PayFi Unlocked: Crypto Payment Use Cases in 2025

Announcements

Crypto isn't just for trading anymore, it's becoming something people use in their everyday life. From coffee shops to online shopping, people are starting to use crypto not just to trade, but to live. That's what inspired us to launch

PayFi Unlocked: Crypto Payment Use Cases

, our latest research report diving deep into how people actually want to spend crypto today. Based on insights from 4,599 users across 9 regions and 3 generations, this report reveals the behaviors driving the next wave of onchain finance.

From Investment to Utility: The Shift in Crypto Behavior

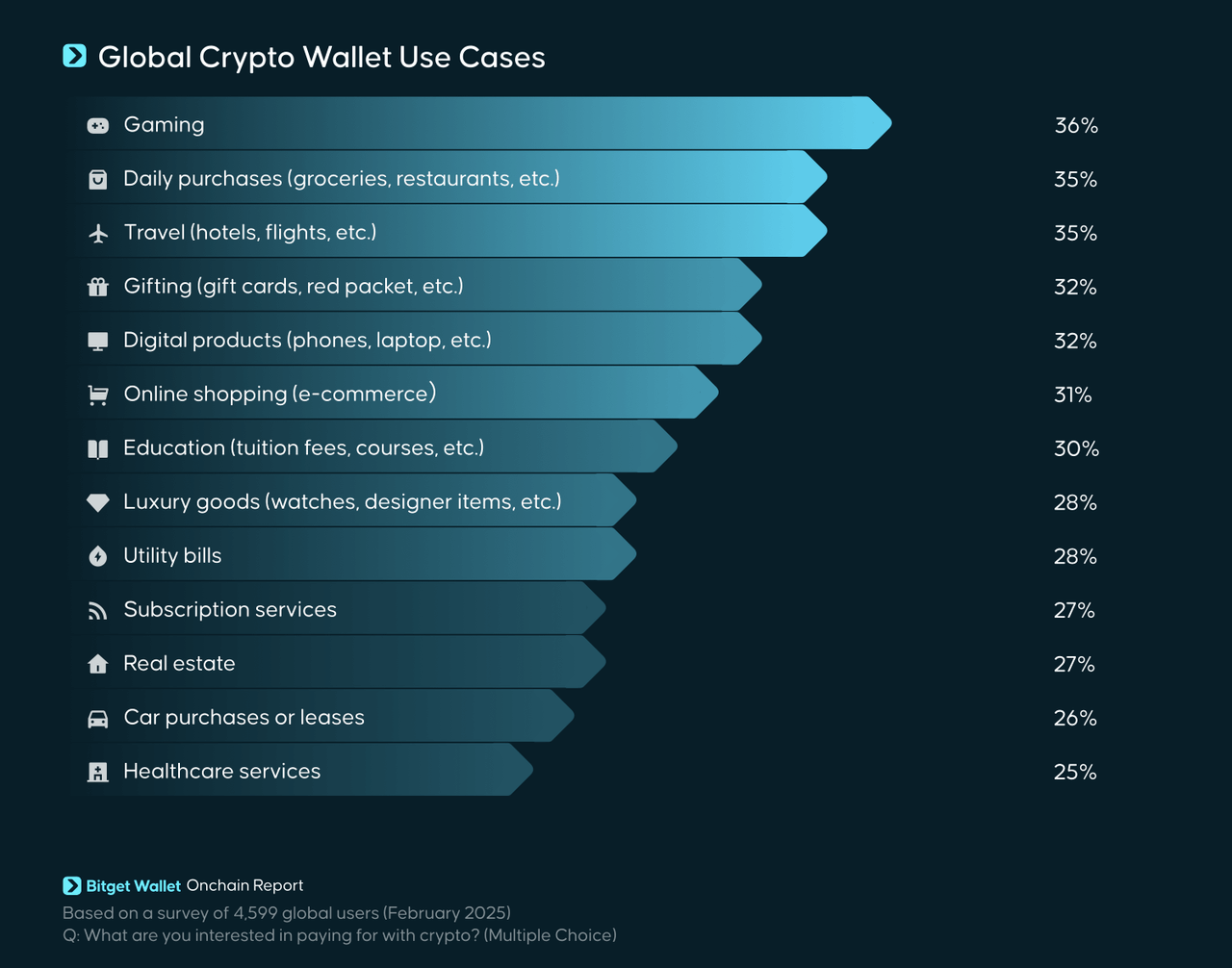

A growing number of users are turning to digital assets for everyday payments—whether it's buying groceries, subscribing to a streaming service, or booking a flight. Our report confirms this shift toward real-world use cases, with 35% of surveyed users interested in using crypto for daily purchases, followed closely by gaming (36%) and travel (35%). This shows a clear demand for crypto to function like traditional money: accessible, flexible, and practical.

And this isn't just theory. With rising adoption of QR-based payments, mobile wallets, and crypto-linked cards, users are increasingly confident in the stability of stablecoins and the reliability of crypto-based payment rails. From in-app purchases to in-store QR scans, the infrastructure is finally catching up to the demand.

Generational Differences: Gen Z Spends, Gen X Shops Smart

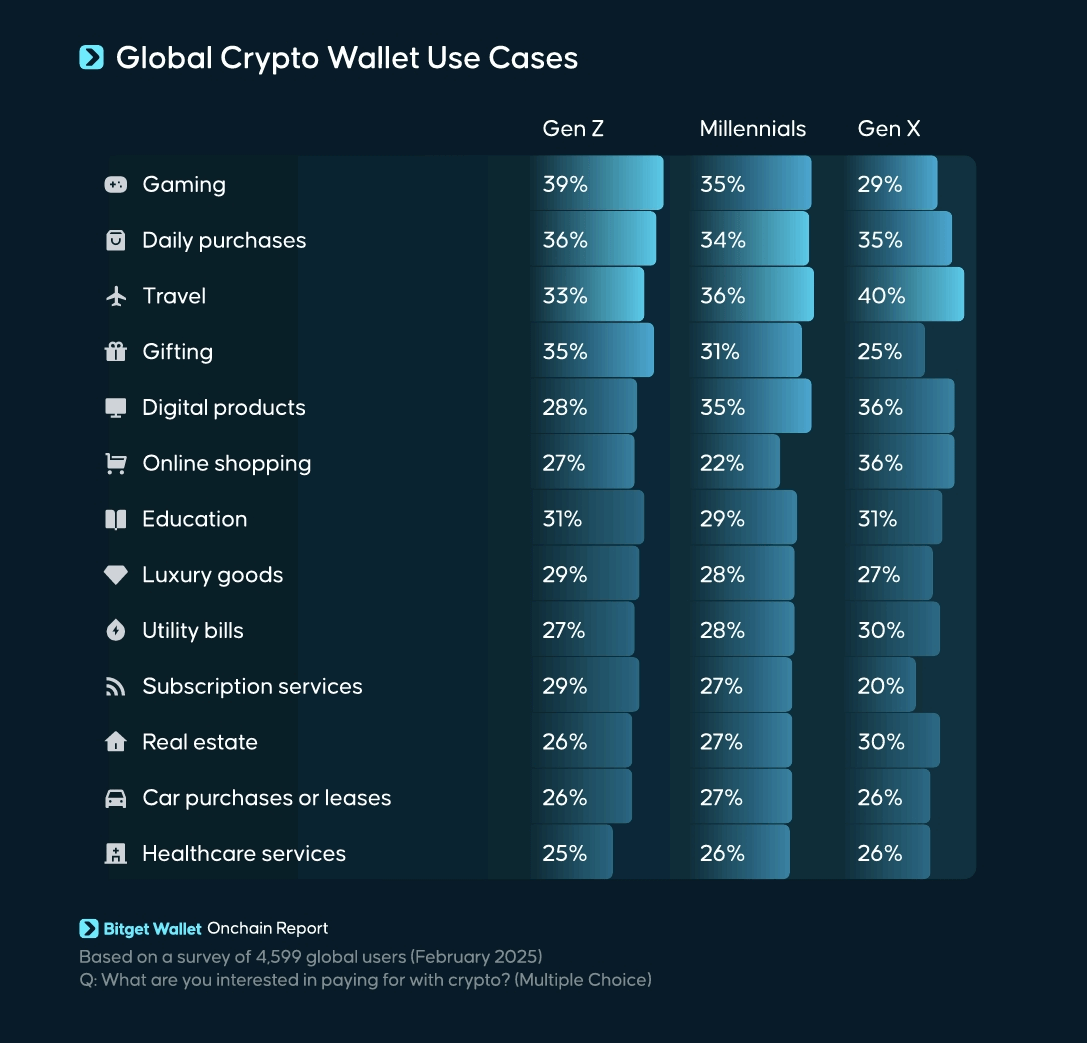

Different generations are embracing crypto in different ways. Gen Z (ages 18–29) is leading the way in social and entertainment-driven use cases. Nearly 40% use crypto for gaming, and 35% for gifting, revealing a preference for immediacy, seamless user experience, and peer-to-peer sharing. They're engaging with crypto through fun, fast, and gamified experiences.

Millennials (30–44) take a more balanced approach. They prefer using crypto for travel (36%), gaming (35%), and digital products (35%), making them the most versatile spenders. For this group, crypto is a multipurpose tool, one that enables convenience, savings, and access to global markets. From booking hotels to buying gadgets, crypto fits into their increasingly mobile and connected lifestyles.

Gen X (45+) is using crypto for bigger, more traditional expenses. They're most likely to use it for travel (40%), digital products (36%), online shopping (36%), and even utility bills and real estate payments. For this group, crypto is more about function and how it is a secure, stable, and borderless alternative to fiat, particularly in regions where financial systems are complex or costly.

Global Trends: Same Crypto, Different Needs

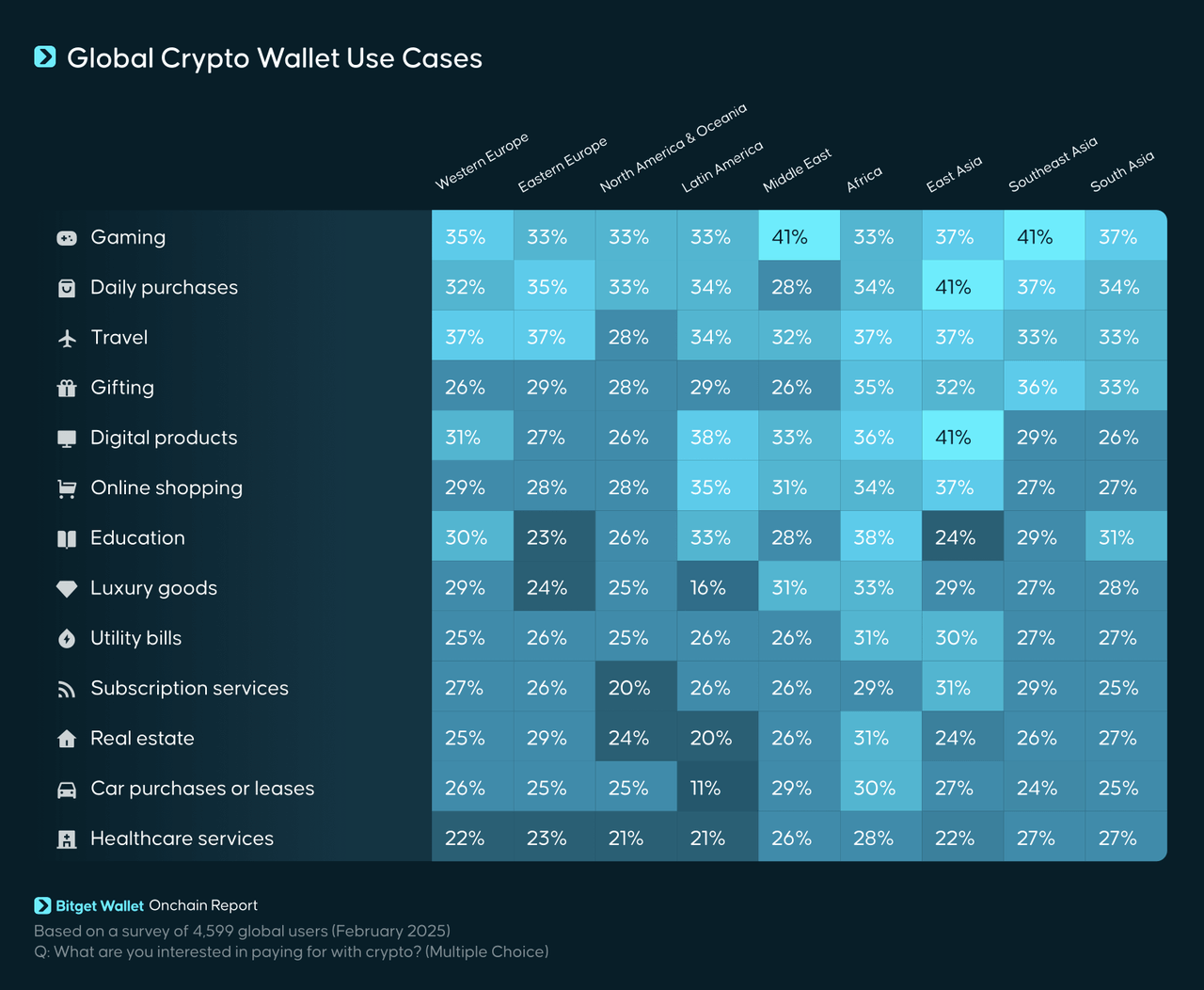

Across regions, the story is the same: people are spending crypto but their motivations differ. In East Asia, crypto is deeply integrated into tech and consumer ecosystems, with 41% of users spending it on digital products and daily purchases. Southeast Asia leads in gaming (41%) and gifting (36%), reflecting the dominance of play-to-earn games and the need to bypass traditional banking gaps. Africa stands out in the interest of using crypto for education (38%), showing how digital assets can empower access to learning and upward mobility.

In Latin America, crypto tends to be used for online shopping (35%) and digital products (38%), largely driven by high inflation and distrust in fiat currencies. Meanwhile, the Middle East prefer using crypto for lifestyle upgrades with strong interest in gaming (41%), luxury goods (31%), and car purchases (29%). In Eastern and Western Europe, travel bookings and even real estate transactions are popular, pointing to crypto's evolving role in wealth diversification. North America and Oceania show a balanced pattern with gaming and daily spending both at 33%.

What It Means for Builders

Crypto is already being used in everyday life and this means the time to build for real-world payments is now. Developers, merchants, and wallet providers need to lean into the behavioral patterns of their users. Gen Z expects gamified UX. Millennials want utility and flexibility. Gen X demands trust and reliability. In each region, the infrastructure must adapt to meet local needs, from in-store QR support in Asia to inflation-proof payments in Latin America.

At Bitget Wallet, we're answering that call. We've already integrated real-world payment options from crypto gift cards and

in-app shopping to

national QR systems and our very own

crypto-linked card. Our focus now is to scale these services to even more regions and refine the experience so that spending crypto feels just as natural as using traditional cash or cards.

The Future of PayFi Is Already in Motion

Crypto is no longer a distant dream or a speculative bet but it's becoming a real, usable currency for everyday life. This report doesn't just reflect user sentiment but also confirms a global shift. People aren't asking

when crypto will go mainstream. The next billion users aren't waiting. They're already here: spending, exploring, and expecting more. And we're building for them.

At Bitget Wallet, we've evolved beyond storage, becoming a full-stack financial interface where anyone can trade, earn, pay, and discover with ease. Whether it's tapping to pay, scanning a QR code, or shopping in-app, our users are proving that crypto isn't the future—it's the now.

About Bitget Wallet

Bitget Wallet is a non-custodial crypto wallet designed to make crypto simple and secure for everyone. With over 80 million users, it brings together a full suite of crypto services, including swaps, market insights, staking, rewards, DApp exploration, and payment solutions. Supporting 130+ blockchains and millions of tokens, Bitget Wallet enables seamless multi-chain trading across hundreds of DEXs and cross-chain bridges. Backed by a $300+ million user protection fund, it ensures the highest level of security for users' assets. Its vision is Crypto for Everyone — to make crypto simpler, safer, and part of everyday life for a billion people.

2025-07-16

2025-07-16Recommended

- AnnouncementBuilding Decentralized Finance in 2025: A Letter from Bitget Wallet CMO Jamie Elkaleh

2025-01-27