What Is a Rug Pull? How Crypto Scams Work and How to Protect Yourself

What is a rug pull is more than just a trending question—it’s one of the most urgent topics in the ever-evolving crypto ecosystem.

A rug pull is a type of crypto scam. In this scheme, developers launch a project, attract liquidity or mint funds, and then suddenly abandon it. Investors are left with worthless tokens and no recourse. This type of crypto fraud is especially common in decentralized finance (DeFi) and in high-volume NFT launches. These projects are often run by anonymous teams and operate with little or no regulation.

As blockchain adoption grows, new tokens continue to flood the market. Alongside this growth, the number of rug pull scams is rising. These scams affect all types of projects—from staking platforms and meme coins to hyped NFT collections. The threat is real and widespread. For anyone participating in the crypto space, knowing how to avoid rug pulls is not optional. It is a basic requirement for self-protection.

This guide breaks down what a rug pull is, how it works, the signs of rug pulls you should look for, and tools like Bitget Wallet that can help protect your investments.

What Is a Rug Pull in Crypto?

A rug pull in crypto is a scam where developers suddenly withdraw all funds or liquidity from a project. This leaves investors holding worthless tokens. The developers often vanish without warning. It is one of the most deceptive tactics in the digital asset space.

In decentralized finance (DeFi), scammers may launch a token, attract liquidity, and then drain the pool. In NFT projects, they hype the mint, sell out the collection, and disappear. No roadmap. No updates. Just broken promises.

These scams are becoming more frequent. They affect both DeFi platforms and NFT communities. That’s why it’s crucial to understand how rug pulls work. Spotting early warning signs can help protect your funds. Recognizing the patterns behind crypto rug pull scams is the first step in staying safe.

Source: TradingView

Why Are Rug Pulls Dangerous in 2025?

In 2025, rug pulls continue to pose one of the biggest threats in the crypto space. Whether it’s a rug pull NFT or a classic liquidity theft from a DeFi protocol, these scams are growing more frequent, more sophisticated, and more damaging.

With the rise of anonymous developers, frictionless token creation tools, and viral meme culture, crypto rug pull scams are no longer fringe occurrences—they’ve become systemic hazards that target everyone from new investors to seasoned crypto users.

Hard vs. Soft Rug Pulls

| Type | Definition | Speed | Warning Signs |

| Hard Rug Pull | Direct and malicious. Developers pre-code exit strategies or drain liquidity. | Instant to hours | No liquidity lock, suspicious smart contracts, anonymous team |

| Soft Rug Pull | Gradual. Founders abandon the project after cashing out or fading from view. | Days to weeks | Team disappears, no updates, quiet sell-off of tokens by insiders |

1. Rug Pulls Are Rapidly Increasing in Frequency

According to Comparitech, 92 rug pulls occurred in 2024, resulting in nearly $126 million USD in losses. These events are no longer rare. They’re part of a larger trend impacting NFTs, DeFi, and memecoins across major chains like Ethereum, Solana, and BNB Chain.

Scams are happening faster, spreading wider, and evolving to avoid detection. What used to be isolated has become global.

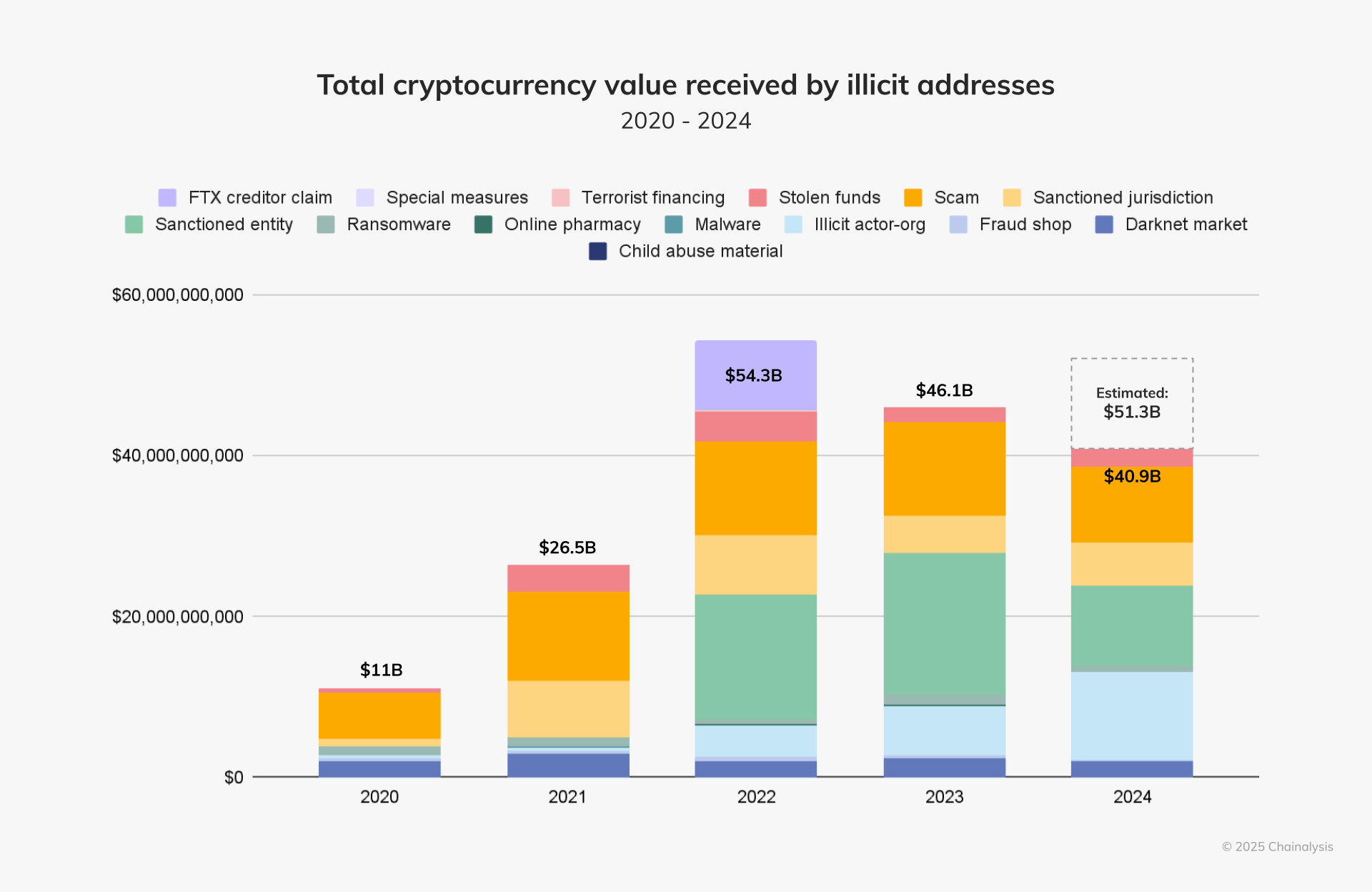

Source: Chainalysis

2. Financial Losses Are Severe and Immediate

One of the most dangerous aspects of a rug pull is how quickly it unfolds. Investors can lose their entire portfolio in a matter of minutes. Once the funds are withdrawn from a liquidity pool or mint wallet, they’re gone. Due to the immutable nature of blockchain, these transactions are irreversible.

Notable examples include:

- OneCoin – a multi-billion-dollar scam disguised as a legit cryptocurrency

- AnubisDAO – $60M vanished overnight after a suspicious liquidity withdrawal

- Squid Game Token – collapsed after devs pulled the liquidity; token fell to nearly zero instantly

3. Trust in Crypto Ecosystems Is Eroding

Rug pulls don’t just hurt investors—they damage the reputation of entire ecosystems. Each scam makes it harder for legitimate projects to attract users and raise capital. Investors become more cautious, while the media coverage intensifies skepticism around DeFi and NFTs.

This erosion of trust can slow innovation and adoption, particularly among mainstream users and institutions who already view crypto with caution.

4. New DeFi Tools Lower the Barrier for Scammers

The same tools that empower innovation in DeFi also empower fraud. It’s now easier than ever to launch a token with minimal cost and no identity verification. Platforms like Solana, BNB Chain, and Ethereum Layer 2s allow rapid, anonymous deployments of smart contracts.

These low entry barriers attract both visionary builders—and opportunistic scammers looking to exploit hype for profit.

5. Rug Pulls Often Masquerade as Hype Projects

Scammers increasingly use viral marketing, memes, and influencer endorsements to create a false sense of legitimacy. Flashy websites, aggressive countdowns, and celebrity-backed tokens are used to stir FOMO and mask the lack of real fundamentals.

Examples include:

- Frosties NFT – promised staking, rewards, and a metaverse… then vanished

- Hawk Tuah Token – capitalized on meme virality, rugged within days

In this landscape, hype can be a smokescreen for exit scams.

What Are the Types of Rug Pulls?

Rug pulls in crypto typically fall into two main categories: hard rug pulls and soft rug pulls. Understanding the difference is essential for spotting red flags before it's too late—whether you're buying a rug pull NFT or investing in a new DeFi project.

1. Hard Rug Pull

A hard rug pull is a direct and deliberate scam, often coded at the smart contract level. Developers embed malicious functions into the project’s code, allowing them to seize investor funds, disable trading, or withdraw all liquidity instantly.

This type of rug pull is premeditated. It’s not just abandonment—it’s outright theft by design.

Examples:

- AnubisDAO: Raised over $60 million in ETH—then the liquidity vanished within 24 hours.

- Libra Token: Promised to rival Facebook’s coin, but the team drained funds through flawed contract logic.

- Thodex: A centralized Turkish exchange where the CEO fled with user deposits, totaling hundreds of millions.

Source: CoinMarketCap

2. Soft Rug Pull

A soft rug pull isn’t executed via code, but through behavior. In these schemes, developers or insiders slowly withdraw from the project—cashing out their tokens, halting development, or ghosting the community.

This type of scam is subtler but just as damaging. It often masquerades as “market failure” rather than outright fraud.

Examples:

- Evolved Apes: Promised a game and roadmap. The creator disappeared after selling NFTs, delivering nothing.

- Hawk Tuah Token: Exploited meme virality, then collapsed after a quick pump-and-dump by insiders.

- Frosties NFT: Marketed staking and metaverse features—vanished after mint, costing users millions.

Source: CoinGecko

How Can You Identify a Rug Pull?

Knowing how to avoid rug pulls starts with recognizing the red flags that often go unnoticed—until it's too late. Rug pulls, whether they occur in DeFi, NFTs, or memecoin launches, often follow predictable patterns. By learning what to look for, investors can better protect themselves in an industry where hype sometimes overshadows substance.

Source: whitebit.com

What Are the Red Flags to Watch Out For?

-

Anonymous Teams

If no one knows who’s behind the project, there’s no accountability. Anonymous founders can vanish without consequence.

-

Lack of Audit

Smart contract audits help ensure there are no hidden backdoors. If a project hasn’t been audited—or worse, fakes one—it’s a major red flag.

-

Promises of Unrealistic Returns

Claims of “1000x gains,” “instant passive income,” or “guaranteed ROI” are classic bait. In crypto, if it sounds too good to be true—it usually is.

-

Centralized Liquidity Control

If the devs retain control over the liquidity pool and haven’t locked it, they can drain the funds whenever they want.

-

Blocked Sell Functions

Malicious contracts may prevent users from selling their tokens while allowing the creators to cash out. This is theft, dressed as code.

What Makes a Project Seem Legit but Isn’t?

-

Hype on Discord/X

A loud community doesn’t equal legitimacy. Paid bots, fake giveaways, and influencer “shilling” are often used to generate false excitement.

-

Fake Whitepapers or Overuse of Buzzwords

A glossy PDF filled with phrases like “AI-powered,” “revolutionary,” or “metaverse-ready” without technical substance is a red flag.

-

Tokenomics That Heavily Favor Devs

If a large percentage of tokens is reserved for the team or unlocked quickly, it's a setup for an insider dump.

Are Rug Pulls Illegal?

The legal status of rug pulls in crypto is far from straightforward. While some are clearly fraudulent, others exist in a murky space between unethical behavior and outright crime. The decentralized, pseudonymous nature of blockchain makes enforcement challenging—and the law often lags behind the technology. Understanding when a rug pull crosses the line into crypto fraud depends on multiple factors, including the nature of the scam, the jurisdiction, and the intent behind the project’s failure.

Why Rug Pulls Exist in a Legal Grey Area

Rug pulls operate across a legal spectrum largely because crypto regulation varies dramatically by country—and even between U.S. states. A scheme that qualifies as criminal fraud in one region might be unregulated or ambiguous in another.

Enforcement often depends on the type of fraud involved:

- If a token qualifies as a security, it may violate securities laws.

- If assets are misappropriated, property or wire fraud laws may apply.

But not all rug pulls are immediately prosecutable. Many appear as “project failures” unless investigators can prove intent, deception, or malicious design.

How U.S. Regulators Define Crypto Fraud

In the U.S., crypto fraud is shaped by a patchwork of federal and state interpretations.

- The SEC (Securities and Exchange Commission) views many cryptocurrencies as securities. This means they must be registered, and failure to do so—especially when misleading investors—may constitute fraud.

- The IRS treats crypto as property, taxing gains accordingly. This complicates enforcement because tax violations may trigger separate investigations.

- States may apply additional consumer protection or money transmission laws—creating inconsistency across jurisdictions.

The lack of unified definitions leaves many crypto scams floating in a regulatory void.

What Is the Howey Test and Why It Matters?

The Howey Test is a legal standard used to determine whether a transaction qualifies as an investment contract—and therefore a security. According to the SEC, a token is a security if it involves:

“an investment of money in a common enterprise with the expectation of profits derived from the efforts of others.”

This test is crucial because the SEC uses it to decide whether tokens—and their issuers—must comply with securities laws. But other agencies (like the CFTC or IRS) may interpret token use and intent differently, leading to further regulatory fragmentation.

Are Hard Rug Pulls Illegal by Default?

In most cases, hard rug pulls are considered outright fraud or theft. These scams often involve code-level manipulations, such as:

- Blocked sell functions, preventing users from exiting their positions

- Liquidity theft, where developers pull funds from the pool after inflating token price

Examples include:

- AnubisDAO: $60M vanished within 24 hours of its token launch.

- Thodex: A centralized exchange whose founder fled with customer assets, triggering international arrest warrants.

When intent and malicious design are provable, hard rug pulls are typically prosecutable.

Why Soft Rug Pulls May Not Break the Law

Soft rug pulls blur the legal line. In these cases, developers don’t touch the code or steal directly—instead, they slowly exit:

- Abandoning the roadmap

- Dumping their tokens

- Disappearing from communication channels

Because these actions mimic poor project management or market failure, intent is much harder to prove. Regulators may see them as unethical but not criminal, unless deceptive marketing or misappropriation of funds is documented.

Even if they escape prosecution, soft rug pulls erode public trust and can still lead to lawsuits, delistings, or bans on future crypto activity.

What Are the Most Famous Rug Pull Cases?

Several crypto rug pull scams have made global headlines due to the size of the losses, speed of execution, and the sheer number of investors affected. These cases serve as cautionary tales—and each one highlights different tactics scammers use to deceive the market.

What Happened With Thodex and OneCoin?

Source: Dailysabah

- Thodex (Turkey, 2021): Over $2.6 billion vanished when the centralized exchange’s CEO, Faruk Fatih Özer, fled the country—leaving 390,000+ users locked out of their accounts. He was later captured and sentenced to 11,196 years in prison.

- OneCoin (Global, 2014–2017): One of the largest Ponzi-style rug pulls in history, $4.4 billion was stolen from investors across 175 countries. Co-founder Ruja Ignatova, known as the “Cryptoqueen,” remains missing and on the FBI’s Most Wanted list.

These cases show how centralized control, anonymity, and aggressive marketing can devastate even experienced investors.

Why Did the Squid Game Token Collapse?

Source: Coinmarketcap

- Timeline: Launched in late October 2021

- Peak Price: Nearly $2,800

- Crash: Dropped to $0.0007 in minutes

- Investors affected: Over 40,000 wallet holders were locked out due to blocked sell functionality in the smart contract.

The project had no affiliation with Netflix, but mimicked the show's branding to build viral hype. It collapsed in a classic liquidity theft maneuver when the developers cashed out and shut down communications.

What Can We Learn From the Hawk Tuah Incident?

Source: Cryptopolitan

- Launched: July 2024, following the viral “Hawk Tuah” meme

- Rugged: Within 4 days

- Mechanism: Token pumped on social media, then insiders dumped holdings, draining liquidity

The Hawk Tuah rug pull exemplifies soft rug pull dynamics: hype-driven marketing, fake influencer engagement, no roadmap, and fast insider sell-offs. It’s a textbook case of how meme culture is weaponized to create exit scams under the guise of community tokens.

How Can You Avoid a Rug Pull?

Learning how to avoid a rug pull requires more than luck—it demands vigilance, due diligence, and the right tools. As crypto scams grow in sophistication, protecting your assets means developing a healthy skepticism, checking project fundamentals, and using platforms designed with security in mind.

What Security Practices Should You Follow?

-

Research the Project Thoroughly

Before investing, investigate the team, tokenomics, whitepaper, and roadmap. No roadmap? Anonymous founders? That’s already two red flags.

-

Verify Liquidity Locks and Smart Contract Audits

Check if the project has locked its liquidity (e.g., via Unicrypt or Team Finance) and whether the contract has been independently audited. No audit = no go.

-

Use Communities as a Sanity Check

Engage in Discord, Telegram, or Reddit discussions. If questions are ignored or banned, or the project is all hype and no substance—exit stage left.

Why Should You Use Trusted Platforms Like Bitget Wallet?

Using a secure, audited platform like Bitget Wallet can dramatically reduce your exposure to rug pulls. Bitget Wallet’s built-in DeFi tools, DEX aggregator, and smart contract scanner allow users to interact safely with decentralized assets—while staying informed about contract risks and token trust scores.

Bitget also supports multi-chain compatibility, token verification, and asset tracking—making it a powerful all-in-one hub for exploring Web3 without falling for traps.

Conclusion

What is a rug pull is not just a technical question—it’s a real and growing risk in today’s crypto landscape. From NFT hype schemes to DeFi liquidity thefts, rug pulls continue to evolve, exploiting both new investors and seasoned traders alike.

Smart investing means staying informed, questioning hype, and choosing tools that put your security first.

Platforms like Bitget Wallet give users a secure, user-friendly gateway to explore crypto without falling into common traps. With built-in security features, smart contract scanners, and DeFi integration, it’s a solid choice for anyone looking to navigate Web3 with confidence.

👉 Start using Bitget Wallet to avoid scams and manage your crypto securely.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is Crypto Fear and Greed Index: How Traders Read Fear vs Greed Signals2025-11-19 | 5 mins

- How to Pay with Crypto: Fast, Safe, and Beginner-Friendly Method2025-11-18 | 5 mins

- How to Convert Your Crypto to Cash: 5 Easy Ways for Beginners2025-11-18 | 5 mins