What Is Aerodrome Finance (AERO): the Liquidity Engine Powering Coinbase's Base Layer-2 Ecosystem

Aero Finance (AERO) is not just an ordinary token; it symbolizes the spirit of decentralization and next-generation financial freedom. In the realm of decentralized finance (DeFi), it combines cutting-edge blockchain infrastructure with the vision of open, permissionless access to global financial tools—opening a new chapter in the world of cryptocurrency.

With strong support from leading DeFi innovators and a growing community of users and developers, Aero Finance (AERO) not only represents a major trend in the evolving crypto landscape but also offers significant opportunities for early investors. This article will guide you through every aspect of Aero Finance (AERO) so you can seize this opportunity for profit and become part of the movement redefining the future of finance.

Key Takeaways

- Built on Coinbase’s Base: Aerodrome Finance (AERO) is the main liquidity hub for Base, offering efficient, low-cost DeFi trading.

- Powerful Governance Model: Locking AERO grants veAERO voting rights, letting users control emissions, upgrades, and rewards.

- High-Yield Incentives: Liquidity providers earn boosted rewards through emissions, trading fees, and project-backed bribes.

What is Aerodrome Finance (AERO)?

Aerodrome Finance (AERO) is a DeFi governance token built on Coinbase’s Base Layer-2 blockchain, representing the next evolution of decentralized liquidity infrastructure. The project embodies the following values:

- Efficiency in Capital Deployment

- Community-Driven Governance

- Transparency and Financial Inclusion

Aerodrome Finance (AERO) blends the cooperative spirit of early decentralized communities with advanced AMM technology to reshape decentralized finance. It empowers users to govern, earn, and shape liquidity flows—building a more equitable and robust DeFi ecosystem.

Source: X

Aerodrome Finance (AERO), a dominant DeFi protocol on Base, has surpassed $1.2 billion in TVL and now handles over $125 million in daily trading volume. Backed by the Base Ecosystem Fund and Coinbase integration, AERO enables full fee redistribution to veAERO holders and leads innovation in liquidity mechanics with concentrated pools and governance NFTs.

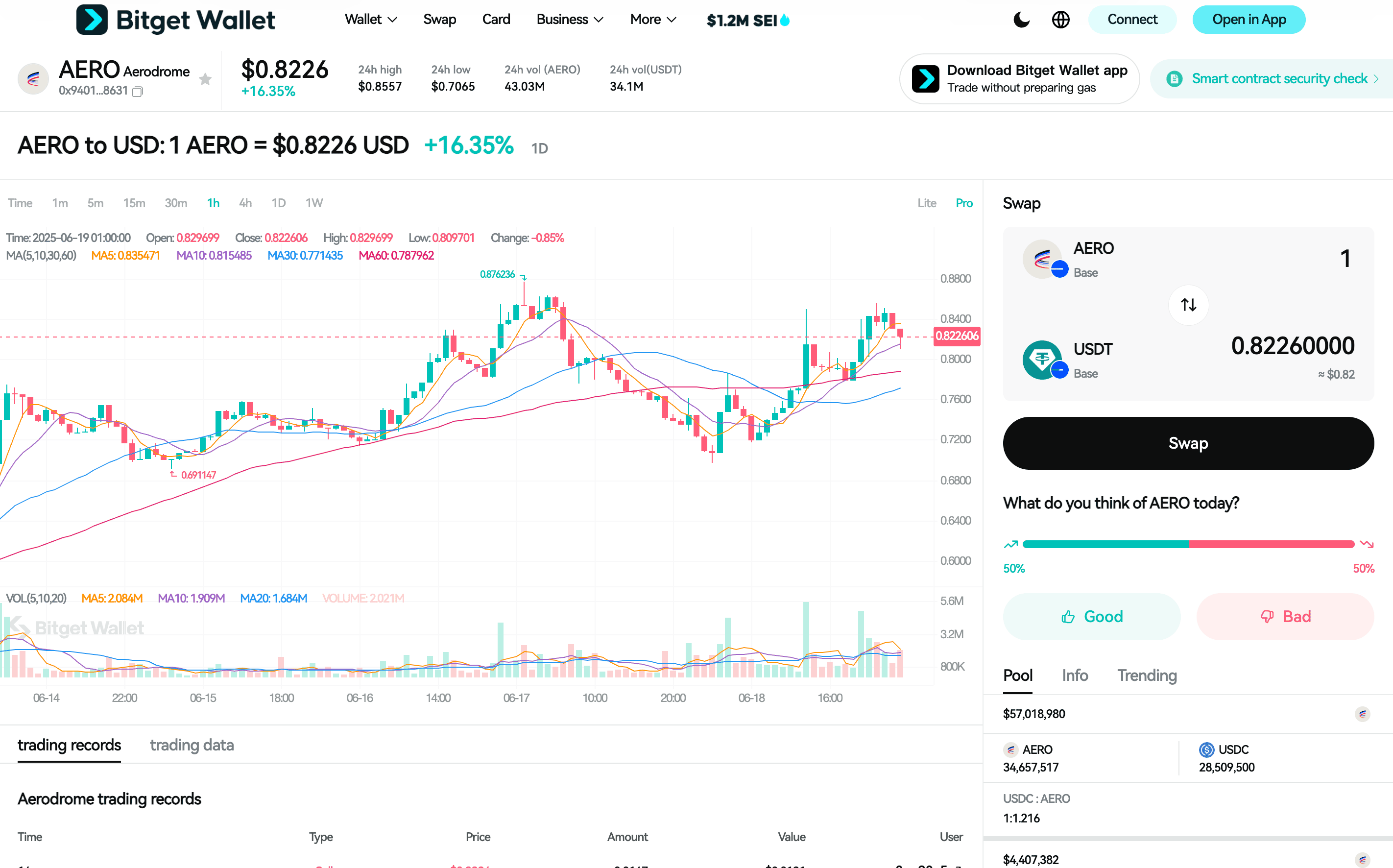

Aerodrome Finance (AERO) Price Prediction 2025

Predicting the price of any cryptocurrency relies on market trends, project fundamentals, and community adoption. With strong backing from Coinbase’s Base Ecosystem Fund and a unique role in driving decentralized liquidity, Aerodrome Finance (AERO) is expected to stabilize within the range of $0.60 to $0.80 by the end of 2025.

If the project maintains its development trajectory and expands its applications in decentralized finance (DeFi)—particularly as Base adoption grows and veAERO governance gains traction—the value of Aerodrome Finance (AERO) could rise to $1.00 or more in the long term. Source: CoinCodex, TradingBeasts and Wallet Investor

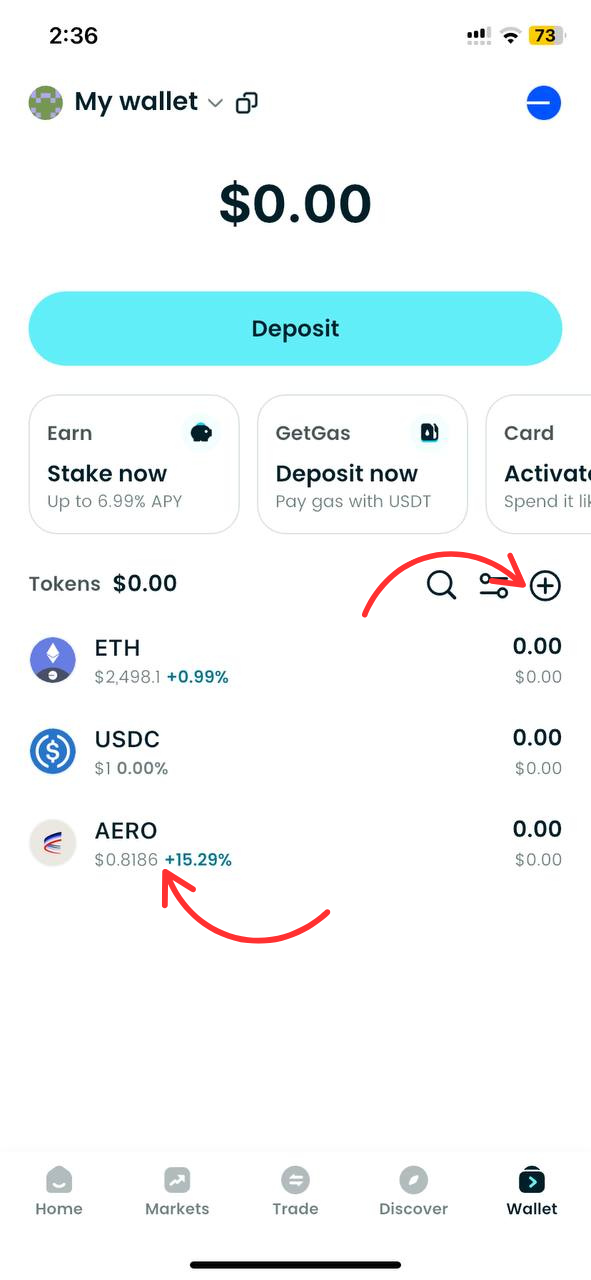

Source: Bitget Wallet

Key Features of Aerodrome Finance (AERO)

-

veAERO Governance & Full Fee Redistribution

Users can lock AERO tokens to mint veAERO NFTs, which grant voting rights over emissions and protocol upgrades. Uniquely, 100% of trading fees on the platform are redistributed to veAERO holders—making governance directly profitable and highly participatory.

-

Slipstream Pools & Concentrated Liquidity

Aerodrome implements advanced concentrated liquidity pools, inspired by Uniswap V3, known as Slipstream Pools. These allow liquidity to be placed precisely where trades happen most, improving capital efficiency and minimizing slippage for high-volume traders.

-

Base-Native Integration with Institutional Backing

Built natively on Base, Coinbase’s Layer-2, Aerodrome benefits from deep ecosystem alignment. It is backed by the Base Ecosystem Fund, which actively holds veAERO to direct emissions and liquidity toward strategic pools—demonstrating institutional trust and ecosystem commitment.

How Does Aerodrome Finance (AERO) Work?

The operation of Aerodrome Finance (AERO) is based on its innovative veAERO governance model, concentrated liquidity infrastructure, and dynamic emission incentives.

-

Vote-Escrowed Governance (veAERO)

Users lock AERO tokens to receive veAERO NFTs, which grant governance rights. veAERO holders decide how new AERO emissions are distributed among liquidity pools and earn 100% of the platform's trading fees—directly linking participation to rewards.

-

Bribe-Based Emission Allocation

Protocols on Base can offer “bribes” to veAERO holders, incentivizing them to vote for specific liquidity pools. This mechanism enables a free-market approach to emissions, where the most active or valuable pools can attract the most rewards.

-

Slipstream Concentrated Liquidity Pools

Aerodrome’s Slipstream Pools allow liquidity providers to allocate capital only within targeted price ranges, increasing efficiency and reducing slippage for traders—similar to Uniswap V3 but optimized for the Base chain.

By integrating community-first governance, DeFi-native incentive mechanisms, and strong partnerships—such as with Coinbase’s Base Ecosystem Fund—Aerodrome Finance (AERO) aims to become a sustainable and influential project within the evolving crypto and DeFi ecosystem.

Aerodrome Finance (AERO)'s Team, Vision, and Partnerships

The Team

Aerodrome Finance (AERO) is led by the experienced Velodrome Finance team, including co‑founders Alex Cutler and Tao Watts, veterans of the influential Velodrome V2 project on Optimism. With a proven track record in liquidity engineering, decentralized governance, and smart contract architecture, the team seeks to establish Aerodrome as a leading symbol of community-driven DeFi governance and infrastructure.

The Vision

Aerodrome’s core mission is to become Base’s primary liquidity hub—a seamless, efficient, and transparent DeFi ecosystem. By combining concentrated liquidity, vote-escrowed governance, and full fee redistribution, Aerodrome aims to build a sustainable financial infrastructure that embodies transparency, decentralization, and user alignment within the Base ecosystem.

Partnerships

-

Base Ecosystem Fund (Coinbase Ventures):

In February 2024, the Base Ecosystem Fund invested in Aerodrome and actively locks AERO to direct emissions toward strategic pools like cbBTC, reinforcing Aerodrome’s integration into Base’s growth strategy.

-

MC² Finance:

In May 2025, Aerodrome integrated with MC² Finance to enable advanced DeFi asset management and liquidity synergies on Base Ecosystem.

-

Coinbase / Base Network:

Built in close collaboration with Base, Aerodrome launched in August 2023 as the principal AMM and liquidity layer for assets on the network.

Use Cases of Aerodrome Finance (AERO)

Aerodrome Finance (AERO) serves a variety of purposes, including:

-

Governance Voting with veAERO

AERO holders can lock their tokens to receive veAERO, which gives them governance power. These holders vote on emissions distribution, liquidity pool rewards, and protocol changes, shaping the future of the platform.

-

Liquidity Mining and Yield Generation

AERO is distributed as a reward to users who provide liquidity to trading pairs on Aerodrome. By participating in Slipstream Pools, users can earn AERO while supporting efficient trading on Base.

-

Bribe Market Participation

Projects on Base can offer bribes to veAERO holders to attract more emissions to their pools. This creates a market-driven competition for liquidity incentives, helping protocols gain visibility and rewards.

These applications highlight the practical value of $AERO in decentralized finance (DeFi), particularly as a governance and incentive token within the Base Layer‑2 ecosystem.

Roadmap of Aerodrome Finance (AERO)

| Quarter | Roadmap Highlights |

| Q1 2025 | Received a 650K OP grant to boost TVL on Base; introduced OP token incentives—resulting in a 275% jump in TVL in select pools, lockups exceeding emissions for 5 consecutive epochs, and a remarkable 57% share of Base DEX trading volume. |

| Q2 2025 | Flashblocks upgrade on Sepolia testnet, reducing block time from 2 s to 200 ms to enhance transaction speed and lower slippage; rollout to Mainnet expected in Q2, promising faster trades and better LP returns. |

| Q3 2025 | Focus: Transition to sustainable “Cruise” mode—managing gradual emissions decay (≈1% per epoch), optimizing yield distribution, and preparing for next-phase governance features to maintain protocol stability. |

These roadmap milestones underscore the practical utility of $AERO in Layer‑2 DeFi, particularly in scalable liquidity provisioning and performance optimization.

How to Buy Aerodrome Finance (AERO) on Bitget Wallet?

Trading Aerodrome Finance (AERO) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and verifying your identity.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading Aerodrome Finance (AERO).

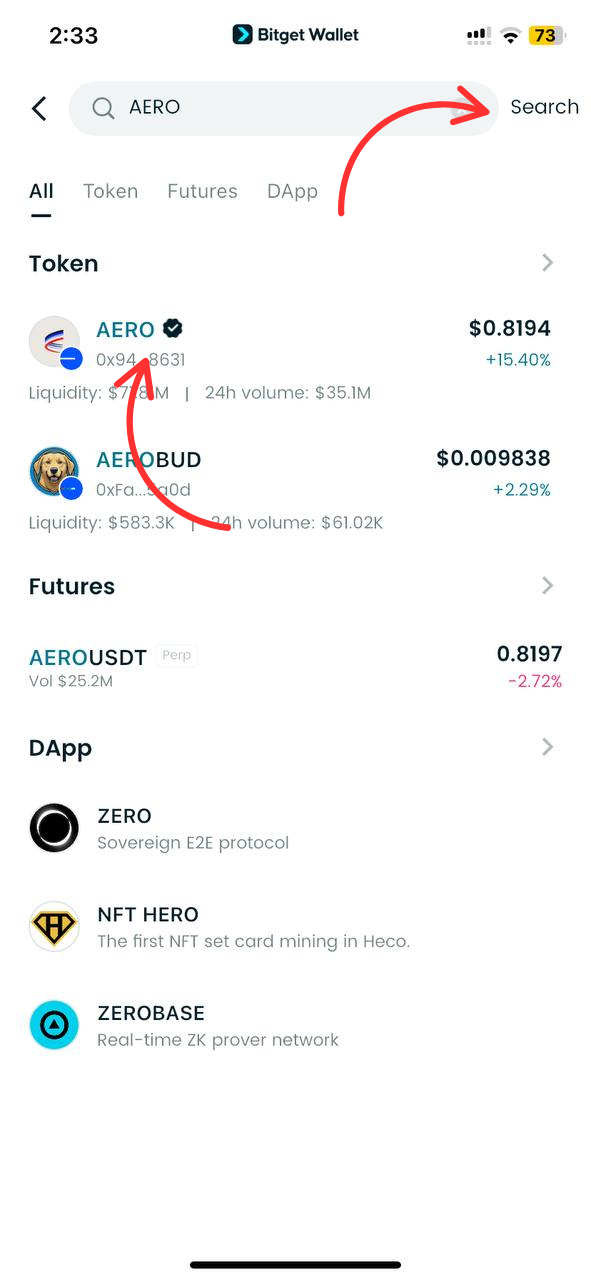

Step 3: Find Aerodrome Finance (AERO)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find Aerodrome Finance (AERO). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

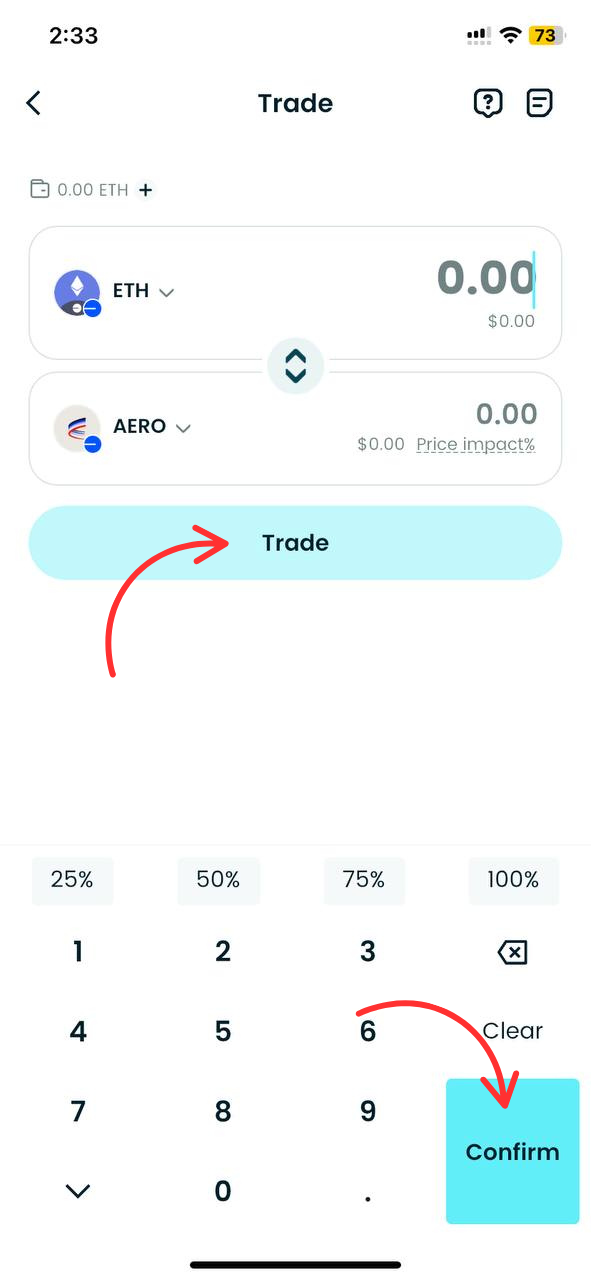

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as AERO/USDT. This will allow you to trade Aerodrome Finance (AERO) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of Aerodrome Finance (AERO) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired Aerodrome Finance (AERO).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your Aerodrome Finance (AERO) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶Learn more about Aerodrome Finance (AERO):

Conclusion

Aerodrome Finance (AERO) is a next-generation DeFi protocol on Coinbase’s Base network, offering veAERO governance, concentrated liquidity, and full fee redistribution. With strong backers and a growing ecosystem, AERO is a core asset in the Base DeFi landscape.

Why use AERO with Bitget Wallet?

Bitget Wallet makes it easy to buy, store, and manage AERO with secure custody, low fees, and integrated swaps. Its multi-chain support and real-time tracking offer a seamless Web3 experience.

Get started in minutes:

Download Bitget Wallet to access AERO and the broader DeFi ecosystem—quickly, securely, and effortlessly.

Download Bitget Wallet

FAQs

1. What is Aerodrome Finance (AERO)?

Aerodrome Finance is a decentralized exchange (DEX) and liquidity hub built on Coinbase’s Base Layer-2 blockchain. Its native token, AERO, powers governance, liquidity incentives, and emission distribution across the platform.

2. How does veAERO work?

veAERO is created by locking AERO tokens for a fixed duration (up to 4 years). Holders of veAERO receive voting power over emissions and protocol upgrades and earn 100% of trading fees from the platform.

3. Why should I buy AERO on Bitget Wallet?

Bitget Wallet offers a fast, secure, and user-friendly platform with fiat onramps, low fees, and multi-chain support. It’s an ideal way to access and manage your AERO holdings while participating in the Base DeFi ecosystem.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.