Crypto Lifecycle for Investors: How to Spot Opportunities at Every Stage?

The crypto lifecycle is the key to understanding when and where to invest in Web3 projects. It covers every stage of a crypto project, from the first idea to full maturity, following structured crypto project stages and blockchain project lifecycle phases. Each stage carries unique opportunities and risks for investors.

Understanding this full crypto lifecycle breakdown gives investors an advantage: they can discover early opportunities, avoid hype-driven mistakes, and position for long-term growth. Own your Web3 journey easily with Bitget Wallet – secure, fast, and beginner-ready.

What Is the Crypto Lifecycle in Web3?

The crypto lifecycle is the structured path every blockchain project takes from idea to market maturity. It outlines the crypto project stages that transform a concept into a working product with an active token economy and user base.

This blockchain project lifecycle typically includes:

- Ideation and team formation – defining the vision, market fit, and assembling a capable team

- Whitepaper and tokenomics design – creating a clear technical plan and economic model

- Token sales – funding through seed rounds, private sales, presales, and public offerings

- Token Generation Event (TGE) and exchange listing – enabling the token to trade and begin price discovery

- Post-listing development and ecosystem growth – executing the roadmap, building partnerships, and driving adoption

Each stage carries a different risk and reward profile for investors. Early stages offer high upside potential but also significant uncertainty, while later stages focus on liquidity and adoption but often come with smaller price swings. Understanding where a project sits in the crypto lifecycle helps investors match their strategies to their risk tolerance and long-term goals.

Early-Stage Opportunities — From Idea to Whitepaper

The early stage of crypto lifecycle is where projects move from concept to execution planning. It begins with ideation, where a unique solution or market opportunity is defined. Next comes the team, whose experience and transparency determine execution strength. The whitepaper then outlines the vision, tokenomics, and roadmap, giving investors insight into how the project plans to grow. Finally, the investment decision depends on evaluating these factors together—high risk, but with the potential for early, outsized returns if the project succeeds.

Step 1 — Understand the Founding Vision and Market Fit

Every blockchain project starts with an idea. Investors must evaluate whether the project solves a real problem or merely copies existing solutions.

- Problem focus: Is the solution relevant and impactful?

- Innovation check: Does it bring something new or unique to Web3, DeFi, or gaming?

- Roadmap realism: Are milestones achievable with available resources and technology?

A project with a strong founding vision and a clear target market often has better long-term sustainability.

Step 2 — Evaluate the Core Team and Advisory Board

Even the best idea can fail without the right people behind it. Investors should:

- Verify that team members are public and verifiable.

- Check experience in blockchain, finance, or software development.

- Look for credible advisors who add strategic value.

Anonymous teams or unverifiable LinkedIn profiles are common red flags for early-stage investors.

Step 3 — Analyze the Whitepaper and Tokenomics Design

The whitepaper is the technical and economic blueprint of the project. It should clearly describe:

- The project’s vision and use case

- Tokenomics design: allocation, vesting schedules, supply caps

- Governance structures or DAO plans

- Roadmap with measurable milestones

Weak tokenomics often indicate tokenomics risk, such as excessive team allocation or unsustainable token emissions.

Step 4 — Assess Risk vs. Reward Before Investing

Early-stage investing offers maximum potential upside but also maximum risk. Investors must weigh both:

- Risks: No working product, limited information, high chance of failure.

- Rewards: Early entry prices can deliver exponential returns (10x, 50x, even 100x).

Risk–reward across lifecycle stages:

| Stage | Risk Level | Reward Potential |

| Concept / Seed Round | 🔴 Very High | 💰💰💰💰💰 (Maximum potential) |

| Private Sale | 🟠 High | 💰💰💰💰 |

| Public Sale (ICO/IDO) | 🟡 Moderate | 💰💰💰 |

| Exchange Listing | 🔴 High Volatility | 💰💰 (Short-term gains) |

| Post-Launch Development | 🟢 Lower Risk | 💰💰💰💰 (Long-term growth) |

How Investors Can Join at Each Token Sale Stage?

The crypto lifecycle includes several token sale stages, each offering unique access levels and risk exposure. Entry timing significantly affects token price and overall return potential.

1. Seed Round — High Risk, Maximum Reward

- Participants: Founders, strategic partners, early venture capital

- Risk level: 🔴 Very High

- Reward potential: 💰💰💰💰💰

- Pros: Lowest entry price, maximum upside

- Cons: Long vesting periods, minimal liquidity, little legal protection

2. Private Sale — Strategic Access for Partners & Funds

- Participants: VC firms, angel investors, sometimes whitelisted retail

- Risk level: 🟠 High

- Reward potential: 💰💰💰💰

- Pros: Significant token discount, strong early positioning

- Cons: Lockup requirements and allocation limits

3. Presale — Public Access with Early-Stage Perks

- Participants: Community supporters, influencers, whitelisted retail investors

- Risk level: 🟡 Moderate–High

- Reward potential: 💰💰💰💰

- Pros: Discounted entry, exclusive early access

- Cons: Allocation caps, KYC requirements

Read more: What Is a Crypto Presale? How It Works, Key Benefits, and Smart Investment Strategies

4. Public Sale — ICO, IDO, and Launchpads

- Participants: Open to all retail investors

- Risk level: 🟡 Moderate

- Reward potential: 💰💰💰

- Pros: Full public access, transparent pricing

- Cons: Higher volatility, potential scams

Read more: Crypto Presale vs Public Sale: Which One Offers Better Investment Opportunities?

Token Sale Stage Comparison Table

| Stage | Who Can Join | Access | Price Level | Lockup | Risk Level | Reward Potential |

| Seed Round | Founders, early VCs | Invitation only | Extremely Low | Long (12–36m) | 🔴 Very High | 💰💰💰💰💰 (Max) |

| Private Sale | VCs, angels, whitelisted | Semi-private (KYC) | Discounted (50–70%) | Medium | 🟠 High | 💰💰💰💰 |

| Presale | Community, influencers | Whitelisted access | Discounted (20–40%) | Short (3–6m) | 🟡 Mod–High | 💰💰💰💰 |

| Public Sale | All retail investors | Open public (ICO/IDO) | Market-driven | Minimal | 🟡 Moderate | 💰💰💰 |

How Investors Can Join at Exchange Listing and Price Discovery Phase?

The token launch lifecycle reaches a critical moment at the listing stage, when tokens first become tradable. This is where crypto price discovery begins, often bringing extreme volatility and liquidity surges.

TGE vs Exchange Listing: What’s the Difference?

- Token Generation Event (TGE): Tokens are minted and distributed, often non-tradable initially.

- Exchange Listing: Tokens become publicly tradable, allowing open-market price formation.

Knowing the difference between TGE vs listing helps investors plan entries and exits, especially where listings may occur regionally first.

| Event | Timing | Tradable? | Risk Level | Key Opportunity |

| TGE | Token minted & distributed | No | 🟠 Medium | Allocation received; price TBD |

| Listing | Token tradable on exchange | Yes | 🔴 High | Volatility-driven entry/exit plays |

What Happens on Day 1 of a Listing?

The listing stage of the token launch lifecycle is one of the most volatile phases because it marks the beginning of crypto price discovery. On day one, demand from retail traders often surges, pushing prices up rapidly. At the same time, early investors or private-sale participants may take profits, creating downward pressure.

Liquidity providers and market makers inject capital to help stabilize spreads, but this initial phase still carries significant risk of pump-and-dump behavior and extreme swings.

Short-term strategies for investors:

- Trade early volatility carefully to capture quick gains without overexposure

- Monitor order book depth and global trading volume to gauge market health

- Watch liquidity pools to avoid excessive slippage during large trades

Should Investors Buy at Listing or Wait?

Investors face two common approaches at the listing stage:

- Immediate buy: Suited for tokens with strong hype, established communities, and deep liquidity on launch day. This strategy can work well for popular tokens, including meme coins or projects with heavy exchange support, but carries high volatility risk.

- Wait and watch: A safer option when expecting post-listing dips, especially if token unlock schedules could increase selling pressure in the coming weeks. It also reduces exposure to thin liquidity or regional exchange limitations that may distort early price action.

Both approaches require understanding the difference between TGE vs listing and aligning timing with risk tolerance.

How Can Investors Evaluate Post-Listing Growth and Long-Term Potential?

The post-listing development of crypto determines whether a token can move beyond short-term hype and achieve long-term sustainability. Evaluating this stage helps investors avoid speculative traps and focus on projects that show real progress. Sustainable value depends on product upgrades, adoption growth, and clear token use cases, all of which are core to effective crypto lifecycle maintenance.

What Should Investors Track After Launch (Beyond Price)?

After a token is listed, short-term price moves often dominate headlines. However, smart investors look beyond price and monitor key metrics that signal whether a project is building real, sustainable value:

- Developer activity (GitHub commits, protocol upgrades): Frequent updates and active development indicate a committed team improving and expanding the product. Projects with little to no ongoing development often rely solely on hype and tend to fade quickly.

- TVL (Total Value Locked) for DeFi-related tokens: A growing TVL shows users are committing funds to the platform, reflecting trust and actual usage. Speculative tokens may experience short-lived liquidity spikes that vanish once the hype subsides.

- Partnerships and ecosystem integrations (real-world use cases, cross-chain support): Expanding collaborations and integrating with other networks demonstrate real-world adoption and network effects, which are essential for long-term growth. Hype-driven tokens often lack meaningful partnerships and depend heavily on marketing buzz alone.

- Tokenomics adjustments (burns, staking rewards, governance changes): Responsible supply management and evolving incentive structures show that the team is focused on long-term sustainability. Speculative projects often use extreme rewards or giveaways that create unsustainable token inflation.

Monitoring these token growth indicators helps investors separate projects focused on fundamental development and lasting adoption from those built only on short-term speculative momentum.

How Can Bitget Wallet Help Monitor Token Performance?

Bitget Wallet offers tools designed for investors who need clear, real-time insights into their holdings and the wider market:

- Multi-chain price alerts: Stay informed of price changes across different blockchains in real time.

- Portfolio performance tracking: Monitor token values, historical performance, and asset distribution from one dashboard.

- Integrated staking and earn features: Access yield opportunities directly, making it easier to grow holdings without leaving the wallet.

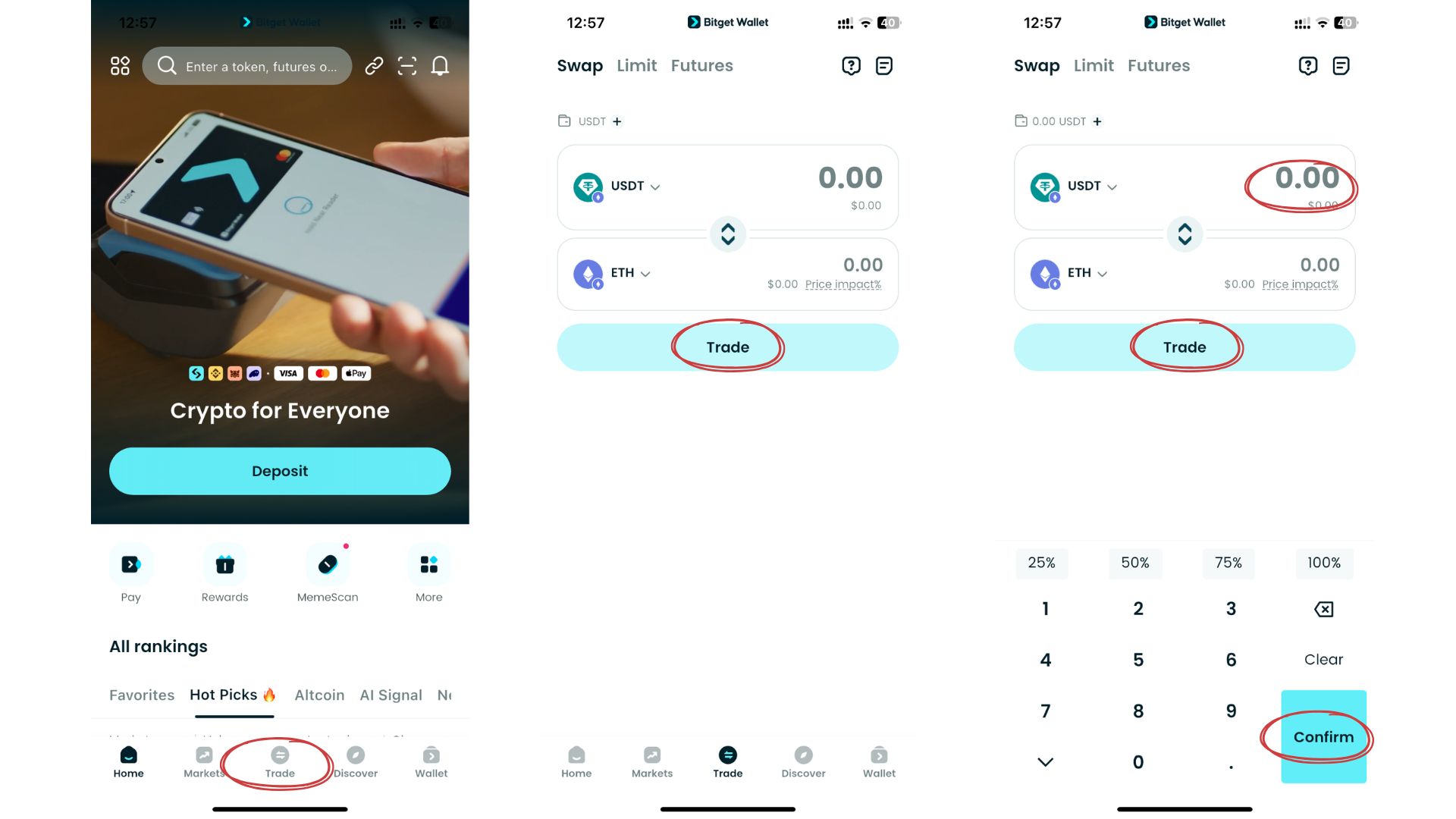

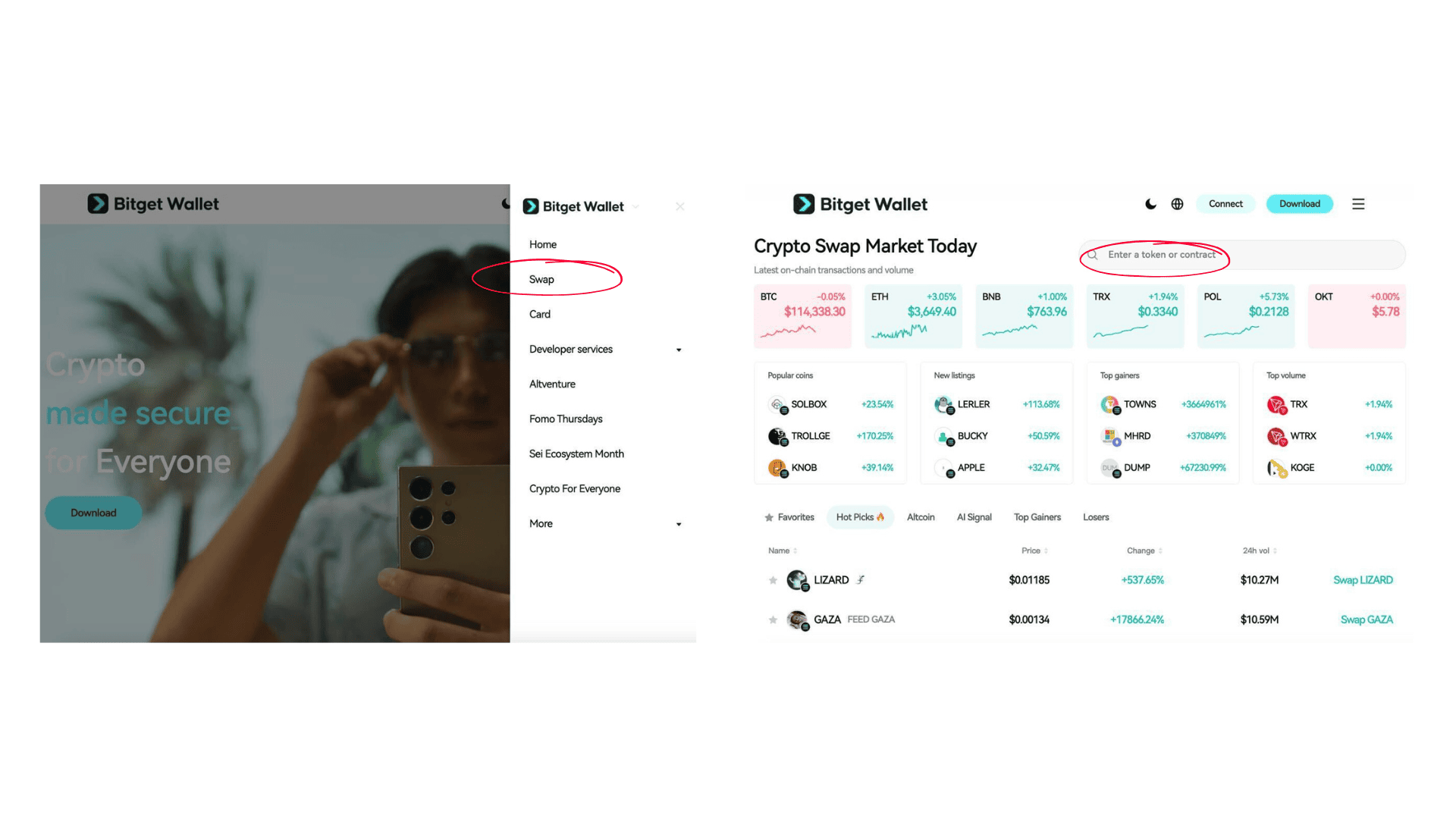

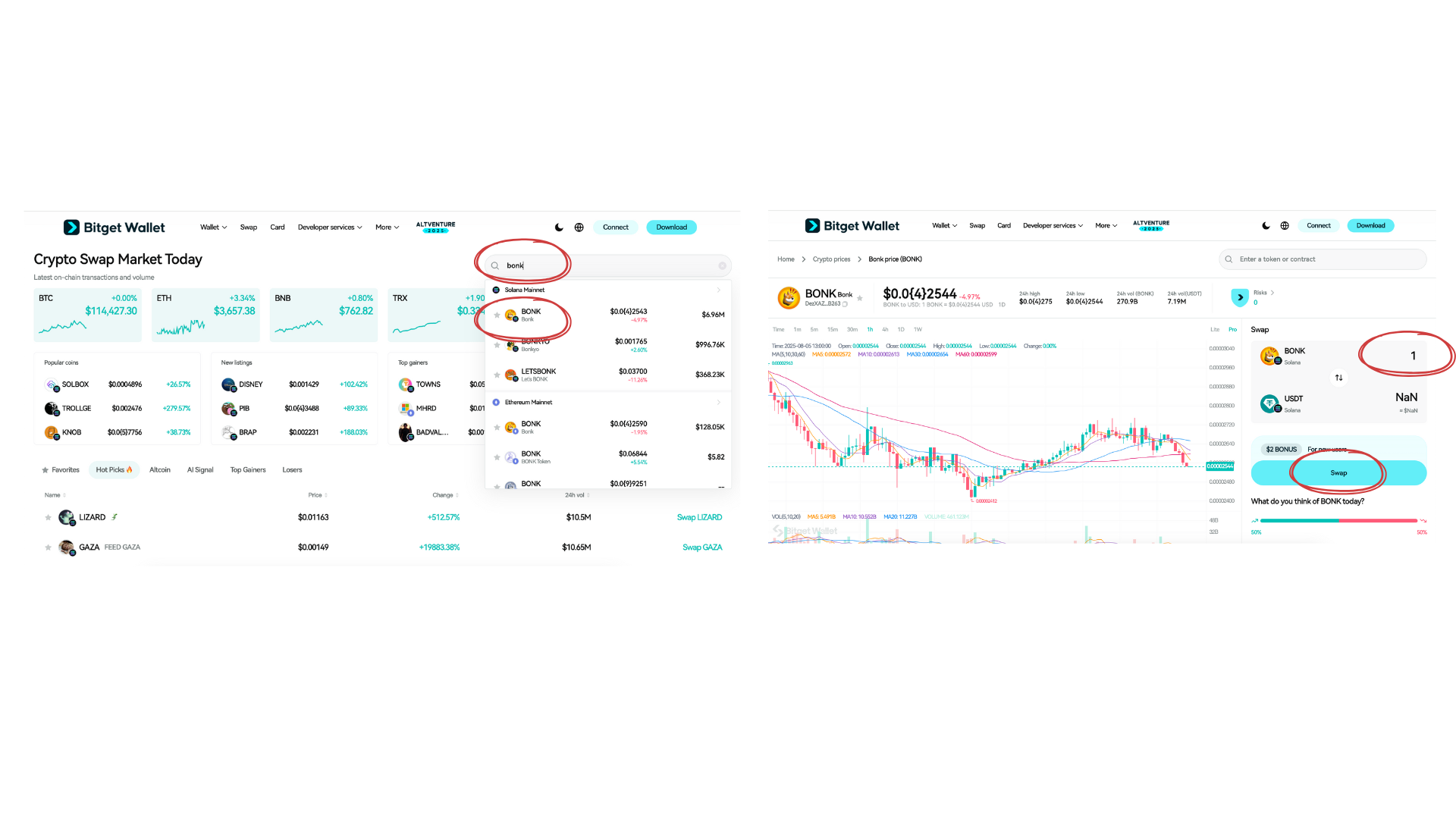

Mobile App:

Website:

By consolidating these features, Bitget Wallet gives investors a single platform to track performance, manage risk, and explore earning opportunities across the crypto lifecycle.

What Are the Risks and Red Flags at Each Stage of the Crypto Lifecycle?

Each stage of the crypto lifecycle presents unique risks. Knowing them helps with scam detection, tokenomics risk assessment, and checking for smart contract audit results.

| Lifecycle Stage | Common Investor Risks | Red Flags to Watch For |

| Concept & Whitepaper | Unrealistic promises | Anonymous team, plagiarized content |

| Tokenomics Design | Unbalanced supply and emissions | No vesting, insider-heavy allocation |

| Smart Contract Deployment | Code vulnerabilities | No smart contract audit, no bug bounty |

| Token Generation Event | Over-valuation, fake demand | Suspicious unlock schedules |

| Exchange Listing | Pump-and-dump manipulation | Thin liquidity, one-exchange listing |

| Post-Listing Development | Stagnant growth, abandoned roadmap | No dev activity, poor partnerships |

Final Thoughts

The crypto lifecycle gives investors a clear roadmap—timing is everything. Entering at the right stage helps avoid hype-driven mistakes and supports better long-term strategies. Focus on fundamentals like roadmap execution, token utility, and ecosystem growth instead of chasing short-term price spikes.

Own your Web3 journey easily with Bitget Wallet – secure, fast, and beginner-ready.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. Is it safer to buy at TGE or at the exchange listing?

TGE allocations are discounted but illiquid; exchange listings offer immediate trading but high volatility.

2. How can I detect if a token project is a scam before investing?

Check for a transparent team, fair tokenomics, and a completed smart contract audit. Avoid anonymous teams or unrealistic promises.

3. Can I track token growth and staking rewards in one place?

Yes. Bitget Wallet supports multi-chain price alerts, staking features, and portfolio performance tracking.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is Crypto Fear and Greed Index: How Traders Read Fear vs Greed Signals2025-11-19 | 5 mins

- How to Pay with Crypto: Fast, Safe, and Beginner-Friendly Method2025-11-18 | 5 mins

- How to Convert Your Crypto to Cash: 5 Easy Ways for Beginners2025-11-18 | 5 mins