USDY Token: What Is Ondo US Dollar Yield and How to Earn Passive Income with 4.25% APY

What is Ondo US Dollar Yield (USDY)? Ondo US Dollar Yield (USDY) carries financial reliability and innovation, blending tradition with innovation in DeFi. Ondo US Dollar Yield (USDY) uses blockchain technology to bring cultural significance into digital assets. Blending cultural heritage with blockchain technology unlocks fresh possibilities in the digital asset space. It both upholds historical values and modernizes digital asset applications.

With strong backing from Ondo Finance and Institutional investors, Ondo US Dollar Yield (USDY) is shaping the future of digital assets while enabling investors and participants to engage with its expanding network. More than just a token, it is a key component in tokenized U.S. treasury exposure and DeFi collateralization, securing its lasting impact in the industry.

This article explores Ondo US Dollar Yield (USDY), highlighting its mission, core features, and growth potential. Whether you're looking toward its blockchain role, investment value, or market impact, this guide has you covered.

Key Takeaways

-

USDY offers a 4.25% APY by tokenizing short-term U.S. Treasuries, combining stable returns with blockchain accessibility.

-

The token ensures on-chain transparency, making all transactions and reserves verifiable and secure for users.

-

USDY is DeFi-ready, serving as collateral and a yield-generating asset across decentralized finance platforms.

USDY Token: What Is Ondo US Dollar Yield?

Ondo US Dollar Yield (USDY) is a tokenized financial product that combines security in short-term U.S. treasuries with the accessibility and transparency of blockchain technology. This product is designed to offer yield in a decentralized manner. USDY bridges traditional finance with the evolving DeFi landscape. In Bitget Wallet USDY holders get 4.25% APY, which attracts more users and makes it a standout product.

Key Features

-

Real Yield from U.S. Treasuries:

USDY is backed by short-term U.S. government bonds, and bank deposits, offering a stable, yield-bearing alternative way for traditional stablecoins. -

Institutional-Grade Compliance:

Issued by Ondo Finance with a regulated structure in place, catering to qualified investors to invest in it. -

Passive Income for Holders:

USDY accrues yield over time without requiring active management, making it ideal for conservative crypto investors and traders.

Source: Noble XYZ

How Much Money Can I Make If I Buy $USDY?

The amount of income you can earn with $USDY depends on how much you invest, the APY offered, and how long you hold the token. The table below illustrates estimated passive income for different investment amounts and timeframes—monthly, quarterly, semi-annually, and annually—assuming a fixed APY of 4.25% and no compounding. Use it as a quick reference to understand the potential rewards from staking or holding $USDY.

Estimated Earnings with $USDY (Non-Compounded)

| Investment Amount |

Monthly Earnings |

Quarterly Earnings |

6-Month Earnings |

Annual Earnings |

| $1,000 |

$3.54 |

$10.62 |

$21.25 |

$42.50 |

| $5,000 |

$17.71 |

$53.13 |

$106.25 |

$212.50 |

| $10,000 |

$35.42 |

$106.25 |

$212.50 |

$425.00 |

📌 Note: These figures are estimates based on a fixed 4.25% APY with simple interest. Real returns may vary depending on platform rules, compounding frequency, and market conditions.

Benefits of APY Tokens

✅ Passive Income – Earn rewards simply by holding or staking $USDY, with no need for active trading.

✅ Compound Growth – Reinvested earnings can grow over time through the power of compounding.

✅ Flexible Earning Options – $USDY offers both fixed and flexible earning plans to suit different risk levels.

✅ Enhanced Utility – $USDY often supports staking, liquidity mining, or governance, increasing their ecosystem value.

✅ Lower Entry Barrier – Ideal for beginners who want to earn yield without complex trading strategies.

✅ Incentivized Holding – APY rewards encourage long-term commitment, which can help reduce market volatility.

How to Buy Ondo US Dollar Yield (USDY) on Bitget Wallet?

Trading Ondo US Dollar Yield (USDY) is easy on Bitget Wallet. Follow these easy steps to get started:

Step 1: Create a Wallet

If you don't have a Wallet, download the Bitget Wallet app. Sign up by creating a new wallet and keep the backup safe.

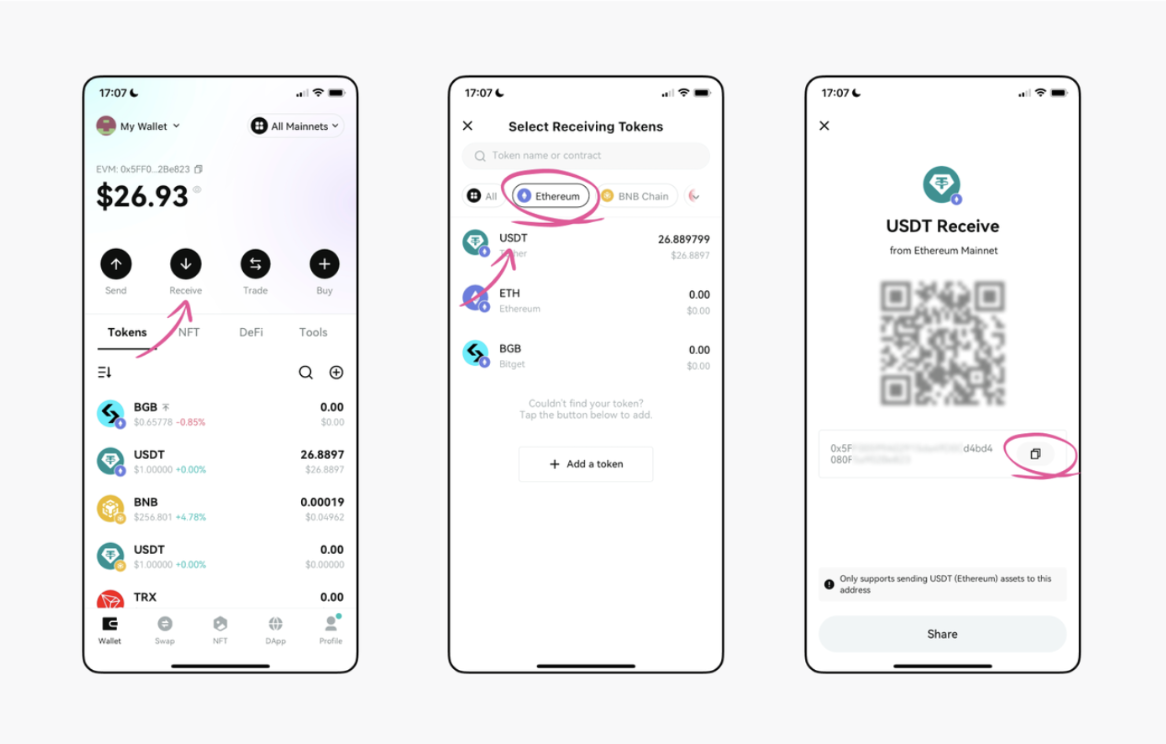

Step 2: Deposit Funds

Once your wallet is set up, you need to deposit funds. You can do this by:

-

Transferring Cryptocurrency: Send crypto from another wallet.

-

Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitge Wallet, ensuring you have enough funds for trading Ondo US Dollar Yield (USDY).

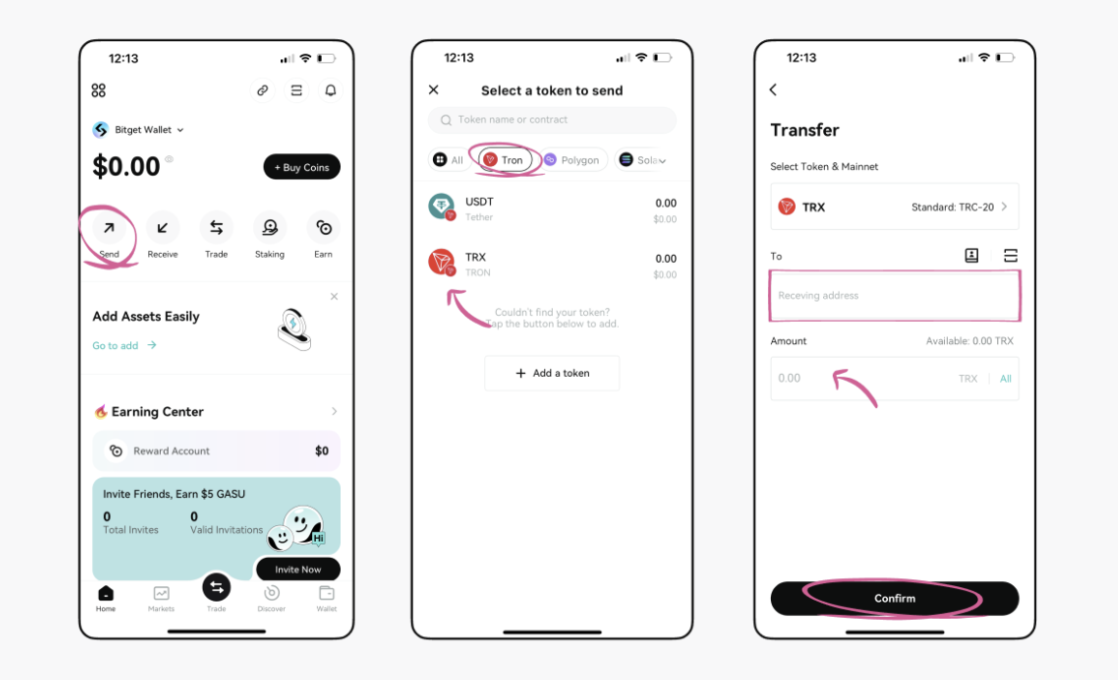

Step 3: Find Ondo US Dollar Yield (USDY)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find Ondo US Dollar Yield (USDY). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as USDY/USDT. This will allow you to trade Ondo US Dollar Yield (USDY) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of Ondo US Dollar Yield (USDY) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired Ondo US Dollar Yield (USDY).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your Ondo US Dollar Yield (USDY) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

Ondo US Dollar Yield (USDY) Features: What Sets It Apart?

The standout features of Ondo US Dollar Yield (USDY) include:

-

Defi Ready Integration

USDY is compatible with DeFi platforms for use as collateral, in defi lending protocol, and treasury management tools. This flexibility allows users to earn yield for holding USDY in their decentralized wallet. -

Blockchain-powered Transparency

Every transaction made worldwide is accessible through blockchain technology, which ensures full transparency within the user ecosystem of USDY. -

Real-world Yield Backed by U.S. Government

USDY is backed by short-term U.S. treasury bills and bonds, offering investors a stable yield, and ensuring risk-free investment. Unlike other stablecoins which don't make any return, USDY provides returns in terms of rewards.

What Sets It Apart?

What makes USDY unique is its ability to deliver real yield from U.S. Treasuries while maintaining full on-chain transparency. Unlike typical stablecoins, it’s DeFi-ready and built for real-world utility across both traditional and decentralized finance.

How Does Ondo US Dollar Yield (USDY) Work?

-

Built on Ethereum Blockchain, enabling fast and secure transactions.

-

Uses smart contract infrastructure to validate transactions efficiently.

-

Supports DeFi applications, offering yield-bearing stablecoin solutions and integration with DeFi protocols.

Key Benefits

-

Stable Yield

USDY provides consistent returns by being backed with U.S. Treasuries, offering a reliable income stream in the crypto space. -

On-chain Transparency

All transactions and reserve assets are easily verifiable in the blockchain explorer, ensuring full value transparency and a trustworthy environment. -

Defi Integration

USDY is designed to be used across the defi platforms, allowing users to get yield while maintaining liquidity control.

Who Leads Ondo US Dollar Yield (USDY) - Team & Key Partnerships

The Team

Ondo US Dollar Yield (USDY) is led by Nathan Allman, Founder & CEO of Ondo Finance, with prior experience at Goldman Sachs. He is joined by Justin Schmidt (President & Chief Operating Officer) and Chris Tyrrell (Chief Risk Officer), both with strong backgrounds in traditional finance and digital assets.

Key Partnerships

Ondo has partnered with Pyth Network for real-time price feeds, Wintermute to boost liquidity, Stellar Network for global accessibility, and Axelar for cross-chain interoperability. These alliances enhance USDY’s reach, transparency, and integration across blockchain ecosystems.

How Ondo US Dollar Yield (USDY) is Used: Practical Benefits and Solutions

Ondo US Dollar Yield (USDY) is made to bring traditional yield-bearing financial asset into the blockchain space. By combining the reliability of U.S. Treasuries with the flexibility of tokenized assets, USDY serves both institutional and individual users looking for stable, transparent, and yield-generating digital assets.

Practical Benefits and Solutions

-

Passive Income Generation:

USDY offers a stable yield backed by U.S. Treasuries, allowing users to earn passive income without high risk. -

Collateral in DeFi:

USDY can be used as secure collateral for borrowing and lending across decentralized finance platforms. -

Treasury Management:

Institutions and DAOs can hold USDY as a low-risk asset to manage reserves while earning yield.

How Ondo US Dollar Yield (USDY) is Evolving: A Look at Its Roadmap

- Q1 2025 - Tokenized Cash Adoption

Expand USDY across blockchains and improve global access through partnerships like Stellar, focusing on payments and DeFi use. - Q2 2025 - Broaders Asset Tokenization

Start tokenizing other public securities to grow on-chain asset variety and solve market infrastructure gaps. -

Q3 2025 - Real World Integration

Deepen ties with traditional finance to enhance USDY's utility and bridge DeFi with real-world financial systems.

Conclusion

Ondo US Dollar Yield (USDY) offers a unique way to earn passive income by tokenizing U.S. Treasuries with a 4.25% APY—combining the stability of traditional finance with blockchain accessibility. It’s a smart option for users seeking steady returns in the crypto space.

Using Bitget Wallet to buy and manage USDY makes the process simple, secure, and efficient. With a user-friendly interface, cross-chain support, and non-custodial design, Bitget Wallet puts you in full control of your assets.

During bear markets, Bitget Wallet truly shines. It helps users avoid risks, protect their portfolios, and earn yields with confidence. As a secure, easy-to-use, and cross-chain wallet, Bitget Wallet is the perfect choice for staying ahead in uncertain times.

FAQs

1. What is USDY and how does it work?

USDY is a tokenized version of short-term U.S. Treasury bills offering 4.25% APY. It brings yield-bearing, fully backed assets to the blockchain.

2. Is USDY a stablecoin or a security token?

USDY functions similarly to a stablecoin in price stability but is classified as a security token due to its backing by U.S. Treasury bills.

3. Can USDY be used in DeFi protocols?

Yes, USDY is designed for DeFi use cases and can be utilized as collateral or a yield-generating asset across various decentralized finance platforms.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- FIFA World Cup Odds 2026: How to Bet on the World Cup 2026 Winner2026-03-03 | 5mins

- Fabric Airdrop Guide: How to Participate and Claim $ROBO Rewards2026-03-03 | 5mins

- Can I Buy World Cup Ticket with Cryptocurrencies?2026-03-02 | 5mins