What is Makina: $MAK Token Sale Details and How to Join the $1.30M Public ICO

What is Makina (MAK)? Makina (MAK) represents a new wave of programmable asset management, blending institutional-grade execution with on-chain automation across multiple blockchains. Instead of following traditional fund structures, Makina uses advanced DeFi infrastructure to modernize how capital is deployed, optimized, and managed on-chain. By bringing transparency, efficiency, and automated risk control into digital asset strategies, it unlocks fresh possibilities for both retail users and professional managers.

With strong backing from leading Web3 investors, builders, and ecosystem partners, Makina (MAK) is shaping the future of decentralized asset management while enabling participants to engage directly with its expanding cross-chain network. More than just a token, MAK serves as the core governance and utility asset that powers Machines, execution engines, and yield-driven strategies across the protocol—cementing its long-term role in Web3 infrastructure.

This article breaks down Makina (MAK), covering its mission, key features, and public token sale. If you're looking to understand its role in the blockchain ecosystem, evaluate its investment value, or stay informed about its token launch and market potential, this guide has you covered.

Key Takeaways

- MAK public ICO on Legion raises $1.30M, selling 17,333,333 MAK with a controlled vesting model for long-term stability.

- Makina (MAK) is an Ethereum token powering a programmable DeFi engine for automated, institutional-grade asset management.

- Makina uses Machines, Calibers, and MakinaVM to run complex, risk-managed strategies across multiple EVM chains.

What Is Makina: MAK Overview and Key Features

Makina (MAK) is a governance and utility token built on the Ethereum blockchain, powering Makina’s next-generation DeFi Execution Engine. The project represents a modern evolution of decentralized asset management, enabling automated, cross-chain investment strategies with professional-grade risk controls.

- Transparency – all strategies run on-chain with verifiable execution

- Security – multi-layer auditing, atomic execution, and robust risk limits

- Efficiency – automated yield, hedging, and cross-chain deployment using Machines and Calibers

Makina (MAK) brings institutional-level strategy execution into decentralized finance, delivering a sustainable, trust-driven ecosystem.

Source: Makina on X

Makina Legion ICO Attracts Investor Attention Ahead of TGE

Recently, Makina has gained strong traction as its Season 0 and early Machines attracted over $100M+ in TVL, demonstrating rapid user adoption and market confidence in its programmable asset-management model. The successful strategic round—raising $3M from top crypto funds—further strengthened credibility ahead of the MAK token launch.

Makina’s ongoing ICO on Legion has also drawn significant attention, offering investors early access to one of DeFi’s most advanced execution engines. With cross-chain strategy automation, advanced risk controls, and multi-phase token distribution, the project is positioning itself as a high-potential infrastructure layer for institutional DeFi participants.

Key Features of Makina (MAK)

- Machine: The core abstraction that manages deposits, redemptions, and fees

- Caliber: Handles cross-chain operations and accounting

- Governance: Manages permissions, risk parameters, and system updates

What Is the $MAK ICO Structure?

The $MAK ICO is structured to balance fairness, supporter rewards, and controlled distribution through a clear dual-layer model on Legion Launchpad (ICM). The sale introduces two rounds — Priority ICO and Public ICO — each with fixed allocations, transparent vesting, and strict participation requirements to maintain long-term stability for the Makina ecosystem.

Source: Makina on X

MAK ICO Key Details

- Public ICO Window: November 25 – December 2, 2025

- Total Raise: $1.30 million USD

- Public Sale Price: $0.075 per MAK

- Tokens for Public Sale: 17,333,333 MAK (≈ 1.73% of total supply)

- Vesting Conditions:

- 25% unlocked at TGE

- 75% vests linearly over 9 months

These conditions ensure controlled release, reduced early sell pressure, and long-term ecosystem stability.

MAK ICO Structure Breakdown

Makina allocates 5.5% of total supply to ICO participants across two layers:

- Priority ICO – 4.5% of Total Supply

- Designed for Legion Ticket holders, primarily early supporters from Makina Season 0.

- These participants receive guaranteed allocation per wallet, with an over-bid mechanism that redistributes any unused allocation to higher bidders within the priority pool. This structure ensures loyalty is rewarded while keeping distribution fair within the supporter base.

- Public ICO – 1% of Total Supply

- Open to all KYC-verified users on Legion Launchpad, including Ticket holders seeking additional tokens.

- Allocation is available on a first-come or contribution-based basis depending on the final sale mode, giving broader market participants a transparent chance to join the Makina ecosystem.

Through this two-layer sale framework — combined with fixed pricing, limited public allocation, and controlled unlock schedules — the $MAK ICO delivers a balanced, sustainable token distribution model tailored for both early adopters and new participants.

Makina Public Token Sale Guide

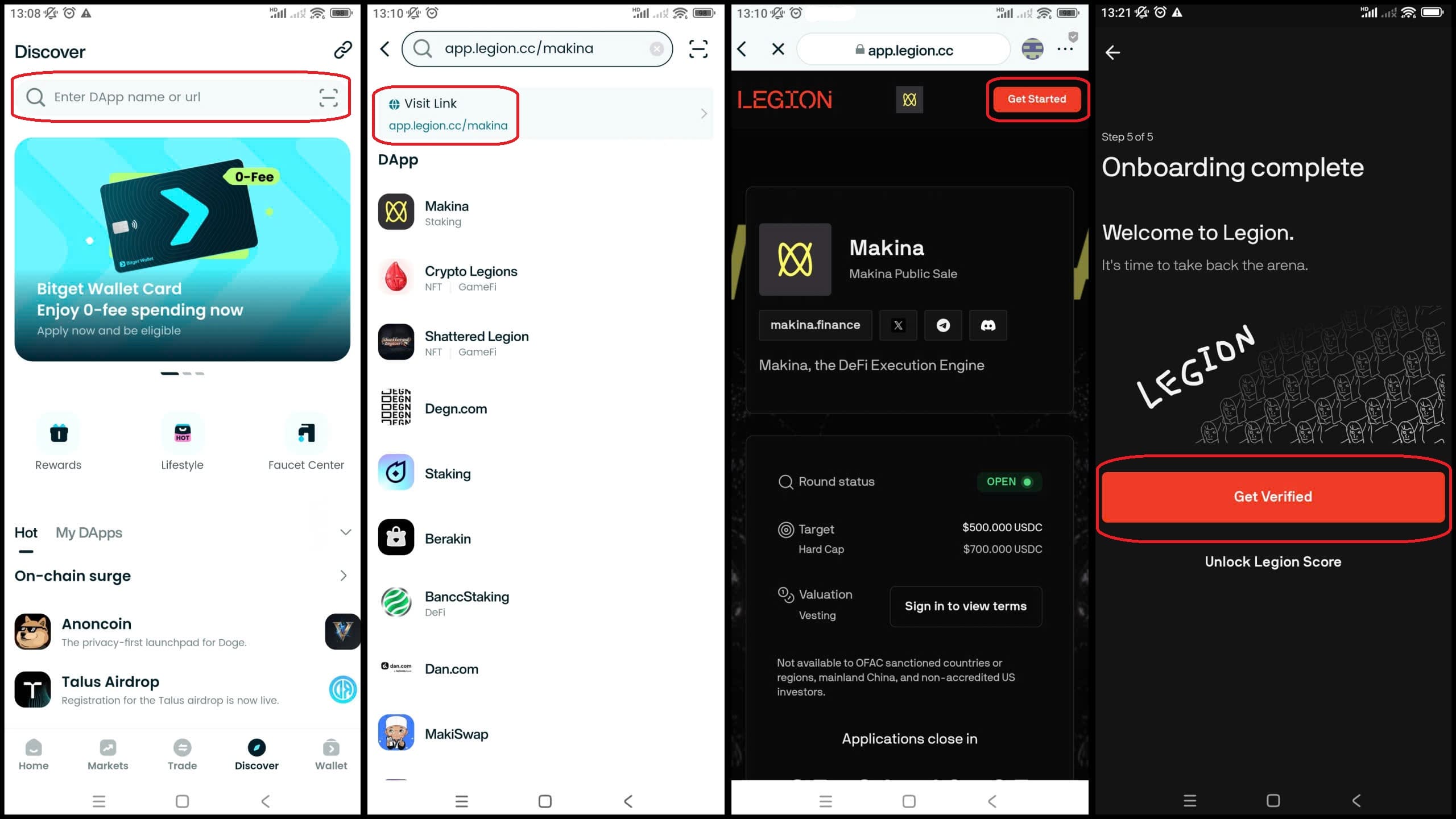

Follow these steps to join the MAK Public Token Sale on Legion Launchpad:

-

Create or Log In to Your Legion Account

-

Visit the Legion platform (app.legion.cc/makina) and connect your Bitget Wallet.

-

Complete KYC verification, which is mandatory for Public ICO participation.

-

-

Prepare Your Funds

-

Ensure your wallet holds sufficient USDC (or the accepted sale currency).

-

Bitget Wallet is recommended for its secure storage, smooth swaps, and reliable transaction execution.

-

-

Navigate to the Makina Public ICO Page

- Open the MAK Public Sale section on Legion Launchpad.

- Review all sale parameters — price ($0.075), total raise ($1.30M), allocation remaining, vesting, and eligibility rules.

-

Join During the Active Sale Window

- Contribution must be made between November 25 and December 2, 2025.

- Enter the desired amount and complete your purchase before the allocation fills.

-

Confirm Your Allocation

- Your purchased tokens will appear in your Legion dashboard.

- Vesting details will be displayed clearly (25% at TGE + 9-month linear vest).

-

Claim Your $MAK at TGE

- Once the Token Generation Event goes live, return to the dashboard to claim your initial 25% unlock.

- Remaining tokens will distribute automatically according to the vesting schedule.

Download Bitget Wallet now to get ready for the MAK token launch — secure your allocation early, stay updated with official announcements, and manage your assets safely!

Makina (MAK) Future Price Outlook: 2025 and Beyond

Makina’s price will depend on market conditions, protocol growth, and user participation. With its strong design and early traction, Makina (MAK) may trade within [NA] after launch. If adoption accelerates and the protocol continues expanding in the on-chain asset-management sector, MAK has the potential to reach [NA].

What Affects Makina (MAK) Price?

Several factors influence the potential price trajectory of [Project Name] (Token Name):

- Investor Sentiment: Influenced by market conditions, DeFi narratives, and confidence in Makina’s execution engine.

- Adoption & Demand: Higher TVL and increased use of Machines/Calibers may drive stronger token demand.

- Regulatory Influence: DeFi and cross-chain regulations can shape liquidity, participation, and market accessibility.

Future Price Prospects

If Makina sustains growth and strengthens its position in automated, cross-chain strategy execution, increased adoption could support a move toward [NA]. Still, price performance will depend on broader market trends, regulatory shifts, and overall economic conditions

Core Features of Makina (MAK) and Why They Matter

The standout features of Makina (MAK) include:

- Programmable Asset Management (Machines)

- Makina introduces Machines—programmable, modular vaults that allow users and institutions to deploy complex investment strategies such as delta-neutral farming, hedged yield, or multi-asset indexing.

- Each Machine issues its own ERC-20 Machine Token, enabling users to access professional-grade strategies with full transparency, liquidity, and on-chain auditability.

- Cross-Chain Execution Engine (Calibers)

- Through Calibers, Makina performs automated execution across multiple EVM chains. This includes opening/closing positions, claiming rewards, reallocating liquidity, or rebalancing yield.

- The system relies on Wormhole messaging to synchronize NAV updates across chains, ensuring every action is fully trust-minimized while maintaining execution accuracy.

- Institutional-Grade Risk Framework

- Makina is engineered with an advanced risk framework composed of pre-approved instructions, exposure limits, atomic execution, and a governed Security Module.

- These safeguards ensure that every strategy remains within safe operational boundaries while allowing capital to be deployed efficiently.

- Users benefit from controlled risk, high uptime, and an automated unwind mechanism powered by flash-loan-based emergency exits.

How Makina (MAK) Operates and What Benefits It Delivers

Makina (MAK) operates as a DeFi execution engine built on Ethereum, enabling users, funds, and AI-driven agents to deploy sophisticated on-chain investment strategies in a secure, scalable, and fully automated environment.

Key Technological Components

-

Blockchain Network: Ethereum Mainnet (ERC-20)

Makina leverages Ethereum’s settlement security and liquidity depth. Machines and Machine Tokens are based on ERC-20 standards, while Calibers extend execution to other EVM chains such as Arbitrum and Base.

-

Consensus Mechanism: Proof-of-Stake (Ethereum)

Ethereum’s PoS provides Makina with a robust, energy-efficient consensus layer. This ensures reliable transaction finality and supports long-term scalability for cross-chain operations.

-

Smart Contracts: Machines, Calibers, MakinaVM

Makina’s modular architecture uses three major smart contract layers:

-

Machines handle strategy logic and accounting.

-

Calibers execute instructions cross-chain.

-

MakinaVM processes complex multi-step instructions atomically.

This allows Makina to automate portfolio management with unparalleled precision.

-

-

Scalability Solutions: Cross-Chain Infrastructure via Wormhole

Makina integrates Wormhole messaging to achieve low-latency synchronization across chains. This enables real-time rebalancing, scalable strategy deployment, and efficient capital routing without compromising safety.

The Companies and Organizations Supporting Makina (MAK)

The Companies

| Section | Details |

| The Team | Led by Jenna Zenk, former CTO of Enzyme (Melon Protocol), alongside a seasoned engineering and DeFi security team. Their goal is to make Makina (MAK) the leading on-chain execution layer for institutional and AI-driven asset management. |

| The Vision | Focused on building a programmable, risk-managed infrastructure for automated asset management, Makina aims to create a sustainable and transparent ecosystem powering funds, strategies, and autonomous agents. |

| Partnerships | Makina collaborates with cyber•Fund, BaseDAO, Bodhi Ventures, Hypernative Labs, Kiln, and cross-chain infrastructure providers such as Wormhole. These partners support liquidity, auditing, security, and multi-chain expansion. |

How They Work Together

The Makina ecosystem works through a coordinated network of contributors:

- The core team develops the execution engine, Machines, and risk framework.

- Investors and strategic partners provide capital, infrastructure, market access, and institutional integrations.

- Security partners conduct audits, testing, and real-time threat monitoring to maintain protocol integrity.

- Ecosystem collaborators help expand Makina’s reach across EVM networks and DeFi platforms.

Together, these elements allow Makina to operate as a unified, highly composable DeFi infrastructure—delivering accessible, institution-grade portfolio automation to both retail users and professional capital allocators.

How Makina (MAK) is Used: Practical Benefit

Makina (MAK) serves a variety of purposes, including:

- Staking to receive veMAK: Stake MAK to mint veMAK — a non-transferable governance token used for voting on strategies, fee structures, security parameters, and protocol upgrades.

- Governance and strategy voting: veMAK holders influence how Machines (vaults) operate, how rewards are allocated, and which cross-chain strategies are deployed.

- Revenue sharing: MAK stakers and veMAK holders earn a portion of protocol revenues, including management fees and performance fees generated across all Machines.

- Ecosystem growth incentives: MAK is used to reinforce liquidity, bootstrap new strategic Machines, and reward early adopters or high-performing Operators.

- Alignment between users and Operators: MAK aligns incentives across capital providers, Machine Operators, and the protocol, ensuring optimized, risk-managed, and sustainable strategy performance.

- Future utility expansion: As Makina scales cross-chain, $MAK is expected to support advanced staking models, security modules, and additional governance layers across new deployments.

These applications highlight the practical value of $MAK in unlocking advanced, institution-grade automated asset management within the broader DeFi ecosystem.

Makina (MAK)'s Benefits

- Long-term value alignment through ve-tokenomics and slow, sustainable vesting.

- Revenue-backed utility, giving stakers exposure to fees from real on-chain economic activity.

- Governance influence over Machines, strategies, and the expansion of Makina’s cross-chain architecture.

- Enhanced execution reliability, as MAK-based governance ensures Operators follow strict risk-managed guidelines.

- Ecosystem-wide incentives, supporting liquidity, new Machines, and user growth.

Makina (MAK) Roadmap 2025: Key Milestones and Expansion Plans

The roadmap for Makina (MAK) outlines a clear path for growth and innovation:

| Quarter | Roadmap |

| Q3 2025 | NA |

| Q4 2025 | NA |

| Q1 2026 | NA |

| Q2 2026 | NA |

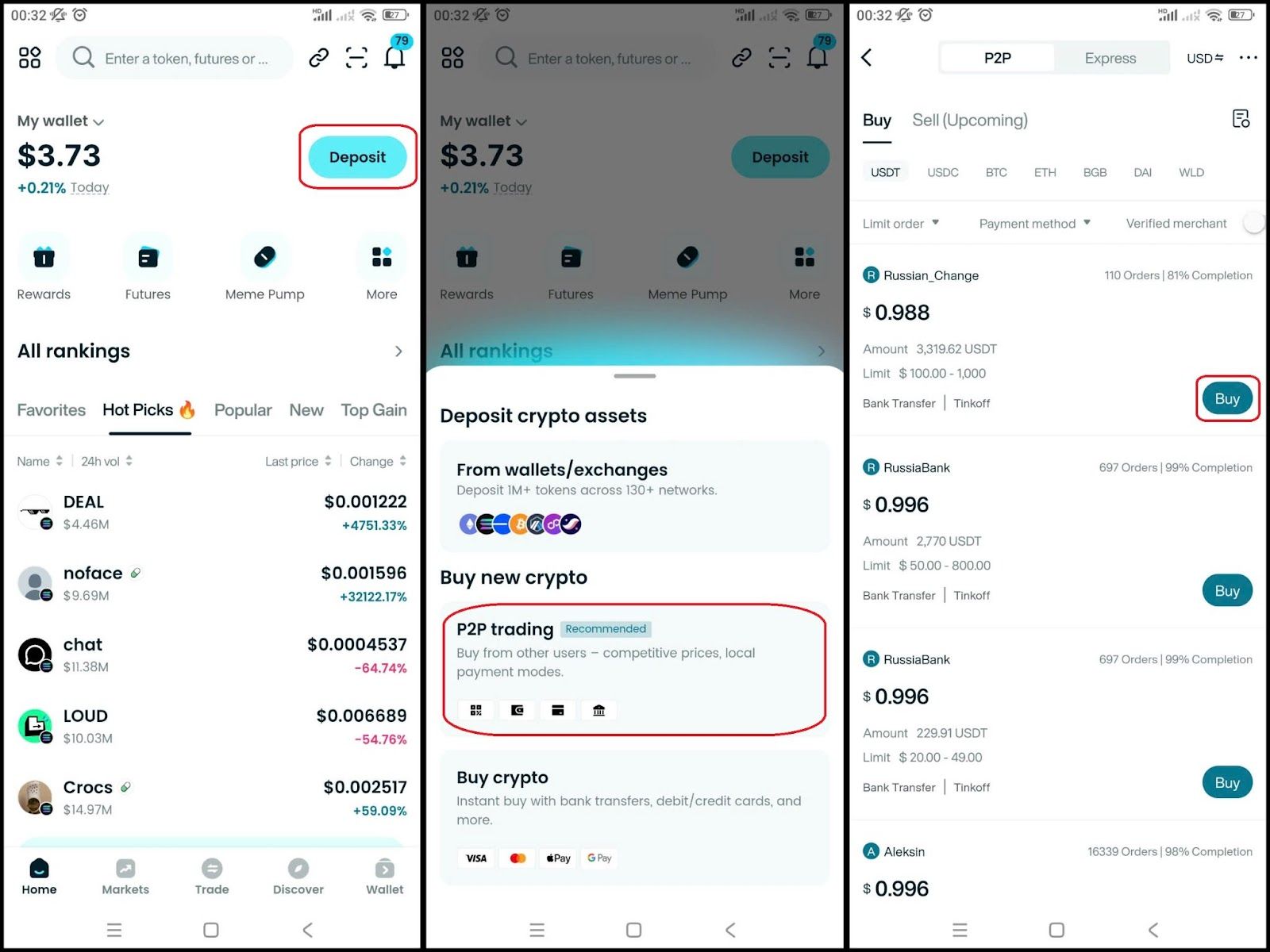

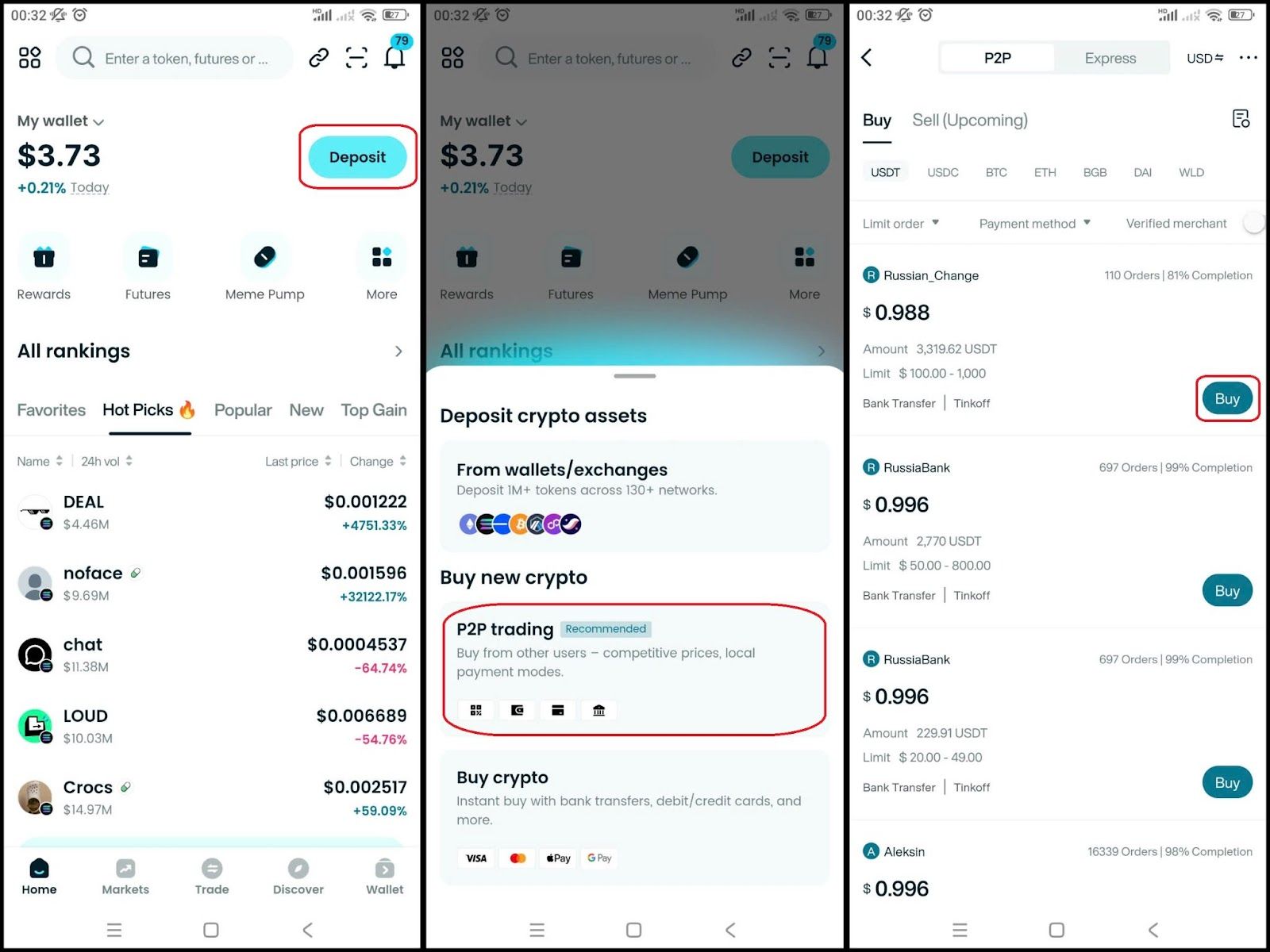

How to Buy Makina (MAK) on Bitget Wallet?

Buying Makina (MAK) on Bitget Wallet is easy! Just follow these simple steps:

Step 1: Create a wallet

- If you don't have a wallet, download Bitget Wallet app now.

- Register with your phone number or email, verify quickly and you can use it right away.

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

- Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

- Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app and then exchange it for USDC.

Step 3: Find Makina (MAK)

- In the main interface of the wallet, go to Market, type "MAK" in the search bar.

- Select Makina (MAK) to see the trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

Step 4: Select the trading pair

Select the pair you want to trade, for example MAK/USDT. So you can use USDT to buy Makina (MAK), or vice versa.

Step 5: Place an order

Enter the amount of Makina (MAK) you want to buy, check carefully and confirm the order.

Step 6: Check the order

After buying, you can check your MAK in the Wallet section.

Step 7: Withdraw (if needed)

Once you have Makina (MAK), if you want to withdraw to another wallet, go to Withdraw, fill in the receiving wallet address, check the blockchain network and the amount carefully, then confirm.

▶Learn more about Makina (MAK):

- What is Makina (MAK)?

- Makina (MAK) Airdrop Guide

- Makina (MAK) Listing Date and How to Buy It

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

Conclusion

Makina (MAK) stands out as a next-generation DeFi execution engine, bringing programmable, cross-chain asset management and institutional-grade risk controls into a single, on-chain framework. Through its $1.30M public ICO on Legion, clearly defined priority and public sale tranches, and gradual vesting structure, Makina aims to align long-term supporters with the protocol’s growth while limiting short-term sell pressure. For users who believe in the future of automated, transparent, and yield-driven portfolio strategies, MAK offers direct exposure to the core governance and utility layer powering Machines, Calibers, and the broader Makina ecosystem.

If you want to join the Makina ecosystem with the highest level of convenience and security, Bitget Wallet provides one of the best experiences for managing funds before, during, and after the token sale. With multi-chain support, smooth swaps, and reliable execution, you can easily prepare USDC for the ICO, track your allocations, and manage MAK tokens once they unlock. Bitget Wallet’s secure storage, institutional-grade safety features, and fast transaction routing ensure that every step — from participating in the public sale to holding MAK long-term — is seamless, efficient, and protected.

Download Bitget Wallet now to get ready for the MAK launch and manage all your assets in one place.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Makina (MAK)?

Makina (MAK) is the governance and utility token powering Makina’s programmable DeFi execution engine on Ethereum. It enables cross-chain strategy automation, risk-managed Machines, and community-driven governance, forming the core of Makina’s decentralized asset-management ecosystem.

2. What is the Makina (MAK) Public ICO on Legion?

The MAK Public ICO on Legion is an open token sale where verified users can purchase MAK at $0.075 during Nov 25–Dec 2, 2025. The sale offers 17.3M tokens with 25% unlocked at TGE and 75% vested over 9 months, giving investors early access to Makina’s expanding DeFi infrastructure.

3. What is the best wallet for storing MAK?

Bitget Wallet is the best option for storing MAK thanks to its secure non-custodial design, smooth cross-chain support, integrated swaps, and reliable execution. It also makes joining token launches, managing vesting, and interacting with DeFi strategies simple and beginner-friendly.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.