Bitcoin Hits ¥18 Million: Why Is It Breaking All-Time Highs Now?

1 Bitcoin over 18 million yen**—history made. This milestone price rise is due to several 2025 factors coming together: institutional adoption, ETF approvals, and growing real-world usage on a city scale. Here's the breakdown in this article of why this achievement had to occur now, how Bitcoin is transforming as an asset class, and what techniques are best for long-term holding and secure storage.

We explain the price surge driven by ETF approvals, corporate buying, and real-world adoption—plus how to strategically manage Bitcoin as an asset with reliable storage solutions like Bitget Wallet.

Key Takeaways

-

Spot ETF approvals and regulatory clarity are energizing institutional markets

-

Adoption by major companies and local governments is pushing prices higher

Bitcoin is evolving from a “speculative bet” to “digital gold”

Why Has Bitcoin Surpassed ¥18 Million?

Bitcoin started 2025 at around $94,000. By April, it had crossed $100,000, and by mid-July, it exceeded $120,000—equivalent to ¥18 million+, marking a 30%+ year-to-date rise (as of July 14, 2025: $123,153 ≈ ¥18.2M).

At the same time, global crypto market cap hit $2.3 trillion—approaching Apple’s ~$3T and Microsoft’s ~$3.7T valuations. Price charts reveal distinct bullish waves in January, April, and July.

How 2025 Market Trends Boosted BTC Prices?

The year 2025 has proven pivotal for Bitcoin, with several key developments driving its price to new heights and reinforcing its position as a leading digital asset. Here are the major market trends fueling BTC’s surge this year:

-

Spot Bitcoin ETF Approval in the U.S.

The SEC approved spot BTC ETFs in October 2024, and capital inflows have continued into H1 2025.

-

Massive Corporate Purchases in the U.S.

Companies like MicroStrategy and Strategy Inc. have increased BTC holdings by the thousands, reinforcing market confidence.

-

Detroit Begins Accepting BTC for Taxes

As of mid-2025, Detroit now allows tax and utility payments in BTC—encouraging wider citizen use

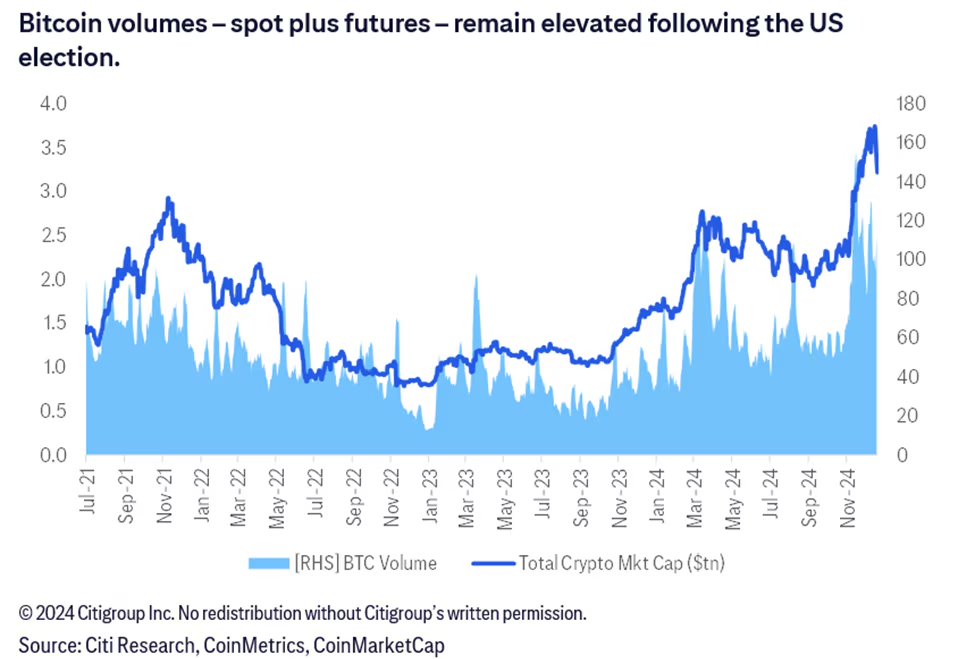

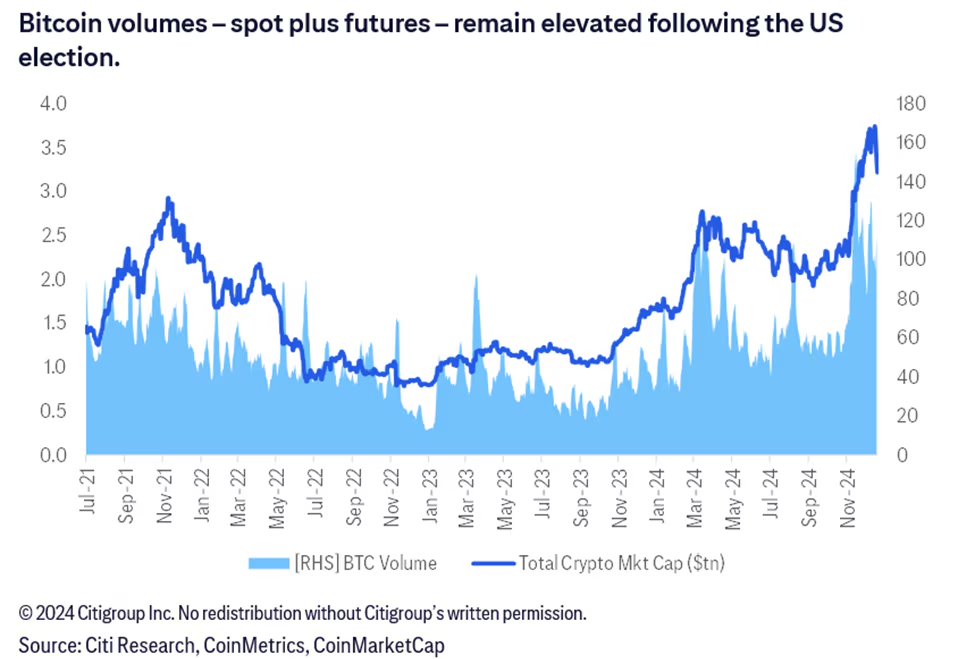

Source: Citi

How Has Bitcoin Evolved from “Suspicious Speculation” to a Recognized Asset?

Bitcoin is no longer seen as just a get-rich-quick vehicle. It’s becoming an accepted part of the global financial system, and here’s why.

Key Factors:

-

Fixed Supply = Inflation Hedge

With a hard cap of 21 million coins, Bitcoin offers built-in protection against inflation—similar to gold.

-

Decentralization = Political Independence

Free from central bank control, BTC serves as a hedge against fiat currency devaluation and political instability.

-

Real-World Utility Is Growing

Countries facing unstable currencies are increasingly turning to BTC for remittances, savings, and now, taxes.

-

"Digital Gold" Narrative

Both institutional and retail investors are embracing Bitcoin as a defensive asset class—especially after ETF approval.

How Does BTC Compare to Gold and Stocks?

Bitcoin’s investment profile is becoming more refined—occupying a space between traditional risk assets like tech stocks and defensive assets like gold.

| Metric / Asset | Bitcoin (BTC) | Ethereum (ETH) | Gold |

| Nature | Digital gold, scarce | Smart contract platform | Traditional hedge |

| Main Use | Remittance, value storage, payments | dApps, NFTs, DeFi | Wealth preservation |

| 2025 Narrative | ETF-backed, institutional interest | Broke $3,500 in July, high activity | Stable price, weak momentum |

| Market Cap | ~$2.3T | ~$430B | ~$12T |

Although still volatile, Bitcoin’s increasing liquidity and regulatory recognition are giving it staying power in portfolios alongside—or even instead of—gold.

What’s Next for Bitcoin After Breaking Records?

Bitcoin’s next chapter is already unfolding: mainstream integration into daily life

How New Technologies Quietly Become Part of Everyday Life?

From the iPhone to cashless apps to generative AI, most paradigm-shifting technologies face skepticism at first. Bitcoin is undergoing the same transformation.

Where once it was mocked or feared, BTC is now entering a phase of silent ubiquity. Government use cases, consumer adoption, and media normalization are converging.

Ethereum Is Surging Too - What Does It Mean for Bitcoin?

On July 14, ETH surged from $3,081 to over $3,500, signaling renewed interest in Web3 ecosystems. Analysts now forecast a price range of $7K–$10K by year-end.

While Bitcoin is seen as a hedge asset and long-term store of value, Ethereum is viewed as a utility platform that powers decentralized applications (dApps), NFTs, and DeFi. Both assets are becoming pillars of the new internet economy, serving distinct but complementary roles.

Source from Citi

Is Long-Term Holding Still a Smart Bitcoin Strategy?

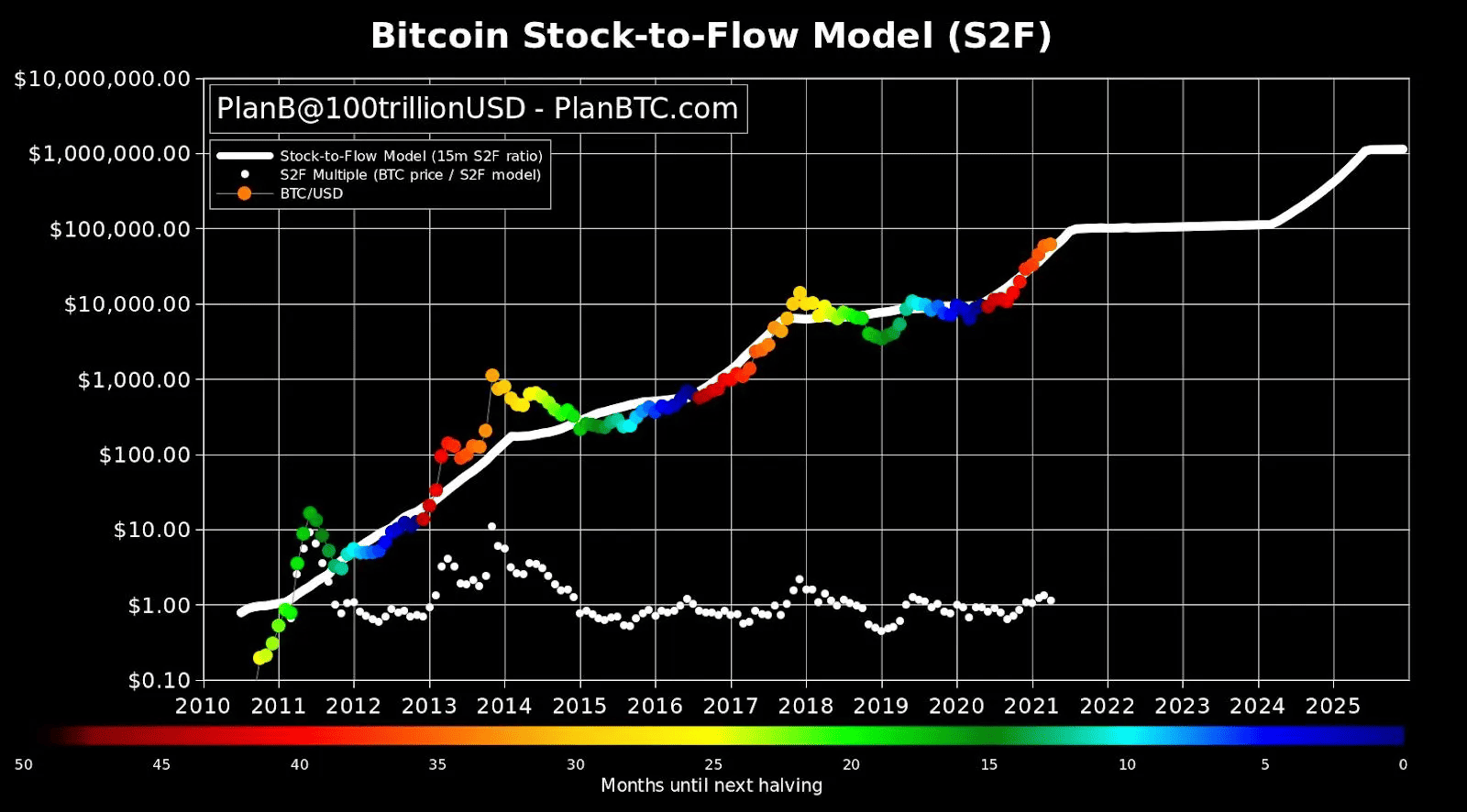

Long-term holding continues to be a widely recommended Bitcoin investment strategy backed by various market models and historical data. Forecasts from models like Stock-to-Flow and Quantile Theory project that Bitcoin’s price could rise to between $500,000 and $1 million during the 2030s, indicating significant growth potential over the long term.

Furthermore, dollar-cost averaging (DCA) is recognized as an effective approach to mitigate Bitcoin’s price volatility by distributing investment purchases evenly over time, reducing overall risk.

Data shows that investors who maintain long-term positions tend to outperform traders who try to time market fluctuations, particularly during major macroeconomic cycles.

What Do You Need to Hold and Manage Bitcoin Safely?

To safely hold and manage Bitcoin over the long term, prioritizing security and self-custody is essential. Utilizing a non-custodial wallet ensures you retain full control over your private keys, mitigating risks associated with centralized exchanges.

Bitget Wallet is a trusted, all-in-one crypto wallet that supports over 130 blockchains, including Bitcoin, Ethereum, and Solana. It offers real-time price tracking, transaction history, and seamless access to DeFi and NFT platforms.

Designed with a beginner-friendly interface and a security-first approach, Bitget Wallet provides a secure and efficient solution for managing your digital assets.

Secure your wallet 👉 Download Bitget Wallet

Conclusion

Now that Bitcoin has broken past 18 million Japanese Yen, the question is how we respond to this major turning point. Behind the surge lies a combination of factors: growing market capitalization, increasing geopolitical and fiat currency risks, and a wave of institutional and governmental adoption. These trends highlight why a long-term perspective is more important than ever—short-term volatility may persist, but Bitcoin’s role as a resilient, decentralized asset is solidifying.

To navigate this new phase safely and effectively, managing your holdings with the right tools is essential. If you're planning to treat Bitcoin as a serious asset, using Bitget Wallet is becoming more important than ever. From DeFi to NFTs to even paying taxes Bitget Wallet lets you manage everything securely in one place. Try it today and be ready for what's next.

Download Bitget Wallet Now! - Access the world of decentralized finance with Bitget Wallet—your secure, multi-chain Web3 companion.

Download Bitget Wallet

FAQs

1. Will Bitcoin keep rising in price?

Many long-term models project BTC reaching $500,000–$1,000,000 in the 2030s. While short-term volatility exists, the long-term outlook remains bullish.

2. Is Bitget Wallet secure and multi-chain compatible?

Yes. Bitget Wallet supports over 130 blockchains and allows users to control their private keys—offering both flexibility and security.

3. How do I handle taxes with Bitcoin?

Bitget Wallet enables CSV exports of your transaction history, making it easy to work with tax software and accounting tools.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.