How to Use a Crypto Card for Daily Transactions?

Crypto cards have transformed the way users make daily purchases by enabling direct spending of digital assets. A crypto card is a payment card—usually issued in partnership with Visa or Mastercard—that allows users to convert cryptocurrencies like Bitcoin, Ethereum, or stablecoins into fiat at the point of sale. As digital currencies gain traction, more people are exploring ways to integrate them into everyday life—from shopping and dining to bill payments and travel. This guide will walk you through everything you need to know about how to use a crypto card, from setup and usage to the best options available.

Key Takeaways

- Spend crypto like cash: Use your crypto card for everyday purchases—groceries, dining, travel, and bills—thanks to real-time conversion from digital assets to local currency at checkout.

- Unlock powerful benefits: Enjoy perks like zero foreign transaction fees, cashback rewards, and the ability to earn through staking—all while spending directly from your crypto wallet.

- Set up in minutes: Follow a step-by-step guide to activating and using the Bitget Wallet Card, and see how it compares with top crypto card providers in 2025.

What Is a Crypto Card and How Does It Work?

A crypto card functions like a traditional payment card but connects to your crypto wallet. It allows you to pay with crypto by converting your digital assets into fiat currency in real time when making a purchase.

Types of Crypto Cards

| Type | Description | Example |

| Crypto Debit Card | Linked to your crypto wallet; funds are deducted instantly | Bitget Wallet Card |

| Crypto Credit Card | Offers a line of credit based on crypto collateral or repayment cycle | Crypto.com Credit Card |

| Prepaid | Load crypto beforehand and spend as needed | Wirex Card |

| Virtual | Digital-only version, ideal for online transactions | Binance Virtual Card |

How Crypto Cards Convert Crypto to Fiat?

When you pay with crypto, the card's provider instantly converts your selected cryptocurrency into local fiat currency. Visa or Mastercard then processes the payment like any traditional card transaction.

Are Crypto Cards Safe to Use?

Yes. Most crypto cards are equipped with robust security features:

- Two-factor authentication (2FA)

- Fraud protection and instant freeze options

- Non-custodial options for maximum control over funds

Read more: What Are Crypto Payments? Crypto PayFi vs. Traditional Payments

Benefits of Using a Crypto Card for Daily Transactions

1. Real-Time Conversion and Spending Anywhere

Crypto card payment happens instantly. With cards like the Bitget Wallet Card, your crypto is converted into fiat at the point of sale, enabling seamless use in stores, cafés, or online shops—even if the merchant doesn’t accept crypto directly. These cards are powered by Visa or Mastercard networks, so you can spend crypto with card globally.

2. Rewards, Cashback, and Staking

Just like traditional cards offer airline miles or cashback, crypto cards come with benefits:

- Bitget Wallet Card offers up to 8% APY on staked stablecoins

- New users receive extra cashback within the first 30 days This means you earn even while spending.

3. No Foreign Transaction Fees

Most banks charge 2–3% on international transactions. Crypto cards like Bitget’s waive foreign transaction fees, making them ideal for travelers, digital nomads, and remote workers. They also support Apple Pay and Google Pay across borders.

4. Enhanced Privacy and Web3 Compatibility

Using crypto protects your privacy. Cards like Bitget Wallet Card offer:

- Direct connection to Bitget Wallet

- One-tap access to Web3 apps and NFTs

- No exposure of bank accounts or intermediaries

Read more: PayFi Benefits and Advantages: What is PayFi Crypto?

What Are Common Everyday Uses for a Crypto Card?

1. Shopping (Online and In-Store)

Crypto cards can be used just like traditional debit or credit cards to buy groceries, clothing, electronics, and more. Whether you're shopping online or in a physical store, your crypto is instantly converted into local currency at checkout.

2. Bill Payments and Subscriptions

Pay your monthly utility bills, mobile plans, or digital subscriptions like Netflix and Spotify using your crypto card. Services like BitPay and CoinGate make it easy to route recurring payments through your crypto balance.

3. Dining and Travel

From grabbing coffee to booking a flight on Travala or calling an Uber, crypto cards let you pay on the go. They work globally at any location that accepts Visa or Mastercard, removing the need to manually convert funds.

4. ATM Withdrawals and Peer-to-Peer Transfers

Withdraw cash from ATMs worldwide by accessing your crypto balance through the Visa or Mastercard network. You can also transfer funds directly to friends or family using wallet addresses linked to the card provider.

Read more: Where Can You Use PayFi for Crypto Payments? Top Use Cases Explained

How To Use a Crypto Card for Purchases?

1. In-Store and NFC Payments

Tap to pay using your crypto card or mobile wallet at checkout counters, even if the store doesn’t accept crypto directly.

2. Online Transactions and Virtual Card Use

Use your virtual crypto card to pay with crypto for Netflix, mobile plans, or digital services. Payment platforms like BitPay simplify this process.

3. ATM Withdrawals and Fiat Conversions

Withdraw local currency using your crypto balance via ATMs. Just ensure your card is Visa or Mastercard-enabled. Bitget Wallet Card supports this feature.

Read more: Bitcoin ATMs Under Scrutiny: Is PayFi The Better Alternative?

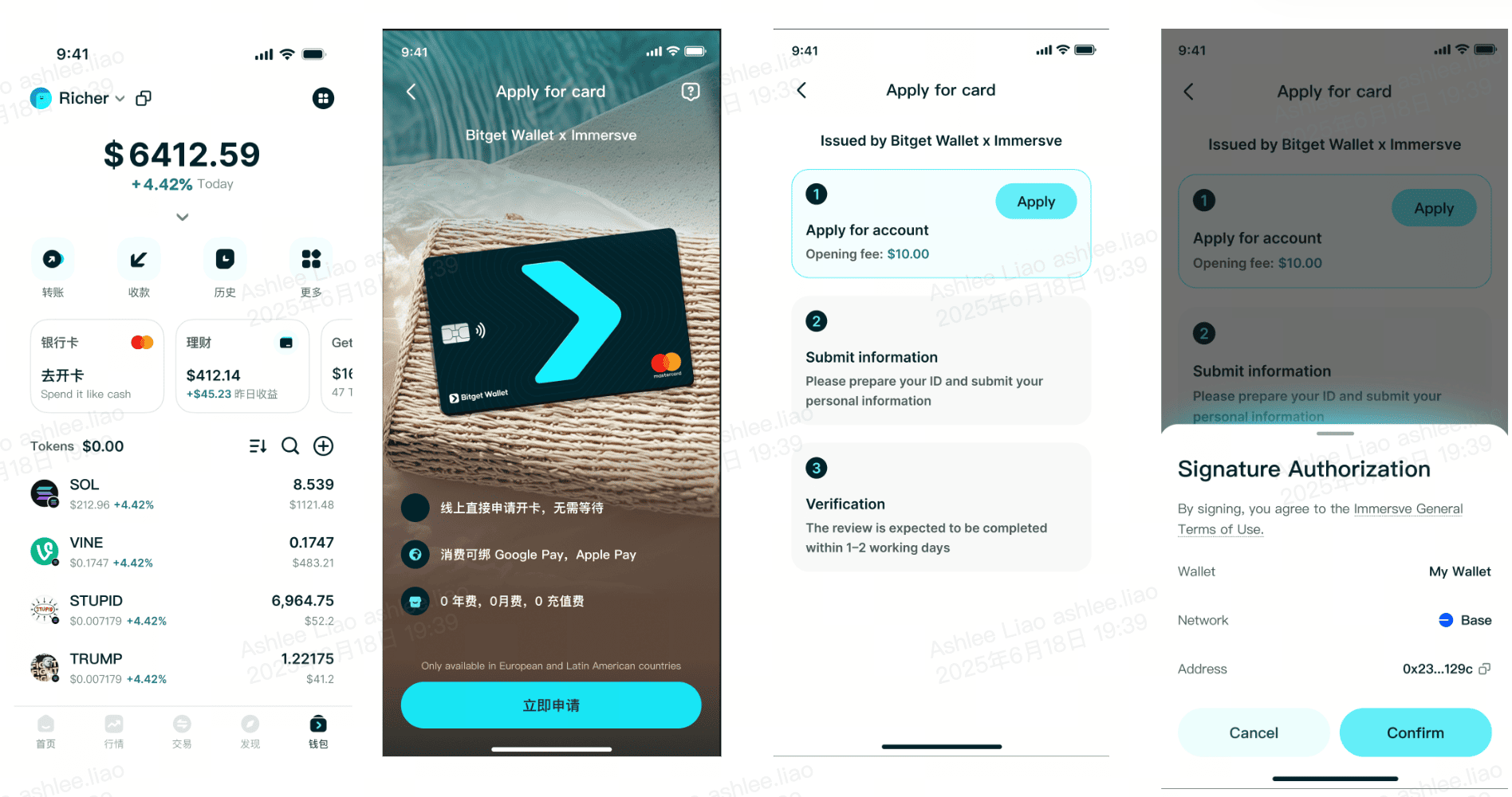

Source: Bitget Wallet

4. Dining and Travel

Use your crypto card to pay for travel bookings, flights, or restaurants. Redeem rewards while traveling and book through crypto-friendly platforms.

How To Get and Set Up a Crypto Card?

Step-by-Step Application Process

Bitget Wallet Card offers a simple sign-up experience:

- Download Bitget Wallet App

- Complete KYC (approval in minutes)

- Activate the card inside the wallet

- Choose spending crypto (BTC, ETH, USDT, etc.)

- Start using crypto card via Apple Pay, Google Pay, or wait for the physical card

Apply in app and start using within minutes:

Choosing Between Credit, Debit, and Prepaid Cards

- Credit: Use borrowed funds, repay monthly

- Prepaid: Preload funds before spending

- Debit: Spend directly from available wallet balance

Bitget Wallet Card offers the convenience of prepaid with the flexibility of real-time debit transactions.

Why Bitget Wallet Card Stands Out?

Among the many options available in the crypto card space, the Bitget Wallet Card distinguishes itself through its legal infrastructure, seamless wallet integration, and highly competitive fee model. Unlike most crypto cards that act as third-party extensions, Bitget's solution is directly backed by its wallet ecosystem — allowing users to enjoy smoother KYC, native crypto-to-fiat conversion, and a host of financial perks.

Here’s why the Bitget Wallet Card is one of the most compelling choices :

✅ Sign Up, Verify, Earn: Complete KYC and get $5 cashback, no strings attached.

✅ Extra financial perks: Enjoy up to 8% APY on staked stablecoins (region-based), plus cashback bonuses during the first 30 days.

✅ Lowest fees on the market: Only 1.7% comprehensive fee, compared to 2–3% for most competitors, with zero top-up or monthly charges.

✅ Legally issued: Through official Mastercard in the EU and Visa in Asia, making it one of the few truly licensed cross-region crypto cards.

✅ Seamless payment experience: Integrated with Google Pay and Apple Pay, enabling NFC tap-to-pay at any Mastercard/Visa terminal.

✅ Native crypto-to-fiat conversion: Instantly converts crypto at the moment of transaction, removing manual steps or delays.

👉 Ready to experience the future of crypto payments?

Get started with the Bitget Wallet Card today and enjoy low fees, instant crypto-to-fiat spending, and exclusive rewards — all backed by a trusted Web3 wallet.

🔗 Download Bitget Wallet and apply in minutes.

Comparing the Best Crypto Cards in 2025

Top 5 Crypto Debit and Credit Cards

- Bitget Wallet Card: Among the many options available in the crypto card space, the Bitget Wallet Card distinguishes itself through its legal infrastructure, seamless wallet integration, and highly competitive fee model. Unlike most crypto cards that act as third-party extensions, Bitget's solution is directly backed by its wallet ecosystem — allowing users to enjoy smoother KYC, native crypto-to-fiat conversion, and a host of financial perks.

- Crypto.com: Well-known card with CRO staking requirements and tier-based benefits.

- Binance Card: Offers BNB-based cashback but is not supported in all regions.

- Swissmoney: Virtual-first card with strong data privacy features.

- Wirex: Multi-currency support and instant rewards, but some fees apply.

Crypto Debit Card Comparison: Bitget Wallet Card vs Top Competitors (2025)

| Card | APY | Cashback | ATM Fees | KYC Required | Supported Coins |

| Bitget Wallet Card | Up to 8% | Yes | Low | Yes | BTC, ETH, USDT, etc. |

| Crypto.com | Up to 5% | Yes (CRO-based) | Medium | Yes | BTC, ETH, CRO |

| Binance | 0% | 1–8% BNB | Varies | Yes | BTC, ETH, BNB |

| Swissmoney | N/A | N/A | Medium | Yes | BTC, ETH |

| Wirex | Up to 4% | Yes | Medium | Yes | Multi-chain support |

Apply for Bitget Wallet Card Right Now!

If you're looking for a legally issued crypto debit card with industry-low fees, instant crypto-to-fiat conversion, and seamless integration with your wallet and mobile payments — the Bitget Wallet Card is your best bet in 2025.

✅ Get $5 free just for verifying your account — no strings attached.

✅ Enjoy just 1.7% total fees — lower than 90% of the market

✅ Stake stablecoins and earn up to 8% APY

✅ Get extra cashback in your first 30 days

✅ No top-up or monthly fees, and quick KYC approval

👉 Ready to simplify your crypto spending?

Download Bitget Wallet and apply for your first crypto debit card in minutes!

Download Bitget Wallet

FAQs

1. Can I use a crypto card if I don’t live in the US or EU?

Yes. Bitget Wallet Card is issued via Visa in Asia and Mastercard in the EU, making it accessible and usable worldwide.

2. Do I need to sell my crypto before using it with the card?

No. The card converts your crypto into fiat automatically at the time of purchase—no manual action needed.

3. What cryptos can I use with the Bitget Wallet Card?

You can use major cryptocurrencies like BTC, ETH, USDT, and more, directly from your Bitget Wallet.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Apply for a Crypto Mastercard2026-01-05 | 5 mins

- How to Apply for a Crypto Visa Card and Start Spending Crypto Worldwide2026-01-02 | 5 mins

- How to Top Up Your Crypto Debit Card with USDT2025-12-29 | 5mins