On-chain RWA Market 2026: Growth, Risks, and Investment Opportunities

The on-chain RWA market 2026 has become one of the fastest-growing areas in DeFi, with total value locked (TVL) hitting $26.59B. RWA tokenization transforms assets like U.S. Treasuries, private credit, real estate, and carbon credits into blockchain-based instruments, making them globally accessible and programmable.

Its appeal lies in blending the trust of traditional finance with DeFi innovation. Institutional leaders such as BlackRock (BUIDL, ~$2.7B AUM), Franklin Templeton (BENJI, ~$706M), and Ondo Finance anchor adoption, while regional pilots in Dubai, Singapore, and Europe show how compliance accelerates growth.

For investors, RWAs are more than yield opportunities—they bridge risk-adjusted stability with access to new asset classes. Tokenized Treasuries serve as safe anchors, while private credit and real estate open higher-yield niches.

This article explores the evolution of RWAs, global trends, notable projects, risks, and investment strategies — while revealing why Bitget Wallet is the key to accessing this trillion-dollar market safely and effectively.

Key Takeaways

- The on-chain RWA market 2026 has surpassed $26.59B TVL, with tokenized Treasuries and private credit driving more than 80% of the market share.

- Leading RWA asset managers such as BlackRock, Franklin Templeton, and Ondo Finance are scaling products across multiple chains, signaling long-term confidence.

- Despite regulatory uncertainty and liquidity risks, RWA investors can adopt a “Core + Satellite” strategy to balance safety and yield.

What Is the On-chain RWA Market in 2026 ?

The on-chain RWA market 2026 has grown from a niche into a multi-asset ecosystem with global adoption. Unlike earlier DeFi cycles focused on speculative tokens, this phase is driven by tokenization of real-world assets backed by verifiable collateral and institutional players.

Private credit makes up ~42% of AUM, Treasuries ~38%, while real estate, commodities, and equities share the rest. This balance shows RWAs are shifting from safe-haven Treasuries toward diversified assets offering stability and yield.

Tokenized Treasuries: The Core of RWA Growth

Tokenized Treasuries anchor the ecosystem, giving blockchain-based access to the world’s safest asset. Rising interest rates boosted demand in 2026 .

- BlackRock’s BUIDL fund reached ~$2.7B AUM.

- Franklin Templeton’s BENJI grew to ~$706M.

- Ondo Finance expanded with short-duration products.

With ~$10B TVL, Treasuries remain the risk-free foundation for all other RWAs.

Private Credit: Yield Engine of the On-chain Market

Private credit is the main growth engine, tokenizing SME, real estate, and fintech loans.

- Atlas Bonds launched infrastructure loans in emerging markets.

- LendAsia Pro opened SME pools in Asia.

Now ~42% of AUM, private credit reflects strong demand for higher yields, with institutions like Maple and Securitize bridging compliance frameworks.

Real Estate & Carbon Credits: Emerging Use Cases

Though smaller, real estate and carbon credits show long-term potential.

- RealEstateFi fractionalizes global properties.

- GreenCarbonX tokenizes carbon credits for ESG compliance.

Together <15% of AUM, these categories highlight future growth opportunities, especially as climate-linked finance gains traction.

▶Read more: What Is Real Estate Tokenization? Gates and Oasys Partner to Bring RWAs to Japan's Property Market

How Has the On-chain RWA Market Evolved Over Time?

The rise of the on-chain RWA market has unfolded over three years, moving from pilots to institutional adoption. Tracing 2023 (experimentation), 2024 (scaling), and 2026 (compliance-led growth) shows why this cycle differs from speculative DeFi booms.

What Happened in 2023?

2023 was the experimentation year:

- Franklin Templeton introduced tokenized money market funds.

- Maple Finance and Goldfinch piloted private credit pools with limited liquidity.

- Regulatory clarity was minimal, with most pilots permissioned.

These steps proved real-world collateral could link to blockchain rails.

How Did 2024 Set the Stage for Growth?

2024 marked scaling:

- BlackRock launched BUIDL on Ethereum, attracting billions.

- Ondo Finance added tokenized Treasuries and bonds.

- Regulators in Singapore & Hong Kong encouraged pilots.

By late 2024, RWAs were no longer experiments but integrated DeFi assets for lending, collateral, and stablecoins.

Why Is 2026 a Turning Point?

In 2026 , RWAs reached institutional scale:

- Treasuries drove ~40% of TVL by Q2.

- Dubai & Singapore tested real estate pilots.

- Brazil advanced tokenized carbon credits.

Challenges remain—liquidity, fragmented rules, and operational risk—but compliance and diversification now define the market’s trajectory.

Which Regions Dominate the On-chain RWA Market in 2026 ?

The on-chain RWA market 2026 has a clear global footprint, with adoption varying by region. Estimates place North America at 45%, Europe at 25%, Asia-Pacific at 20%, while Latin America and Africa together account for about 10%. These dynamics help investors see both mature and frontier opportunities.

Source: Cryptopolitan.com

Why Does North America Lead the Market?

North America, led by the United States, is the epicenter of RWA tokenization.

- U.S. Treasuries remain the dominant asset class, accounting for the majority of on-chain inflows.

- Institutional heavyweights like Circle and Ondo Finance anchor the ecosystem by providing liquidity and trusted issuance.

- U.S.-based investors also prefer dollar-denominated assets, reinforcing demand for tokenized Treasuries and funds.

The combination of liquidity depth, institutional trust, and regulatory clarity around Treasuries ensures North America’s leadership.

How Is Europe Driving Carbon Credit Tokenization?

Europe positions itself as the hub for sustainability-focused RWAs.

- The EU Emissions Trading System (ETS) framework has pushed projects to tokenize carbon credits for easier trading and verification.

- Real estate pilots in Germany and France are exploring fractionalized ownership for institutional and retail investors.

- European investors, already attuned to ESG mandates, are showing strong appetite for sustainability-linked RWAs.

This makes Europe a pioneer in carbon and green finance tokenization.

What Makes Asia-Pacific a Hotspot for Real Estate and Credit?

Asia-Pacific is emerging as a compliance-driven innovation hub.

- Singapore leads with a clear legal framework for tokenized securities and has approved multiple private credit pilots.

- Dubai and the UAE are advancing real estate tokenization projects, allowing global investors to buy fractional property shares.

- SME lending protocols, such as LendAsia Pro, are leveraging blockchain to expand access to underbanked businesses.

This region’s strength lies in blending regulatory clarity with high-growth asset classes like real estate and private credit.

Why Are Latin America and Africa Niche but Emerging?

Though smaller in size, LatAm and Africa provide frontier opportunities.

- In Brazil, initiatives like GreenCarbonX tokenize Amazon rainforest carbon credits, appealing to ESG-focused funds.

- In Africa, renewable energy bonds and infrastructure pilots are opening new channels for impact-driven investors.

While adoption remains limited, these regions could become long-term growth engines for investors seeking ESG exposure and diversification.

▶Read more: What Is Asset Tokenization and Its Impact on Global Investors?

What Are the Key Events and Projects Driving the RWA Market in 2026 ?

The on-chain RWA market 2026 is not only expanding in size but also shaped by milestone events and standout projects. From BlackRock and Franklin Templeton to newer names like Atlas Bonds and GreenCarbonX, each development signals where the sector is heading.

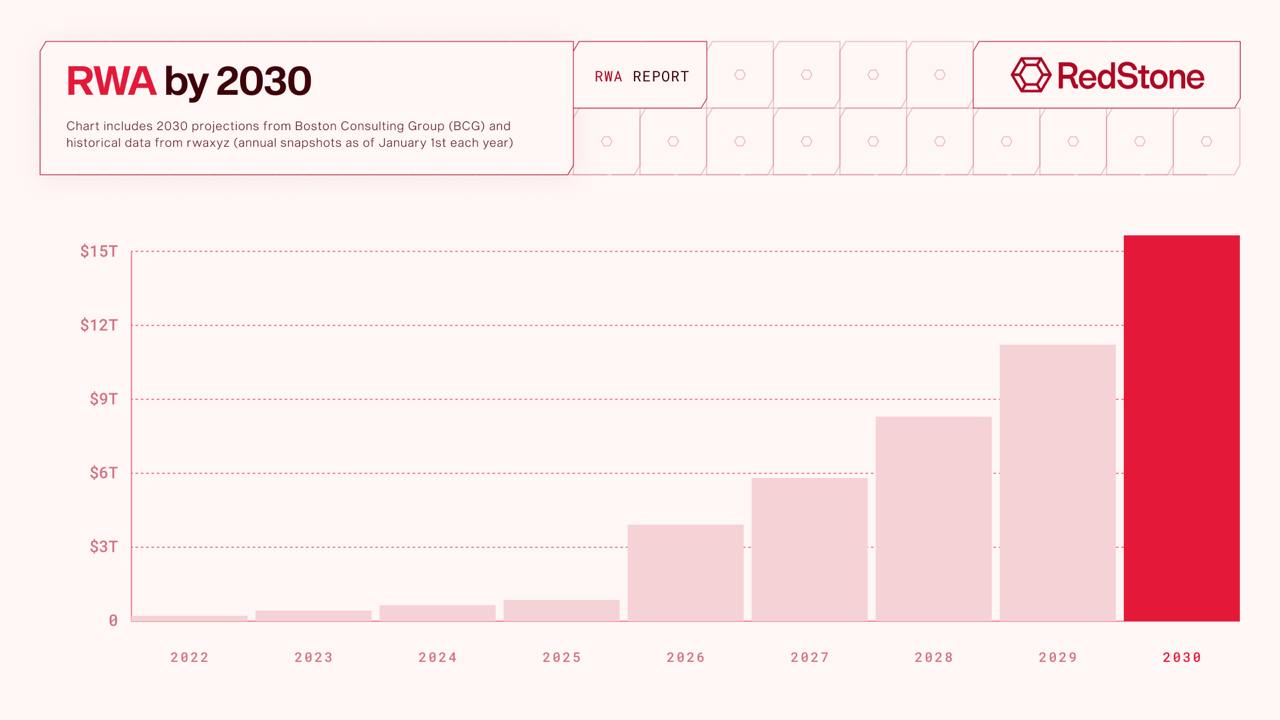

Source: RedStone Blog

Which Institutional Funds Are Scaling Fastest?

Institutional adoption is the biggest accelerator of RWA tokenization.

- BlackRock’s BUIDL Fund surpassed $2.7B in assets under management (AUM), becoming the largest tokenized U.S. Treasury vehicle.

- Franklin Templeton’s BENJI Fund reached nearly $706M AUM, with strong retail and institutional participation.

- Ondo Finance continues to expand across Ethereum, Solana, and Polygon, offering tokenized Treasuries, corporate bonds, and credit pools.

These players establish credibility and liquidity, setting the foundation for other issuers.

Which New Projects Showcase Innovation?

Beyond the big names, emerging projects are pushing tokenization into new frontiers:

-

Atlas Bonds (U.S., Ethereum):

Brings municipal bonds on-chain with fractional access for global investors.

-

GreenCarbonX (Brazil, Polygon):

Tokenizes carbon credits tied to Amazon rainforest preservation, enabling ESG-linked DeFi markets.

-

CommodiChain (Australia, BNB Chain):

Pioneers tokenized commodities like gold and agricultural futures, bridging traditional commodities with DeFi rails.

-

RealEstateFi (UAE, private chain pilot):

Experiments with fractionalized real estate in Dubai’s luxury property market.

These initiatives highlight diversification beyond Treasuries.

Why Are These Projects Attractive to Investors?

For investors, the appeal of these projects lies in a blend of:

-

Diversification:

Exposure across bonds, real estate, carbon, and commodities.

-

Yield potential:

Treasuries provide safe anchor yields, while private credit and carbon offer higher returns.

-

Compliance advantage:

Projects operating under clear frameworks (Singapore, EU, UAE) reduce legal and counterparty risks.

Together, these case studies show how RWAs are maturing into a multi-asset investment ecosystem, offering both security and upside potential.

▶Read more: Which Assets Can Be Tokenized?

What Risks Should Investors Consider in the On-chain RWA Market 2026 ?

The on-chain RWA market 2026 presents attractive opportunities, but investors must also weigh key risks. Unlike purely digital assets, RWAs carry both traditional market exposure and blockchain-related challenges. Knowing these risks is crucial for strategy and allocation.

How Does Regulatory Uncertainty Affect Investors?

Regulation is the biggest wildcard shaping the RWA market.

- The MiCA framework in Europe provides clarity for tokenized assets but has strict compliance rules.

- Hong Kong’s digital green bond pilot and Singapore’s tokenized credit regulations show progress but remain region-specific.

- In the U.S., tokenized Treasuries enjoy relative clarity, but broader RWA categories lack uniform guidance.

For investors, this means navigating fragmented rules, where compliance in one region may not protect them globally.

Why Is Secondary Liquidity a Key Concern?

Although RWA adoption is surging, secondary market liquidity remains underdeveloped.

- Investors may face redemption delays, especially in private credit and real estate tokens.

- Without sufficient market-making mechanisms, RWA assets risk trading at discounts to NAV.

- Liquidity fragmentation across chains (Ethereum, Polygon, Solana, BNB Chain) creates additional friction.

This makes exit strategy planning as important as the initial investment.

What Are the Risks in Private Credit and Real Estate?

Private credit and real estate RWAs carry both higher yield potential and higher uncertainty:

-

Transparency issues:

Borrower data, loan performance, and collateral enforcement may not be fully auditable.

-

Default risk:

SME loans (e.g., LendAsia Pro) carry higher probability of non-repayment.

-

Legal enforcement gaps:

Property rights and jurisdictional recognition of tokenized deeds remain untested.

For investors, these sectors are best suited as satellite allocations, complementing safer core positions in Treasuries.

How Should Investors Approach the On-chain RWA Market in 2026 ?

The on-chain RWA market 2026 offers safe yield anchors and high-growth niches. To capture value, investors increasingly apply a “Core + Satellite” strategy, balancing Treasuries with selective exposure to private credit, carbon credits, and real estate for risk-adjusted returns.

What Is the ‘Core + Satellite’ Strategy for RWA?

The Core + Satellite model ensures stability while leaving room for growth:

-

Core allocation:

U.S. Treasuries and tokenized money market funds (stable, low-risk assets, 50–70% of portfolio).

-

Satellite allocation:

Private credit, carbon credits, and real estate (higher yield, diversification, 20–40% of portfolio).

This structure provides both predictable income and exposure to emerging opportunities, making it attractive for risk-adjusted returns.

How Can Institutions and Retail Investors Allocate Differently?

Investor type determines allocation preferences:

- Institutions prioritize regulated products such as BlackRock BUIDL and Franklin BENJI, ensuring compliance and liquidity.

- Retail investors often access RWAs through packaged products or DeFi protocols that bundle exposure, offering simplicity and lower entry barriers.

This dual-track adoption highlights how RWA tokenization serves both sophisticated and everyday investors.

Why Is Liquidity Planning Essential for Investors?

Liquidity remains a critical factor in portfolio construction:

- Redemption windows vary widely across RWA products, from daily (Treasuries) to quarterly (private credit or real estate).

- Market makers and secondary liquidity pools are still developing, creating potential exit delays.

- Tools like Bitget Wallet allow investors to track allocations, manage swaps, and monitor liquidity conditions across chains.

By planning liquidity in advance, investors can avoid the mismatch between yield expectations and exit flexibility.

▶Read more: What Is XStocks and How to Trade Tokenized US Stocks on Bitget Wallet

Why Is Bitget Wallet the Best Gateway for the On-chain RWA Market 2026 ?

Bitget Wallet is the best gateway for the on-chain RWA market 2026 , positioned as an all-in-one RWA and stablecoin solution for global investors.

Investor-Focused Features of Bitget Wallet

- Tokenized equities: Trade 100+ tokenized stocks and ETFs from $1, including Tesla, Apple, and NVIDIA—24/5 access, no KYC, zero fees.

- Tokenized treasuries & credit: Access institutional-grade assets via Centrifuge and Aerodrome, enabling trading, collateral, and DeFi use.

- Stablecoin swaps & trading: Swap into USDC, earn ~10% APY (up to 18% bonus), with flexible withdrawals and 130+ chain cross-trading.

- Secure storage: Store equities, bonds, carbon credits, and real estate tokens safely, backed by custody and $300M protection fund.

- Multi-chain support: Compatible with Ethereum, Solana, BNB Chain, Polygon, Base and more for seamless RWA access.

Why Investors Prefer Bitget Wallet

- Accessibility: Invest globally from just $1, trade anytime with zero fees and no KYC barriers.

- Institutional security: Backed by regulated custodians, daily checks, and $300M asset protection.

- Yield opportunities: Earn from tokenized stock dividends, stablecoins, and private credit yields.

Bitget Wallet bridges TradFi stability with DeFi innovation, making it the best gateway for exploring tokenized assets.

👉 *Download Bitget Wallet today to explore the future of on-chain RWAs and stablecoin trading with confidence.*

Conclusion

The on-chain RWA market 2026 is shaping the next phase of digital finance, blending traditional asset credibility with blockchain efficiency. With over $26B in total value locked, RWAs have evolved from pilots into a core component of both DeFi and institutional strategies. Investors are drawn to the market’s risk-free anchor in tokenized Treasuries, while private credit, real estate, and carbon credits offer diversification and higher yield. Yet challenges remain—regulatory fragmentation, liquidity gaps, and asset authenticity risks demand careful due diligence and strategic allocation.

RWAs are becoming the long-awaited bridge between TradFi and DeFi, providing transparency, accessibility, and real-world value. To capture these opportunities, investors need a secure gateway that unites yield, diversification, and compliance. Bitget Wallet is built for this future, offering seamless swaps, multi-chain support, and institutional-grade security—making it the ideal hub for managing Treasuries, credit pools, and ESG-linked assets.

👉 *Download Bitget Wallet today to securely explore RWA opportunities, track yields, and unlock the future of tokenized finance.*

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is the on-chain RWA market 2026 ?

The on-chain RWA market 2026 refers to the tokenization of real-world assets—such as U.S. Treasuries, private credit, real estate, and carbon credits—on blockchain networks. It has grown into a $26B market, offering investors yield, liquidity, and diversification.

2. Why are tokenized Treasuries the main driver of growth?

U.S. Treasuries provide a risk-free yield anchor, making them the most trusted and liquid on-chain RWA. Institutional funds like BlackRock BUIDL and Franklin BENJI have accelerated adoption by offering compliant, scalable Treasury-backed products.

3. Why use Bitget Wallet for RWA investing?

Bitget Wallet is an all-in-one gateway for RWAs, offering secure multi-chain storage, seamless stablecoin swaps, and access to tokenized Treasuries, private credit, and ESG assets. It simplifies investing for both retail and institutions.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.