What is Cliff Unlock: Token Unlock Trading Strategy and Key Investor Insights

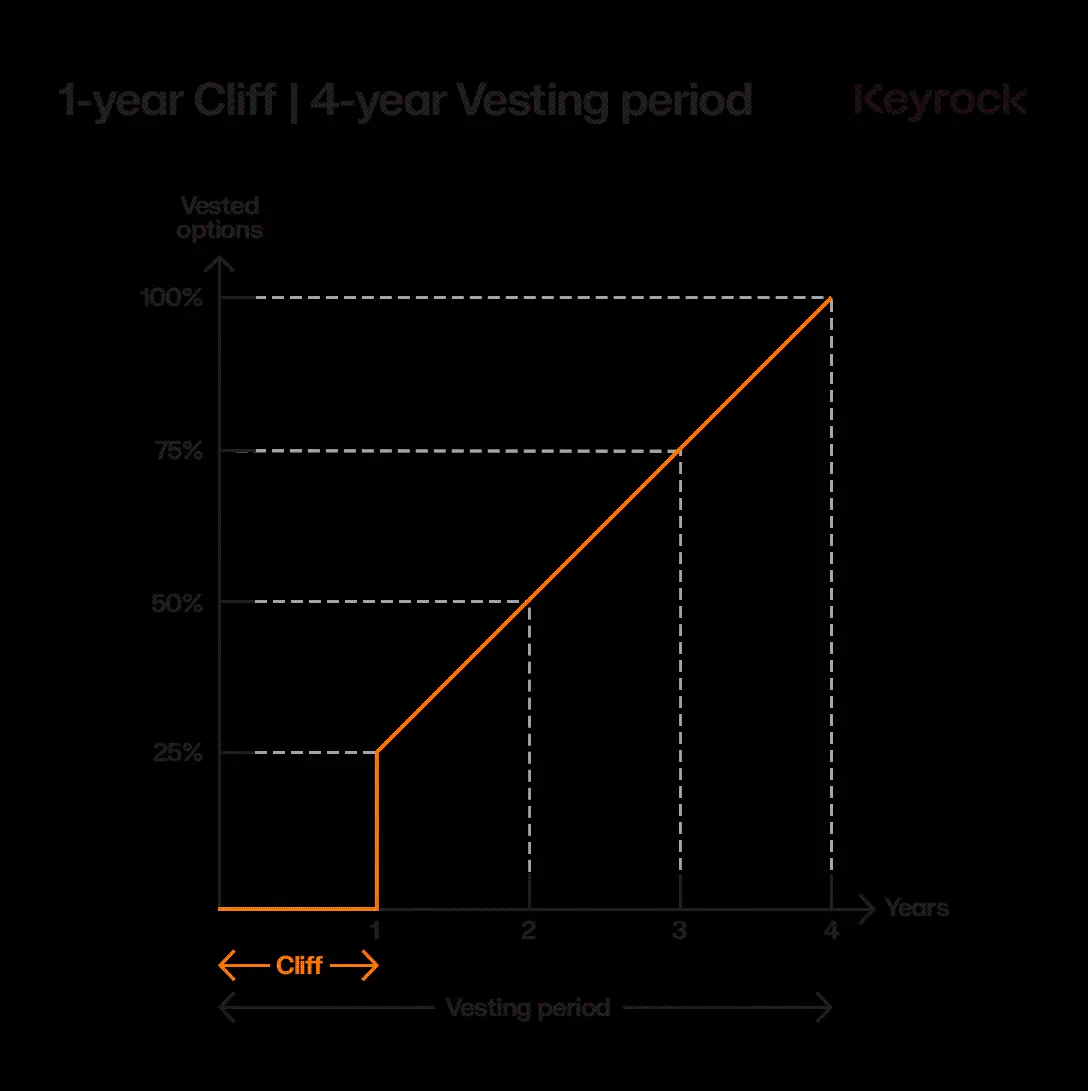

What is Cliff Unlock in crypto tokenomics? A cliff unlock is a vesting mechanism where tokens remain completely locked during a set period and then get released all at once when the cliff expires. Unlike gradual unlocks, this method creates a sudden increase in circulating supply, which can influence both token price and investor behavior.

Cliff unlocks matter because they determine token distribution schedules, shape market price stability, and influence how much trust investors place in a project’s long-term vision. When handled transparently, they reassure communities and prevent early dumping.

Real-world case studies like SUI, AVAX, and ARB demonstrate that cliff unlock events don’t always trigger bearish moves—sometimes they act as catalysts for growth, depending on timing and market conditions. If you’re looking to track and trade these events, tools like Bitget Wallet provide an easy way to monitor unlock schedules and participate securely.

Key Takeaways

- Cliff unlock means tokens stay fully locked until a set date, then release all at once, creating sudden shifts in supply.

- These events can impact market price stability—sometimes bearish due to sell pressure, but also bullish when demand outweighs new supply (as seen in SUI, AVAX, ARB).

- Understanding token unlock strategies helps investors manage risk, time entries, and spot opportunities—especially when tracked with tools like Bitget Wallet.

What is Cliff Unlock in Tokenomics?

How Does a Cliff Unlock Work in Crypto Projects?

What is Cliff Unlock in tokenomics? It’s a vesting setup where no tokens are available until the end of a “cliff period,” after which a large batch is released at once. The cliff usually follows the Token Generation Event (TGE), meaning early investors, teams, or advisors must wait before gaining access to their allocations.

Think of it like a dam holding back water: nothing flows until the gate opens, and then suddenly, a surge enters the market. This design delays token access, aligning long-term commitment while preventing immediate sell pressure at launch.

Cliff Unlock vs. Linear Unlock – What’s the Difference?

The key distinction lies in timing. In a cliff unlock, tokens are withheld completely and then released all at once, while a linear unlock gradually distributes tokens over weeks or months. This is why the debate of “Cliff vs linear unlock” matters—one creates sudden liquidity shocks, the other provides smoother, predictable supply.

- Cliff unlocks can increase short-term volatility, as large holders may decide to sell quickly.

- Linear unlocks often stabilize markets, giving investors and projects more breathing room to adapt.

Source: Bitget

Read more: What Is Token Unlocks in Crypto and How It Affects Prices in 2025

Why Are Cliff Unlocks Important in Tokenomics?

How Do Cliff Unlocks Impact Token Price Stability?

Cliff unlocks play a critical role in market price stability tokenomics. By delaying access to tokens, projects can reduce early selling pressure and create a more balanced trading environment at launch. However, once the cliff period ends, a sudden flood of tokens can hit the market, potentially driving prices down if demand doesn’t match supply. For this reason, understanding the impact of cliff unlock on token price is essential for traders. Timing and investor expectations remain vital to maintaining confidence during unlock events.

How Do Cliff Unlocks Protect Investors and Teams?

Beyond price effects, cliff unlocks serve as a safeguard for both teams and investors. They prevent insiders from dumping tokens immediately after launch, building credibility and ensuring project participants stay committed. For investors, this delay reduces the risk of panic-driven sell-offs. The recurring question—“Is cliff unlock bullish or bearish?”—doesn’t have a single answer: in some cases, unlocks can trigger fear; in others, they show strong governance and encourage long-term trust. Transparency in unlock schedules, and clarity about the cliff in tokenomics, help maintain investor confidence and signal that a project is structured for sustainability rather than short-term gain.

Cliff Token Unlock vs. Linear Token Unlock — What’s the Difference?

A cliff unlock happens when tokens are released all at once, while a linear unlock distributes tokens gradually over time. This distinction is fundamental in tokenomics because it shapes how supply enters the market and how investors respond. Understanding the mechanics of a Cliff Token Unlock helps traders anticipate volatility, while linear unlocks provide a more measured approach to token distribution. Both methods highlight the importance of selecting the right token unlock strategy for long-term stability.

What Happens During a Cliff Token Unlock?

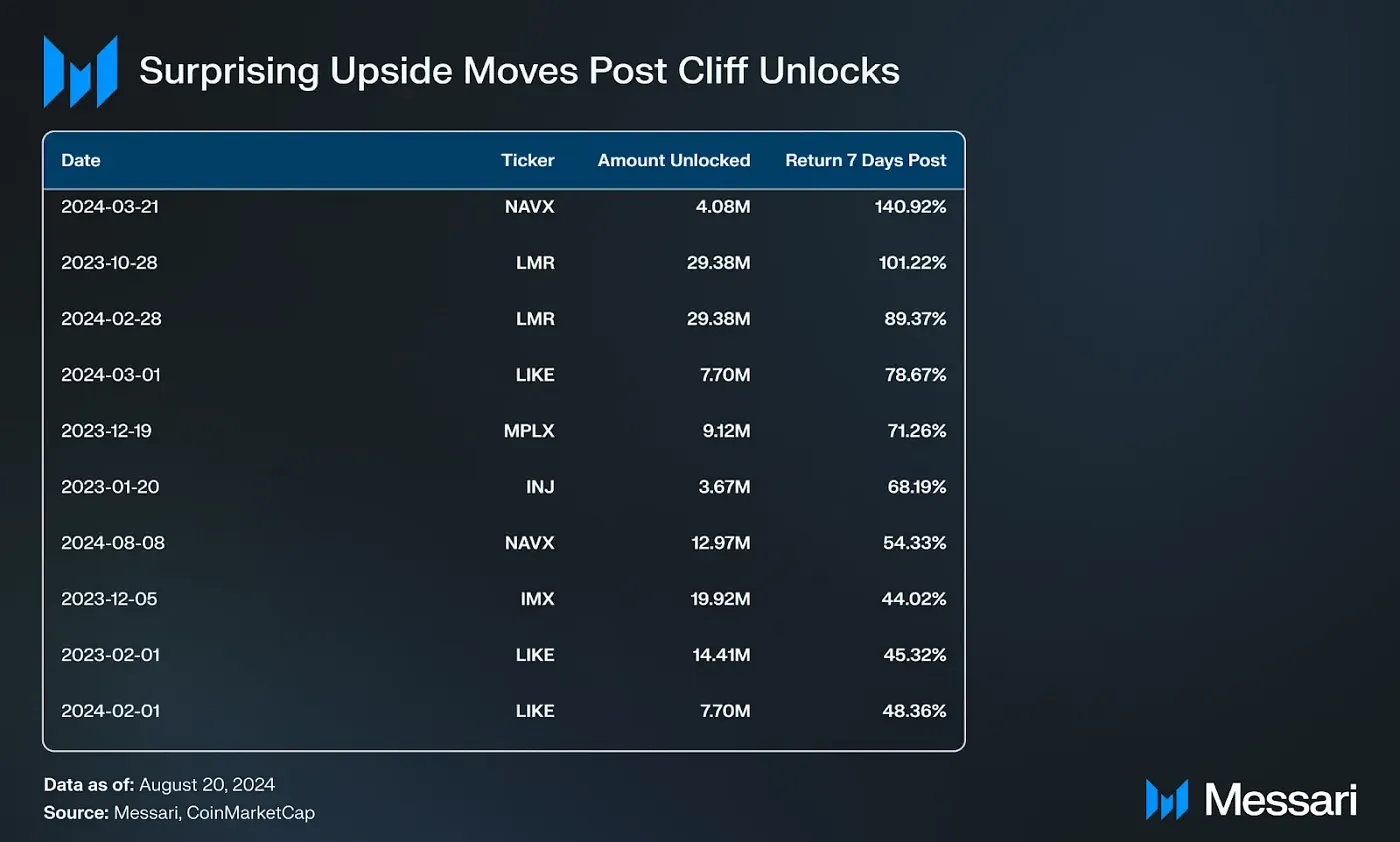

In a cliff unlock, all tokens are withheld until the cliff period ends, followed by a one-time release. This sudden increase in supply can create market shocks—leading to either price drops from selling pressure or sharp rallies if demand is strong. For example, projects like SUI and AVAX showed that not all unlocks are bearish; in some cases, these events sparked renewed market interest. As a token unlock strategy, cliff unlocks are riskier but can also generate momentum when paired with bullish market conditions.

Source: Messari

How Does Linear Token Unlock Work?

By contrast, a linear unlock releases tokens gradually, often monthly or quarterly, over a defined vesting period crypto. This steady flow reduces sudden shocks to supply, smoothing out volatility and helping projects maintain price stability. Investors tend to view linear unlocks as less risky, since markets can absorb the incremental supply more easily than a one-time cliff event.

Which Unlock Method is Better for Market Stability?

The answer depends on context.

- Cliff unlocks can cause higher short-term volatility but sometimes spark bullish runs due to increased attention and liquidity.

- Linear unlocks provide predictability and are often favored by institutional investors for their stability and reduced sell pressure.

Ultimately, the “Cliff vs linear unlock” debate highlights that both methods have strategic roles. For traders, the key is preparation: tracking unlock schedules with tools like Bitget Wallet can help manage risks and position for opportunities when these events unfold.

Are Cliff Unlocks Always Bearish?

Can a Cliff Unlock Trigger a Price Rally?

Cliff unlocks often spark fear of sell pressure, but history shows they can also ignite rallies under the right conditions. For example:

- SUI surged over +140% following its cliff unlock, as renewed demand outweighed the influx of supply.

- AVAX jumped +32% after a major unlock, proving that strong market sentiment can flip expectations.

- ARB gained +22%, showing how coordinated community engagement can turn an unlock into a bullish catalyst.

These cases highlight that it’s not just the release of tokens that matters—it’s the balance of supply and demand, paired with investor attention and market narratives, that determines the outcome.

Source: Tradingview

How Do Developers Strategically Manage Cliff Unlock Events?

Teams often prepare in advance to minimize risk and sometimes even harness cliff unlocks as opportunities. Strategies include:

- Campaigns and announcements to build positive sentiment.

- New staking proposals, giving holders an incentive to lock tokens instead of selling.

- Ecosystem updates, such as partnerships or feature launches timed with unlock dates.

A strong example is the ARB staking proposal launched on its unlock day, which absorbed potential selling pressure and encouraged long-term participation. These efforts illustrate how a well-planned cliff unlock trading strategy can transform a perceived risk into momentum for growth. For investors, recognizing the cliff in tokenomics is critical to identifying whether an unlock could be a danger or an opportunity.

How to Analyze Upcoming Cliff Unlocks as an Investor?

Where to Find Token Unlock Schedules?

For investors, the first step is knowing when unlocks are coming. Reliable platforms like CoinMarketCap, TokenUnlocks, and Messari publish detailed calendars that track upcoming events. These tools outline each project’s token distribution schedule, giving traders a transparent view of how and when supply will enter the market. Monitoring these schedules helps avoid surprises and allows investors to plan positions ahead of time.

What Trading Strategies Work During Cliff Unlocks?

Cliff unlocks don’t always follow the “bearish dump” script, so investors need flexible strategies. Some traders treat unlocks as bottom-call opportunities, anticipating that prices might rebound strongly once initial selling pressure is absorbed. Others take a defensive approach, scaling out before unlocks to reduce exposure.

The best practice is risk management: never assume all token unlock events crypto are bearish, but don’t blindly expect rallies either. Comparing strategies—such as short-term selling vs. holding through volatility—helps investors align decisions with their risk tolerance. Ultimately, the most successful traders use unlocks as data points, not certainties, and adapt based on market sentiment and liquidity conditions. Choosing the right token unlock strategy depends on your risk profile, project fundamentals, and timing.

How Can You Track and Trade Cliff Unlocks with Bitget Wallet?

How to Monitor Token Unlock Calendars in Bitget Wallet?

Staying ahead of unlocks starts with reliable tracking. While platforms like CoinMarketCap and TokenUnlocks provide detailed breakdowns of upcoming releases, Bitget Wallet integrates this process into a single, easy-to-use Web3 tool. Investors can view unlock schedules, check token amounts, and monitor circulating supply changes directly through Bitget’s research features.

For those who want deeper insights, Bitget’s academy also publishes monthly updates that help traders understand market context and prepare for major unlock events. This combination of data and analysis makes Bitget Wallet one of the most convenient ways to stay informed.

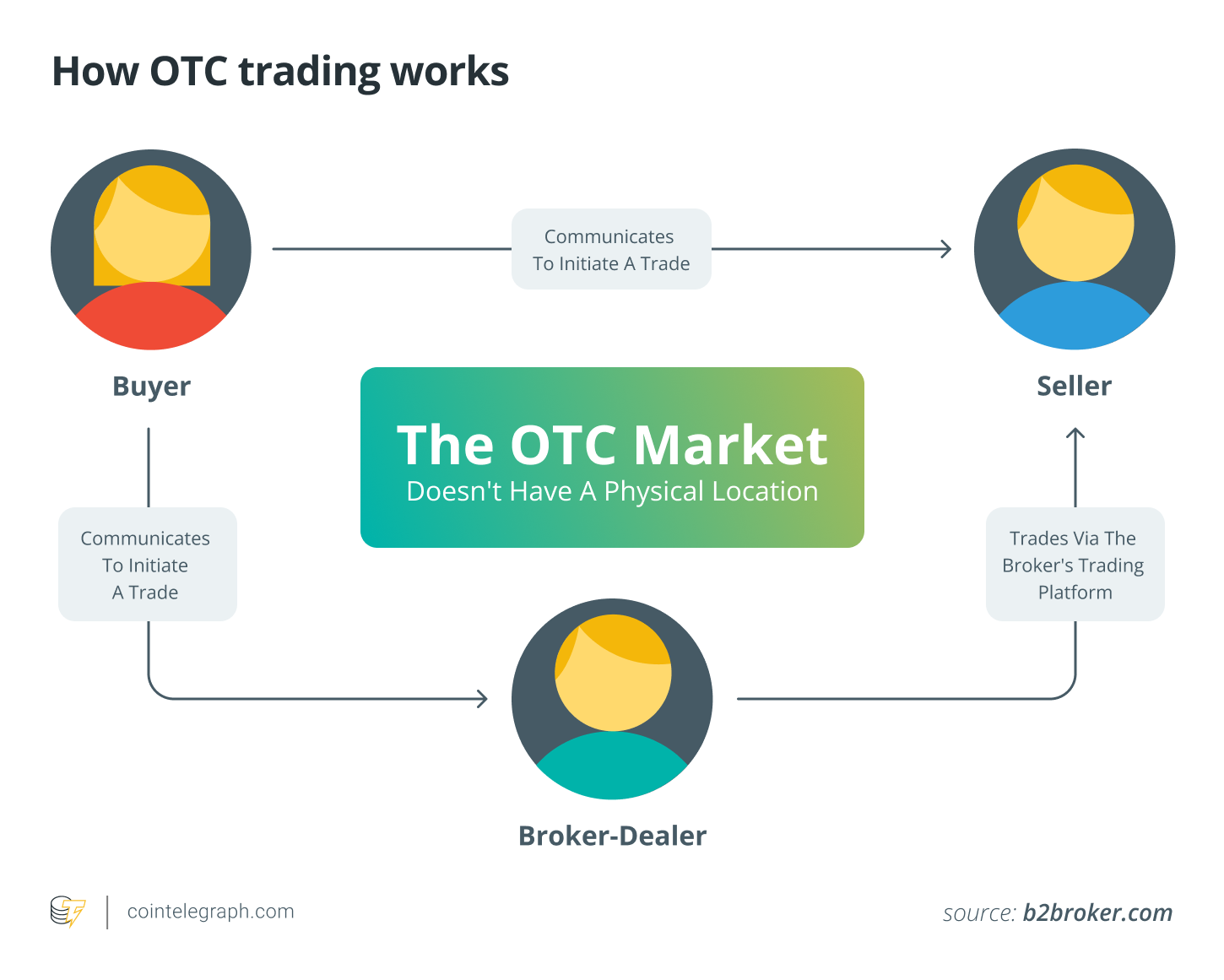

How to Trade Tokens During Cliff Unlock Events with Bitget Wallet?

Once unlocks occur, timing becomes everything. Bitget Wallet gives traders the flexibility to react instantly with its cross-chain swap function, allowing users to trade newly unlocked tokens without the need for a centralized exchange. The app is beginner-friendly, supports seamless token swaps across multiple blockchains, and offers strong security features for holding unlocked tokens safely.

*Download Bitget Wallet to track token unlocks, trade seamlessly, and manage your crypto securely – all in one app.*

Source: Cointelegraph

Conclusion

What is Cliff Unlock teaches us that tokenomics isn’t just about numbers—it’s about timing, trust, and strategy. Cliff unlocks delay token access until a set period ends, then release a large supply at once. This mechanism plays a pivotal role in shaping market stability, guiding token distribution, and influencing how traders and investors position themselves.

While many fear these events will trigger sell-offs, history shows that not all unlocks are bearish. Cases like SUI, AVAX, and ARB prove that with the right balance of supply, demand, and community attention, cliff unlocks can actually spark opportunities for rallies. For investors, the key lies in preparation—tracking schedules, assessing sentiment, and applying disciplined strategies.

That’s where Bitget Wallet comes in. With its built-in tools to monitor token unlocks, manage crypto portfolios securely, and trade everything from stablecoins to memecoins across chains, it’s the all-in-one solution for navigating unlock events.

Own your Web3 journey easily with Bitget Wallet – secure, fast, and beginner-ready.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs About Cliff Unlocks in Tokenomics

1. Is cliff unlock bullish or bearish?

It depends on context. A cliff unlock can be bearish if large holders dump tokens immediately, causing oversupply. But history shows it can also be bullish—projects like SUI, AVAX, and ARB saw rallies after their unlocks. The outcome hinges on demand, liquidity, and investor sentiment.

2. What is the difference between Cliff vs linear unlock?

A cliff unlock releases all tokens at once after the cliff period, while a linear unlock distributes tokens gradually over weeks or months. Cliff unlocks create sharper volatility, while linear unlocks offer smoother price movements and are often preferred by institutional investors.

3. How do token unlock events crypto affect traders?

Token unlock events crypto can trigger short-term price swings as supply hits the market. Traders may use them as entry points, exit signals, or opportunities to stake tokens if new utility is introduced at the same time.

4. Why is a token distribution schedule important?

A clear token distribution schedule ensures transparency, builds investor trust, and helps markets prepare for supply changes. It prevents surprises that could lead to panic selling or distrust in the project.

5. What tools can help track cliff unlocks?

Platforms like TokenUnlocks, Messari, and CoinMarketCap provide calendars of upcoming unlocks. For hands-on trading, Bitget Wallet integrates tracking with secure storage and instant cross-chain swaps, making it easier to prepare for and act on unlock events.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy LGNS in 2026: A Beginner’s Step-by-Step Guide to Longinus2026-02-04 | 5mins

- How to Buy JYPC in 2026: A Beginner’s Step-by-Step Guide to JPY Coin2026-02-02 | 5mins