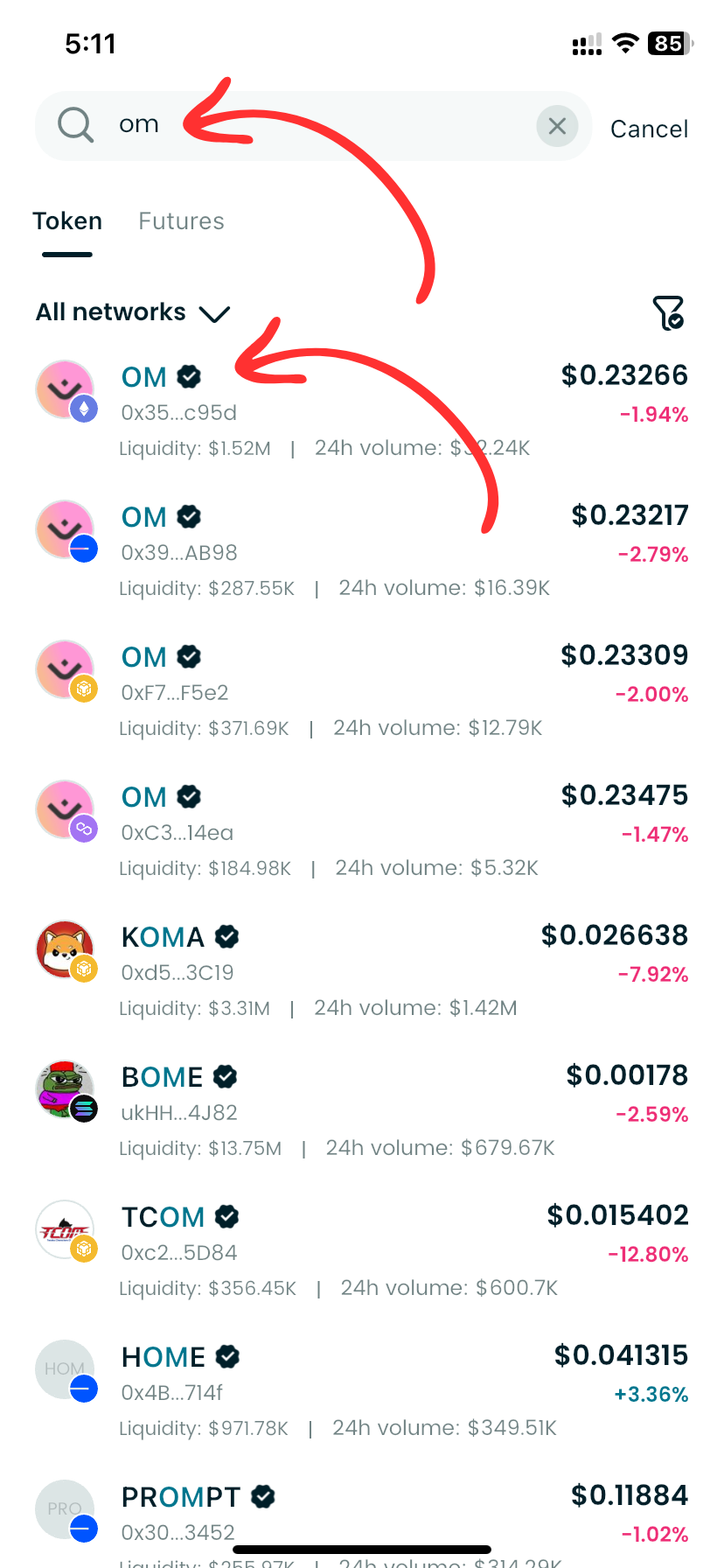

Step 3: Find MANTRA (OM)

On the Bitget Wallet platform, go to the market area. Search for MANTRA (OM) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

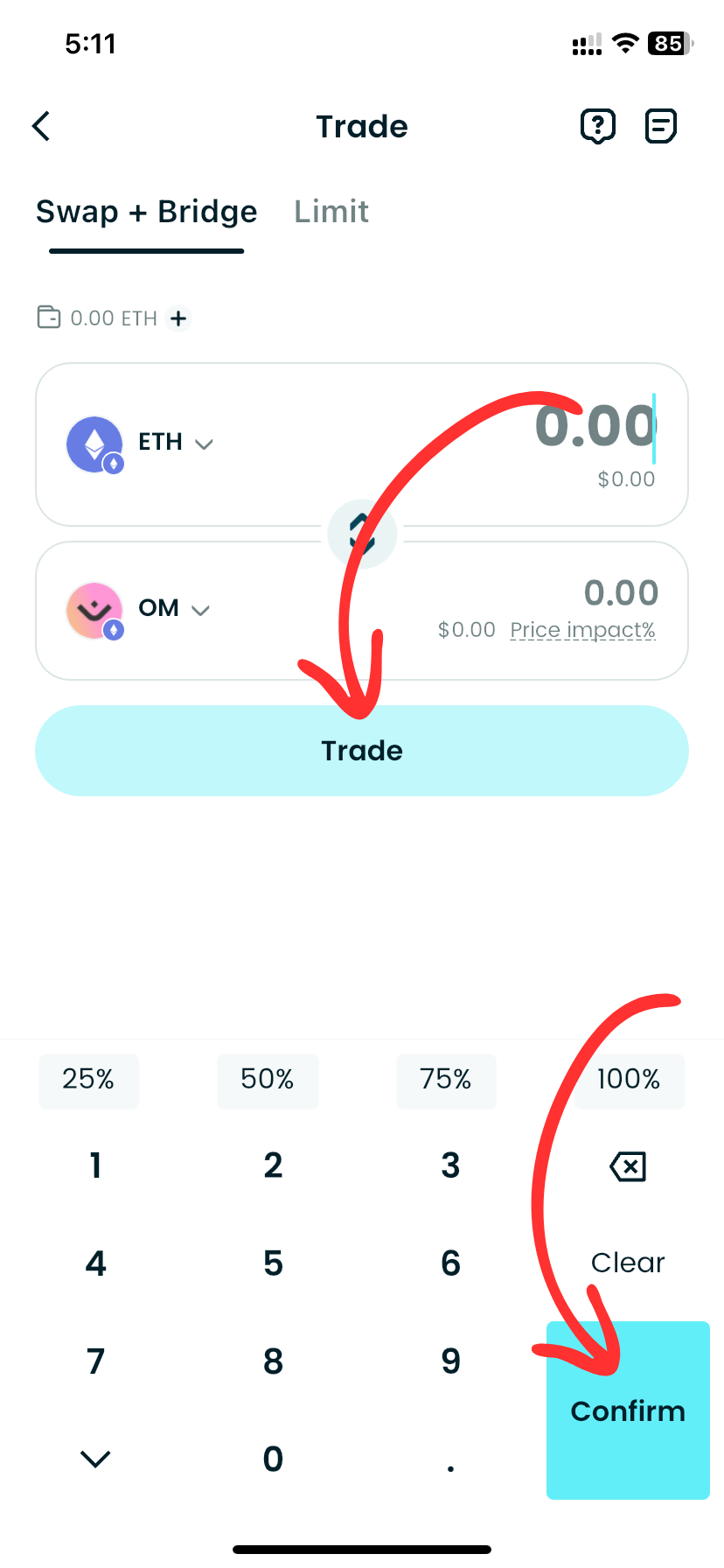

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, OM/USDT. By doing this, you will be able to exchange MANTRA (OM) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of MANTRA (OM) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased MANTRA (OM).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your MANTRA (OM) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

MANTRA (OM) stands out as a compliance-first Layer-1 blockchain designed for real-world asset (RWA) tokenization. With its Cosmos foundation, dual CosmWasm and EVM support, and strong institutional partnerships, MANTRA is building the bridge between traditional finance and Web3. What is Mantra OM? It is the governance and utility token that powers staking, governance, and regulatory frameworks on the chain, positioning MANTRA as a unique player in the regulated DeFi space and offering investors both growth potential and a utility-driven ecosystem.

For those looking to access OM seamlessly, Bitget Wallet provides the perfect gateway. With secure stablecoin storage, hot memecoin trading, and seamless cross-chain experience, Bitget Wallet makes it easy to buy, hold, and manage OM alongside all your other tokens. Manage all your tokens in one beginner-friendly app – download Bitget Wallet today and stay ahead in the next wave of compliant crypto innovation.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is MANTRA (OM) used for?

OM is used for staking, governance, transaction fees, and RWA tokenization on Mantra Chain. It secures the network through Proof-of-Stake, lets holders vote on governance proposals, pays for transactions and compliance modules, and powers the tokenization of assets like real estate and institutional funds.

2. Is MANTRA (OM) a good investment in 2025?

MANTRA appeals to investors because of its compliance-first focus, strong institutional partnerships, and proposed staking yields of up to ≈18% APR. However, risks remain — including liquidity crunches, centralization concerns, and regulatory changes — so it’s best approached as part of a diversified portfolio.

3. How can I buy and store MANTRA (OM)?

You can purchase OM on major exchanges like Bitget, trading it in the OM/USDT pair. For secure storage and easy management, use Bitget Wallet — it offers secure stablecoin storage, hot memecoin trading, and seamless cross-chain experience. With Bitget Wallet, you can manage all your tokens in one beginner-friendly app.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- FIFA World Cup Odds 2026: How to Bet on the World Cup 2026 Winner2026-03-03 | 5mins

- Fabric Airdrop Guide: How to Participate and Claim $ROBO Rewards2026-03-03 | 5mins

- Can I Buy World Cup Ticket with Cryptocurrencies?2026-03-02 | 5mins